Understanding How to Compensate Employees in Global Payroll for Time Reported Through Time and Labor

This topic discusses:

Tasks performed by Global Payroll after integration.

How Time and Labor creates payable time.

What happens when you start a pay run.

Planning considerations.

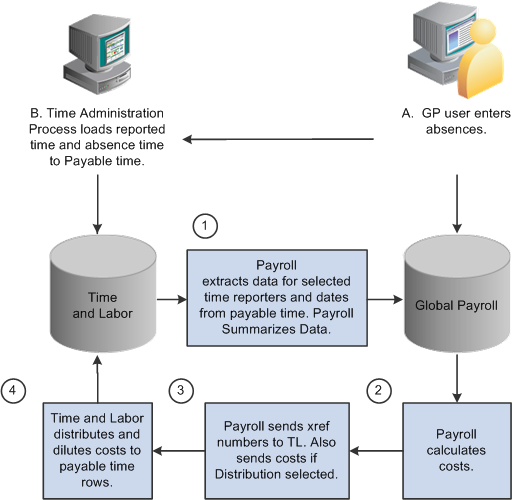

Time and Labor tracks the time that payees work and generates payable time that can be processed by payroll systems such as Global Payroll. If your organization uses Time and Labor with Global Payroll, you can process payable time during your pay runs, transmit cost data back to Time and Labor after a pay run, and share employee schedules.

Once you configure your systems to work together, Global Payroll:

Makes approved absence data available to Time and Labor so that it can be evaluated by the rules process that Time and Labor uses to create payable time for cost evaluation.

Loads payable time into Global Payroll when you start the Calculate phase of a pay run.

Treats payable time as generated positive input, meaning that all rules that apply to generated positive input also apply to payable time.

Processes payable time for the current period or an offsetting period.

Sends cost data back to Time and Labor after a pay run is complete so that the data can be distributed across payable time entries and sent to PeopleSoft Projects and other applications.

Note: When using Time and Labor with Global Payroll, you can enter absence events in Global Payroll using the Absence Event page, Time and Labor Self Service time sheet in the Absence Event topic, or Absence Self Service pages. Absence events populate the Absence Event Definition table (GP_ABS_EVENT) that is used during the Absence Take process and the Time Administration process in Time and Labor.

Each incident of time that is reported in Time and Labor is associated with a time reporting code (TRC) that identifies its type (for example, regular or meeting), units, currency, and other attributes. You can also assign task codes to each time entry, enabling your organization to track time at a finer level of detail—by product, location, and other categories. In addition, you can track the accounting information that flows between Time and Labor and Global Payroll. Integrating Time and Labor with Global Payroll requires that you map earning, deduction, and absence take elements to TRCs. You might also need to map supporting elements or variable task codes, and chartfields.

Time that is reported in Time and Labor must be converted to payable time before it can be sent to a payroll system for processing. The payable time must also have a payable status to indicate that it is ready for processing. The Time Administration process in Time and Labor creates payable time that's ready for payroll processing by applying a set of user-defined rules to time entries based on their TRCs. It can apply rules for overtime, holiday pay, guaranteed hours, consecutive days, and other situations.

During the Calculate phase of a pay run, Global Payroll retrieves payable time that's ready for processing from Time and Labor. The first time that the Calculate phase runs, Global Payroll processes all payees that are identified in the current calendars. During subsequent runs, Global Payroll creates an iterative trigger and a retroactive trigger for each instance of payable time that has changed and reprocesses only the payees that are in error or have iterative triggers. Payable time is retrieved each time the payroll is run.

After a pay run is finalized, you start an update process that updates the payable time entries in Time and Labor. This process also invokes the Labor Distribution and Labor Dilution processes in Time and Labor, if you have elected to use those features. If you are not using labor distribution, Global Payroll sets the status of payable time entries to CL (closed).

The following flowchart illustrates the interactions between Global Payroll and Time and Labor.

Note: Absence data that is sent to Time and Labor is not used to compensate payees for absences. Global Payroll calculates payee compensation for absences, and when the labor distribution feature is used, sends the resultant amounts back to Time and Labor after a pay run is finalized.

Both Global Payroll and Time and Labor are rules-based systems that are capable of carrying out some of the same types of rules. Before integrating the two products, think carefully about which rules you want each system to apply. In general:

Define rules that calculate payable time, including overtime, shift differentials, and other special situations, in Time and Labor.

Define rules that calculate pay in Global Payroll.

Time reporting codes (TRCs) are mapped to Global Payroll earnings and deductions that add to or subtract from gross and net pay accumulators. You should decide on a strategy for mapping earning elements to TRCs. For example, you might map a TRC to an earning element that does not accumulate to gross pay. This enables you to use a separate rule to calculate the costs that are associated with a TRC but do not contribute to gross pay, such as an employer-paid health insurance premium. You might use the same approach for salaried employees, where the hours that are reported by Time and Labor are not used in the payroll calculation, but are used for costing.

To summarize:

Define one earning element that accumulates to gross.

This is the earning element that the payroll process uses to calculate a payee's payslip. Do not map this element to a TRC.

Define a second earning element that does not contribute to gross pay.

This earning element is used for costing purposes only and, in addition to the payee's salary, can include overhead costs or any costs that you want to add. Map this element to a TRC so that accurate cost data is returned to Time and Labor and made available to the cost accounting, planning, or budgeting application.

Note: For hourly workers and in other situations where you do want the second earning elements to add to gross pay, you can map a TRC to a second earning element that accumulates to gross pay.

Note: Make sure that any earnings to which you map TRCs are set up to receive positive input. This is because Global Payroll brings in Time and Labor information as generated positive input.

Note: If you change the status of an element that's mapped to a TRC to Inactive, update the TRC mapping in Time and Labor.