Understanding Multiple Currencies

A key part of any multiple country system is currency support. Global Payroll streamlines the process of using multiple currencies. You can enter amounts and make payments in any currency—the system performs all necessary conversions using the parameters that you define.

This topic discusses:

Using and defining currency.

Currency at the pay entity level.

Currency at the element level.

Exchange rate types and dates.

Accumulators and currency.

Viewing payments across multiple currencies.

Online currency defaults.

Currency in batch processing.

Note: Global Payroll is designed to meet the changing currency requirements of the European Monetary Union (EMU). The system supports all currencies and enables multiple currency conversions.

To use multiple currencies in Global Payroll, you set up and maintain the following tables:

CURRENCY_CD_TBL (stores currency code data).

CURR_QUOTE_TBL (stores currency quotation method data).

RT_INDEX_TABLE (stores market rate index data).

RT_TYPE_TBL (stores market rate types).

RT_RATE_TABLE (stores market rate data).

These PeopleSoft Component tables are used universally by PeopleSoft HR.

See PeopleSoft 9.1 product documentation: Enterprise Components

Once you have defined the currency codes, types, exchange rates, and base currencies that you use in your system, you'll need to understand how Global Payroll uses this information so that you can run your payroll using multiple currencies.

The pages referred to in this discussion are described in detail in other areas of this documentation; here we discuss only how the fields on the pages are used in currency processing.

Once you've set up your currency rate codes, rate types, and exchange rates, you can use them to control your input and output amounts.

This table describes the Global Payroll two-tiered approach to currency codes:

|

Tier |

Currency Code Use |

|---|---|

|

Pay Entity |

Determines the processing currency for all payees in this pay entity. If no override currency code is present at a lower level, the system assumes that the amounts are in this processing currency. |

|

Definition of database field or element |

When you enter a payee's base compensation as a database field, on the Job Table or in the Payee Data component, you can enter a currency code. Also, when you define certain other elements, such as earnings and deductions, you assign a currency code to the definition. Then the system knows that your input for this definition is in that currency. The currency is converted to the processing currency for gross-to-net processing. |

In Global Payroll, you must enter a currency code every time you enter a monetary value on a page. The currency code designates what monetary unit you are entering.

For payroll purposes, the pay entity is the highest level of an organization. All payees are assigned to pay groups. Each pay group is assigned to one—and only one—pay entity. The currency entered on the Pay Entity page affects all pay groups that are assigned to that pay entity and all payees who are assigned to those pay groups. We refer to the pay entity currency as the processing currency.

All calculations for payees who are associated with this pay entity occurs in the pay entity currency. Before processing, all input items are converted to this currency. After processing, all output values are stored with net distribution information for each payee. Eventually this information is passed to banking payment files. Any conversion of a monetary output value to a different currency is handled by the party who receives the information, such as a bank.

Always define your processing currency as the currency that is used for most of your input and output, unless your country or locality requires stipulating what currency must be used for processing.

Note: You cannot override the processing currency. This doesn't mean that you can't enter amounts, or get output, in other currencies; it means that the processing occurs in this currency. If you override the default currency, the payments are converted to the processing currency for processing.

There are many kinds of monetary elements in Global Payroll. You can use currency with base compensation and with other elements.

Using Currency with Base Compensation

When a payee's base earnings are entered on the Job Data pages, you attach a currency code to the amount. If this currency is not the same as the processing currency, the system converts the amount entered into the processing currency before processing a payee's payment. If you do not enter a currency code, the system assumes that the amount is expressed in the processing currency and does no conversion.

Note: The currency code on Job Data appears by default from the base currency on the Installation Table, not from the Pay Entity Table. The base currency does not have to be the same as the pay entity currency—base currency has no impact on Global Payroll. However, check the code carefully to ensure that the default is correct. If it is not correct, change it.

Using Currency with Other Elements

Earnings and deductions are examples of elements. When you define an earning or deduction element, you enter other supporting elements, such as variables, in one of the component fields for the earning or deduction element. A component field, such as a base or a rate, can have a monetary format. The system requires that a currency code be provided for any field with a monetary format. At the point of entry into the batch system, the currency of a monetary value will be converted to the processing currency. If a monetary value is defined on a variable, then in the variable program, the amount will be converted to the processing currency. From that point on, the converted value will be used during the calculations. If the variable is used within an earning calculation, the converted value will be used.

When the Global Payroll calculation encounters a currency value that is not in the processing currency as defined at the Pay Entity level, the payroll system must perform a currency conversion. To do this, the system must know which exchange rate type to use and the dates to which it applies. The exchange rate type and dates documented below only apply to calculations performed within the Global Payroll process. They do not apply to other features like online currency conversions.

Exchange Rate Types and Dates at the Payee Level

You can override the exchange rate type and date at the payee level on the Payee Data Defaults page. Let's say that ten payees in the United Kingdom are working in Germany. One has a special rate, and the other nine get the official bank rate. For the pay group that includes these payees, you define the exchange rate type as the official bank rate. But let's say that you need to override that entry for the tenth payee. You can override the exchange rate in Job Data.

The default values for the payee are those defined for the payee's pay group. The system stores a value at the payee level only if you override the default.

To determine the exchange rate date, the system looks at the period end date, payment date, or period begin date and compares the date to the calendar period dates. It determines which exchange rate—based on the appropriate effective date—should be used for any required currency conversions during batch processing.

An accumulator tracks values in a single currency. If you change the processing currency, the system automatically converts the accumulator's value to the new processing currency. So, if you switch the processing currency from FRA to EUR on July 1, the system converts the accumulator's June 30 value to euros. Any amounts that are added to or subtracted from the accumulator after June 30 are tracked in euros.

If a payee receives earnings from countries that use different currencies, a separate accumulator must be defined for each currency. Say that a payee works in one country and is paid in that country's currency. An accumulator stores the payee's year-to-date earnings. The payee's job is redefined and now he works in two countries that use different currencies. The payee's earnings can no longer be stored in a single accumulator. You must define a new accumulator to store year-to-date earnings for the second country.

Many online pages that display earnings or amounts in one currency enable you to view these amounts in another currency so that you can track conversions across all currencies that are supported by the system.

In Global Payroll, you can view monetary values in multiple currencies on data entry pages and on pages where you view information.

When you enter a monetary value, you must also enter a currency code. You can change the default currency codes.

Currency defaults can come from operator preference, element definition, or pay entity. Operator preference refers to the EXCHNG_TO_CUR field on the Operator Defaults Table — HR record (OPR_DEF_TBL_HR). It is set on the Operator Preferences page. The record is not effective-dated. The pay entity record and the element definition record are effective-dated.

This table lists the currency code defaults and the as of date used:

|

Page |

Default Currency Code From |

As of Date |

|---|---|---|

|

Earnings |

Operator preference |

Not applicable. |

|

Deduction |

Operator preference |

Not applicable. |

|

Variables |

Operator preference |

Not applicable. |

|

Brackets |

Operator preference |

Not applicable. |

|

Historical Rule |

Operator preference |

Not applicable. |

|

Positive Input |

Element definition (if currency exists on element definition; else from pay entity for calendar ID) |

If from element definition, use the definition as of the Definition As Of Date. If from Pay Entity, use Pay Period End Date. |

|

Supporting Element Overrides |

Pay entity definition (if currency exists on element definition, else from paying entity) |

Current Date. |

|

Pay group definition (if currency exists on element definition, else from pay entity for that pay group) |

Current Date. |

|

|

Pay calendar definition (if currency exists on element definition, else from pay entity for the calendar's pay group) |

Pay Period End Date. |

|

|

Payee definition (if currency exists on element definition, else from Operator Preference) |

Current Date. |

|

|

Overrides |

Payee definition (if currency exists on element definition, else from Operator Preference) |

Current Date. |

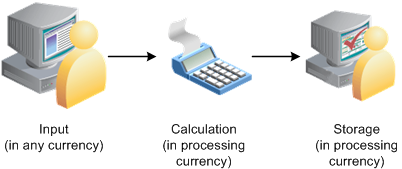

Here are the steps that take place during batch processing with regard to currency conversion:

The user enters monetary amounts into the system in any type of currency that the user chooses.

The system calculates exchange rates and converts amounts into a single processing currency (the processing currency that is defined at the pay entity level).

If it cannot find an associated currency code for a monetary value, the element is not resolved and the payment is placed in error.

The batch processes use a standard PeopleSoft currency conversion application that does the conversion and passes back the corresponding numerator and denominator to be applied against the input currency. The processes also handle triangulation.

For calculation, any value (for example, an accumulator value) that is being retrieved from a previous period, and is stored in a different currency, is converted into the current processing currency using the current period's exchange rate type and effective date.

The system performs calculations, using the processing currency, and stores the results in the processing currency in the PINV array.

The system stores the calculation results in the processing currency in the appropriate tables. It does not store the exchange rate that is used for currency conversions, the numerators and denominators that are used in the batch currency conversion program, or the original source input monetary value and currency code.

If the batch process cannot find an associated currency code for a monetary field (that is, the field is blank or the currency code is not valid), the system cannot resolve the element and puts the payment in error.

Note: To find the original source input monetary value and currency code for a calculation, look in the input source tables.

This flowchart illustrates how currency is managed during batch processing.