Viewing Transactions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_BNK_RCN_EXCP |

View exception transactions that resulted from the reconciliation process. |

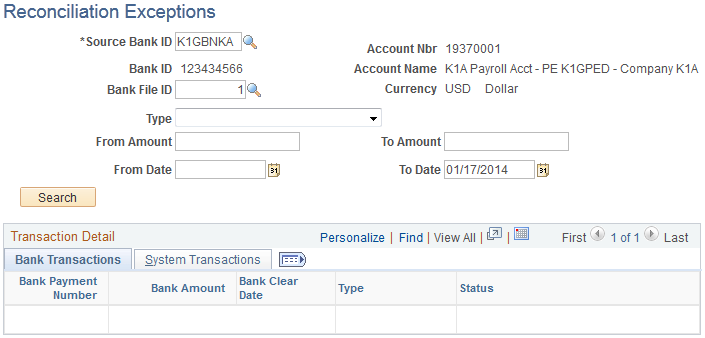

Use the Reconciliation Exceptions page (GP_BNK_RCN_EXCP) to view exception transactions that resulted from the reconciliation process.

Navigation:

This example illustrates the fields and controls on the Reconciliation Exceptions page.

Field or Control |

Description |

|---|---|

Source Bank ID |

Enter the source bank ID. This required field derives the values for the Bank Account, Bank ID, Account Name, and Currency fields. |

Bank File ID |

A unique sequence number assigned whether the bank file is loaded using component interface or manually. If this field along with the Source Bank ID is entered the user will view transaction generated from the auto reconciliation process. If this field is left blank the user will view the updated system transactions only. These would include transactions with a status of Expired, Stop, or Unclaimed. |

From Amount and To Amount |

Enter from and to amounts to narrow the search criteria. |

From Date and To Date |

Enter from and to dates to narrow the search criteria. |

Type |

Enter the type of method of payment. Valid Values are Check , Transfer, and Wire. |

Search |

Click this button to search on the criteria entered. Once the search is complete the reconciliation exceptions will display. |

Note: Results can be exported to Excel.

For auditing purposes, you may want to view which bank transaction reconciled to the system transaction. You must create a query in order to view this information.

During the auto generate reconciliation process, the system will assign a unique bank file ID to each process, as well as, a unique sequence number for each reconciled transaction. To view these reconciled transactions, you can query a report where GP_BNK_FILE_DTL.SEQ_NBR = GP_PYMT_BNK_TBL.SEQ_NBR. This query displays the reconciled system transactions and the line of bank data it was reconciled against.