Setting Up and Viewing Salary Packaging Tax Options

This topic discusses how to set up and view tax options for salary packaging.

To set up and view salary packaging tax options, use the FBT/GST (PKG_FBT_TBL), FBT Stat Interest (PKG_FBT_INT_TBL), FBT Vehicle Rates (PKG_FBT_VEH_TBL), State Payroll Tax (PKG_PYTX_TBL), and the Tax Scales (PKG_TAX_SCALES_AUS) components.

PeopleSoft delivers and maintains the Fringe Benefits Tax (FBT) and Goods and Services Tax (GST) tables in the system. Because you can create salary package components to represent fringe benefits, such as a car allowance or a housing allowance, review the FBT and GST table information as part of your salary package setup. The system uses these tables when it calculates salary package FBT and GST liabilities for package components. Link the tax liability information to a salary package component using the Additional Comp page.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PKG_FBT_TBL |

View the FBT and GST rates for Australia. The GST percentage and rate for the calculation of Fringe Benefits Tax (FBT) appear. |

|

|

PKG_FBT_INT_TBL |

View FBT statutory interest rates. The statutory percentage rate used in the calculation of interest payments for depreciation of motor vehicles and low interest loans appear. |

|

|

PKG_FBT_VEH_TBL |

Review FBT motor vehicle statutory percentage information. The kilometer thresholds and the corresponding statutory percentages used in determining the taxable value of a motor vehicle appear. |

|

|

PKG_PYTX_RT_TBL |

Specify the payroll tax percent rate for all states where employees in a specific company are located. This page provides maintenance functions for the State Payroll Tax tables. These percentages are used in the notional calculation of tax during package modelling. |

|

|

PKG_TAX_SCALES_AUS |

Maintain tax scales used in package calculations. Set up and view the thresholds and the percentage of tax for each threshold. Use only if you have Human Resources and not Global Payroll installed. If Global Payroll is installed, the Global Payroll PAYG Tax Scales are used by Salary Packaging. |

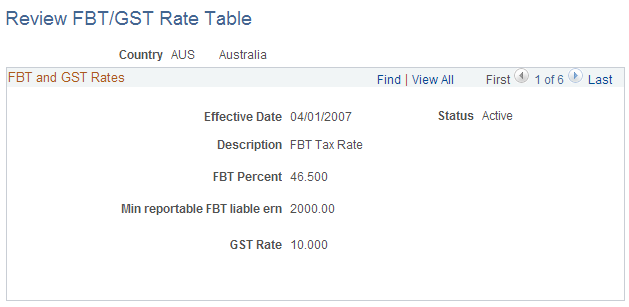

Use the Review FBT/GST Rate Table page (PKG_FBT_TBL) to view the FBT and GST rates for Australia.

The GST percentage and rate for the calculation of Fringe Benefits Tax (FBT) appear.

Navigation:

This example illustrates the Review FBT/GST Rate Table page.

FBT and GST Rates

Field or Control |

Description |

|---|---|

FBT Percent (Fringe Benefits Tax percentage) |

The rates are set by the Australian Taxation Office, with any changes generally effective in line with the FBT year of April 1 to March 31. |

Min reportable FBT liable ern (minimum reportable Fringe Benefits Tax liable earning) |

When producing payment summaries, the system has to determine if an employee has received, in the FBT year, fringe benefits with a total taxable value exceeding 1,000 AUD. A collection process totals the FBT liable earnings and, if they exceed 1,000 AUD, reports the grossed-up taxable value on the payment summary. |

GST Rate |

The GST on your package components is calculated using this rate. |

Use the Review FBT Stat Interest Rate page (PKG_FBT_INT_TBL) to view FBT statutory interest rates.

The statutory percentage rate used in the calculation of interest payments for depreciation of motor vehicles and low interest loans appear.

Navigation:

This example illustrates the Review FBT Stat Interest Rate page.

FBT Statutory Interest Rate

Field or Control |

Description |

|---|---|

Statutory Percent |

Used in the calculation of interest payments for depreciation of motor vehicles and low interest loans. |

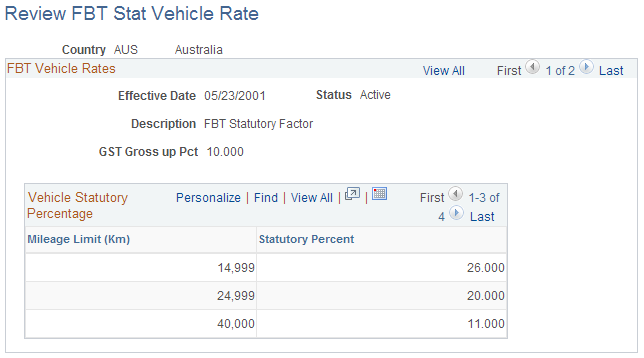

Use the Review FBT Stat Vehicle Rate page (PKG_FBT_VEH_TBL) to review FBT motor vehicle statutory percentage information.

The kilometer thresholds and the corresponding statutory percentages used in determining the taxable value of a motor vehicle appear.

Navigation:

This example illustrates the Review FBT Stat Vehicle Rate page.

FBT Vehicle Rates

Field or Control |

Description |

|---|---|

GST Gross up Pct |

Used in the calculation of GST on vehicles. |

Vehicle Statutory Percentage

Field or Control |

Description |

|---|---|

Mileage Limit (Km) / Statutory Percent (mileage limit [kilometer/statutory percentage) |

Determine the taxable value of a motor vehicle. The statutory percentage rate is used in the calculation of interest payments for depreciation of motor vehicles and in the calculation of FBT for components with a component type of motor vehicle. |

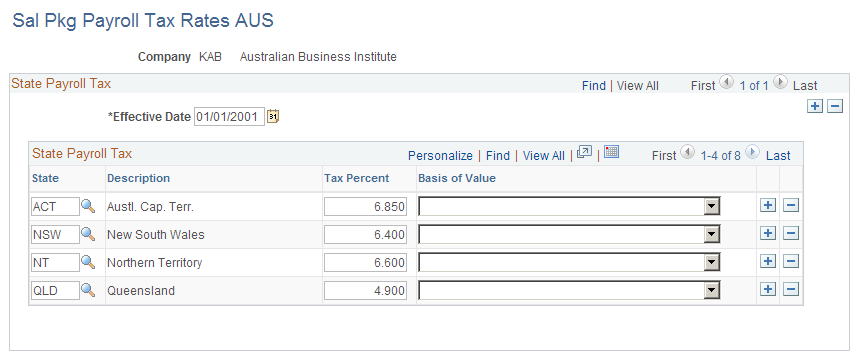

Use the Sal Pkg Payroll Tax Rates AUS page (PKG_PYTX_RT_TBL) to specify the payroll tax percent rate for all states where employees in a specific company are located.

This page provides maintenance functions for the State Payroll Tax tables. These percentages are used in the notional calculation of tax during package modelling.

Navigation:

This example illustrates the Sal Pkg Payroll Tax Rates AUS page.

State Payroll Tax

Field or Control |

Description |

|---|---|

State/Tax Percent |

If you want the notional payroll tax liability to be calculated during salary package modelling, enter the tax percent for each state in which you pay employees. If you don't enter these details, the system does not calculate liability for payroll tax for employees when you model salary packages. The tax percentage rates you enter are only used in salary packaging calculations. For most Australian states, the tax rate varies based on the value of your company payroll. To obtain an even more accurate notional tax calculation, specify the percentage rate of tax for each state. To do so, enter a rate based on your knowledge of your company payroll. For example, if you know the amount of your total wages bill in a given state, and you know that the threshold you are allowed to take effectively reduces your true net payroll tax rate from 7 percent to 6.75 percent, then enter the 6.75 percent here. Then your true net rate is used in package modelling, so your notional calculations in Administer Salary Packaging are more accurate. Note: Specify company payroll tax liability on the Company Table. |

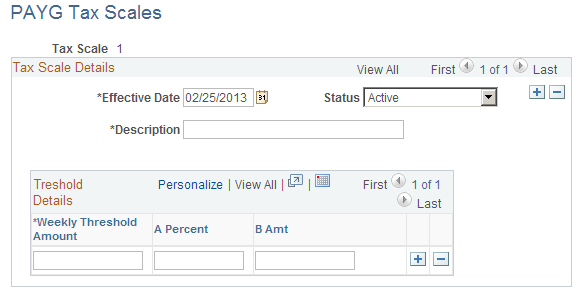

Use the PAYG Tax Scales page (PKG_TAX_SCALES_AUS) to maintain tax scales used in package calculations by setting up and viewing the thresholds and the percentage of tax for each threshold.

Navigation:

This example illustrates the PAYG Tax Scales page.

Threshold Details

Field or Control |

Description |

|---|---|

Weekly Threshold Amount / A Percent / B Amt (weekly threshold amount and a percentage and B amount) |

Set up and view the thresholds and the percentage of tax for each threshold. These values correspond to the information on the "Statement of Formulae for Calculating Income Tax Installments," issued by the Australian Taxation Office (ATO). In addition to the tax scales on that document, PeopleSoft has introduced tax scales A, B, and L for processing annual leave, long service leave, and leave bonus payments. The system identifies the top threshold and then works down, checking the weekly amounts and using its logic to calculate the tax installment. Note: If you need to apply special tax rates, create your own tax scales using the PAYG Tax Scales page. For example, you might choose to establish a Tax Scale E where no tax applies for tax exempt employees or for those employees who you keep on a flat amount or percentage of tax due to instructions that you've received from the ATO. This page is used if you use Administer Salary Packaging without Global Payroll. If Global Payroll is used, then salary packaging uses the Global Payroll PAYG Tax Scales. |