Defining Deductions and Earnings for Assignment Compensation

To set up deductions and earning for assignment compensation, use the Global Assignment Earnings (EARNINGS_TABLE1), and Global Assignment Deductions (DEDUCTION_TABLE1) components.

These topics discuss assignment deductions and earnings.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEDUCTION_TABLE1 |

Add deduction codes and classification information. |

|

|

DEDUCTION_TABLE2 |

Define tax treatments for assignment deductions. |

|

|

EARNINGS_TABLE1 |

Add earnings codes for global assignments. |

Employees on global assignments often are entitled to supplemental earnings, such as cost-of-living adjustments and hardship premiums. You might also take additional deductions from the employee's paycheck because of estimated taxes.

Enter earnings and deductions as they relate to home and host assignment data. For example, an employee might receive a cost-of-living adjustment that is paid for by the host location and a hardship premium that the home location absorbs. Enter these components in multiple currencies; the system automatically calculates the equivalent amounts in the home currency.

To identify recurring payments or isolated incidents of supplemental earnings or deductions, track compensation data by employee and payment instruction type. PeopleSoft includes two types of payment instructions: global compensation and one-time payments. These are sufficient for most compensation that relates to global assignments.

If the organization is not using PeopleSoft Payroll for North America and you want to track assignment compensation, set up deduction, tax, and earnings information on the Earnings and Deductions components.

You can track assignment compensation on the Assignment Compensation component.

See Deduction Table Page.

Note: Use the Payroll for North America Earnings and Deductions tables (Set Up HCM, Product Related, Payroll for North America) to set up earnings and deductions if you use Payroll for North America. The global assignments tables do not contain enough information to substitute for the payroll tables.

Make the tables in the Global Assignments menu display-only to ensure that all updates take place by using the pages in North American Payroll.

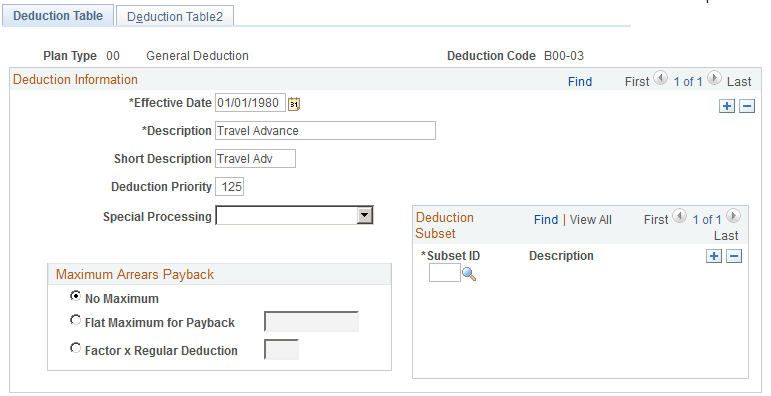

Use the Deduction Table page (DEDUCTION_TABLE1) to add deduction codes and classification information.

Navigation:

This example illustrates the fields and controls on the Deduction Table page. You can find definitions for the fields and controls later on this page.

For deduction codes for global assignments, enter a Plan Type of 00.

Warning! Enter information in these fields only: Effective Date, Description, and Short Description. Otherwise, the system assumes that the code that you define here is for payroll purposes when you enter the code on other assignment pages. You could also receive an error message if you don't fill in all of the required fields that are on the other pages for the table that is in the Payroll for North America or Payroll Interface menus, depending on the payroll system that you use.

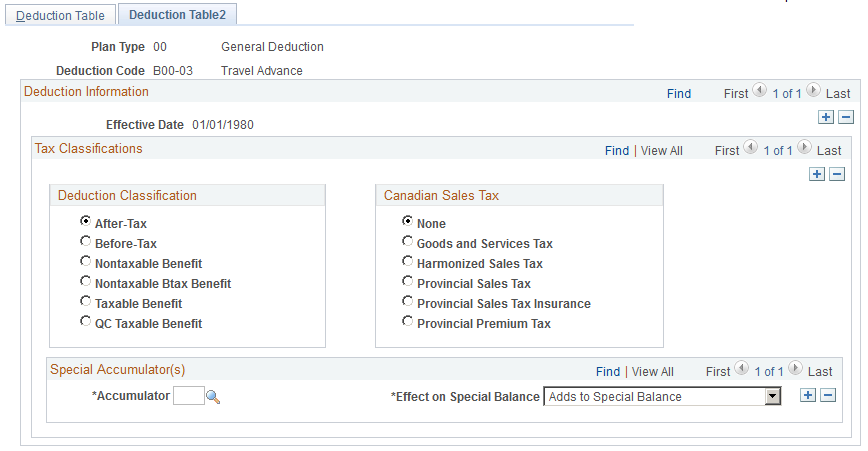

Use the Deduction Table2 page (DEDUCTION_TABLE2) to define tax treatments for assignment deductions.

Navigation:

This example illustrates the fields and controls on the Deduction Table2 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Deduction Classification |

Select a deduction type. |

Canadian Sales Tax |

Select the type that is required in Canada. |

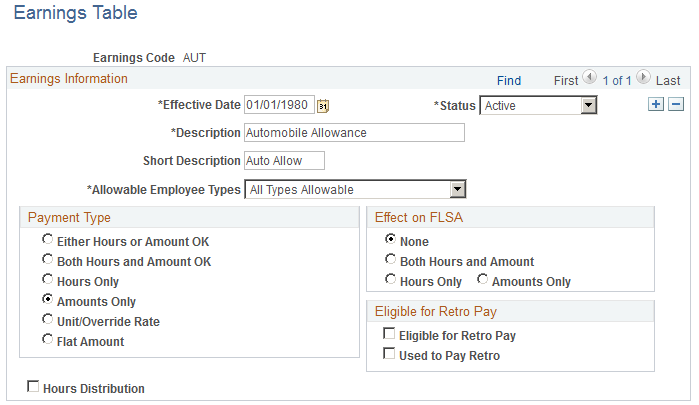

Use the Earnings Table page (EARNINGS_TABLE1) to add earnings codes for global assignments.

Navigation:

This example illustrates the fields and controls on the Earnings Table page. You can find definitions for the fields and controls later on this page.

Warning! Enter information in these fields only: Effective Date, Description, and Short Description. Otherwise, the system assumes that the code that you define here is for payroll purposes when you enter the code on other assignment pages. You could also get an error message because you don't fill in all of the required fields that are on the other pages for the table that is in the Payroll for North America or Payroll Interface menus, depending on the payroll system that you use.