Defining Earnings for Translation to the ROE Form

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Tax Form Definitions Page |

TAXFORM_DEFN_TBL |

(CAN) Define earnings for translation to the ROE form. |

|

PY_ROE_MAP_CODES |

(CAN) View the system’s default mapping of the 3-character Other Monies codes. |

Define earnings for translation to the ROE form by using the Tax Form Definition page. The system uses this information to determine how to distribute the following information to the boxes in block 17 on the ROE form:

Earnings information that you enter manually on the ROE Data 2 page.

Vacation pay and other monies that you pay in the final pay period using the Pay Calculation COBOL SQL process (PSPPYRUN).

The following table describes the earnings information to enter for each ROE box on the Tax Form Definition page:

|

Box |

Earnings Description |

Explanation |

|---|---|---|

|

17A |

Vacation pay |

Specify the earnings code(s) that you use to pay vacation pay owing to an employee, on an interruption of earnings. |

|

17B |

Statutory holiday pay |

Specify the earnings code(s) that you use to pay statutory holiday pay for holiday dates occurring after the date in block 11 of the ROE form. |

|

17C |

Other monies |

Specify the earnings codes for other payments that you might owe to an employee after an interruption of earnings. Earnings that you must report in this box include pension payments, both lump sum and ongoing severance payments or retiring allowances, wages in lieu of notice, and retroactive wage increases. Note: Effective May 31, 2014, 1-digit ROE Other Monies codes were replaced with one to several 3-digit codes, making more codes available and each code more specific. Use the ROE Codes Mapping page (PY_ROE_MAP_CODES) to determine the default 3-digit codes that the system uses. |

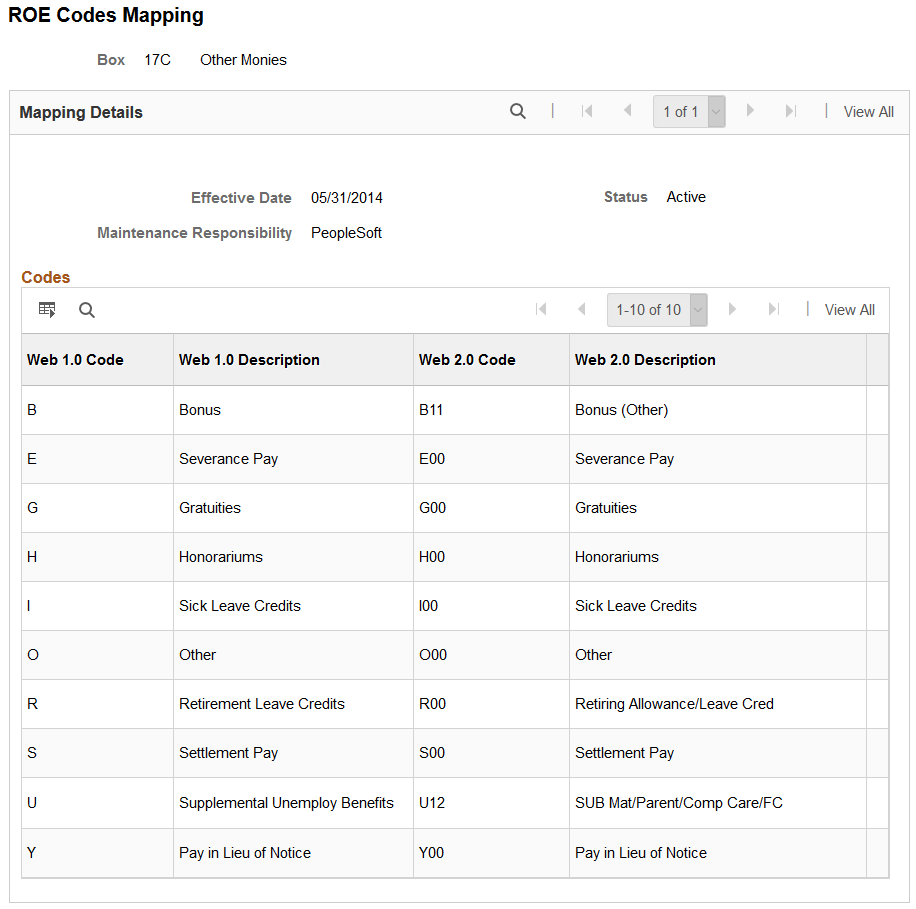

(CAN) Use the ROE Codes Mapping (PY_ROE_MAP_CODES) page to view the system’s default ROE Web 2.0 3-character Other Monies codes.

Note: Oracle’s PeopleSoft delivers and maintains this read-only page for informational data history purposes.

This example illustrates the fields and controls on the ROE Codes Mapping page.

With the latest ROE Web XML changes (effective December 3, 2017), Block 16 (Code Z00), Block 17C (code U12) and Block 19 (Code MAT01) have been renamed to reflect the new Family Caregiver Benefits. The web 2.0 description for code U12 is updated to SUB Mat/Parent/Comp Care/FC.

With the implementation of Web ROE 2.0 (effective May 31, 2014) Service Canada expanded the 1-character ROE Box 17C Other Monies codes to 3-character codes.

To prevent the ROE XML file from being rejected by Service Canada after applying the Web ROE 2.0 changes, PeopleSoft has mapped each former ROE Web 1.0 1-character Other Monies code to a predetermined ROE Web 2.0 3-character code. If your Tax Form Definitions table is not updated with the full set of 3-character codes, the PeopleSoft system automatically converts the former 1-character code to the default 3-character code shown in the ROE Codes Mapping page. For example, code B Bonus, will be converted to code B11 Bonus (Other) for reporting on the ROE XML file.

To determine or confirm the Web ROE 2.0 changes, consult the Payroll for North America Tax Update 15-D (for 2015) in My Oracle Support.