Deleting Employee Balances

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PAY_DEL_BAL |

Specify process parameters for the Delete Balances process. You can delete balances for a specific company and a specific balance year and period. |

The Delete Balances process is an effective way to purge obsolete historical data from the system and free disk space. This process deletes employee payroll balances for the year and period that you specify. Specifically, it deletes balances for earnings, deductions, taxes, and paychecks YTD.

When you run the Delete Balances process depends on when your company no longer has legal or corporate requirements that require it to maintain the information. For example, you might run the process annually after you print W-2s, produce quarterly reports, and so on.

Warning! Running the Delete Balances process deletes balances for earnings, deductions, taxes, and paychecks YTD for the year and period that you specify. Once deleted, this information is not recoverable. Use this process with care.

Use the Balance Deletion page (RUNCTL_PAY_DEL_BAL) to specify process parameters for the Delete Balances process.

Navigation:

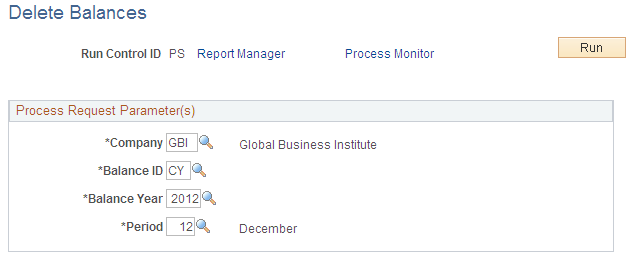

This example illustrates the fields and controls on the Delete Balances page.

You can delete balances for a specific company and a specific balance year and period.

Field or Control |

Description |

|---|---|

Balance ID |

Maintain these values in the Balance ID table, and identify the various year types for which you maintain balances (for example, calendar year, or fiscal year). For each balance ID in the Balance ID table, you must also define the following:

|

Balance Year and Period |

For the balance year, the system deletes employee balance records up to but not including:

In February 2005, an organization deletes balances for the previous calendar year, specifying December 2004 as the period on the Balance Deletion page. The system:

If an employee had a deduction that met its goal balance in September, the September balance record would be retained, because it is the latest updated balance record for that deduction. |