Double-time Calculations for FLSA and Alternative Overtime Employees

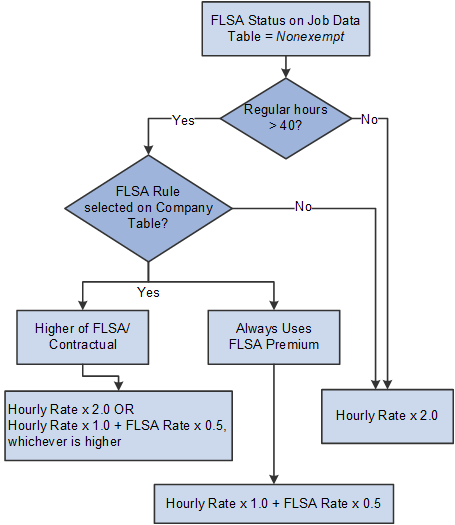

The system calculates double-time pay based on a combination of options that are set on the Job Data Table, the Company Table, and the Alternative Overtime State Table. These settings work together and your outcome can vary based on what is selected in the three tables.

On the Job Data Table (Job Information page), the system considers the FLSA Status setting.

If Nonexempt is selected, then the system allows a calculation of FLSA only after the employee reaches 40 hours. The system looks at the Company Table to determine the FLSA rule to use.

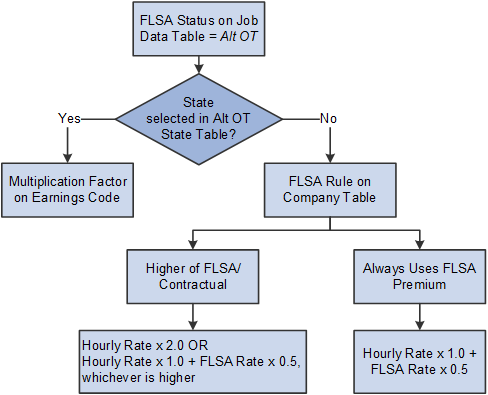

If Alt OT (alternate overtime) is selected, then the system ignores the 40-hour threshold and looks at the Alternative Overtime State Table to determine if the employment state is listed.

This diagram illustrates how the system calculates double-time based on options that are set on the Job Data Table, the Company Table, and the Alternative Overtime State Table.

For FLSA nonexempt employees, the system considers the FLSA rule specified on the Company Table (Default Settings page).

If the FLSA Required check box is selected and Higher of FLSA/Contractual is specified, then the system compares the amounts calculated for each of these 2 rules and picks the higher of the two:

Rule 1: Hourly rate times 2.0 for hours over 40.

Rule 2: Hourly rate times 1.0 (for the straight time portion) plus the FLSA rate times .5 (for the premium portion) for hours over 40.

If the FLSA Required check box is selected and Always uses FLSA Premium is specified, then the system calculates the double-time amount as follows for any hours over 40:

Hourly rate times 1.0 (for the straight time portion) plus the FLSA rate times .5 (for the premium portion).

Note: The premium portion of the double-time pay is always paid at .5, and not as specified on the earnings table. To ensure the multiplication factor on the earnings table is used in the calculation, the employee must be set up with FLSA Status of ALT OT, and the employee’s work state must be set up in the Alternative Overtime Table.

If the FLSA Required check box is not selected, then the system calculates the hourly rate times 2.0 for any hours over 40.

This diagram illustrates how the system calculates double-time for FLSA Alt OT employees based on the FLSA rule that is specified on the Company Table (Default Settings page).

For Alternative Overtime employees, the system determines if the employment state is listed on the Alternative Overtime State Table page.

If the state is listed in the Alternative Overtime State Table, then the system uses the multiplication factor in the Earnings Table to calculate the double-time pay regardless of whether the Company Table is set to Higher of FLSA/Contractual or Always Use FLSA Premium. If the double-time earnings code is set up with a multiplication factor of 2.0, then the double-time pay is calculated as follows for any hours over 40:

Hourly rate times 1.0 (for the straight time portion) plus the FLSA rate times 1.0 (for the premium portion).

Note: The premium portion is calculated using the FLSA rate regardless of which FLSA rule is selected on the Company Table.

If the state is not listed, then the system uses the FLSA rule that is set on the Company Table.

Examples for Hourly Employee with Fixed FLSA Period Rule

The following table lists calculations for 5 double-time hours based on a regular 40-hour week at a standard rate of 10.00 USD per hour and a $100.00 bonus.

|

Example |

FLSA Rule on Company Table |

FLSA Status on Job Table |

State Listed in Alt OT State Table |

Rate Used |

Rate Amount USD |

Overtime Calculation Amount USD |

|---|---|---|---|---|---|---|

|

1 |

Higher of FLSA/ Contractual |

Non Exempt |

NA |

Hourly Rate |

20.000000 |

100.00 |

|

2 |

Always Use FLSA Premium |

Non Exempt |

NA |

FLSA |

12.222222 |

80.56 |

|

3 |

Higher of FLSA/ Contractual |

Alt OT |

Yes |

Alternative Rate |

12.2222222 |

111.11 |

|

4 |

Always Use FLSA Premium |

Alt OT |

Yes |

Alternative Rate |

12.222222 |

111.11 |

|

5 |

Higher of FLSA/ Contractual |

Alt OT |

No |

Hourly Rate |

20.000000 |

100.00 |

|

6 |

Always Use FLSA Premium |

Alt OT |

No |

FLSA |

12.222222 |

80.56 |

Rate for FLSA/ALT OT: 40

(Regular) Hours x 10.00 USD (Standard Rate) = 400.00 USD 5 (Double

Time Hours) x 10.00 USD (Standard Rate) = 50.00 USD Bonus= 100.00

USD Subtotal = 550.00 USD 550.00 USD/45 Total Hours = 12.22222

USD

Example 1

On the Job Table the employee has an FLSA status of Non Exempt, and on the Company Table the rate to use is Higher of FLSA/Contractual.

5.00 hours x 20.00 USD (10.00 USD x 2.0) = 100.00 USD is higher than (5.00 hours x 10.00 USD) + (5.00 x 12.222222 x .5) = 80.56 USD.

The system will pay the employee 100.00 USD of overtime pay.

Example 2

On the Job Table the employee has an FLSA status of Non Exempt, and on the Company Table the rate to use is Always Use FLSA Premium. The system uses the Federal FLSA Rule, which is hourly rate times 1.0 (for the straight time portion) plus the FLSA rate times .5.

(5.00 hours x 10.00 USD) + (5.00 x 12.222222 x .5) = 80.56 USD.

The system will pay the employee 80.56 USD of overtime pay.

Examples 3 and 4

The state is set up in the Alternative Overtime State Table and on the Job Table the employee has an FLSA status of Alt OT. Therefore the system uses the Multiplication Factor in the Earnings Table to determine the rate calculations regardless of whether the Company Table is set to Higher of FLSA/Contractual or Always Use FLSA Premium. In this example, the Double Time earnings code is set up with a multiplication factor of 2.0. The Category for FLSA has regular pay included. This means the employee will get the Premium Calc (FLSA) on anything over 1.0 (regular pay).

(5.00 hours x 10.00 USD) + (5.00 x 12.222222 x 1.0) = 111.11 USD

The system will pay the employee 111.11 USD of overtime pay.

Example 5

On the Job Table the employee has an FLSA status of ALT OT, but the employee’s state is not listed in the Alternative Overtime State Table. With this setup, the employee does not need to meet the 40-hour threshold to obtain an Alt OT calculation. The system bases the calculation on the Standard Federal FLSA calculation routine. The system looks at the Company Table and sees that the rate to use is the Higher of FLSA/Contractual.

5.00 hours x 20.00 USD (10.00 x 2.0) = 100.00 USD is higher than (5.00 hours x 10.00 USD) + (5.00 x 12.222222 x .5) = 80.56 USD.

The system will pay the employee 100.00 USD of overtime pay.

Example 6

On the Job Table the employee has an FLSA status of ALT OT, but the employee’s state is not listed in the Alternative Overtime State Table. The same as in example 5, with this setup, the employee does not need to meet the 40-hour threshold to obtain an Alt OT calculation. The system bases the calculation on the Standard Federal FLSA calculation routine. However, in this example the system looks at the Company Table and sees that the rate to use is Always Use FLSA Premium. The system limits the overtime calculation to Federal rules of 1.5.

(5.00 hours x 10.00 USD) + (5.00 x 12.222222 x .5) = 80.56 USD

The system will pay the employee 80.56 USD of overtime pay.