Grouping Earnings, Deduction, and Tax Expenses

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PYGL_ACTIVE_ERNGRP |

Group earnings codes into expense groups. |

|

|

PYGL_ACTIVE_DEDGRP |

Group deduction codes into expense groups. |

|

|

PYGL_ACTIVE_TAXGRP |

Group taxes into expense groups. |

If your organization uses non-commitment accounting, you can track expenses by grouping expense activities into logical definitions that share the same combination of ChartField values. For example, you can group all regular earnings in one group and all overtime earnings in another group.

You can then map the groups to the combination of ChartField values for each group.

Note: Work with your finance office to identify expense activity groups and their members, and to map each group to the correct combination of ChartField values.

The GL Activity Grouping Component

When you add a new value and enter the component, you must select an activity type in the Valid Activity Type(s) group box. The selected activity type determines which page in the component is available for data entry.

You must then access the correct page in the component for the type of expense group that you are creating.

Default Groups

You must create a default group for each activity type. Select Group contains all codes.

During distribution of costs, when the GL Interface process encounters an expense that is not mapped to a valid group, it assigns the expense to the default group for that activity type.

The default group contains all codes so that no expense of this activity type is excluded from this group.

Updating Expense Groups

After you map all expense activities, if you add new earnings, deductions, or taxes, you must add the new codes to an existing group, create a new group, or let the new code be distributed to the existing default group. If you add a group, you must also map it to the correct ChartField combination.

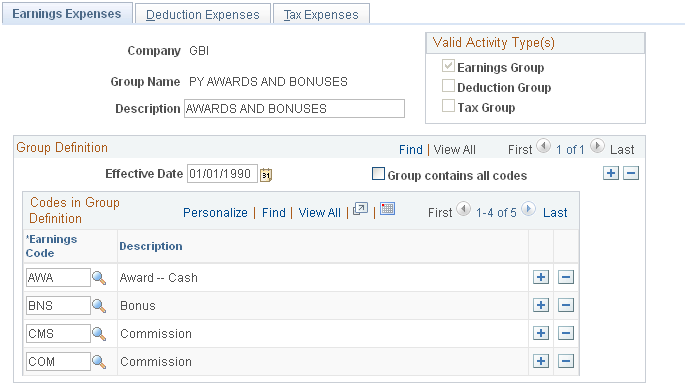

Use the Earnings Expenses page (PYGL_ACTIVE_ERNGRP) to group earnings codes into expense groups.

Navigation:

This example illustrates the fields and controls on the Earnings Expenses page.

Field or Control |

Description |

|---|---|

Valid Activity Type(s) |

Select Earnings Group. |

Group contains all codes |

To create the required default earnings group, select Group contains all codes. This group is used for any earnings expenses that are not included in a specific group. When you select this check box, the other fields on the page disappear. |

Codes in Group Definition

Field or Control |

Description |

|---|---|

Earnings Code |

Select earnings codes to include in this group. |

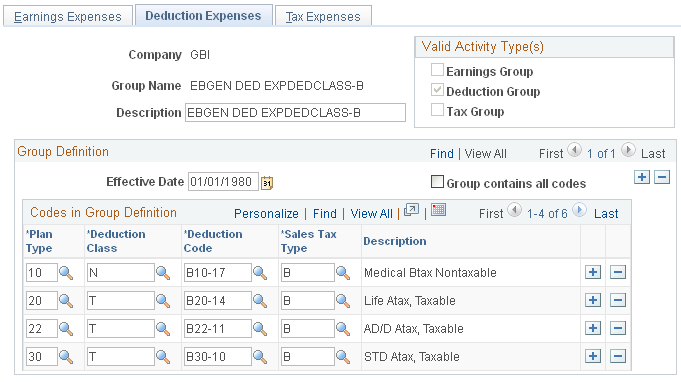

Use the Deduction Expenses page (PYGL_ACTIVE_DEDGRP) to group deduction codes into expense groups.

Navigation:

This example illustrates the fields and controls on the Deduction Expenses page.

Field or Control |

Description |

|---|---|

Valid Activity Type(s) |

Select Deduction Group. |

Group contains all codes |

To create the required default deduction group, select Group contains all codes. This group is used for any deduction expenses that are not included in a specific group. When you select this check box, the other fields on the page disappear. |

Codes in Group Definition

Field or Control |

Description |

|---|---|

Plan Type, Deduction Class, and Deduction Code |

Select the appropriate plan type and deduction class for the deduction code you are adding to the group. For a particular deduction code, all applicable deduction classes must be included in groups. Applicable deduction classes for expenses are: N: Nontaxable benefit. P: Nontaxable before-tax benefit. T: Taxable benefit. L: Taxable benefit (Canada - Quebec). |

Sales Tax Type |

Sales tax type applies only to Canada. Available values vary depending upon the deduction code. Note: (USA) U.S. users must select B (none), which is the default. |

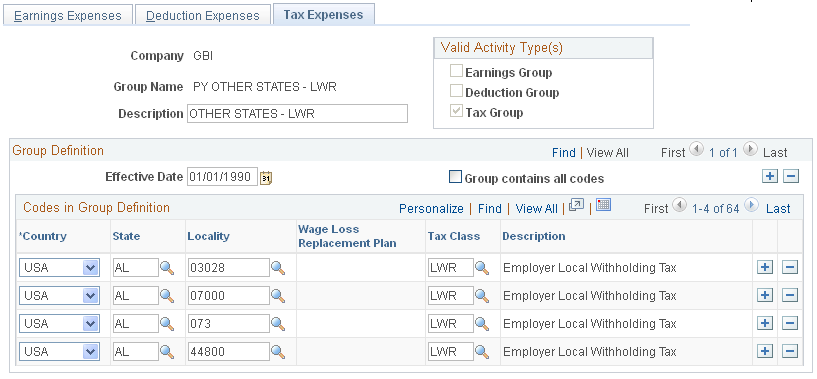

Use the Tax Expenses page (PYGL_ACTIVE_TAXGRP) to group taxes into expense groups.

Navigation:

This example illustrates the fields and controls on the Tax Expenses page.

Field or Control |

Description |

|---|---|

Valid Activity Type(s) |

Select Tax Group. |

Group contains all codes |

To create the required default tax group, select Group contains all codes. This group is used for any tax expenses that are not included in a specific group. When you select this check box, the other fields on the page disappear. |

Codes in Group Definition

Field or Control |

Description |

|---|---|

Country |

The country that you select determines the fields that are available for data entry: USA: The State, Locality, and Tax Class fields are available. Canada: The Wage Loss Replacement Plan and Tax Class fields are available. |

State and Locality |

(USA) Use of the State and Locality fields depends upon the type of tax and the location. For example, FICA OASDI is a federal tax that would not require the State and Locality fields. |

Wage Loss Replacement Plan |

(CAN) Set up a separate group for each different wage loss plan for purposes of employment insurance (EI). |

Tax Class |

Tax Class is always a required field. The values available for selection depend upon the values selected in preceding fields. |