Reversing Paychecks

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PAY_REV |

(USA, USF) Define the parameters for the check reversal process. |

|

|

Reverse/Adjust Paycheques Page |

RUNCTL_PAY_REV |

(CAN) Define the parameters for the cheque reversal process. The (CAN) Reverse/Adjust Paycheques page is similar to the (USA) Reverse/Adjust Paychecks page. |

|

PAY_CHECK_E |

View reversed checks. |

Run paycheck reversal when a system-generated check is incorrect and has not been cashed or deposited. The key to reversing checks is running the Paycheck Reversal/Adjustment COBOL SQL process (PSPPYREV), which eliminates the need to enter each check to be reversed as a manual check. This program locates the checks you've specified on a special run control and creates an off-cycle paysheet page for each reversal. The resulting paylines reflect the original paysheet entries, with negatives in the hours and amount fields. These pages are display-only.

During the Paycheck Reversal/Adjustment process, the system makes a copy of the paycheck record and reverses the signs (plus/minus) on the amount fields. The original paycheck record is retained, not deleted. You can view both the original and the reversed paycheck records from the Paycheck pages. On the reversed check, all of the amounts display as negative numbers, and the message "Calculated Check Reversal" appears in the upper-left corner.

To reverse paychecks, you do not need to run the Pay Calculation process. When you run the Paycheck Reversal/Adjustment process, the system finds the check or checks that you've specified and reverses the plus/minus signs. Because the amounts themselves have already been calculated, no additional calculation is necessary.

Deleting a Reversal

You can delete a reversal if you made a mistake. Select Delete Current Reversal/Adjustment on the Reverse/Adjust Paychecks run control page and run the process again. If you must make a correction after the reversal has been confirmed, you must process a manual check.

Updating Balance Records

To update the balance records with the final reversal information, run the Pay Confirmation process. After confirmation, when you view the paycheck, the message "Confirmed Check Reversal" appears in the upper-left corner. You can then issue an on-demand or online check for the correct amount.

Reversing Time and Labor Payable Time

If the check you're reversing (not adjusting) includes payable time from Time and Labor, you specify the processing option:

Reverse Only: Generates only an offset row for the payable time row being reversed.

Reverse and Generate New Row: Reverses the check and creates a new payable time row to process later.

Note: If you unconfirm a reversal that includes Time and Labor payable time, you must run a process to correct the corresponding payable time rows in Time and Labor.

See Unconfirming Pay.

(USA, USF) Use the Reverse/Adjust Paychecks page (RUNCTL_PAY_REV) to define the parameters for the check reversal process.

(CAN) Use the Reverse/Adjust Paycheques page (RUNCTL_PAY_REV) to define the parameters for the cheque reversal process.

Navigation:

Navigation:

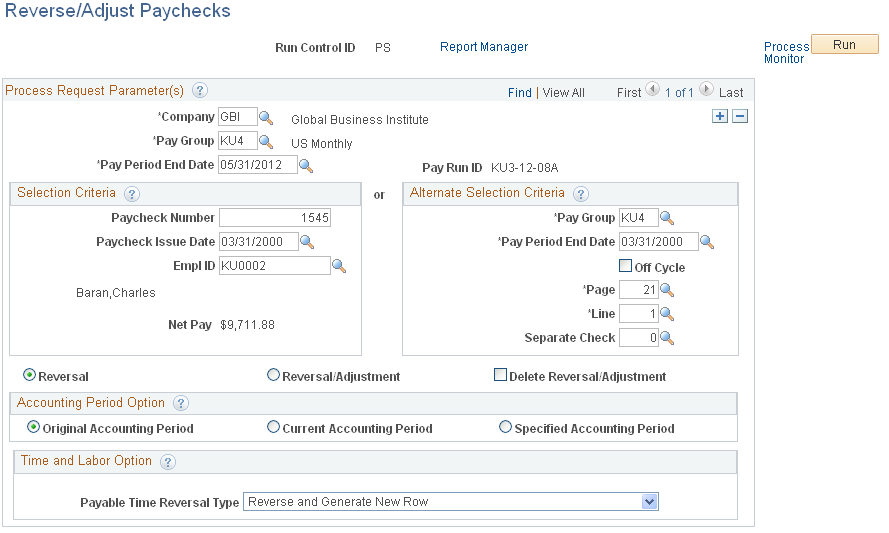

This example illustrates the fields and controls on the Reverse/Adjust Paychecks page.

Note: The page is the same for reversals and adjustments.

Field or Control |

Description |

|---|---|

Run Control ID |

For every Reverse/Adjust Paychecks run control you enter, the system sets up a separate off-cycle paysheet page and line. |

Company, Pay Group and Pay Period End Date |

The pay period end date corresponds to the on-cycle pay calendar with which you want to process the reversal or reversal/adjustment. Check reversals cannot be run if the pay run ID for the specified pay period end date is blank on the Pay Calendar table. Also, the reversal must be associated with a pay calendar that is not closed for off-cycle processing. |

Paycheck Number and Paycheck Issue Date |

If you know the check number and issue date, you can search for the corresponding check to be reversed. |

Pay Period End Date, Off Cycle, Page and Line |

If you do not know the check number and issue date, you can locate the check by searching for these values in the fields in the right column. |

Separate Check |

If the check to be reversed was issued as a separate check, enter a value here. You can also find the paycheck number and paycheck issue date information either online or off-line: Online: Use the Paycheck Data pages. Off-Line: Refer to your Payroll Register or Payroll Check Register reports. |

Reversal |

Select for a check reversal. |

Reversal/Adjustment |

Select for a check reversal and an adjustment check. |

Delete Reversal/Adjustment |

To delete an unwanted reversal or reversal/adjustment, set up a run control with this option selected and run the Paycheck Reversal/Adjustment process. |

Accounting Period Option

This option applies to commitment accounting only.

Field or Control |

Description |

|---|---|

Original, Current, and Specified |

Select to process the original, current, or a specified accounting period. |

Fiscal Year |

This field appears if you select the Specified accounting period option. Select the fiscal year of the specific accounting period that you want to process. |

Time and Labor Option

Field or Control |

Description |

|---|---|

Payable Time Reversal Type |

This field becomes visible only if you're processing a reversal without adjustment and the check you're reversing includes payable time from Time and Labor.

See Summary of the Pay Confirmation PSJob Process (PAYCONF). |

(USA, USF) Use the Paycheck Earnings page (PAY_CHECK_E) to view reversed checks.

(CAN) Use the Paycheque Earnings page (PAY_CHECK_D) to view reversed cheques.

Navigation:

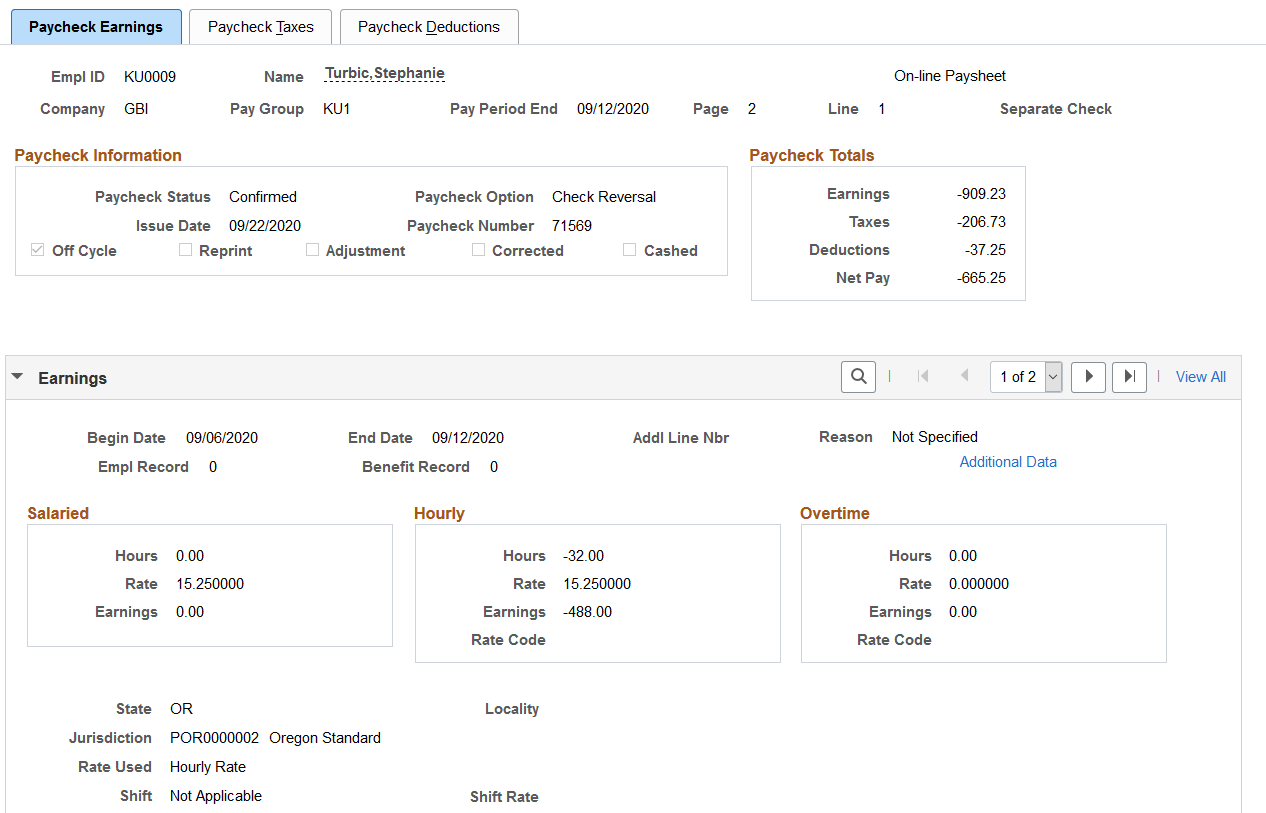

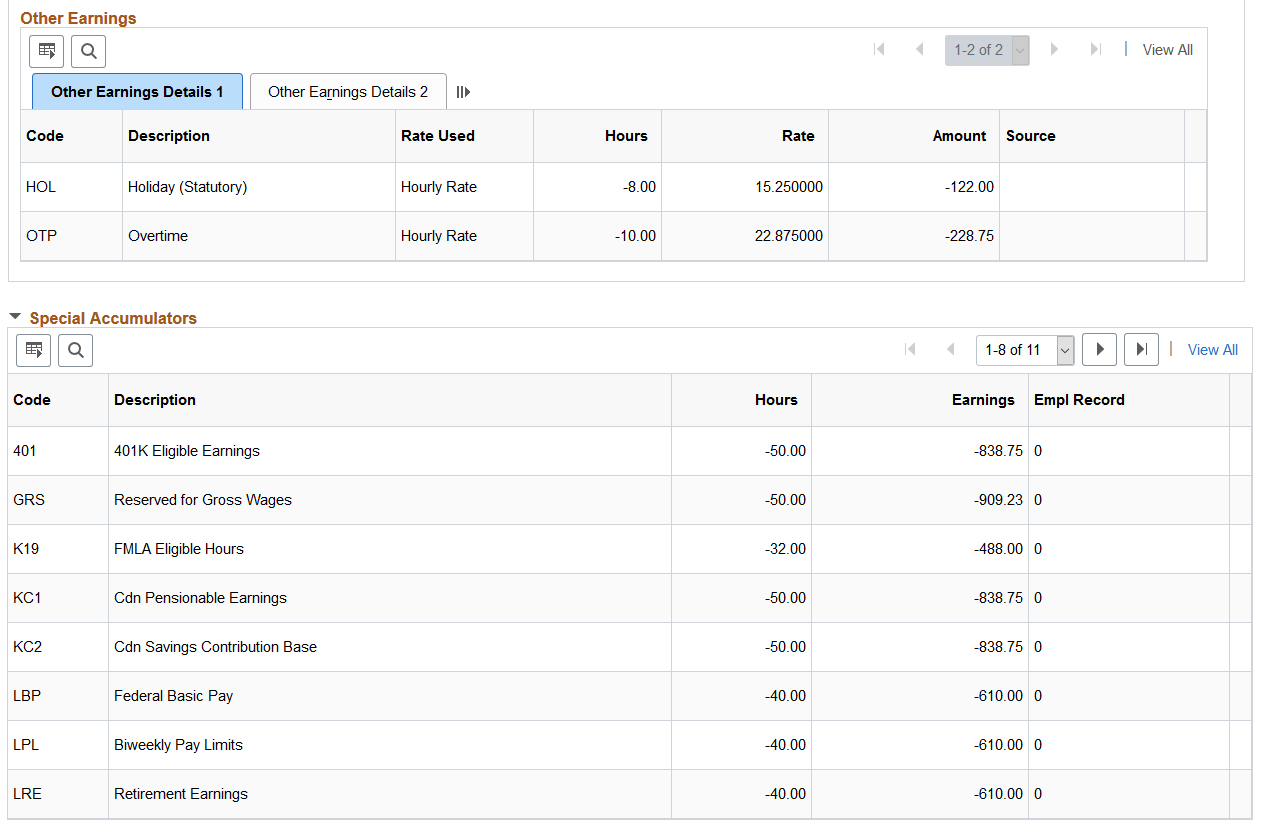

This example illustrates a reversed check on the Paycheck Earnings page (2 of 2).

You can view the effects of the reversal by looking at the original check and the reversed check on the Paycheck Earnings page.

On the reversed check, all of the amounts display as negative numbers. The paycheck option is set to Check Reversal.

If you view the effects of the reversal on any of the Paysheet pages, you will not be able to add or delete any paylines if one of the paylines is a reversal.

If you view the effects of the reversal on any of the Payline pages, you will not be able to add or delete the reversal payline.

When you're satisfied that the reversal is correct, confirm the reversal by running the Pay Confirmation process.

After confirming the check reversal, you can issue a check for the correct amount.

Warning! When confirming reversals and adjustments, you must use the right side of the Confirm Payroll run control page and select All Reversals/Adjustments. Running reversal and adjustment confirmation from the left side of the Confirm Payroll page results in calculation errors later in the process.

After you run pay confirmation, you can view information, including updated balances, using the Review Paycheck pages in the Payroll Processing menu, and you can run any required reports.

Note: You cannot update paysheet information after pay confirmation has been completed.