Setting Up Group-Term Life Insurance in the U.S.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEDUCTION_TABLE2 |

Specify a deduction classification for deduction codes that are used for group-term life insurance. |

|

|

DEDUCTION_TABLE3 |

Specify tax considerations for the group-term life insurance deduction that you are defining. |

Group-term life insurance that employers provide to employees and their dependents is a special type of benefit subject to taxation and reporting requirements. After you set up tables and enroll employees in the plans, the system automatically calculates employees' imputed income and associated taxes.

Note: (USF) Imputed income is not an issue for federal employers, because Federal Employee Group Life Insurance (FEGLI) is paid by employee deductions and is not employer-provided.

Group-Term Life Insurance for an Employee

The value of the first 50,000 USD of group-term life insurance that a employer provides to a U.S. employee is not considered taxable income. The value of coverage in excess of 50,000 USD (computed according to Internal Revenue Service [IRS] regulations) minus premiums that the employee pays with after-tax dollars, is considered taxable income and is subject to social security and Medicare taxes. Although you must report the amount as taxable income on the employee's Form W-2, the value of excess group-term life insurance coverage is not subject to federal income tax withholding.

Group-Term Life Insurance for Dependents

An employer can also provide group-term life insurance coverage for an employee's spouse and children. Dependent group-term life insurance coverage up to a value of 2,000 USD for each dependent does not represent taxable income. However, if the value of the dependent group-term life insurance exceeds 2,000 USD for a dependent, the value of that dependent's entire coverage amount (computed according to IRS regulations) becomes taxable income and is subject to social security and Medicare taxes. Unlike the taxable income that is attributed to the employee's excess life insurance, it is also subject to federal income tax withholding.

To calculate imputed income for all group-term life plans (except dependent life) in accordance with IRS regulations, the system performs the following processes when you run the Pay Calculation COBOL SQL process (PSPPYRUN):

Determines the total life insurance coverage for an employee (except dependent coverage), including both employer- and employee-paid coverage.

For example, an employee might belong to several group-term life plans, such as basic life, supplemental life, and extra life coverage. In this case, the system combines the calculated coverage of all the plans to determine the employee's total life insurance coverage.

Subtracts 50,000 USD from the total coverage—the amount of coverage that the IRS does not consider taxable.

If the resulting amount is less than or equal to zero, then the employee is not liable for any imputed income. If the amount is greater than zero, then the cost of coverage for that amount is considered taxable, and the system uses that cost to calculate imputed income.

Uses the IRS Uniform Premium table to establish the amount to include in the employee's taxable gross.

The rates in this table are generally less than the actual cost of the insurance. PeopleSoft stores the information from the Uniform Premium table under the IRS Age-Graded Rate Table. This table is maintained by PeopleSoft, and should not be changed unless you have a compelling reason to do so.

The age is based on the age as of December 31 of the year in which the benefit is taxable.

Note: There is no need to enter the IRS rate table in the Benefit Deduction Program table, because the system uses it automatically.

Subtracts employee-paid, after-tax contributions to the coverage.

The IRS stipulates that if an employee contributes to the total cost of coverage, then you must subtract the amount of the employee contribution from the total cost of coverage. The resulting amount is considered the taxable benefit—the amount that is included in the employee's taxable gross. The system uses only after-tax deduction classifications; it ignores before-tax deductions. The system does not take into account one-time paysheet adjustments, but rather recalculates these at the end of the year.

If the employee is not paid monthly, the system annualizes the monthly taxable benefit by multiplying the results from step 4 by 12.

If the employee is not paid monthly, the system calculates the per pay period taxable benefit by dividing the annualized taxable benefit (calculated in step 5) by the number of pay periods in which the deduction is taken.

Note: Calculate the number of periods in which the deduction is taken by adjusting the pay frequency for the deduction frequency as specified on the Deduction Table – Schedule page. For example, if the pay frequency is semimonthly (24 pay periods in the year) and the deduction is taken from the first pay period only, then the deduction is taken in 12 pay periods per year.

The system adds the resulting amount to the employee's taxable gross in the Paycheck record. View this amount using the Paycheck Deductions page. It appears as the taxable benefit under the appropriate group-term plan type and deduction code.

Example of Imputed Income Calculation

An employee might be liable for imputed income, even if there is no employer contribution on all of the life insurance plans. If the employee has more than one type of life coverage, the system calculates imputed income in an iterative manner.

For example, Robert, age 60, has basic life (employer- and employee-paid) and supplemental life (employee-paid):

|

Plan Type |

Description |

Coverage |

Premium |

|---|---|---|---|

|

20 |

Life |

150,000 USD |

Employer-paid premium: 49 USD Employee-paid premium: 10 USD |

|

21 |

Suplmntl Life (supplemental life) |

200,000 USD |

Employer-paid premium: 0 USD Employee-paid premium: 100 USD |

Robert is paid monthly. The following illustrates how the system calculates Robert's paycheck deductions:

The system calculates the basic life plan:

Determine the total coverage for basic life:

150,000 USD

Calculate the amount that is subject to imputed income by subtracting 50,000 USD from the total coverage:

150,000 USD – 50,000 USD = 100,000 USD subject to imputed income.

Apply the IRS Uniform Premium table.

Robert is 60 years old. In this age bracket, the Uniform Premium table calls for a calculation of 1.17 USD per month per 1,000 USD of coverage:

100,000 USD / 1,000 USD x 1.17 USD = 117.00 USD

Subtract employee-paid, after-tax contributions to the coverage:

117 USD – 10 USD = 107 USD taxable benefit.

The system calculates the supplemental life plan:

Determine the total coverage:

150,000 USD basic life + 200,000 USD supplemental life = 350,000 USD total coverage.

Subtract 50,000 USD from the total coverage to determine the imputed income:

350,000 USD – 50,000 USD = 300,000 USD subject to imputed income.

Apply the IRS Uniform Premium table.

Robert's age of 60 calls for a calculation of 1.17 USD per 1,000 USD of coverage.

100,000 USD / 1,000 USD x 1.17 USD = 117.00 USD.

Subtract employee-paid, after-tax contributions to the coverage:

351 USD – 110 USD = 241 USD total taxable benefit.

The system subtracts the initial 107 USD taxable benefit for basic life from the 241 USD total taxable benefit to determine the supplemental life taxable benefit:

241 USD – 107 USD = 134.00 USD.

Robert's Paycheck Deduction record displays:

|

Plan Type |

Tax Class |

Amount |

|---|---|---|

|

Life |

After-Tax |

10 USD |

|

Life |

Nontaxable Benefit |

49 USD |

|

Life |

Taxable Benefit |

107 USD |

|

Supp (supplemental) |

After-Tax |

100 USD |

|

Supp |

Taxable Benefit |

134 USD |

In dependent life plans, if the total dependent coverage is 2,000 USD or less for each dependent, the coverage amount is not considered taxable. If the total dependent coverage for a dependent is greater than 2,000 USD, the entire coverage amount is considered taxable—not just the amount in excess of 2,000 USD. Unlike the taxable income that is attributed to the employee's excess life insurance, the taxable benefit for dependent life is also subject to federal income tax withholding.

Here is a summary of the calculation of dependent life taxable benefit deductions:

The system adds up the total dependent coverage for each dependent.

The system determines whether the total coverage is greater than 2,000 USD for any dependent.

If any dependent's coverage is greater than 2,000 USD, the system calculates the monthly taxable benefit deduction.

Note: For the dependents whose coverage is greater than 2,000 USD, the system calculates the taxable benefit deduction amount for the entire coverage amount. For example, if one dependent has 3,000 USD coverage and one dependent has 2,000 USD coverage, the system calculates the taxable benefit deduction on 3,000 USD.

If the employee is not paid monthly, the system annualizes the monthly amount and divides that by the number of pay periods in the year to calculate the taxable benefit deduction.

The Paycheck Deductions page displays the results of dependent life calculations as a taxable benefit separate from the regular (individual) group-term life taxable benefits.

Example of Dependent Life Plan Calculation

Deborah Fields, age 41, elected the following coverage for her dependents:

|

Dependent ID |

Name |

Flat Amount |

|---|---|---|

|

01 |

Fields,Tom |

3,000 USD |

|

02 |

Fields,Sally |

2,000 USD |

Deborah is paid weekly. The monthly rate for her age range is .1 for each 1,000 USD of eligible coverage.

The system calculates the taxable benefit deduction like this:

Determines the total coverage for each dependent.

Identifies that the coverage for dependent 01 (Tom) is over 2,000 USD.

Determines the monthly taxable benefit amount for Tom's coverage:

3,000 USD / 1,000 USD = 3.

3 x .1 = .3

Annualizes the rate and calculates the weekly pay period deduction amount:

.3 x 12 = 3.60

3.60 / 52 = .07

Deborah's Paycheck Deduction record displays:

|

Plan Type |

Tax Class |

Amount |

Calculated Base |

|---|---|---|---|

|

Dependent Life |

Taxable |

0.07 |

5,000.00 |

Note: The calculated base displayed on the paycheck record is not necessarily the base that the system uses to calculate the deduction, because dependents with 2,000 USD or less in coverage are exempt. In this example, the calculated base is 5,000 USD, but the taxable benefit deduction is calculated only on the 3,000 USD coverage for the dependent whose coverage exceeds 2,000 USD.

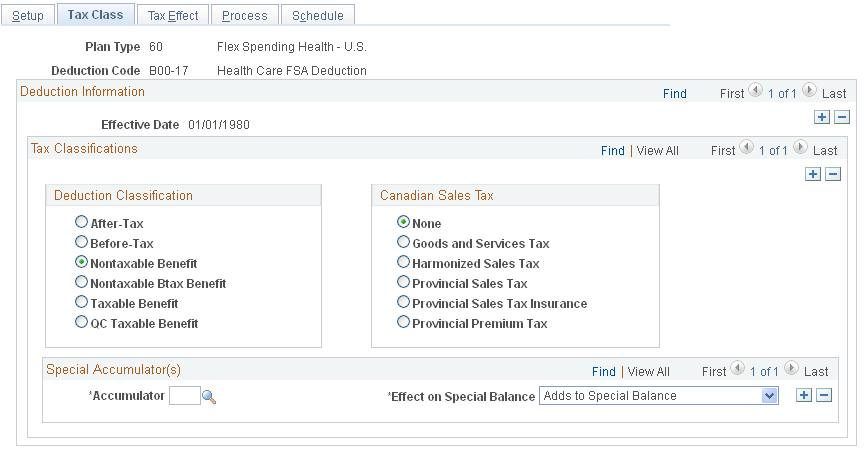

Use the Deduction Table - Tax Class page (DEDUCTION_TABLE2) to specify a deduction classification for deduction codes that are used for group-term life insurance.

Navigation:

This example illustrates the fields and controls on the Deduction Table - Tax Class page.

Field or Control |

Description |

|---|---|

Plan Type |

When you enter the page, enter a plan type from 20–29 (Life). |

Deduction Classification |

Select After-Tax or Before-Tax if the employee pays all or part of the cost of the life insurance. Select Nontaxable Benefit if the employer pays all or part of the cost of the insurance. Select Taxable Benefit if the employer pays all or part of the cost. This classification is used to record the imputed income when the total amount of life insurance for an employee is over 50,000 USD. |

Example

If, for example, the employer pays for half the plan and the employee pays for the other half, use three classifications:

Nontaxable Benefit

After-Tax (or Before-Tax)

Taxable Benefit

Note: (USF) For FEGLI, there are no additional classifications. It is an after-tax employee deduction.

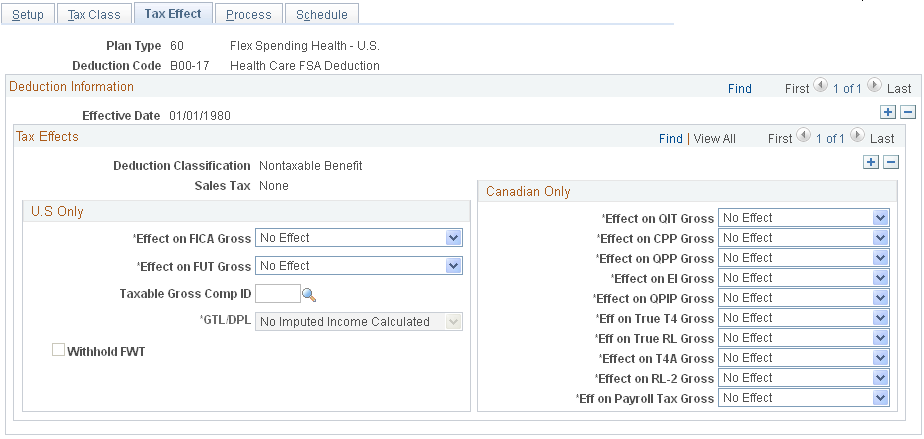

Use the Deduction Table - Tax Effect page (DEDUCTION_TABLE3) to specify tax considerations for the group-term life insurance deduction that you are defining.

Navigation:

This example illustrates the fields and controls on the Deduction Table - Tax Effect page.

Set up the deduction so that the system calculates the taxable amount for federal, state, and local taxable income.

In most cases, indicate that imputed income (the taxable benefit):

Adds to the effect on the Federal Insurance Contributions Act gross.

Has no effect on the federal unemployment tax gross.

The cost of group-term life insurance in excess of 50,000 USD is not subject to federal withholding tax (FWT). Therefore, to have the system withhold FWT, select the Withhold FWT (withhold federal withholding tax) check box.

If you must calculate state or local taxes based on a taxable gross that differs from the federal taxable gross, select GTL (group-term life) as the taxable gross component ID. This links the deduction to the Taxable Gross Definition table. The Taxable Gross Definition table defines the taxability for earnings or deduction types (such as imputed income) that you must treat differently at the state or local level than at the federal level. The Taxable Gross Definition table is where you make changes to taxable gross definitions.

PeopleSoft maintains the entries in the Taxable Gross Definition table for group-term life taxable grosses (for U.S. only). The only time you might change an entry is when state or local taxing authorities alert you about changes in their regulations. PeopleSoft also incorporates the changes in the next tax update. If you discover an error or missing information, please notify the Support Center, so PeopleSoft can incorporate the change or addition in the next tax update.

You don't ordinarily change the Taxable Gross Definition table, but you can change definitions of taxable gross for state and local income taxes, state disability insurance, and state unemployment taxes.

In the Taxable Gross Definition table, specify whether the withholding for each state follows the federal rules.

Depending on whether you set up an employee group-term life plan or a dependent life plan, select the appropriate value in the GTL/DPL (group-term life/dependent life) field on the Deduction Table - Tax Effect page. The system calculates imputed income for dependent life separately from regular (individual) group-term life. Your selection determines which calculation the system uses.