Setting Up Overtime Pay Calculations on Flat Sum Bonus Payments

This topic discusses steps and pages for setting up overtime pay calculations on flat sum bonus payments.

To set up overtime pay calculation on flat sum bonus payments:

Create new earnings codes to be used for flat sum bonus payments using the Earnings Table component.

On the General page, enter these values:

Field or Control

Description

Payment Type

Amounts Only

Effect on FLSA

Amounts Only

On the Calculation page, enter these values:

Field or Control

Description

Multiplication Factor

1.0000

Category for FLSA

Regular

Add an entry to the Flat Sum Bonus Table Page for any states where you will be paying flat sum bonuses (for example, California).

Create earnings codes to be used for additional overtime amounts due on flat sum bonus payments using the Earnings Table component. For example, one for time-and-one-half overtime, and another one for double-time.

(Time-and-one-half overtime) On the General page, enter this value:

Field or Control

Description

Effect on FLSA

None

On the Calculation page, enter these values:

Field or Control

Description

Multiplication Factor

1.5000

Category for FLSA

Excluded

(Double-time) On the General page, enter this value:

Field or Control

Description

Effect on FLSA

None

On the Calculation page, enter these values:

Field or Control

Description

Multiplication Factor

2.0000

Category for FLSA

Excluded

Map Overtime earnings codes to Overtime on Flat Sum Bonus earning codes on the Overtime on Flat Sum Bonus Table Page for any states where you will be paying flat sum bonuses (for example, California).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FLAT_SUM_BONUS_TBL |

Specify bonus earnings codes that are eligible for the Overtime on Flat Sum Bonus calculation in a specific state. |

|

|

OT_PREMIUM_MAPPING |

Map overtime earnings codes to corresponding Flat Sum Bonus earnings codes for a specific state. |

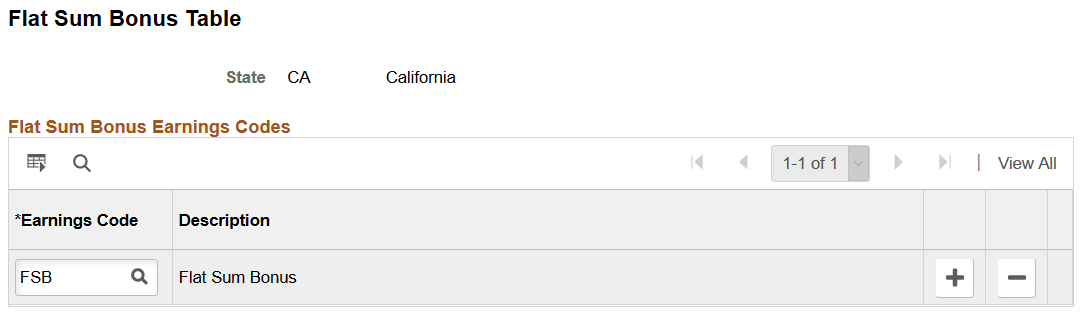

Use the Flat Sum Bonus Table page (FLAT_SUM_BONUS_TBL) to specify bonus earnings codes that are eligible for the Overtime on Flat Sum Bonus calculation in a specific state.

Navigation:

This example illustrates the fields and controls on the Flat Sum Bonus Table page.

Field or Control |

Description |

|---|---|

Earnings Code |

Enter an earnings code that is created for flat sum bonus payments. |

Note: Earnings codes that are added to this page are excluded from FLSA calculations in corresponding states.

Note: An earnings code (created for flat sum bonus) can be used by any US state. If the earnings code is not added to the Flat Sum Bonus Table page for a state, the calculation of overtime on flat sum bonus earnings code payments will remain the same as the standard FLSA overtime calculation for that state.

Currently, California is the only state for which a Flat Sum Bonus Table entry is required.

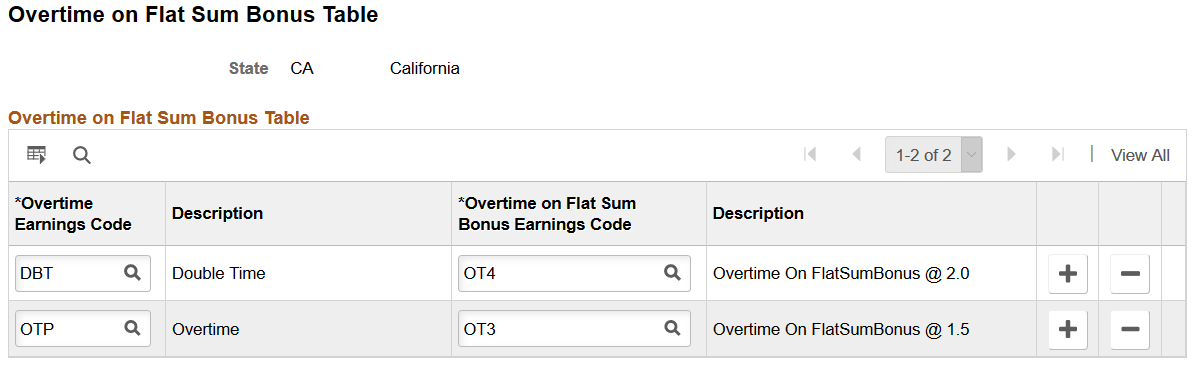

Use the Overtime on Flat Sum Bonus Table page (OT_PREMIUM_MAPPING) to map overtime earnings codes to overtime on flat sum bonus earnings codes for a specific state.

Navigation:

This example illustrates the fields and controls on the Overtime on Flat Sum Bonus Table page.

Each Overtime earnings code that requires the calculation of overtime on flat sum bonus payment must be mapped to a corresponding unique Overtime on Flat Sum Bonus earnings code on this page.

During pay calculation, the calculation of overtime due on a flat sum bonus payment generates and inserts paylines using the mapped Overtime on Flat Sum Bonus earnings code.

Currently, California is the only state for which a Flat Sum Bonus Table entry is required.