Setting Up Tax Types for PeopleSoft Payables Integration

To set up tax types for PeopleSoft Accounts Payables integration, use the Tax Type Table USA component (TAX_TYPE_TBL), Tax Type Table USF component (TAX_TYPE_TBL), or Tax Type Table CAN component (CAN_TAX_TYPE), the State Tax Types/Classes USA component (STAT_TAX_TYPE_TBL) or State Tax Types/Classes USF component (STAT_TAX_TYPE_TBL), and the Local Tax Types/Classes USA component (LOCL_TAX_TYPE_TBL) or Local Tax Type/Classes USF component (LOCL_TAX_TYPE_TBL). Use the TAX_TYPE_TABLE component interface to load data into the tables for the Tax Type Table USA component and Tax Type Table USF component

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Tax Type Table Page |

TAX_TYPE_TBL |

Define the names of the tax types you want to use. |

|

CAN_TAX_TYPE |

(CAN) Define Canadian federal and provincial tax types and link them to vendors and tax classes. |

|

|

LOCL_TAX_TYPE_PNL |

(USA, USF) Link a tax type to the local tax authority and the applicable set of tax classes. |

|

|

STAT_TAX_TYPE_PNL |

(USA, USF) Link a tax type to a federal or state tax authority and set of tax classes. |

|

|

VNDR_ID1 |

Enter vendor data for tax collectors. |

If you plan to use PeopleSoft Accounts Payable to send tax authorities the taxes deducted from employees' paychecks, you must link the appropriate set of deductions to each tax vendor.

Tax types are used to link tax classes to vendors. A tax type represents a collection of tax classes, such as withholding, earned income credit, and so on, specific to a particular tax jurisdiction (federal, state, local, provincial).

Setting up tax types and linking them to vendors is done differently for the U.S. and Canada.

Canada

Use the Canadian Tax Types page to name the tax type and link it to tax classes and vendors.

U.S.A.

Define tax types on the Tax Type Table page.

Link tax types to tax classes and vendors on the AP State Tax Types/Classes Table page or the AP Local Tax Types/Classes page.

Example

In the state of California, employees are subject to two taxes for short-term disability: SDI (paid to the state) and OASDI (paid to the federal government). Each tax is comprised of a different set of tax classes. In this case, you might create a tax type named Short-Term disability. You would then access the Fed/State Tax Type/Classes page and define what Short-Term Disability represents at the federal level: For the vendor, you select the Internal Revenue Service; for the tax classes you select only those included in OASDI. You then repeat the process to define Short-Term Disability at the state level. This time, you select the Franchise Tax Board as the vendor and just those tax classes that contribute to SDI.

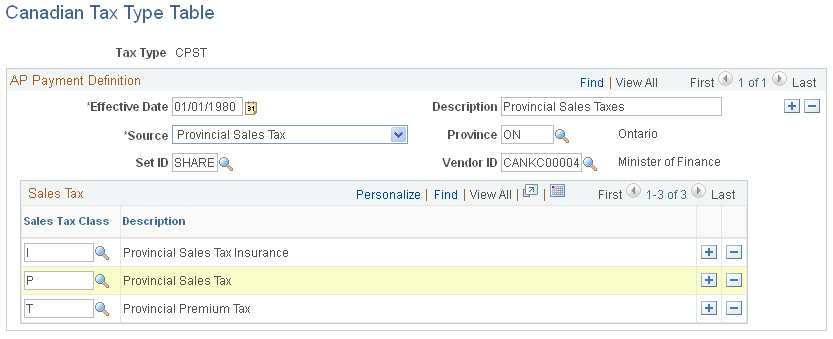

(CAN) Use the Canadian Tax Type Table page (CAN_TAX_TYPE) to define Canadian federal and provincial tax types and link them to vendors and tax classes.

Navigation:

This example illustrates the fields and controls on the Canadian Tax Type Table page.

Field or Control |

Description |

|---|---|

Source |

Select the type of tax transaction from the options available. Values include Goods and Services Tax, Health and Payroll Taxes, Provincial Sales Tax, or Statutory Deductions. |

Province |

If you chose Provincial Sales Tax in the Source field, select the Province in this field. |

Tax Class |

Select the tax class you want to associate with this tax type and vendor from the options available. Add all applicable tax classes. The Source field determines which tax classes are available for selection.

|

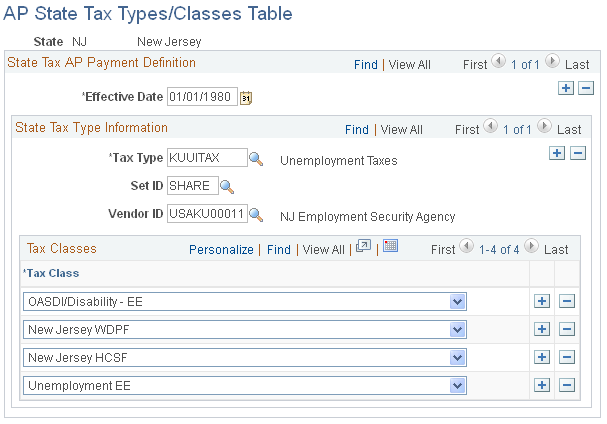

(USA, USF) Use the AP State Tax Types/Classes Table page (STAT_TAX_TYPE_PNL) to link a tax type to a federal or state tax authority and set of tax classes.

Navigation:

This example illustrates the fields and controls on the AP State Tax Types/Classes Table page.

Note: Enter $U in the search page to enter federal tax type information.

Field or Control |

Description |

|---|---|

Tax Type |

Select the tax type you want to define. The prompt table displays the names of the tax types you set up on the Tax Type Table page. |

SetID |

Select the setID for the tax type. This determines which set of vendors (tax authorities) you can select in the Vendor ID field. |

Vendor ID |

Select the tax authority (vendor) to which you want the taxes for this tax type paid. The prompt table displays only those vendors associated with the setID you selected. |

Class Name |

Select the tax classes associated with this tax type and vendor. Add all applicable tax classes. |

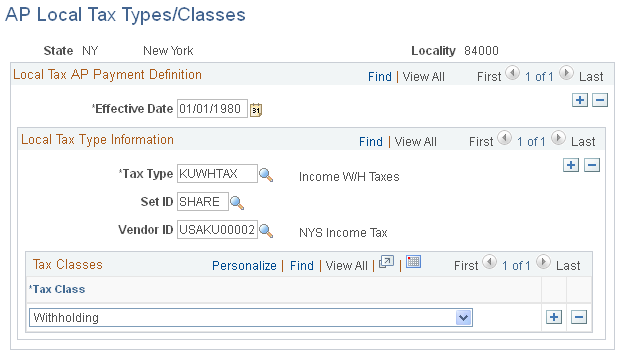

(USA, USF) Use the AP Local Tax Types/Classes page (LOCL_TAX_TYPE_PNL) to link a tax type to the local tax authority and the applicable set of tax classes.

Navigation:

This example illustrates the fields and controls on the AP Local Tax Types/Classes page.

The fields on this page are the same as those on the AP State Tax Types/Classes Table page.

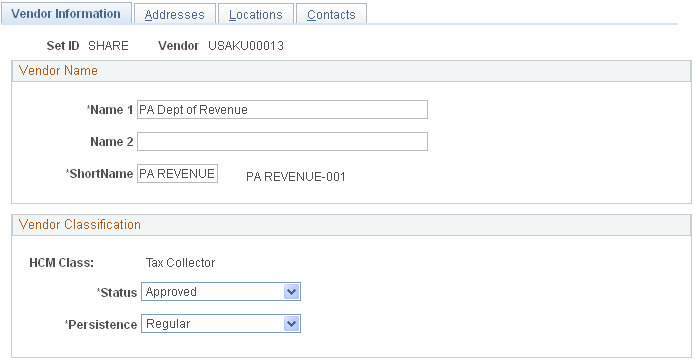

Use the Vendor Information page (VNDR_ID1) to enter vendor data for tax collectors.

Navigation:

This example illustrates the fields and controls on the Vendor Information page.

Set up tax collectors as vendors using the Tax Collector Table (TAX_COLLECTOR_TBL) component Vendor Information page as shown here, or in the Vendor Table component (VNDR_ID).

After entering information about the tax-collecting agency, enter the vendor code on the Local Tax Type - Classes page .

Maintaining the Tax Collector Table for Pennsylvania

For each municipality and overlying school district, the State Tax Register lists the effective rates for both Earned Income and Emergency and Municipal Service taxes for residents and, when applicable, nonresidents. Earned income and emergency and municipal service tax collector information for each municipality and school district are also listed. In some instances, there are different tax collectors for the municipality and the school district. When this occurs, employers must remit the school district's tax to its collector and the municipality's tax to its collector.