(USA) Managing Tax Reciprocity

To manage tax reciprocity, use the State Tax Reciprocity Table component (STATE_TX_RECIP_TBL), local Tax Reciprocity Table component (LOCL_TAX_RECIP_TBL), and the Work Locality Reciprocity component (LCLTX_WK_RECIP_TBL).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

STATE_TX_RECIP_TBL |

Display the rules used during payroll calculation to determine withholding liability when an employee lives in one state and works in another. |

|

|

State Reciprocity Rules Report Page |

PRCSRUNCNTRL |

Run TAX708 to print a summary of the rules that determine where to withhold income taxes when an employee works in one state and lives in another. |

|

LOCL_TAX_RECIP_TBL |

View reciprocal agreements between an employee's state of residence and a locality of employment. |

|

|

Local Reciprocity Rules Report Page |

PRCSRUNCNTRL |

Run TAX709 to print a list of the rules that determine where to withhold income taxes when an employee works in one locality and lives in another. |

|

LOCLWK_TXRCP_TABLE |

Establish reciprocal agreements between work localities. |

|

|

Work Locality Reciprocity Rpt Page |

PRCSRUNCNTL |

Run TAX713 to print the reciprocal rules that determine local income tax withholding when an employee works in a location that has multiple taxing jurisdictions that share a reciprocal agreement. |

Although the employee's residence state may require withholding on all wages paid to the employee, many states provide credit for taxes paid by their residents to another state. Many other examples of reciprocity agreements also exist between states. Under these agreements, wages earned in a work state that has an agreement with the residence state are taxed by, and taxes withheld are submitted to, the employee's residence state. Reciprocity rules are defined in the State Tax Reciprocity table.

The State Tax Reciprocity table doesn't identify every state-to-state combination individually because most states have a single rule for dealing with residents who earn taxable wages in other states. The default reciprocity rule between a state of residence and all other states of employment is the one where no employment state is specified.

If you must modify these table entries, consult the PeopleSoft Global Support Center.

Note: If you're a multi-state employer, review the rules in this table, particularly if you can be considered a non-resident employer for certain employees. For example, Alabama requires that resident employers withhold Alabama tax on wages earned both inside and outside the state by Alabama residents. Non-resident employers must withhold on only those wages earned in Alabama, regardless of where the employee resides. The entries in the State Tax Reciprocity table—as delivered by PeopleSoft—assume that you are a resident employer in each state.

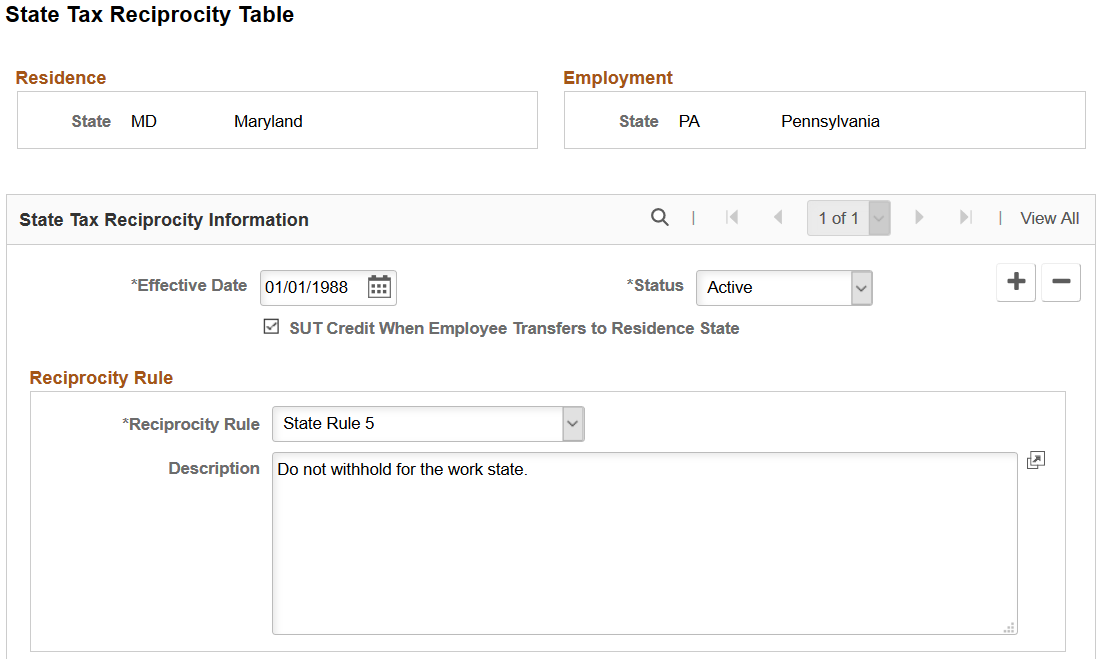

Use the State Tax Reciprocity Table page (STATE_TX_RECIP_TBL) to display the rules used during payroll calculation to determine withholding liability when an employee lives in one state and works in another.

Navigation:

This example illustrates the fields and controls on the State Tax Reciprocity Table page.

Note: The State Tax Reciprocity Table page is used to set up any and all withholding tax relationships between an employee's residence state and employment state, to cover any situation where an employees lives in one state and works in another state. Although some of the table entries reflect formal reciprocal agreements between states, the majority of the table entries do not.

Residence and Employment

The Residence and Employment group boxes identify the state-to-state combination for the reciprocity rule. The default reciprocity rule between a state of residence and all other states of employment is the one where the with no employment state (the State field in the Employment group box is blank).

State Tax Reciprocity Information

Field or Control |

Description |

|---|---|

SUT Credit when employee transfers to residence state |

When selected, this check box indicates that, for unemployment tax purposes, the (residence) state allows credit against its state unemployment taxable wage base for wages paid to an employee in another state. |

Reciprocity Rule

The Reciprocity Rule field displays the rule applied to the residence / employment state combination. In the PeopleSoft system, the Reciprocity Rule value controls the appearance of calculated tax (TAX_CUR) and taxable gross (TXGRS_CUR).

The state tax reciprocity rules are:

Field or Control |

Description |

|---|---|

State Rule 1 |

Withhold both work state tax and residence state tax on work state wages. |

State Rule 2 |

Calculate residence state and work state withholding separately on work state wages. Withhold 100% of calculated work state withholding. Withhold calculated residence state tax on work state wages to the extent that calculated residence state withholding exceeds calculated work state withholding. |

State Rule 3 |

Withhold 100% of calculated work state withholding on work state wages. Then calculate Missouri withholding by the applicable method:

|

State Rule 4 |

Withhold 100% of calculated work state withholding on work state wages. Reduce total residence state wages by work state wages, and calculate residence state tax on the reduced residence state wages. |

State Rule 4A |

Withhold 100% of calculated work state withholding on work state wages. Reduce total residence state wages by work state wages, and calculate residence state tax on the reduced residence state wages. Report total residence state wages. |

State Rule 5 |

Do not withhold for the work state. |

State Rule 5A |

Do not withhold for the work state. Report work state with no wages. |

State Rule 6 |

Special rule for Maryland residents working in Delaware. |

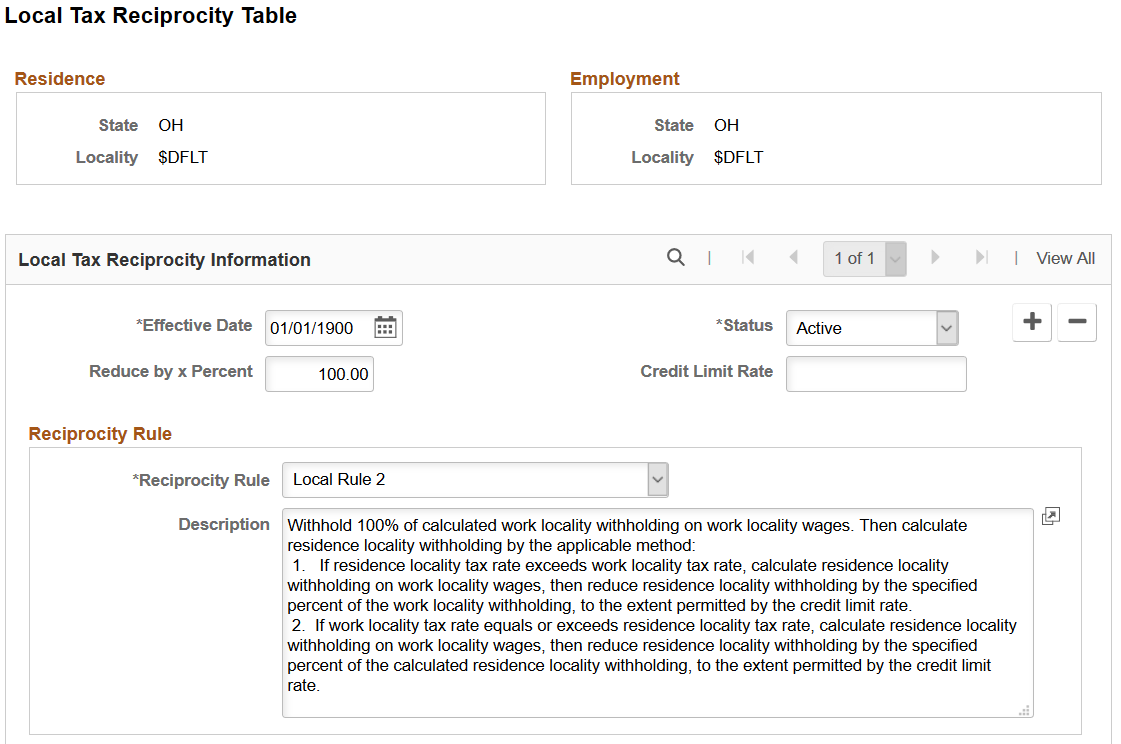

Use the Local Tax Reciprocity Table page (LOCL_TAX_RECIP_TBL) to view reciprocal agreements between an employee's state of residence and a locality of employment.

Navigation:

This example illustrates the fields and controls on the Local Tax Reciprocity Table page.

When the residence locality differs from the employment locality, the system calculates both taxes and applies the reciprocity rule from this table to produce the correct net withholding for the employee in each locality.

Field or Control |

Description |

|---|---|

Residence |

Displays the state and locality for the employee's locality of residence. This table does not identify every residence/employment combination, because most localities in a given state follow the same rule. The table entry for the default value, $DFLT, is used when there is no individual entry. Any exceptions require separate entries and act as overrides. Entries that identify reciprocity agreements between a state of residence and employment localities are special cases. The residence state is specified as usual, but the value in this field is a special code: STATERC. |

Employment |

Displays the state and locality for the employee's locality of employment. This table does not identify every residence/locality combination, because most localities in a given state follow the same rule. The table entry for the default value, $DFLT, is used when there is no individual entry. Any exceptions require separate entries and act as overrides. |

Reduce by x Percent |

The maximum portion of the work locality's tax rate which can qualify as a credit against the resident locality's withholding. |

Credit Limit Rate |

The maximum portion by which the resident locality's tax rate can be reduced by a credit for the work locality's withholding. |

Reciprocity Rule

The Reciprocity Rule field displays the rule applied to the residence / employment locality combination. The local tax reciprocity rules are:

Field or Control |

Description |

|---|---|

Local Rule 1 |

Withhold both work locality tax and residence locality tax on work locality wages. |

Local Rule 2 |

Withhold 100% of calculated work locality withholding on work locality wages. Then calculate residence locality withholding by the applicable method:

|

Local Rule 3 |

Calculate work locality and residence locality withholding separately on work locality wages. Withhold 100% of calculated residence locality withholding. Reduce work locality withholding by the specified percent of the residence locality withholding. |

Local Rule 4 |

Withhold 100% of calculated work locality withholding on work locality wages. Reduce total residence locality wages by work locality wages, and calculate residence locality withholding on the reduced residence locality wages. |

Local Rule 5 |

Do not withhold for the work locality. |

Local Rule 6 |

Withhold 100% of calculated work locality withholding on work locality wages. Calculate residence locality withholding on total work locality wages. Then reduce the residence locality withholding by the work locality's tax rate as applied to the residence locality's definition of taxable wages. |

Local Rule 7 |

Compare resident tax rate of residence locality and nonresident tax rate of work locality, then calculate tax on work locality wages using the higher of the two rates. |

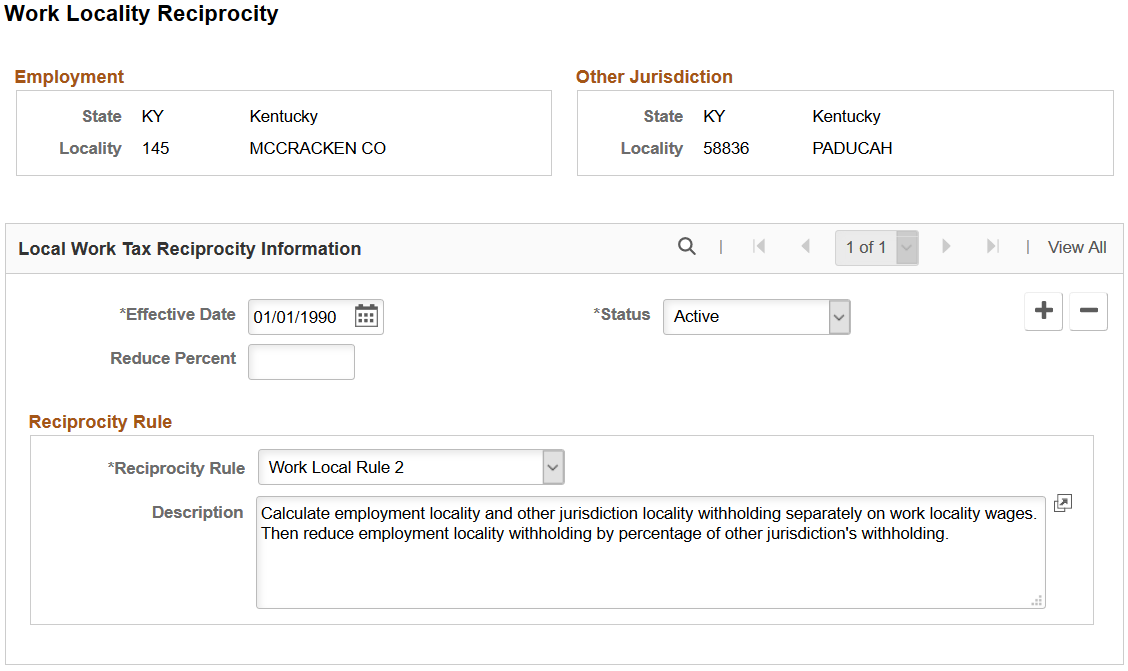

Use the Work Locality Reciprocity page (LOCLWK_TXRCP_TABLE) to establish reciprocal agreements between work localities.

Navigation:

This example illustrates the fields and controls on the Work Locality Reciprocity page.

Other Jurisdiction

Field or Control |

Description |

|---|---|

State |

The state of other jurisdiction for each record represents the state of the primary local tax jurisdiction. That is, the state of the local tax jurisdiction whose tax must be withheld in full. |

Locality |

This represents the primary tax jurisdiction. That is, the jurisdiction whose tax must be withheld in full. |

Local Work Tax Reciprocity Information

Field or Control |

Description |

|---|---|

Reduce Percent |

Where allowed, this represents a percent of other jurisdiction withholding to be credited toward the withholding amount required by the locality of employment. This is not always 100%. PeopleSoft displays the percent of credit reduction allowed. |

Reciprocity Rule

The Reciprocity Rule field displays the rule applied to the employment locality / other jurisdiction combination. The work locality tax reciprocity rules are:

Field or Control |

Description |

|---|---|

Work Local Rule 1 |

Withhold both employment locality tax and other jurisdiction locality tax on work locality wages. |

Work Local Rule 2 |

Calculate employment locality and other jurisdiction locality withholding separately on work locality wages. Then reduce employment locality withholding by percentage of other jurisdiction's withholding. |