(USA) Viewing Local Tax Tables

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

LOCAL_TAX_TABLE1 |

View information about the geographic area associated with a locality code. |

|

|

LOCAL_TAX_TABLE2 |

View the method used to calculate local withholding taxes, tax rates, and other constants. |

|

|

LOCAL_TAX_TABLE3 |

Enter data on the locality's tax reporting requirements. This information is used in quarterly and year end reporting. |

|

|

Local Tax Report Page |

PRCSRUNCNTRL |

Run TAX703 to print information from the Local Tax Table, which contains calculations for local income taxes. |

The local Tax Table component (LOCAL_TAX_TABLE) displays information used when the system calculates local withholding tax. In this table, each locality is assigned a code of up to ten characters. Typically this is how these codes are assigned:

For Pennsylvania municipalities and school districts: an eight or nine character code based on codes assigned in the official Pennsylvania local tax register.

For municipalities in states other than Pennsylvania: a five-character Federal Information Processing Standards (FIPS) code.

For counties: a three-digit county number.

For Ohio school districts: a four-digit district number.

Pennsylvania Localities

The State of Pennsylvania provides a registry of tax rates for all cities, counties, political subdivisions, school districts, and so on located in Pennsylvania. For each municipality and overlying school district, the registry lists effective tax rates for both local Earned Income Tax (EIT) and Local Services Tax (LST) for residents and, where applicable, nonresidents.

Pennsylvania Act 32 requires that, beginning with wages paid on or after January 1, 2012, local EIT must be withheld as follows: The employer must deduct the greater of (1) the resident rate tax of the employee's residence locality, or (2) the nonresident rate tax of the employee's work locality, based on the locality information provided in the employee's completed Certificate of Residency form. Taxes must be remitted and reported to the tax collector of the employee's work location, and must identify the Political Subdivision (PSD) code (all-numeric locality codes for local EITs) of the employee's residence and work locations

This means that for each PA local EIT amount withheld from an employee, you must identify these three codes:

PA EIT Work PSD code

PA EIT Residence PSD code

Locality code (the locality to which taxes are to be remitted and reported).

Note: This code will match the EIT Work PSD code in almost all cases.

The Pennsylvania local tax withholding codes are described as follows:

The PSD Locality code is a 6-digit code that identifies the locality to which the employer must remit and report an employee's local earned income taxes.

PA local EIT PSD codes are all numeric. PA local EIT PSD codes are 6 digits and all numeric. The first 2 digits of each 6-digit PSD code identifies the tax collection district. The first 4 digits of each 6-digit PSD code identifies the school district. The complete 6-digit PSD code identifies the unique municipality/school district combination. A complete list of the Act 32 PSD codes can be found on the website of the Pennsylvania Department of Community and Economic Development.

PA LST codes begin with the letter O. The next six digits are the numerical code assigned to the municipality by the state of Pennsylvania. The alphabetic code in the eighth position signifies the tax rate:

C - combined municipality and school district tax rate.

M - municipality tax rate.

S - school district rate.

A numerical digit in the last position indicates that the municipality overlaps with all or portions of multiple school districts.

Refer to the School District Code field on the Local Tax Table 1 page to determine which locality code applies to which school district, and then choose the appropriate entry for the employee's location.

Note: Pennsylvania Act 32 applies only to Pennsylvania local EIT withholding. Act 32 does not apply to deductions from employees for Pennsylvania LST, and. PSD codes are not used for Pennsylvania LST deductions.

For each municipality and overlying school district, PeopleSoft delivers the following locality types:

|

Pennsylvania Locality Description |

Example |

|---|---|

|

Combined municipality and school district earned income tax |

170303 |

|

Combined municipality and school district local services tax |

O123456C |

|

Municipality local services tax |

O123456M |

|

School district local services tax |

O123456S |

Note: The LST can be imposed by both municipalities and school districts. However, certain LST processing requirements relate to the combined LST rate for municipalities and school districts. Therefore, you must implement the LST using Local Tax Table entries that represent combined LST tax rates. These entries have the letter C in position 8 of the Locality code.

Maintaining Tax Localities

For each locality that PeopleSoft supports, we maintain the entries for that locality in the following tables:

Local Tax Table.

Local Tax Reciprocity table (if applicable).

Taxable Gross Definition table (if applicable).

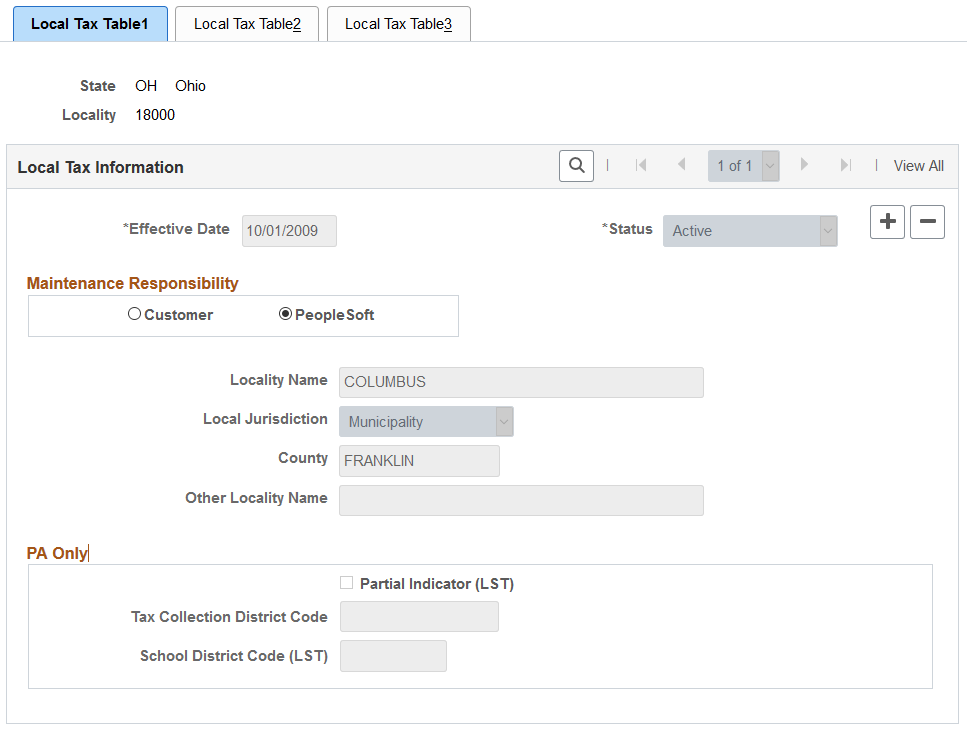

Use the Local Tax Table 1 page (LOCAL_TAX_TABLE1) to view information about the geographic area associated with a locality code.

Navigation:

This example illustrates the fields and controls on the Local Tax Table1 page.

Field or Control |

Description |

|---|---|

Customer or PeopleSoft |

All entries that Oracle delivers are the maintenance responsibility of PeopleSoft. However, if you add a locality to this table, the system marks it as Customer, indicating that it is your organization's maintenance responsibility. |

Locality Name |

The municipality name from the register (except for school district entries, which are school district name). Combined jurisdictions have the appendage M+SD. |

Local Jurisdiction |

Reserved for future use. |

Other Locality Name |

For Pennsylvania localities, combined entries display the school district name. |

PA Only

Field or Control |

Description |

|---|---|

Partial Indicator (LST) (Local Services Tax) |

(Used for Local Services Tax only.) This check box is selected to indicate a Pennsylvania municipality that is co-terminus with multiple school districts, meaning the boundary of the municipality overlaps the boundaries of multiple school districts. For example, in Westmoreland County, the City of Greensburg is co-terminus with both the Greensburg Salem School District and the Hempfield Area School District. Be sure to use the Local Tax Table entry that represents the correct municipality/school district combination. |

Tax Collection District Code |

The 2-digit location code under which local earned income taxes are reported by the employer according to PA Act 32. |

School District Code (LST) (Local Services Tax) |

(Used for Local Services Tax only.) For Pennsylvanian localities, the appropriate school district code appears here. |

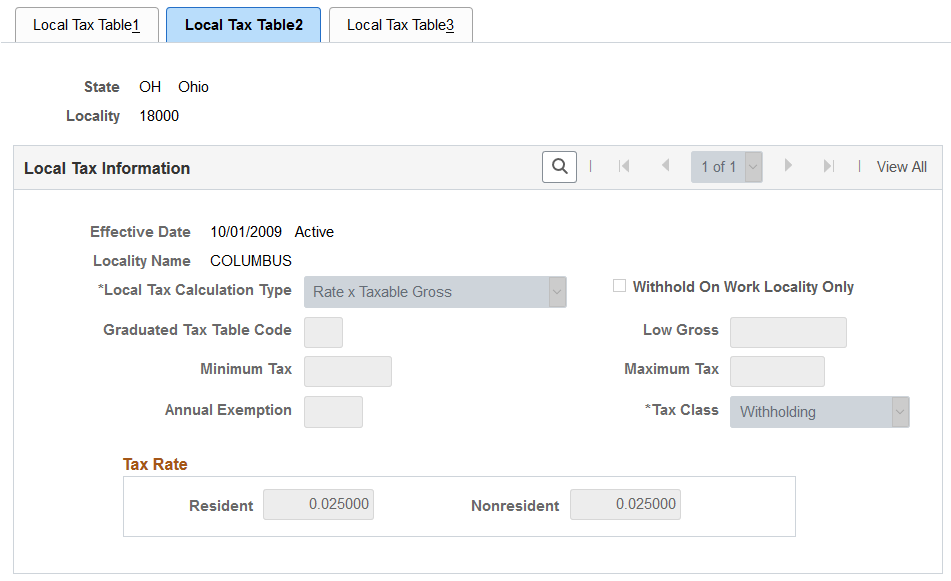

Use the Local Tax Table 2 page (LOCAL_TAX_TABLE2) to view the method used to calculate local withholding taxes, tax rates, and other constants.

Navigation:

This example illustrates the fields and controls on the Local Tax Table2 page.

Field or Control |

Description |

|---|---|

Local Tax Calculation Type |

Indicates the calculation method used to determine the amount of local income tax withheld. |

Withhold On Work Locality Only |

When this check box is selected for a locality, only wages earned in that locality are considered taxable for residents of the locality. No resident tax is withheld from wages paid for work performed outside of the locality. |

Graduated Tax Table Code |

This option takes effect if the locality requires that tax tables be referenced during calculation, as do New York City, Yonkers, and Maryland counties. In this case, the graduated tax table code entered here links the record to the appropriate entry in the PeopleSoft Federal/State Tax table where the graduated tax rates are stored. |

Tax Rate

Field or Control |

Description |

|---|---|

Resident |

This field displays the tax rate for residents of the locality. |

Nonresident |

This field displays the tax rate for nonresidents in the locality. |

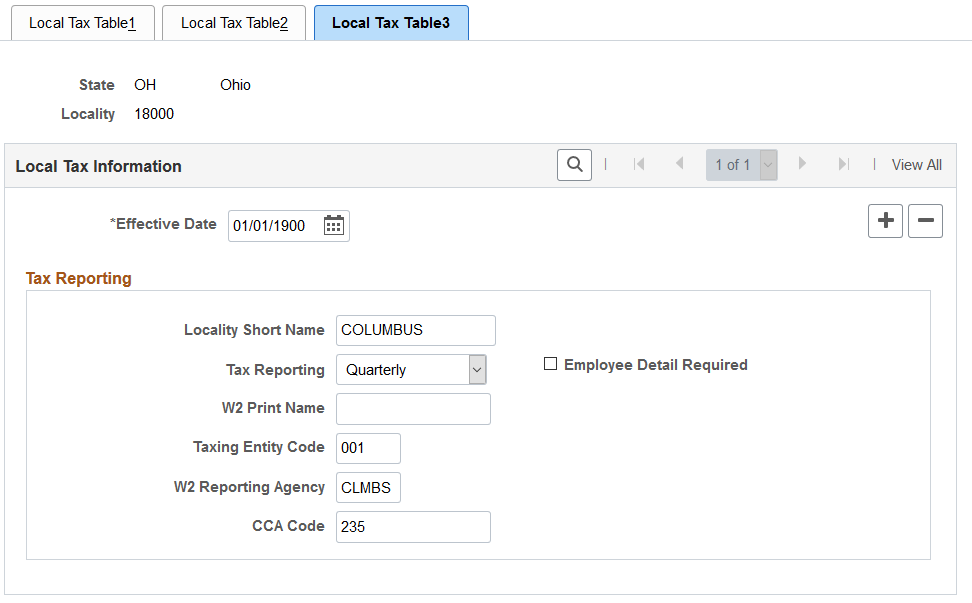

Use the Local Tax Table3 page (LOCAL_TAX_TABLE3) to enter data on the locality's tax reporting requirements.

Navigation:

This example illustrates the fields and controls on the Local Tax Table3 page.

Information on this page is used in quarterly and year-end reporting.

Field or Control |

Description |

|---|---|

Locality Short Name |

The value in this field is printed as the locality name on Form W-2 if the W2 Print Name field is blank. If both the Locality Short Name and W2 Print Name fields are blank, then a truncated version of the value in the Locality Name field on the Local Tax Table1 page is used. Note: Customers are responsible for populating the Locality Short Name field for localities in Pennsylvania |

Tax Reporting |

Displays the interval required by the locality for tax reporting, Monthly, Quarterly, or Annual. This field is for your reference only. It has no function in the system. |

Employee Detail Required |

This check box is for your reference only. It has no function in the system. |

W2 Print Name |

A value entered in this field overrides a value in the Locality Short Name field to print as the locality name on Form W-2. Warning! Do not change any Oracle-delivered value that automatically populates this field. |

Taxing Entity Code |

Identifies the locality on the appropriate electronic or magnetic media records when reporting W-2 data to either state or local tax agencies. The system populates this field for the localities for which PeopleSoft supports the reporting of W-2 data to state and/or local tax agencies. |

W2 Reporting Agency |

Identifies the tax reporting agency to which W-2 data for the locality is submitted electronically or on magnetic media. In some cases, the value in this field is also included in the file records. |

CCA Code |

This field stores specific mandated CCA City Codes that are required in positions 7-9 on the RS Record, as well as specific mandated State Control numbers that are required in positions 331-337 in the files created by TAX960LC to report W-2 data to CCA local tax authorities. The CCA City Code is separated from the State Control number with a hyphen. This field is maintained by PeopleSoft, and is populated for all CCA Members and CCA Recognized Cities. Note: For the Ohio localities where the field is blank, positions 7-9 on the RS Record will be hardcoded with “887” per the CCA requirements. |

Important! If you add a locality, you are responsible for maintaining the entries on these tables for the new locality until PeopleSoft incorporates it into a tax update. Contact your Global Support Center if you discover any localities not listed or any errors so we can include the addition or correction in the next PeopleSoft Payroll Tax Update.