Understanding Deduction Override Processing

This topic discusses:

Fields for specifying deductions.

Deduction override evaluation hierarchy.

Deduction override processing in paysheet creation.

Deduction override status indicators.

Deduction override processing in pay calculation.

Deduction override processing related to unconfirmed pay runs.

Note: If some method other than the delivered Create Paysheet process is used to create/load paysheets into the system, this other method will need to be modified to mirror the paysheet with the latest information, including setting the new deduction status indicator to I (initial).

Specify general deductions and benefit deductions separately. The following are the four fields used for specifying deductions:

General Deductions Taken.

General Ded Subset ID (general deduction subset ID).

Benefit Deductions Taken.

Benefit Ded Subset ID (benefit deduction subset ID).

Note: These fields are collectively referred to as deduction taken fields. Which of these fields appear on a particular page and the values available for selection vary according to the purpose of the page.

To determine deduction overrides, the Create Paysheet and Pay Calculation processes use a deduction override evaluation process, which reads values entered in the General Deductions Taken, General Ded Subset ID, Benefit Deductions Taken, and Benefit Ded Subset ID fields on a succession of pages.

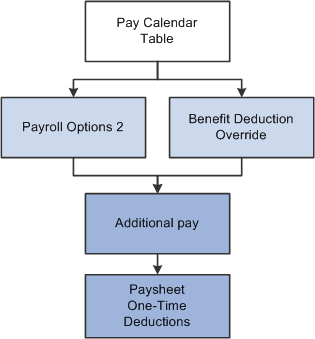

This diagram illustrates the deduction override evaluation process:

This diagram illustrates the deduction override evaluation process.

The following list presents the order of deduction override evaluation. The value listed on each successive page overrides the value on the previous pages in this list:

Pay Calendar Table page: general and benefits deductions at the pay calendar level.

Payroll Options 2 page: general deductions at the employee level.

Override Benefits Deductions page: benefit deductions at the employee level.

Create Additional Pay component (ADDITIONAL_PAY): general and benefit deductions at the employee level for a separate check only.

One-Time Deductions page: general and benefit deduction manual overrides on the paysheet at the employee level.

Note: For off-cycle runs, select the Off-Cycle Ded Override (off-cycle deduction override) check box on the Pay Calendar Table page to enable the deduction taken fields on the Pay Calendar to be overridden by employee level overrides.

The Create Paysheet process enters and overrides the values in the general and benefits deduction taken fields on the paysheet from the values in the Pay Calendar table page, Payroll Options 2 page, Override Benefits Deductions page, and Create Additional Pay component (for separate check) respectively. The deduction taken fields are then accessible for manual overrides on the By Paysheet - One-Time Deductions overrides page at the employee level.

Example of Deduction Override Evaluation Processing in the Create Paysheet COBOL SQL Process (PSPPYBLD)

The details of deduction override evaluation processing in the Create Paysheet process are outlined below in the form of an example.

1. Pay Calendar Table

The default deduction taken values on the paysheet are the Pay Calendar settings as defined on the Pay Calendar Table page. This example assumes the following values:

Field or Control |

Description |

|---|---|

General Deductions Taken |

Deduction |

Benefit Deductions Taken |

Subset |

Benefit Ded Subset ID (benefit deduction subset ID) |

ABC |

2. Payroll Data

The process reviews each employee's payroll data for overrides, as established on the Payroll Options 2 page:

|

Deductions Taken Value |

Effect on Paysheet |

|---|---|

|

NoOverride |

No change to the General Deductions Taken field. |

|

Deduction |

The General Deductions Taken field is overridden with Deduction. |

|

Subset with the subset ID of XYZ |

The General Deductions Taken field is overridden with Subset and the Subset ID field is overridden with XYZ. |

|

None |

The General Deductions Taken field is overridden with None. |

3. Benefit Deduction Processing Overrides

The Create Paysheet process reviews the values established on the Override Benefits Deductions page. For employees with multiple jobs that have different benefit plans, each payline is processed separately for benefit deduction overrides:

|

Deductions Taken Value |

Effect on Paysheet |

|---|---|

|

NoOverride |

No change to the Benefit Deductions Taken field. |

|

Deduction |

The Benefit Deductions Taken field is overridden with Deduction. |

|

Subset with the subset ID of LMN |

The Benefit Deductions Taken field is overridden with Subset and the Subset ID field is overridden with LMN. |

|

None |

The Benefit Deductions Taken field is overridden with None. |

4. Additional Pay

The Create Paysheet process pulls in the values established on the Create Additional Pay component.

If the Create Additional Pay component is not set up for a separate check (the Sep Chk # [separate check number] field is empty), the general and benefit deductions taken values for the additional pay on the paysheet default to the values that are established for the regular pay payline.

If the Create Additional Pay component is set up for a separate check (the Sep Chk # field has a value from 1 to 99) the payline for regular pay remains at the override(s) determined in the review of payroll data and benefit deduction processing override in steps two and three.

The process then reviews the Deductions Taken values on the Create Additional Pay component for the override(s) to apply on that additional pay payline only.

a. General Deductions Taken on the Create Additional Pay Component

|

General Deductions Taken Value |

Effect on Paysheet |

|---|---|

|

NoOverride |

No change to the General Deductions Taken field. |

|

Deduction |

The General Deductions Taken field is overridden with Deduction. |

|

Subset with a subset ID of GHI |

The General Deductions Taken field is overridden with Subset and the Subset ID field is overridden with GHI. |

|

None |

The General Deductions Taken field is overridden with None. |

b. Benefit Deductions Taken on the Create Additional Pay Component

|

Benefit Deductions Taken Value |

Effect on Paysheet |

|---|---|

|

NoOverride |

No change to the Benefit Deductions Taken field. |

|

Deduction |

The Benefit Deductions Taken field is overridden with Deduction. |

|

Subset with a subset ID of RST |

The Benefit Deductions Taken field is overridden with Subset and the Subset ID field is overridden with RST. |

|

None |

The Benefits Deductions Taken field is overridden with None. |

5. Paysheet One-Time Manual Overrides

The final general deduction and benefit deduction value established for the paysheet in the Create Paysheet process remains available to be manually overridden on the By Paysheet - One-Time Deductions page. Any manual override to the General Deductions Taken or Benefit Deductions Taken field on a paysheet sets the corresponding deduction status indicator to U (user update), so that the calculation process will not override this manual value.

The manual override on the By Paysheet - One-Time Deductions page overrides individual deduction codes to be taken on this check only.

The system uses two invisible deduction status indicators to tell the Pay Calculation process whether the benefit and/or general deduction taken information has been modified after running the Create Paysheet process. The two indicators are the General Deduction Status (GENL_DED_STATUS) and Benefit Deduction Status (BEN_DED_STATUS) fields on the PAY_EARNINGS record.

The Create Paysheet process initially sets the status of both deduction status indicators to I (initial). The status of the appropriate indicator changes when you save a modification of the deduction taken fields after the initial paysheet creation.

The Pay Calculation process performs the deduction override evaluation process to determine if deduction overrides apply to the paysheets being processed. The following table shows the deduction status indicator values and the response in the Pay Calculation process:

|

Status |

Explanation |

|---|---|

|

I (initial) |

This value is set by the Create Paysheet process or by manually adding a paysheet. This status indicates that no modifications have been made to deduction taken values. The Pay Calculation process does not check for possible update to paysheets. |

|

U (user update) |

Deduction taken value(s) have been manually updated on the One-Time Deductions page. The Pay Calculation process does not modify the values on the paysheet. |

|

L (pay calendar update) |

Deduction taken value(s) on the Pay Calendar Table page have been modified. The Pay Calculation process checks the deductions taken values for possible update to paysheets. |

|

D (employee data update) |

Deduction taken value(s) on the Payroll Options 2 page or the Override Benefits Deductions page have been modified. The Pay Calculation process checks the deduction taken values for possible update to paysheets. |

|

A (additional pay update) |

Deduction taken value(s) on the Create Additional Pay page have been modified. The Pay Calculation process checks the deduction taken values for possible update to paysheets only for additional pays to be paid on a separate check. |

|

C (calculated) |

Update to the deduction taken value(s) on the paysheet has been processed by the Pay Calculation process. |

If you change and save the value in the General Deductions Taken, General Ded Subset ID, Benefit Deductions Taken, or Benefit Ded Subset ID field, then restore the original value, the value of BEN_DED_STATUS and GENL_DED_STATUS will still indicate that a modification has been made and processing will proceed accordingly.

The Pay Calculation process first uses the deduction override evaluation and the paysheet update processes to update the Benefit Deductions Taken, Benefit Ded Subset ID, General Deductions Taken, and General Ded Subset ID on the paysheets. The Pay Calculation process uses these values on the paysheet to select deductions for pay calculation.

Paysheet Update Process

During the paysheet update process in pay calculation, the program accesses the deduction status indicators to determine if the General Deductions Taken and/or Benefit Deductions Taken field(s) have been manually overridden (U). If a field has been manually overridden, the paysheet update process does not override the field. If a field has not been manually overridden, the paysheet update process performs the override evaluation process to pick up any changes that may have occurred in Payroll Data, Benefit Deduction Processing Override, or Additional Pay.

Deduction Calculation Process

After the paysheet update process has determined which deduction codes to apply, the deduction calculation process uses the selections on the General Ded Code Override (general deduction code override) page to calculate deductions. The options that are selected for each individual deduction code are the final override for that code in the deduction calculation and no changes are made to the Deductions Taken field on the paysheet.

After a paycheck is confirmed, if you continue to make changes to the deduction taken fields on the Pay Calendar Table, Payroll Options 2, Override Benefits Deductions, or Additional Pay (for a separate check) pages, then paysheets for that paycheck would not be marked for deduction override evaluation (deduction override status indicators are not set to tell the system to process overrides).

Consequently, if this paycheck is unconfirmed later and the paycheck recalculated, benefit and general deductions for this paycheck would be calculated based on the deduction taken values on the paysheet, rather than on the updated deduction taken value on the Pay Calendar Table, Payroll Options 2, Override Benefits Deductions, or Additional Pay (for a separate check) pages.

Deduction override processing applies only to additional pay that is paid on a separate check. The Create Paysheet process and the Pay Calculation process first determine whether the additional pay is to be paid on a separate check, then proceeds as follows:

Not a separate check.

If the additional pay is not to be paid on a separate check, then there is no override to the paysheet as the deductions taken value for additional pay follows the value selected for the regular pay line.

Separate check.

If the additional pay is to be paid on a separate check, then the deductions taken value on the Create Additional Pay component overrides the appropriate paysheet deductions taken value (either the original Pay Calendar default or overrides from Payroll Data and/or Benefit Deduction Processing Override) for that payline only.

Employees with Multiple Additional Pays

In the case of employees with multiple additional pays with the same separate check number and varying deductions taken values, the deductions taken value used for the paysheet is the deductions taken value from the additional pay with the lowest additional pay sequence number with the same separate check number.

For example, an employee's additional pay data is represented in the following table:

|

Additional Pay Sequence Number |

Separate Check Number |

General Deduction Taken |

Benefit Deduction Taken |

|---|---|---|---|

|

1 |

1 |

Subset (ABC) |

NoOverride |

|

2 |

1 |

None |

NoOverride |

For this employee's separate check number one, the general deductions taken value on the paysheet is Subset and the general deduction subset ID is ABC. The benefit deductions taken value is as specified on the Pay Calendar table.