Working with Regular Rate of Pay Calculations for Employees

This topic provides an overview of regular rate of pay, calculation examples, setup steps, and discusses how to work with regular rate of pay calculations.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_REG_RT_TABLE |

Specify the states that require regular rate of pay calculation for non-overtime pay. |

|

|

PY_EE_REG_RATE |

Review the regular rate of pay details of employees. |

PeopleSoft for North America supports the calculation of regular rate of pay for states that use it to calculate non-overtime pay for hourly and exception hourly non-exempt employees.

Several U.S. states require the use of regular rate of pay to calculate pay for non-exempt employees. For instance, most employers in California are required to provide paid sick leave to employees. They may opt to pay sick leave at the employee's regular rate of pay for the work week in which the employee took the leave, whether or not the employee worked overtime. In Maine, employers must compensate employees for paid leave at the same base rate of pay that they received the week immediately prior to the leave taken. For non-exempt employees, the base rate of pay is the regular rate of pay used in the overtime pay calculation. In New York, most employers are required to provide paid sick leave to employees at the employees' regular rate of pay or the applicable minimum wage, whichever is greater.

Pay Calculation

The regular rate of pay is calculated as:

The Pay Calculation process triggers the regular rate of pay calculation for an employee when all these conditions are met:

The employee type is Hourly or Exception Hourly.

The FLSA status of the employee is either Nonexempt Alt Overtime or Nonexempt.

Earnings with the Regular FLSA category are present on the paysheet.

The state listed on the payline require the regular rate of pay calculation and is set up on the Regular Rate of Pay Control Page.

Earnings with the Overtime FLSA category are not required to calculate the regular rate of pay.

The system delivers the Regular Rate of Pay Control Page that is used to specify states that require the regular rate of pay calculation for non-overtime pay, as well as the calculation routine to use for each of them. Supported calculation routines are Standard Calculation and Include Overtime Premium.

The calculated regular rate of pay of an employee, which is at least the state's minimum wage, is available for review on the Employee Regular Rate of Pay Page.

Refer to examples below in this topic on how the regular rate of pay is calculated based on factors such as calculation routine, alternative overtime setup for state, and total hours worked.

Alternative Overtime State Table

The regular rate of pay calculation follows the FLSA rules related to minimum hours worked in an FLSA week to determine whether regular rate of pay should be calculated for the employee. If an employee works in a state that is set up on the Alternative Overtime State Table Page, and the employee’s FLSA status is Nonexempt Alternative Overtime, then the FLSA rules apply for the calculation even if the total hours worked is less than 40 hours.

Example 1: Standard Calculation for Maine Employee Working 40 Hours a Week

In this example, the employee in Maine worked for 40 hours in the specified 7-day FLSA period. The selected calculation routine for Maine is Standard Calculation.

Maine is not set up on the Alternative Overtime State Table page. The employee's FLSA status is Nonexempt.

|

Pay Information |

Value |

|---|---|

|

Current Pay Period |

July 11, 2021 – July 24, 2021 |

|

FLSA Period |

July 18, 2021 – July 24, 2021 |

|

State |

ME |

|

Calculation Routine for State |

Standard Calculation |

|

Hourly Rate |

12.50 USD |

|

Regular Hours |

40 |

|

Bonus |

100 USD |

|

Regular Rate of Pay |

(Not calculated) |

The regular rate of pay is not calculated in this example because the total hours worked does not exceed 40 in accordance with the current functionality.

For states that are not set up on the Alternative Overtime State Table Page, the total hours worked for the week must exceed 40 for regular rate of pay to be calculated.

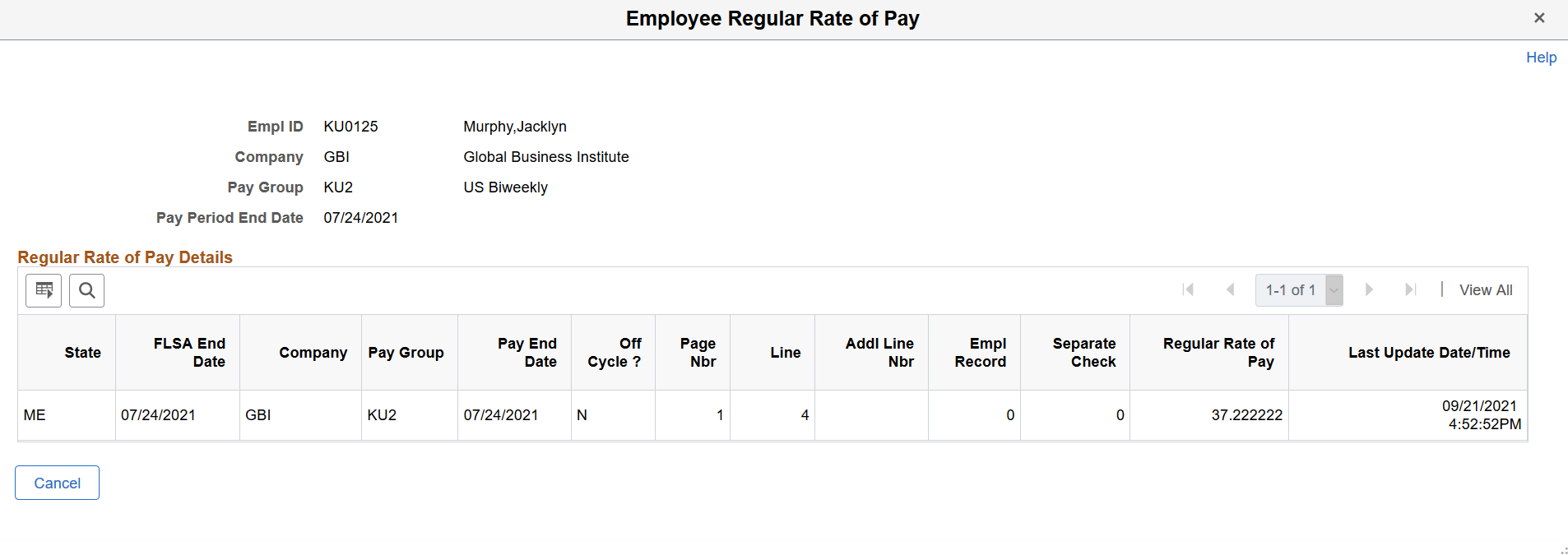

Example 2: Standard Calculation for Maine Employee Working Over 40 Hours a Week

In this example, the employee in Maine worked for 45 hours in the specified 7-day FLSA period. The selected calculation routine for Maine is Standard Calculation.

Maine is not set up on the Alternative Overtime State Table page. The employee's FLSA status is Nonexempt.

|

Pay Information |

Value |

|---|---|

|

Current Pay Period |

July 11, 2021 – July 24, 2021 |

|

FLSA Period |

July 18, 2021 – July 24, 2021 |

|

State |

ME |

|

Calculation Routine for State |

Standard Calculation |

|

Hourly Rate |

35 USD |

|

Regular Hours |

45 |

|

Bonus |

100.00 USD |

|

Total Earnings for the Week |

35 USD x 45 + 100 USD = 1675 USD |

|

Regular Rate of Pay |

1675 USD / 45 = 37.22 USD |

The system calculates the employee's regular rate of pay because the number of total hours worked exceeds 40. The regular rate of pay is calculated by dividing the total earnings for the week by the total hours worked, which is 37.22 USD.

This example illustrates the calculated regular rate of pay for the FLSA period on the Employee Regular Rate of Pay page (example 2).

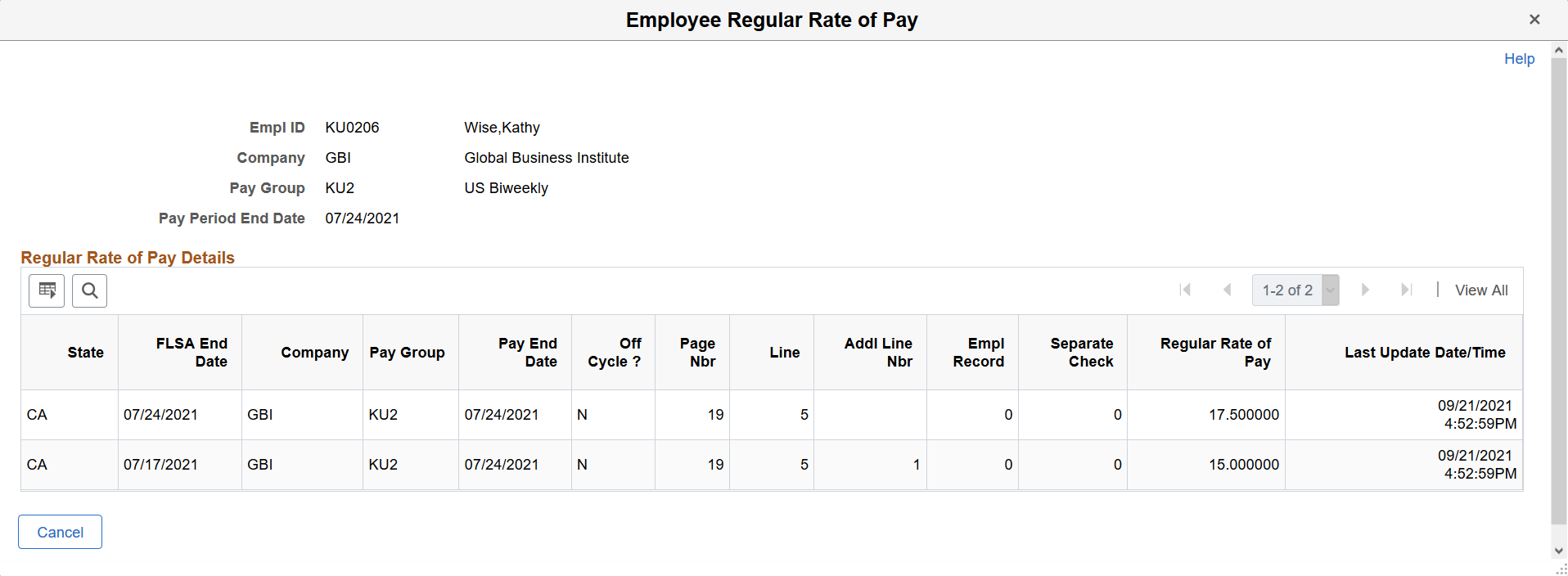

Example 3: Standard Calculation for California Employee Working 40 Hours a Week

In this example, the employee in California worked for 40 hours in each of the two 7-day FLSA weeks of the current pay period. The selected calculation routine for regular rate of pay for California is Standard Calculation.

California is set up on the Alternative Overtime State Table page. The employee's FLSA status is Nonexempt Alternative Overtime.

|

Pay Information |

Value |

|---|---|

|

Current Pay Period |

July 11, 2021 – July 24, 2021 |

|

FLSA Period |

July 11, 2021 – July 17, 2021 |

|

State |

CA |

|

Calculation Routine for State |

Standard Calculation |

|

Hourly Rate |

15 USD |

|

Regular Hours |

40 |

|

Total Earnings for the Week |

15 USD x 40 = 600 USD |

|

Regular Rate of Pay |

600 USD / 40 = 15 USD |

Even though the number of total hours worked doesn't exceed 40, the system calculates the employee's regular rate of pay because the 40-work-hour rule doesn't apply when the state is specified in the alternative overtimes state table and the employee is in the right FLSA status. In the first week's example, the calculated regular rate of pay is 15 USD, same as the hourly rate.

|

Pay Information |

Value |

|---|---|

|

Current Pay Period |

July 11, 2021 – July 24, 2021 |

|

FLSA Period |

July 18, 2021 – July 24, 2021 |

|

State |

CA |

|

Calculation Routine for State |

Standard Calculation |

|

Hourly Rate |

15 USD |

|

Regular Hours |

40 |

|

Bonus |

100 USD |

|

Total Earnings for the Week |

15 USD x 40 + 100 USD = 700 USD |

|

Regular Rate of Pay |

700 USD / 40 = 17.50 USD |

In the second week's example, the employee had a 100 USD bonus and the calculated regular rate of pay is 17.50 USD.

This example illustrates the calculated regular rates of pay for both FLSA periods on the Employee Regular Rate of Pay page (example 3).

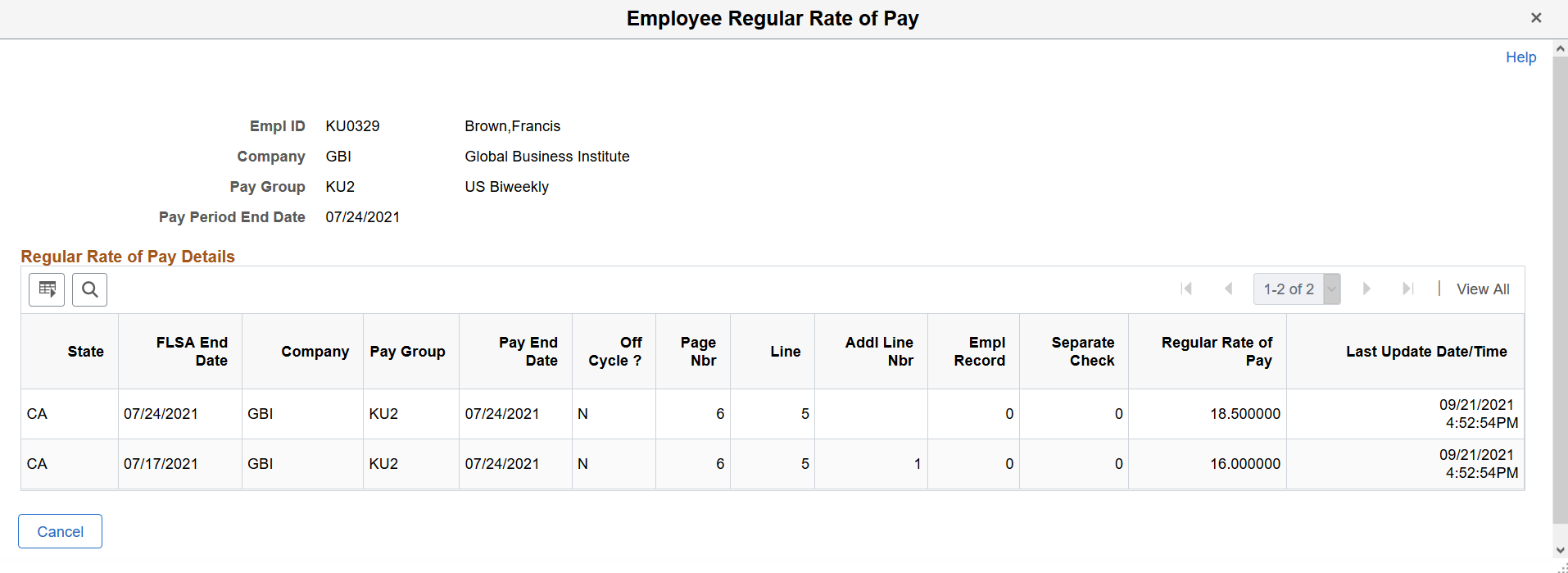

Example 4: Include Overtime Premium Calculation for California Employee Working 40 Hours a Week

In this example, the employee in California worked for 40 hours in the 7-day FLSA period, and had a flat sum bonus. The selected calculation routine for California is Include Overtime Premium.

California is set up on the Alternative Overtime State Table page. The employee's FLSA status is Nonexempt Alternative Overtime.

|

Pay Information |

Value |

|---|---|

|

Current Pay Period |

July 11, 2021 – July 24, 2021 |

|

FLSA Period |

July 18, 2021 – July 24, 2021 |

|

State |

CA |

|

Calculation Routine for State |

Include Overtime Premium |

|

Hourly Rate |

16 USD |

|

Regular Hours |

40 |

|

Flat Sum Bonus |

100 USD |

|

Overtime Premium (Flat Sum Bonus / Regular Hours) |

100 USD / 40 = 2.50 USD |

|

Regular Rate of Pay (Hourly Rate + Overtime Premium) |

16 USD + 2.50 USD = 18.50 USD |

The regular rate of pay is calculated by adding the hourly rate and overtime premium, which is 18.50 USD.

This example illustrates the calculated regular rate of pay for the FLSA period on the Employee Regular Rate of Pay page (example 4).

For more information about the overtime pay calculations for flat sum bonus, see Overview of Overtime Calculations on Flat Sum Bonus Payments.

Paying Employees Using Regular Rate of Pay

The regular rate of pay calculation is for informational purposes only. It is the customer’s responsibility to determine if an employee should be paid at the regular rate of pay. The existing FLSA/Alternative Overtime functionality has not changed.

To pay an employee using the regular rate of pay, select the Override Hourly Rate check box on the employee’s payline(s) and enter the rate as an override hourly rate for these earnings.

Prior Period Adjustment

The regular rate of pay on a confirmed pay run is not adjusted automatically. For example, if a prior period adjustment is entered on an employee’s paysheet that impacts the regular rate of pay, which is associated with a confirmed paycheck, the Pay Calculation process will add an entry on the Employee Regular Rate of Pay page for the current pay end date, referencing the FLSA end date of the prior period adjustment.

Pay Unsheet

The Pay Unsheet process clears the entries from the Employee Regular Rate of Pay page based on the run control parameters.

Pay Reversal/Adjustments

The Reversal/Adjustment process contains two steps: reversing the check and then calculating the new adjustment check. When the Reversal/Adjustment process is run, the first step clears the entries on the Employee Regular Rate of Pay page. The second step calculates the entries on the Employee Regular Rate of Pay page for the defined FLSA period.

If a paycheck is reversed without an adjustment paycheck being issued, the original Regular Rate of Pay entry or entries will not be removed from the Employee Regular Rate of Pay page. If a paycheck is reversed/adjusted, the regular rate of pay will be calculated for the adjustment paycheck.

Retro Pay Calculation

Retro Pay calculation does not support the calculation of regular rate of pay.

Paycheck Modeler

Paycheck Modeler does not support the regular rate of pay calculation.

OK to PAY Deselected

If the OK to Pay check box is deselected on some but not all of the paylines associated with an employee’s paysheet, the Pay Calculation process will recalculate the employee's regular rate of pay for the paysheet being processed during pay recalculation.

However, if the OK to Pay check box is deselected on all paylines associated with an employee’s paysheet after the regular rate of pay is calculated, then a paycheck will be not be generated for the employee, and the entry on the Employee Regular Rate of Pay page will not be cleared.

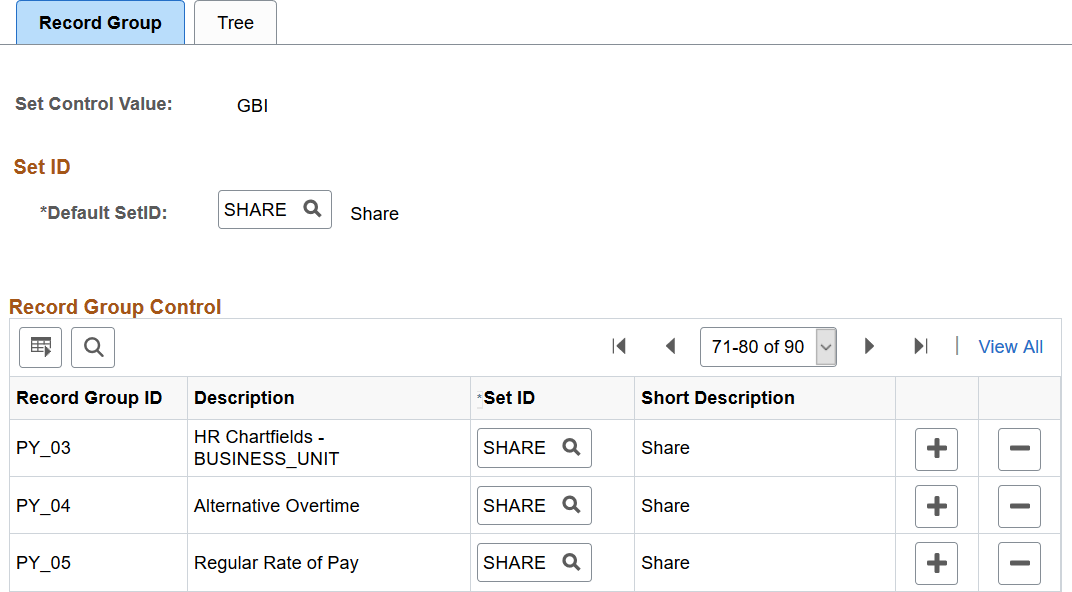

Here are the high-level steps for setting up the Regular of Rate Pay calculation.

Select an setID for the PY_05 record group on the Record Group page (SET_CNTRL_TABLE1) to match the setID that you use for the regular rate of pay setup on the Regular Rate of Pay Control Page.

This example displays the record groups and their setIDs for GBI on the Record Group page. The setID for the PY_05 record group is SHARE, the same setID that is also used in the regular rate of pay setup.

Specify the states that require employees’ regular rate of pay to be calculated for non-overtime pay and the applicable calculation routine on the Regular Rate of Pay Control Page. The Pay Calculation process uses the setID of the company on the payline to determine if the state needs the regular rate of pay calculation as of the earnings end date.

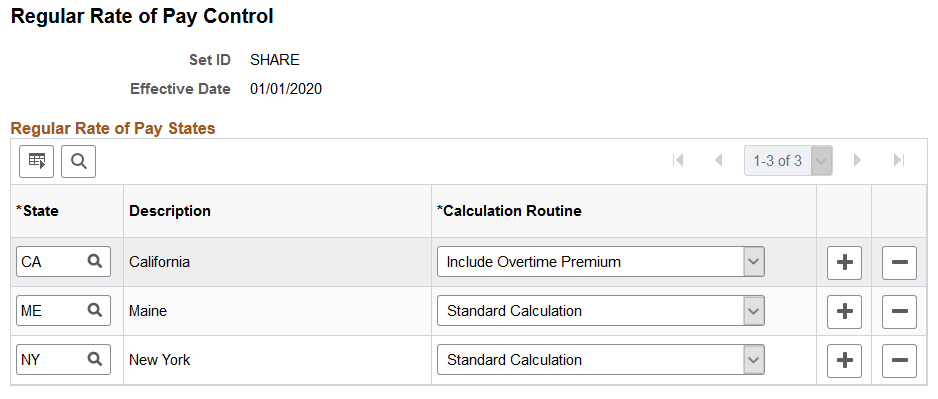

Use the Regular Rate of Pay Control page (PY_REG_RT_TABLE) to specify the states that require regular rate of pay calculation for non-overtime pay.

Navigation:

This example illustrates the fields and controls on the Regular Rate of Pay Control page.

The SHARE setID is delivered as sample data showing the states that use the regular rate of pay to calculate non-overtime pay for non-exempt employees. This screenshot displays state information for illustration purposes. Update information on this page to support your organization's alternative overtime business rules.

|

Field or Control |

Description |

|---|---|

|

State |

Specify the state that requires regular rate of pay calculation. |

|

Calculation Routine |

Select the applicable calculation routine for the state. Values are: Include Overtime Premium: Select this option if the state, for example, California, requires the regular rate of pay to include the overtime premium/regular bonus rate. This calculation routine factors a flat sum bonus that an employee receives into their regular rate of pay by: Amount of the bonus / total number of non-overtime hours worked during the work period Standard Calculation (default value) |

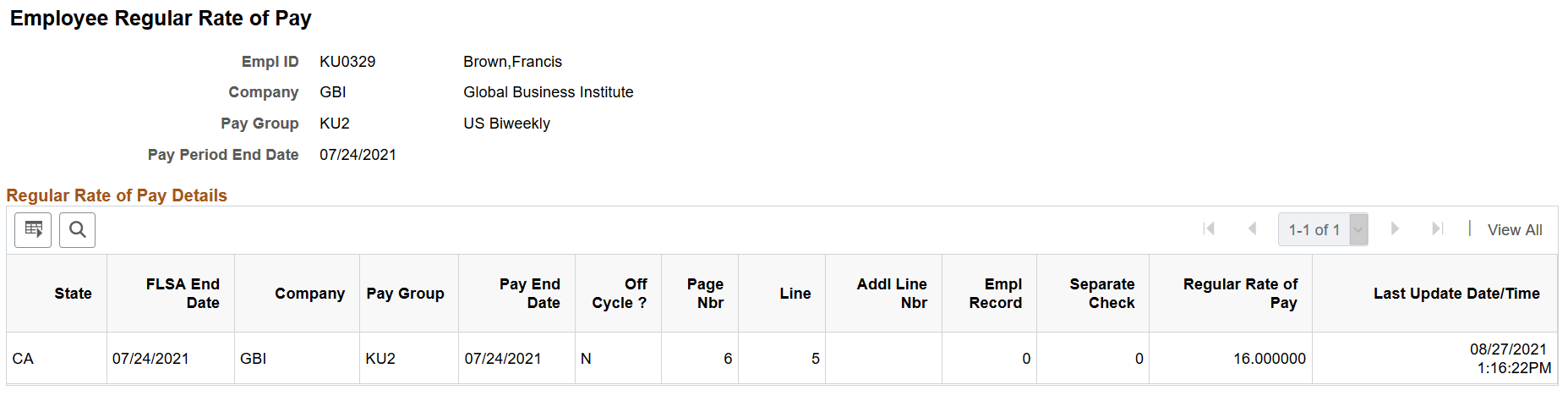

Use the Employee Regular Rate of Pay page (PY_EE_REG_RATE) to view the calculated regular rate of pay details for employees.

Navigation:

Select the Regular Rate of Pay link that appears on the Additional Data page, which is accessible by clicking the Additional Data link on the Paycheck Earnings Page, Review Paycheck Summary page, and the Create Online Check Page.

This example illustrates the fields and controls on the Employee Regular Rate of Pay page.

View the regular rate of pay information of the selected employee. During the calculation or recalculation of paychecks, the system clears the entries from the Employee Regular Rate of Pay page.

If the employee has multiple entries (for example, on-cycle and off-cycle entries) for the same FLSA period, you can use the Last Update Date/Time field value to look for the most current regular rate of pay.