(E&G) Reviewing and Adjusting 1042 Tax Balances

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

1042 Tax Balances Page |

BALANCES_TAX3 |

Review an employee's 1042 tax balances. |

|

1042 Tax Balance Adjustments Page |

BALANCES_TAX4 |

Review online adjustments to an employee's 1042 tax balances. |

|

Adjust 1042 Tax Balance 1 Page |

ADJ_TAX_BAL3 |

Identify the country, income code, tax rate, state, and reason for adjustment to an employee's 1042 tax balances. |

|

ADJ_TAX_BAL4 |

Change 1042 tax balances. |

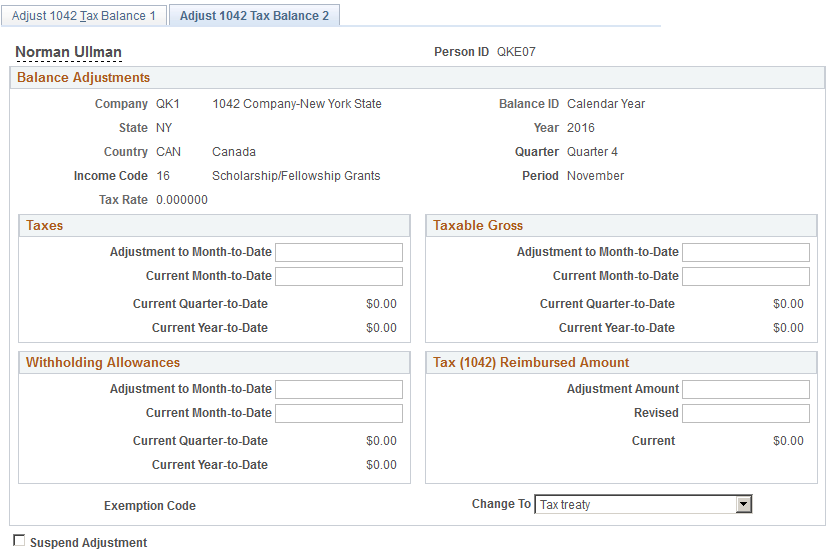

Use the Adjust 1042 Tax Balances 2 page (ADJ_TAX_BAL4) to change 1042 NRA (non-resident alien) tax balances.

Navigation:

This example illustrates the fields and controls on the Adjust 1042 Tax Balance 2 page.

Note: To access this page you must first enter identifying criteria on the Adjust 1042 Tax Balance 1 page, and save it.

Field or Control |

Description |

|---|---|

Current Month-to-Date or Adjustment to Month-to-Date |

Enter the new balance in the Current Month-to-Date field as appropriate in any or all of theTaxes, Taxable Gross, and Withholding Allowances group boxes. The system calculates theAdjustment to Month-to-Date values in each group box based on the current month-to-date balance that you enter. Alternatively, you can enter an adjustment amount in the Adjustment to Month-to-Date field in the appropriate group boxes, in which case the system calculates the new Current Month-to-Date value for that group box. Balances are updated in the payroll calculation and confirmation processes that you run during the year. Note: Balance adjustments are applied individually. If you make an adjustment to a 1042 balance on the Adjust 1042 Balances page, you will also likely want to apply the same adjustment to the summarized 1042 totals on the Adjust 1042 Tax Balance 2 page. |

Exemption Code |

Specify the exemption code that applies to this employee. When the system creates the employee’s 1042 Balance record during payroll calculation and confirmation processes, it enters a default exemption code of Tax Treaty. Before you print the paper forms or generate the electronic file, verify or change the employee’s exemption code on the tax 1042 balance record. |

Suspend Adjustment |

Select this check box to make key fields available for re-entry after saving. |