Setting Up Depreciation Schedules

To set up depreciation schedules, use the Depreciation Schedule Definition (DEPR_SCHEDULE_DEFN) component.

This topic provides an overview of depreciation schedules and discusses how to define depreciation schedules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEPR_SCHEDULE_DEFN |

Add or modify depreciation tables. |

There are several different methods for calculating depreciation. Each depreciation method is an equation by which depreciation is calculated. In most methods, the same equation is used to calculate depreciation for each period. A depreciation schedule is a special type of depreciation method. Depreciation schedules are tables specifying the percentage of depreciation expensed for each period. Currently, the PeopleSoft system delivers schedules (DEPR_SCHED_TBL system table) for the following standard IRS depreciation methods:

Declining balance with straight-line switch:

200 percent

175 percent

150 percent

125 percent

Sum-of-the-years' digits.

ACRS (Accelerated Cost Recovery System), GDS (General Depreciation System), ADS (Alternative Depreciation System).

MACRS (Modified Accelerated Cost Recovery System), GDS, ADS.

Note: Standard depreciation schedules cannot be used for short tax year processing. For short tax year processing, you need to set up special schedules that have the short tax year worked into them.

PeopleSoft Asset Management depreciation schedules are based on the percentage depreciation tables found in IRS Publication 534. You can modify existing depreciation schedules or add new schedules, by using the Depreciation Schedule page. On the Depreciation Schedules page, the method is DB150 with a switch to straight line. The in-service period for each year of the asset's life is the key to determining the percentage of depreciation allowed for any one year. For example, suppose that your organization runs on a monthly calendar and places an asset in service in January 1997. View Year of Life 1, In-Service Period 1 to find the percentage allowed in the first year; view Year of Life 2, In-Service Period 1 to find the percentage allowed for the second year, and so on.

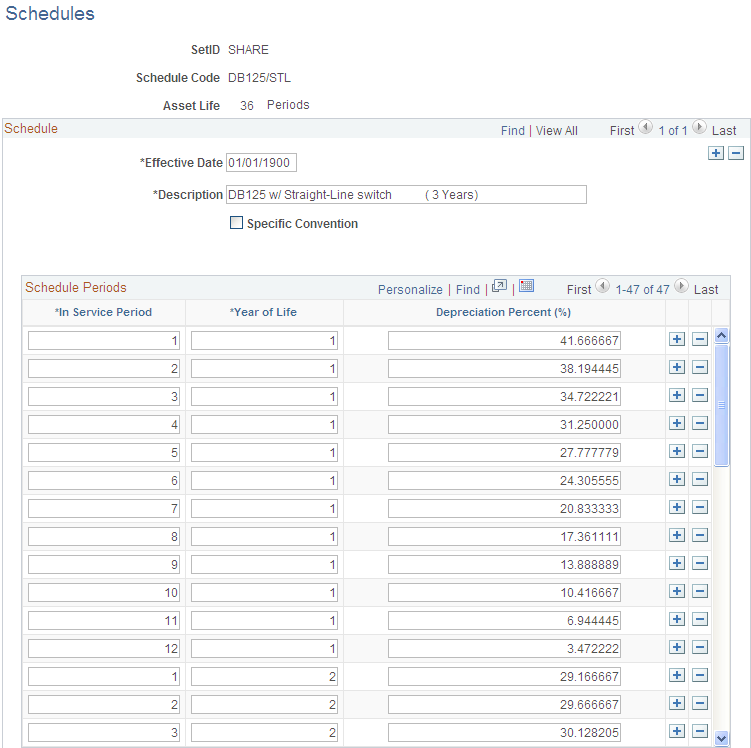

Use the Schedules page (DEPR_SCHEDULE_DEFN) to add or modify depreciation tables.

Navigation:

This example illustrates the fields and controls on the Schedules page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Specific Convention |

Select to apply a particular convention. The page refreshes and displays the Convention list box from which to choose the depreciation convention. |

Convention |

This field appears when selecting the Specific Convention check box. Select the convention that you want to use. |

Note: The schedule periods that you set up should reflect the periods set up in your calendar.