Revaluing Assets Using the Revaluation Worksheet

This topic lists the page used to revalue assets using the Revaluation Worksheet.

The Revaluation Worksheet allows you to revalue financial assets in accordance with International Accounting Standards (IAS 16) to reflect current fair value, provided that the net book value (NBV) of an asset is less than its fair value (FV) at a given point.

Note: Since the NBV is required for determining the revaluation amount, the depreciation reporting table must be loaded prior to performing revaluation.

Revaluing an Asset Below Net Book Value to Meet Australian Accounting Standard AASB 116

PeopleSoft provides you with the ability to revalue an asset below net book value, so that fair market value is less than net book value. This enables Australian users to meet Australian Accounting Standard AASB 116.

When you revalue an asset below net book value, two cost rows are created for this scenario: one row representing the revaluation up to where the net book value is greater than the fair market value, and a second row representing the difference to match the total revaluation of calculating the cost adjustment.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AM_REVALUATION |

Search for financial assets using the desired criteria, mark them for revaluation, supplying the current fair value amount and click the Save button. Changes take effect upon save as the Transaction Loader (AMIF1000) is automatically invoked, provided the Auto-Run Transaction Loader options within Asset Management - User Preferences are selected. |

Use the Revaluation Worksheet page (AM_REVALUATION) to search for financial assets using the desired criteria, mark them for revaluation, supplying the current fair value amount and click the Save button.

Changes take effect upon save as the Transaction Loader (AMIF1000) is automatically invoked, provided the Auto-Run Transaction Loader options within Asset Management - User Preferences are selected.

Navigation:

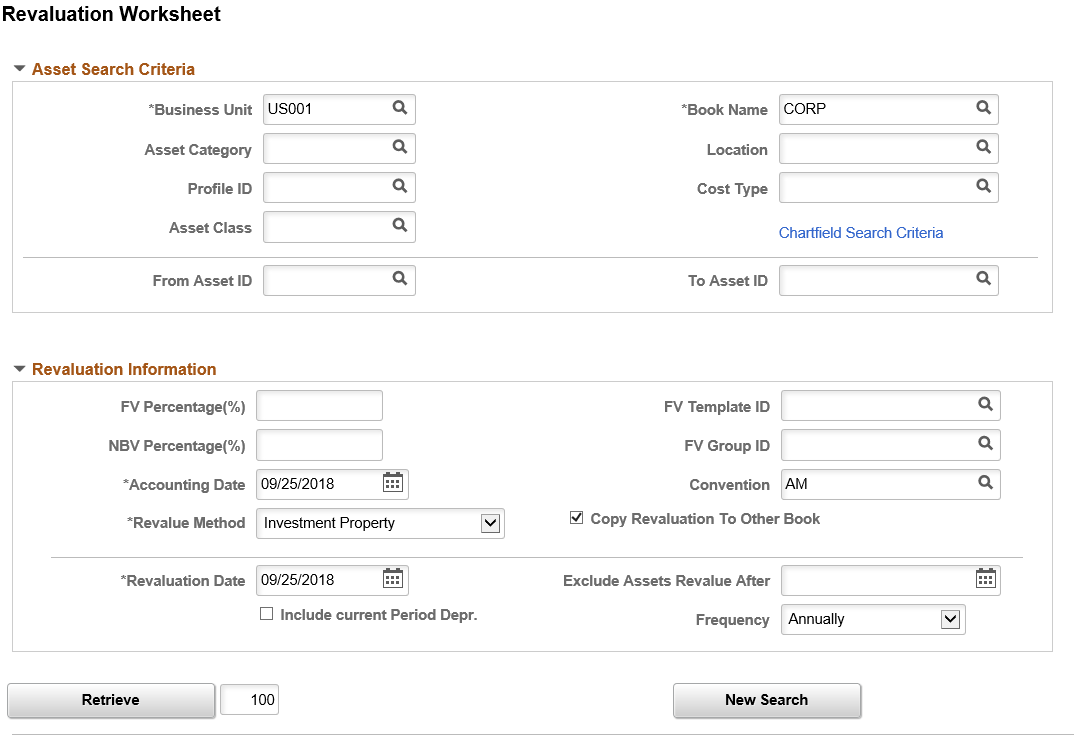

This example illustrates the fields and controls on the Revaluation Worksheet page (1 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Business Unit |

Select a business unit for your search criteria. This is a required field and displays only business units whose revaluation option is enabled. |

|||||||||||||||||||||

Book Name |

Select a book for your search criteria. This is a required field and displays the default book for the business unit that you select in the Business Unit field. |

|||||||||||||||||||||

Cost Type |

(Optional) Select a Cost Type to narrow your search criteria. |

|||||||||||||||||||||

Asset Category |

(Optional) Select a Category to narrow your search criteria. |

|||||||||||||||||||||

Location |

(Optional) Select a Location to narrow your search criteria. |

|||||||||||||||||||||

Profile ID |

(Optional) Select a Profile ID to narrow your search criteria. |

|||||||||||||||||||||

Asset Class |

(Optional) Select an Asset Class to narrow your search criteria. |

|||||||||||||||||||||

From Asset ID/To Asset ID: |

(Optional) Select an asset or a range of assets to further narrow your search criteria. |

|||||||||||||||||||||

ChartField Search Criteria |

(Optional) Use this link to search assets by ChartField. |

|||||||||||||||||||||

FV Percentage (%): (fair value percentage) |

(Optional) Use a percentage that applies to all assets that appears in the search result section when the Retrieve button is pushed. Enter a value that is less than zero if there is a decrease from the original value. If both FV percent and NBV percent exist, the system uses the FV percent. For example, assume that Asset A has a Fair Value of 10,000 USD and the FV has been effective for two years. If you enter a value of 25, it will change the FV of the asset to 12,500 USD with the revaluation date when page is saved, which is 125 percent x Original FV (125% x 10000 = 12500). The calculated FV will appear in the result section. |

|||||||||||||||||||||

FV Template ID (fair value template ID) |

Select an existing fair value template, if applicable. This provides an efficient way to populate the other fair value fields. Upon clicking the Retrieve button, the FV Template ID and FV Group ID in the Asset Search Results retrieves default values from the Revaluation Information section. When marking rows and saving the page, the fair value fields are updated on the Fair Value record (AM_FMV). |

|||||||||||||||||||||

FV Group ID(fair value group ID) |

Default value populates from the selected FV Template ID. You can override the default value that is derived from the FV Template. If the valuation premise from the FV Template is In-Exchange or the FV Template ID is blank, the FV Group ID is disabled. |

|||||||||||||||||||||

NBV Percentage (%): |

(Optional) Use a percentage that applies to all assets that appears in the search result section when the Retrieve button is pushed. You must enter a value that is greater than zero in this field; otherwise, it will cause the FV to be less than the NBV and no revaluation will occur. For example, assume that Asset B has a Fair Value of 9,000 USD and a Net Book Value of 10,000 USD. The FV has been effective for two years. If you enter a value of 30, it will change the FV to 13,000 USD (130% x 10,000) with the revaluation date when the page is saved. The calculated FV will appear in the result section. |

|||||||||||||||||||||

Accounting Date |

Enter the date that the revaluation is to be booked. This date must fall within the open period range and cannot be earlier than the revaluation date. |

|||||||||||||||||||||

Copy Revaluation to Other Book |

Select this check box if you want the revaluation amount in a given book to populate other books whose revaluation process is enabled. PeopleSoft Asset Management copies the revaluation amount to other books in the ledger group as long as the Keep Ledgers in Sync (KLS) option is selected. If the option Copy Revaluation to Other Books is checked, PeopleSoft Asset Management copies the same amount to the books with the revaluation process selected for books that do not point to the ledger group. Depending on the selection of these options, when Copy Zero Impair/Revalue Rows is checked, the system copies zero revaluation data in all the remaining books. For example: Suppose you have a business unit with six books (A, B, C, D, E, F), with the first three books, A, B and C pointing to a ledger group, the ledger group is synchronized with the general ledger business unit and book B is pointing to the primary ledger. However, the other three books, D, E and F, do not point to general ledger and books A, B, C, and E have the revaluation option enabled. PeopleSoft Asset Management processes the revaluation against the primary book, B. The system then copies the revaluation adjustment to book A and book C because they are in the same ledger group, regardless of the status of the optionsCopy Revaluation to other books and Copy Zero Impair/Revalue Rows. If Copy Revaluation to other books is selected, the system copies the same revaluation adjustment to book E because the revaluation option is selected for that book. If the Copy Zero Impair/Revalue Rows option is selected, the system copies zero revaluation rows into book D and F. If theCopy Revaluation to other books option is not selected and the Copy Zero Impair/Revalue Rows option is selected, the system copies zero impairment rows to books D and F. When both options are not selected, the system does not copy any impairment or revaluation row to books D, E and F. |

|||||||||||||||||||||

Revalue Method |

Select the method used to calculate the asset revaluation. This is a required field and includes the following options:

|

|||||||||||||||||||||

Convention |

Enter the depreciation convention. The default value is AM (actual month). |

|||||||||||||||||||||

Revaluation Date: |

Enter the date that the revaluation takes place. This is the transaction date and is used to determine the NBV and the FV. |

|||||||||||||||||||||

Include current Period Depr. |

Select this option if the current period depreciation is to be accumulated. For example: if you perform the revaluation at the end of period 12 (the final period in the year) but you do not want to include period 12 depreciation to compare with FV, you would not select this check box. |

|||||||||||||||||||||

Exclude Assets Revalue After: |

(Optional) Select a date that may assist you in retrieving assets that have not been revalued recently. |

|||||||||||||||||||||

Frequency |

Select the frequency of the revaluation. This is used for audit purposes. |

|||||||||||||||||||||

Retrieve |

Click the Retrieve button to retrieve the assets based on your search criteria. |

Asset Search Results

Once you click the Retrieve button, the Asset Search Results page appears. The Asset Search Criteria section collapses and the revaluation information is visible but disabled.

This example illustrates the fields and controls on the Revaluation Worksheet page (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Mark to Revalue |

Click to revalue the selected assets. The revaluation status of the selected assets is changed to Revalue and when the page is saved, the asset is revalued. |

Mark to not Revalue |

Click to change the revaluation status of the selected assets to Don't Revalue. When the page is saved, the selected assets will not be revalued. A blank revaluation status is treated the same as the "Don't Revalue" asset; however, this designation marks the asset specifically as an asset that should not be revalued and the asset appears in the audit table. |

Mark to Update FV |

Click to update the FV in mass without performing a revaluation. The revaluation status will be FV and implies only an update in the FV table using the date of revaluation as the appraisal and effective date. The FV is necessary for comparison purposes in the revaluation process and this provides a convenient way to update those values for in mass. |

Remove From List |

Click to remove the selected assets from the grid. This action does not generate a new Revaluation Status. |

Refresh |

Click to update changes in the revaluation calculation if you modify the FV before saving the page. |

Mark |

Select those assets to which the action applies. |

Revaluation Status |

Displays the revaluation status of the asset. The values are:

Note: You can change the revaluation status until saving the page. Once you save the page, all data becomes unavailable for change. |

Asset ID |

Displays the asset identifier. |

Cost |

Displays the total cost of the asset in the base currency. |

Accumulated Depreciation |

Displays the total depreciation in the base currency of the asset up to the revaluation period or prior period based on the "Include Current Period Depr." option. Note: If the convention is AD, prior period means prior day. |

Net Book Value |

Displays the asset NBV. This value is copied from the Depreciation Reporting table, which must be loaded before using the Revaluation Worksheet for revaluation. |

Fair Value |

Displays the FV converted from its original currency to the book's base currency at the revaluation date rate. You can update the FV in the book's base currency and at such time, a new entry is created in the FV table at the time of save as long as the revaluation status is Revalue or FV. If you modify the given FV, click refresh button to update the revaluation amount. |

Revaluation |

Displays the revaluation adjustment amount. The system calculates the amount as follows:

|

Cost Adjustment |

Displays the cost adjustment amount. The system calculates this amount as follows: FV less Cost.

|

Accum. Depr. Adjustment(accumulated depreciation adjustment) |

(Applies only when the Depreciation Write-off method is used.) Displays the amount of the accumulated depreciation adjustment due to revaluation. |

Impairment Reversal |

(Applies only when the Depreciation Write-off method is used.) Displays the impairment reversal amount. The system calculates this amount as follows:

|

Carry Cost (Impairment) |

Displays the sum of the Impairment Loss and prior Impairment Reversal (in the base currency.) |

Carry Cost (Revaluation) |

Displays the sum of the prior Revaluation, Revaluation Reversal and Revaluation Write-off (in the base currency.) |

Comments |

Click the Comments link to access the Asset Comments page. Use this page to view or add relevant supporting comments to an asset transaction. |

Attachments |

Click the Attachments link to access the Asset Attachments page. You can view or add relevant supporting attachments to an asset transaction. |

Note: Upon saving, an audit trail is stored in two tables: AM_REV_AUD_HDR and AM_REV_AUD_DTL.