Generating Withholding Reports

To set up your withholding reports, use the following components:

1099 Piggyback States (WTHD_STATE_TABLE).

Report Control Information (WTHD_CONTROL).

PeopleSoft Payables provides withholding reporting capabilities. Throughout the year, PeopleSoft Payables tracks all withholding supplier information. When it is time to send your withholding reports, PeopleSoft Payables extracts all the withholding balances from vouchers in the period, business units, and suppliers you specify, and prepares a report or electronic file for transmission to the tax authority, based on your setup.

This section discusses how to:

Enter transmitter and payor data.

Select suppliers and business units.

(USA) Enter states for the combined federal and state filing program.

Run the Withholding Reporting Application Engine process (AP_WTHDRPT).

Review withholding report information.

Run withholding reports.

Some reports specific to particular tax authorities are discussed in the topic, "Processing Special Withholding Requirements."

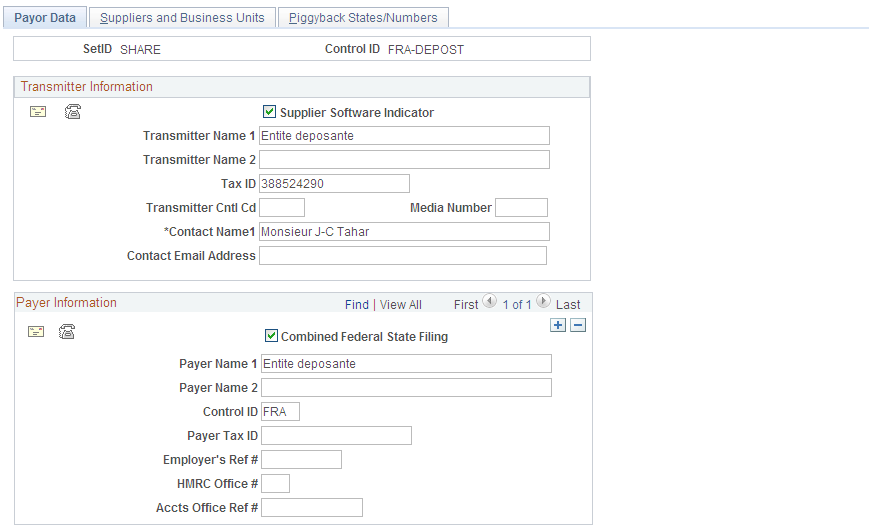

Use the Report Control Information - Payor Data page ( WTHD_CONTROL) to identify payor information.

Navigation:

This example illustrates the fields and controls on the Report Control Information - Payor Data page. You can find definitions for the fields and controls later on this page.

Note: Withholding control information is keyed by SetID and control ID. This enables you to define several control information IDs to run different withholding reports. You may wish to run separate reports based on business units, suppliers, or payors. Typically, you have one control ID set up for each government reporting entity.

Transmitter Information

Field or Control |

Description |

|---|---|

|

Click to access the Transmitter Address page, where you can enter the transmitter's address data, formatted as required by your tax authority. |

|

Click to access the Transmitter Phone page, where you can enter the transmitter's telephone, fax information, and contact information. |

Supplier Software Indicator |

Selected by default indicating that the electronic file was generated via outside supplier software. Deselect this check box if you have customized this process. |

Transmitter Name 1 and Transmitter Name 2 |

Use to enter the transmitter's name. |

Tax ID |

Enter your tax ID for this transmitter. |

Transmitter Cntl Code (transmitter control code) |

If applicable, enter your transmitter control code. |

Media Number |

If applicable, enter your media number. |

Contact Name 1 and Contact Email Address |

Enter the name of a contact person for this transmitter and email address, as applicable |

Payer Information

Field or Control |

Description |

|---|---|

|

Click to access the Payer Address page on which you can enter the payer address data, formatted as required by your tax authority. |

|

Click to access the Payer Phone page on which you can enter the payer's telephone and fax information. |

Combined Federal State Filing Participant |

(USA) Select this flag if the payer is participating in the Combined Federal State Filing program. |

Payer Name 1 and Payer Name 2 |

Enter the payer's name. |

Control ID |

Enter a control ID. This could be a business unit. |

Payer Tax ID |

Enter your tax ID for this payer. |

Employer's Ref #(employer's reference number) |

Enter the employer's reference number for use in payment reporting to Sub-contractors and the monthly reporting for the HMRC. |

HMRC Office #(HM Revenue and Customs office number |

Enter the HM Revenue & Customs Office number for use in payment reporting to Sub-contractors and the monthly reporting for the HMRC. |

Accts Office Ref #(accounts office reference number) |

Enter the HM Revenue & Customs Office reference number for use in payment reporting to Sub-contractors and the monthly reporting for the HMRC. |

Use the Report Control Information - Suppliers and Business Units page (WTHD_CNTL_VNDR_BU) to specify which withholding suppliers you want to include as well as the PeopleSoft Payables business units from which you want the system to select paid vouchers for each payer.

Navigation:

Field or Control |

Description |

|---|---|

All Suppliers |

Select if you want to process all withholding suppliers that are associated with the business units you specify. If you only want to process specific withholding suppliers, deselect this check box. A Suppliers group box displays in which you can enter the individual supplier IDs. Note: (USA) Select this option for 1099 reporting. If you do not, your correction files will be incorrect. |

Include Direct Sales Suppliers |

Select to have the reporting process list all direct sales suppliers who have no vouchers for the reporting year. Only select this for one payer, not for all. Otherwise, the system reports suppliers several times. |

Suppliers |

Use this group box to select the withholding suppliers (that are associated with the business units you specify) on which you want to report if you do not select the All Suppliers option. |

Business Units |

Specify one or more business units to process. The business units must be associated with the selected SetID. If you fail to specify any business units, the system will not find any withholding transactions to report. If you specify multiple business units, the system consolidates the balances of suppliers that have vouchers spread out over the selected business units. |

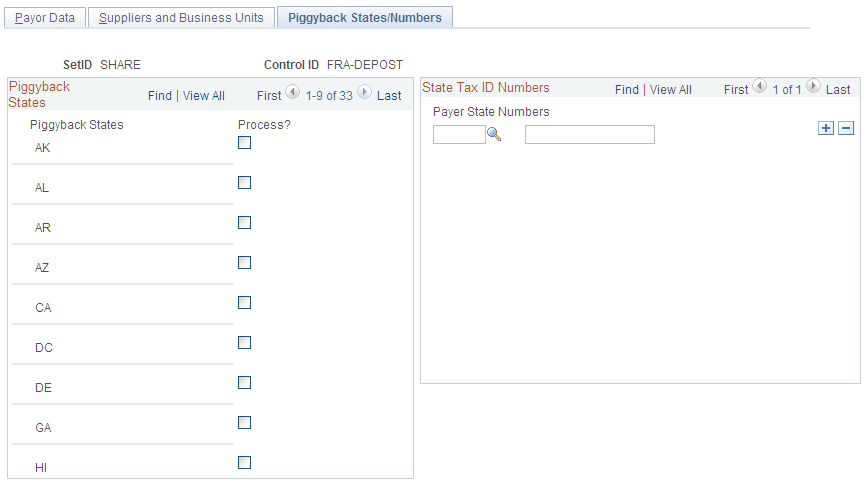

Use the Report Control Information - Piggyback States/Numbers page (WTHD_CNTL_STATE) to enter the information the IRS requires to have the IRS forward copies of your 1099 report tapes to the state governments who have an interest in your suppliers' 1099 earnings.

Navigation:

This example illustrates the fields and controls on the Report Control Information - Piggyback States/Numbers. You can find definitions for the fields and controls later on this page.

Note: This page applies only to 1099 reporting in the U.S.

Field or Control |

Description |

|---|---|

Piggyback States |

Displays the states participating in the combined federal and state 1099 filing process. Only states that you have defined on the 1099 Piggyback States page appear here. |

Process? |

Select the Process check box for each relevant state name to tell the IRS which states need copies. |

Payer State |

Enter the standard two-character alpha state abbreviation for the payer state. |

Numbers |

Enter the state number. This is the ID number that is assigned by individual states. This number is used on the forms (Copy B) that you send to your suppliers, but is not included on the tape you send to the IRS. |

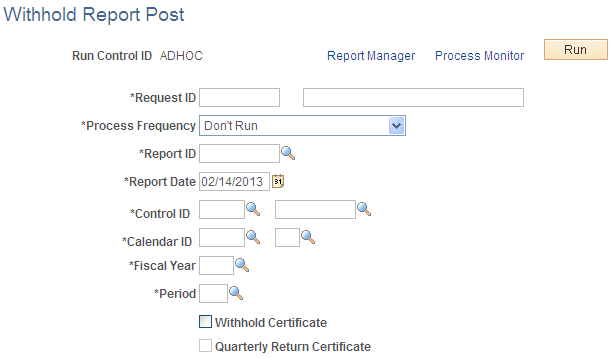

Use the Withhold Report Post page (WTHD_RPT_POST) to run the Withholding Reporting Application Engine process (AP_WTHDRPT) to populate the withholding report table with data from the withholding transaction table based on your report setup.

Navigation:

This example illustrates the fields and controls on the Withhold Report Post page. You can find definitions for the fields and controls later on this page.

Important! For 1099 reports, you use a separate report posting process.

Field or Control |

Description |

|---|---|

Report ID |

Select the withholding report ID for which you want to create the report information. |

Report Date |

Select the date of the report. |

Control ID |

Select the report control ID. |

Calendar ID |

Select the appropriate calendar ID. |

Fiscal Year |

Enter the fiscal year for the report. |

Period |

Enter the period for the report. The fiscal year and period determine the date range used to select supplier payments for withholding reporting. |

Withhold Certificate |

Select if you require the system to create a withholding certificate. |

Quarterly Return Certificate |

Select if you require the system to create a TDS quarterly return certificate. |

Note: Before you can run the Withholding Reporting process, you must define the withholding control information on the pages in the Report Control Information component.

To access the Print CIS Payment Statement page, use the navigation:

Use the Withholding Report Info page (WTHD_RPT_PNL) to review the information you generated during the Withholding Reporting Application Engine process (AP_WTHDRPT).

Navigation:

Field or Control |

Description |

|---|---|

Tax ID and Description |

Displays the tax ID of the supplier from whom the withholding in this report was withheld, and the description of the Tax ID. |

Basis Amt (basis amount) |

Displays the basis amount on which the withholdings were calculated. |

Liability Amt (liability amount) |

Displays the amount of the withholding. |

Paid Amount |

Displays how much of the withholding has been paid to the tax authority. |

Report Date |

Displays the date on which you created your reporting information. |

Use the T4A/T4A-NR Reporting page (AP_T4A_RUN_CTRL) to define run parameters to run your T4A and T4A-NR reports. You must run Create Reporting Information process before you run T4A/T4A-NR reporting to generate T4A and T4A-NR reports.

Navigation:

|

Field or Control |

Description |

|---|---|

|

Withholding Report ID |

Select the ID of the withholding report you want to run. |

|

Map ID |

Enter the Data Export Import Utility (DEIU) map definition. For more information on map definition, see Understanding the Map Definition. |

|

File Path |

Enter the path to the location of the XML file. |

|

File Name |

Enter the name of the XML file. |

Use the Withhold Report page (WTHD_RPT_RUN) to define run parameters to run your withholding reports.

Navigation:

Note: Do not use this page for 1099 reporting or T4A/T4A-NR reporting. Use the Withhold 1099 Report page or T4A/T4A-NR Reporting page respectively.

You must run the Withholding Reporting process before you can generate withholding reports.

Field or Control |

Description |

|---|---|

Withholding Report ID |

Select the ID of the withholding report you want to run. The Report Processes group box displays the name of the process for this report and a description. |

Note: Report ID WTH displays a Copy check box on the Run Control page. Select this check box to print the Japanese Withholding report APX8025 as an internal copy without My Account Number.

The following table lists some of the sample global withholding reports that Oracle provides with PeopleSoft Payables.

|

Report ID |

Report Type |

Country |

Report Name |

|---|---|---|---|

|

APX8025 |

BI Publisher |

Japan |

Japan Withholding Report |

|

APY8030 |

BI Publisher |

Spain |

Spain IRPF Model 190 |

|

APY8031 |

File |

Spain |

Spain IRPF Model 190 File |

|

APX8032 |

BI Publisher |

United Kingdom |

CIS (construction industry scheme) File |

|

APX8035 |

BI Publisher |

France |

DAS-2 'Declaration d'honoraires'/Fees return |

|

|

BI Publisher |

France |

France DAS2 Withholding File |

|

APX8045 |

BI Publisher |

Australia |

PPS Remittance Advice to ATO |

|

APX8048 |

BI Publisher |

Australia |

PPS Annual Reconciliation Statement to ATO |

|

APX8049 |

BI Publisher |

Australia |

PPS Payment Summary to ATO |

|

APX8055 |

BI Publisher |

Italy |

Withholding Report 770 |