Processing ATO Withholding

This section provides an overview of ATO withholding and lists common elements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_POST_BY_DATE |

Post withholding data to the Withholding Report table. |

|

|

WTHD_RPT_RUN2 |

Run the PAYG Voluntary Agreement, PAYG Labour Hire, and PAYG No ABN Quoted reports. |

|

|

WTHD_RPT_RUN3 |

Run the PAYG Payment Summary Statement and PAYG No ABN Quoted Summary Statement reports. |

|

|

WTHD_RPT_LOG_LC |

Adjust or enter payment summary data manually. |

This section discusses:

PAYG overview.

ATO withholding setup.

How information is displayed on ATO forms.

Posting withholding report data.

Running the PAYG Supplier reports.

Printing the reports.

Printing the PAYG payment summary reports.

Adjusting or entering payment summary data manually.

PAYG Overview

To meet PAYG (Pay As You Go) legislative requirements for Australia withholding, the PeopleSoft system provides several withholding report formats and the functionality to handle PAYG withholding as defined by the ATO.

Specifically, the PeopleSoft system supports these reports using impact printers:

Payment Summary - Voluntary Agreement (PAYG Voluntary Agreement - APY8041).

Payment Summary - Labour Hire and Other Specified Payments (PAYG Labour Hire - APY8042).

Payment Summary - Withholding where ABN not Quoted (PAYG No ABN Quoted - APY8043).

PAYG Payment Summary Statement (PAYG Payment Summary Statement - APY8044).

PAYG Withholding where ABN not quoted - Annual Report (PAYG No ABN Quoted Summary Statement - APY8045).

ATO Withholding Setup

This table provides the steps you should follow to set up ATO withholding:

|

Step |

Purpose |

Navigation |

|---|---|---|

|

Oracle recommends that you set up these withholding rules:

|

Tells the system what rules to use and what actions to take during withholding. Note: You can only set up withholding percentages on the Withhold Rule page. |

See Withhold Rule Page. |

|

Use the Withhold Type page to specify the classes that belong to the PAYG withholding type. |

Defines withholding at the highest level in PeopleSoft Payables. For each withholding type, you can define classes, such as Voluntary Agreement, Labor, and No ABN (Australian Business Number). |

See Withhold Type Page. |

|

Set up the ATO as a supplier. |

Tells the system to whom to send the withholdings. Note: You must define the supplier information for the withholding entity before you can complete the Withholding Entity page. Entities are treated the same as suppliers, just like every other payee in your system. If you pay the ATO supplier via EFT, provide your EFT code in the Payment Instruction Ref 1 field in the Electronic File Options section on the Payables Options page. |

|

|

Define the ATO withholding entity (tax authority). |

Tells the system which withholding type/class combinations are associated with the withholding rule. |

|

|

On the Entity Fields - Supplier page, select the Optional check box for the Tax District Reference field. |

Provides the delivered SQRs with the setup it needs for the Tax District Reference field and the ATO withholding entity. Note: Due to the way the Taxpayer Identification Number field is used, you should always leave it blank in the supplier withholding data. All other check boxes for fields should be deselected. |

|

|

Associate the following withholding codes with the PAYG withholding code:

|

Tells the system which withholding codes you want it to process at the same time. |

See Withhold Code Page. |

|

On the Report Definition 1 page, do the following:

|

Tells the system the selection criteria for withholding reports. Also tells the system the layout of the withholding reports based on the tax authority's reporting and filing requirements. Note: Due to the need for additional parameters, the PAYG reports do not use the usual mechanism to launch withholding reports. Therefore, there is no need to set up report associations on the Report Definition 2 page. |

|

|

Set up the ATO withholding entity and ChartFields on the Withholding and Withholding ChartFields pages in the Procurement Control component. |

Tells the system which withholding entities and types are associated with the business unit. Also tells the system which ChartFields should be used when creating the liability entry. |

|

How Information is Displayed on ATO Forms

This table shows how information entered in PeopleSoft Financials is displayed on all three ATO forms:

|

Labels on ATO Form |

Fields on Pages |

Page and Navigation |

|---|---|---|

|

Your ABN |

Tax ID |

Report Control Information - Payor Data page Select |

|

Branch Number |

Transmitter Cntl Cd |

Report Control Information - Payor Data page |

|

Payer's Name (line 1 and line 2) |

Transmitter Name 1 and Transmitter Name 2 |

Report Control Information - Payor Data page |

|

Payee's Address (line 1 and line 2) Suburb/Town, Country, State, Postcode |

Address 1 and 2, City, Country, State, Postal |

Address page Select |

This table shows how information entered in PeopleSoft Financials is displayed for Voluntary Agreement suppliers:

|

Label on ATO Form |

Field on Page |

Page and Navigation |

|---|---|---|

|

Payee ABN |

VAT Registration ID |

VAT Registration Details Select Click the Registration link on the Identifying Information page to access the VAT Registration Details page. |

This table shows how information entered in PeopleSoft Financials is displayed for Labor Hire suppliers:

|

Label on ATO Form |

Field on PeopleSoft Page |

Page and Navigation |

|---|---|---|

|

Payee Tax File Number |

Tax District Reference Note: Make sure you leave the Taxpayer Identification Number blank. |

Withholding Supplier Information Select Click the Global/1099 Withholding link on the Supplier Information - Location page and select the Additional Information tab in the Withholding Information group box. |

This table shows how information entered in PeopleSoft Financials is displayed for No ABN suppliers:

|

Labels on ATO Form |

Fields on PeopleSoft Page |

Page and Navigation |

|---|---|---|

|

Payee Trading Name (line 1 and 2) |

Name 1 and Name 2 |

Address Select Expand the Payment/Withholding Alt Names section to access the Withholding Alternate name group box. |

|

Payee Phone Contact |

Prefix and Telephone |

Address Select Expand the Payment/Withholding Alt Names section to access the Phone Information group box. |

Posting Withholding Report Data

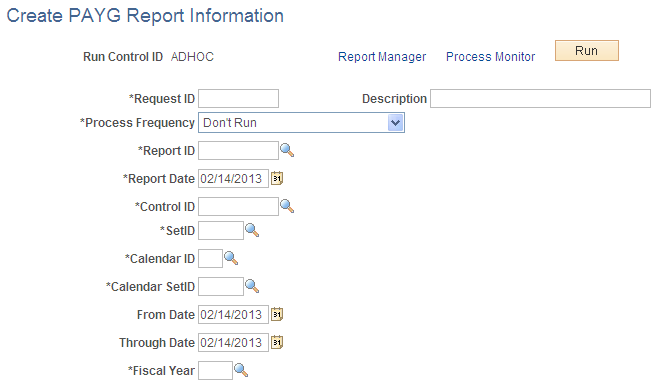

The reports require aggregated data to be present in the Withholding Report table. Data is aggregated into the Withholding Report table through the Withholding Reporting process, which you can run from the Withhold Report Post page or from the Create PAYG Report Information page.

Whether you launch the Withholding Reporting process from the Withhold Report Post page or from the Create PAYG Report Information page depends on what dates you need to use to summarize withholding.

If your dates fall on the start and end of a period in a calendar, which would be the case when aggregating for year-end reporting, use the Withhold Report Post page. The from and through dates, which are hidden, are based on the start and end dates of the specified calendar period.

If you need to aggregate payments between arbitrary dates, which can be the case if you get a request for a payment summary from one of your suppliers during the fiscal year, then you can use the Create PAYG Report Information page to specify arbitrary from and through dates.

Remember that the ATO wants summary reports to exclude payments that have already been reported on previous summaries; therefore, you have to enter appropriate dates. Except for the handling of from and through dates, both methods give the same results as they pass the same parameters to the same process.

Running the PAYG Supplier Reports

PAYG reports for all three classes of PAYG suppliers are run by selecting

At the minimum you need to specify the Report ID, the Supplier SetID and the Supplier ID on this page.

If the information you have provided uniquely identifies the data you want processed in the Withholding Report table, the system defaults the rest of the fields automatically. This would typically happen with suppliers for whom you have only set up one location and which you are only paying from one business unit.

In this case, it saves you from having to enter the Supplier Location, Business Unit and Location.

If the Draft Flag check box is deselected, the report is set to print directly into the boxes on the standard ATO form. If you select the Draft Flag, the report prints explanatory labels above each field, so that you can read the results more easily on plain paper. The system displays the from and through dates to remind you what dates the payments were summarized on.

Note: The PAYG No ABN Quoted report, APY8043.SQR, actually prints one page per payment, rather than one report that sums up the amounts paid during the specified time. That means that you may print several pages or forms from APY8043.SQR if you have made several payments to the specified supplier during that time.

Printing the Reports

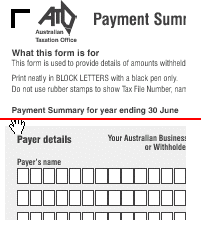

Direct printing on ATO forms requires an impact printer as the forms use carbon copies. There are no feeding sprockets to guide the paper, so you will need to position the paper precisely, which depends on the printer model. On test printers, the printer was lined up 1/8 inch above the yellow shaded boxes and immediately below the Payment Summary for year ending 30 June (see the red line in the following illustration):

This example illustrates the fields and controls on the ATO Payment Summary Form.

To minimize compatibility issues with older printers, the reports print a pure ASCII file, rather than the usual PCL commands found in our regular SQRs. Some of the test printers had problems printing the report date because it was so close to the end of the forms that the printer thought that it was out of paper.

To avoid requesting a page feed when printing on an ATO form, a hardcoded switch is added in APY804.SQC to allow you to skip printing of the report date.

Set this variable to 0 if you have problems with printing the report date. In this case, you will have to fill in the report date by hand.

This switch has no effect when in Draft mode because printing starts at the top of the page.

Printing the PAYG Payment Summary Reports

Under the PAYG Withholding System, payers are required to submit the PAYG Payment Summary Statement form by August 14 to the ATO each year together with the ATO originals of all payment summaries listed on the form. The PAYG No ABN Quoted Summary Statement is submitted separately from this form as per the ATO guidelines.

The PAYG Payment Summary Statement form is a reconciliation report. It comprises the total number of payment summaries issued during the financial year, which must equate to the total amount of gross and tax withheld reported on the form.

After generating all Payment Summaries for Voluntary Agreement and Labor Hire through the APY8041 and APY8042 processes respectively, the system writes the payment information required for the PAYG Payment Summary Statement to the Withholding Report Log. This is irrespective of whether the Issued check box on the Withholding by Supplier page is selected or deselected. Selecting the Issued check box flags the payment to be included in the PAYG Payment Summary Statement process. Deselecting the Issued check box represents a duplicate print to be excluded from the above process.

The Withholding Report Log page displays the relevant information for each of the respective types of payment summaries issued during the financial year. Payments summaries which you have issued to your Payees, and which should be included in the Payment Summary Statement, must have the Issued check box selected. For all payment summary printouts that are duplicated, deselect the Issued check box to exclude them from the Payment Summary Statement.

After you choose all the withholding report history on the Withholding Report Log page by selecting or deselecting the check boxes, you can execute the PAYG Payment Summary Statement process from the Withholding Summary page. For form printing using impact printers, deselect the Draft Flag check box. For draft print mode, select the Draft Flag check box. To freeze the fiscal year so that no one can modify the data once you have reported it to the ATO, select the Close Fiscal Year check box.

Adjusting or Entering Payment Summary Data Manually

If you issued payment summaries by filling in the Voluntary Agreement and Labour Hire forms manually, you can enter that information directly in the Withholding Report Log page. This allows you to meet your reporting requirements for the PAYG Payment Summary Statement.

To add a supplier or payee, click the Add a new row button. Enter the information for the supplier in the Supplier Information group box. You can also enter any required payment summary data manually in the Withholding Information group box.

If you enter data manually, do the following:

Make sure that the Issued check box and amounts agree with the payment summaries you have issued to your suppliers.

Make sure the withholding type is correct for the supplier type. It should be either VOLAG, LABHR, or NOABN in capital letters. The system expects all suppliers to be of the same withholding type. The APY8044 process only selects the VOLAG and LABHR withholding types.

The entry in the Fiscal Year field determines whether it appears on the PAYG Payment Summary Statement for a given year. It is your responsibility to ensure that the fiscal year matches the from and through dates that you indicate and also the contents of your payment summaries. The system does not validate according to the Australian fiscal year calendar.

Alternatively, instead of filling in this page manually, you could run the APY8041, APY8042, or APY8043 (for No ABN Payment Summaries) reports for the same suppliers and reporting periods as you had previously filled in manually on the forms.

The system allows manual adjustments where necessary, as mentioned previously. The Payment Summary reporting processes would then update the historical data automatically and you could update the page as required.

PAYG Payment Summary Statement Form:

The horizontal alignment recommended for impact printers is 2 1/16 inches from the top of the form. As a result, it will print the fiscal year at the top of the boxes. The data should fit into its respective boxes. Initially, you may need to make several adjustments before getting all the data to print in the correct boxes.

When you finalize the payment reports for the financial year and ensure that all payment summaries have been reconciled to the payment statement, it is recommended that you close the financial year by selecting the Close Fiscal Year check box and then running the APY8044 process. This process locks the data for that fiscal year and prevents payment transactions from being reported for the fiscal year for which you have already provided summary reports to the ATO.

Furthermore, the payment information for closed periods will not be available on the Withholding Report Log page. You can view all historical payments against closed fiscal years through the withholding inquiries however, you cannot make further modifications to historical data.

Field or Control |

Description |

|---|---|

Business Unit |

Select the business unit for which you want the reports to be created. |

Draft Flag |

Select this check box to print onto a sheet of regular A4 paper. In this case, the report also prints labels for the data. Deselect this check box if you want the reports to print directly into the boxes of the ATO forms. Direct printing on ATO forms requires an impact printer as the forms use carbon copies. |

Location |

Select the location of the withholding entity for which you want the reports to be created. |

Report Date |

Select the date on which you created your reporting information. |

Report ID |

Select the Report ID of the report for which you want to generate data. |

Request ID |

Specify a request ID and a description. The system uses these IDs to track each posting request; however, the Request ID can be used repeatedly. The Process Scheduler Request ID is the unique number. |

Supplier SetID |

Select a supplier SetID for the suppliers for which you want to run the reports. |

Supplier Location |

Select the supplier location for which you want the reports to be created. |

Supplier ID |

Select the ID of the supplier for which you want the reports to be created. |

Withholding Entity |

Select the withholding entity or taxing authority for which you want the reports to be created. |

Use the Create PAYG Report Information page (WTHD_POST_BY_DATE) to post withholding data to the Withholding Report table.

Navigation:

This example illustrates the fields and controls on the Create PAYG Report Information page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Control ID |

Select a business unit in the first field then select the control ID. These fields determine which business units and suppliers to include. |

Calendar ID |

Select the SetID of the calendar you want to use in the first field. In the second field, select the ID of the calendar you want to use. |

From Date |

Select the first date from which you want to generate data. |

Through Date |

Select the last date from which you want to generate data. |

Fiscal Year |

Select the fiscal year for which you want to generate data. |

Use the Withholding by Supplier page (WTHD_RPT_RUN2) to run the PAYG Voluntary Agreement, PAYG Labour Hire, and PAYG No ABN Quoted reports.

Navigation:

This example illustrates the fields and controls on the Withholding by Supplier page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Issued |

Select this check box to flag the payment to be included in the Payment Summary Statement process. Deselecting the Issued check box represents a duplicate print to be excluded from the process. |

Use the Withholding Summary page (WTHD_RPT_RUN3) to run the PAYG Payment Summary Statement and PAYG No ABN Quoted Summary Statement reports.

Navigation:

This example illustrates the fields and controls on the Withholding Summary page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Withholding SetID |

Select the SetID associated with the withholding entity for which you want to run the summary reports, |

Control ID |

Select the control ID. This field determines which business units and suppliers to include. |

Fiscal Year |

Enter the fiscal year that you want to display on the report. |

Close Fiscal Year |

Select this check box to freeze the fiscal year so that no one can modify the data once you have reported it to the ATO. |

Use the Withholding Report Log page (WTHD_RPT_LOG_LC) to adjust or enter payment summary data manually.

Navigation:

This example illustrates the fields and controls on the Withholding Report Log page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Fiscal Year |

Enter the fiscal year for which you are making entries or adjustments. The entry in this field determines whether it appears on the PAYG Payment Summary Statement for a given year. It is your responsibility to ensure that the fiscal year matches the from and through dates that you indicate and also the contents of your Payment Summaries. The system does not validate according to the Australian fiscal year calendar. |

Withholding Type |

Enter the type of withholding for which you are making an entry or an adjustment. Make sure the withholding type is correct for the supplier type. It should be either VOLAG, LABHR, or NOABN in capital letters. The system expects all suppliers to be of the same withholding type. The APY8044 process only selects the VOLAG and LABHR withholding types. |

Issued |

Select this check box to indicate that you have issued a payment summaries to the supplier. |

Basis Amount |

Enter the amount upon which the withholding was calculated. Make sure the amounts you enter on this page agree with the payment summaries you issued. |

Liability Amount |

Enter the amount of the withholding liability. |