Processing Payment Information Repository Reporting

Payment Information Repository (PIR) is the only method available for Non-Treasury Disbursing Offices (NTDOs) to report TAS/BETC transactions to Treasury and have them transmitted to Treasury’s Central Accounting & Reporting System (CARS). An NTDO is defined as a Federal Government agency/officer given authority to disburse funds, pursuant to Title 31 U.S.C., or that has statutory disbursing authority. NTDOs do not disburse funds through Treasury but could either use third party checking printing services from a commercial bank or disburse from either a Federal Reserve Bank (FRB) or a Regional Financial Center (RFC). NTDO agencies will be required to submit detailed Payment and Accounting data, including TAS/BETC classifications, to the PIR via a standardized file format referred to as the Standard Reporting Format (SRF). Most agencies are Treasury Disbursing Offices (TDOs) meaning that the agency sends Treasury a payment file and Treasury disburses funds on behalf of the agency.

The Payment Information Repository selection process selects payments recorded in PeopleSoft Accounts Payable using the criteria specified on the run control as well as detailed in the payment selection section on the PIR Payment Selection Request page. The PIR processes run as separate processes following pay cycle and bank reconciliation or federal schedule ID reconciliation, if used.

After running PIR Payment Selection the selected payments are reviewed on the PIR Workbench. The Workbench is used to enter the Voucher Number, Voucher Date, Voucher Type, and PIR Classification for all selected payments. Additionally, payments can be excluded from reporting on this page, as deemed necessary by the agency to meet PIR reporting requirements.

Once payments are selected, reviewed, and updated on the Workbench they are marked to be selected by the PIR SRF File Creation process. The PIR SRF file creation process runs on the mapped selections to create the SRF file.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PIR_DEFINITION |

Select bank accounts, payment methods, and EFT layout codes for PIR reporting. |

|

|

PIR_PMT_SELECTION |

Select payments and cancellations for PIR reporting. |

|

|

PIR_WORKBENCH |

Select payments and cancellations for PIR reporting. |

|

|

PIR_SRF_CREATION |

Create the SRF file. |

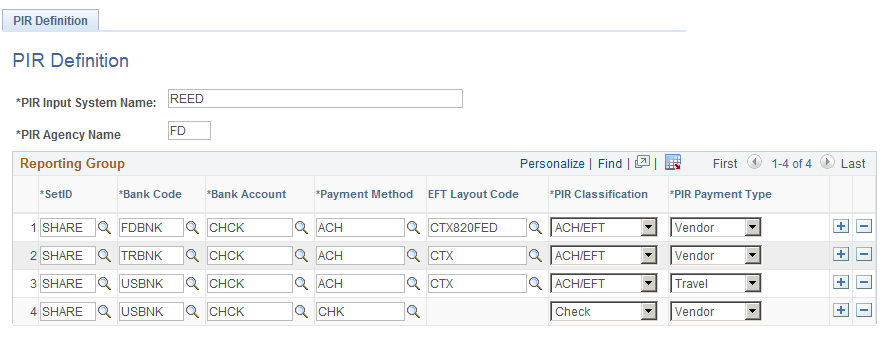

Use the PIR Definition page (PIR_DEFINITION) to select bank accounts, payment methods, and EFT layout codes for PIR reporting and to specify how the payments should be reported.

Navigation:

This example illustrates the fields and controls on the PIR Definition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Input System |

Enter the Treasury assigned PIR Input System name. |

PIR Agency Name |

Enter the Treasury assigned PIR Agency name. |

SetID |

Enter the SetID of the bank to be selected. |

Bank Code |

Enter the bank code for selection. This field lists only banks associated with ALCs where the Non-Treasury Disbursed ALC check box is selected on the ALC Agency Location Code tab and the Reporter Category for the ALC contains AP Payments. |

Bank Account |

Enter the bank account for selection. This field lists only bank accounts set up for the selected SetID and Bank Code. |

Payment Method |

Enter the payment method for selection. This field only lists payment methods set up for the selected SetID, Bank Code, and Bank Account. |

EFT Layout Code |

Select the EFT layout code for EFT, ACH, and WIR payment methods. This field is only available when the Payment Method is EFT, ACH, or Wire and displays only EFT layout codes set up for the selected SetID, Bank Code, Bank Account, and Payment Method. |

PIR Classification |

Select the PIR classification for reporting payments from options:

|

PIR Payment Type |

Select the payment type for the bank account/payment method from options:

Note: : Payment Type Code is assigned at the payment method/layout level. Separate payment methods and/or EFT layout codes may be necessary to denote payment type. |

Use the PIR Payment Selection (PIR_PMT_SELECTION) page to select payments and cancellations for PIR reporting.

Navigation:

This example illustrates the fields and controls on the PIR Payment Selection page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Request ID |

Enter a Request ID. |

Description |

Enter a description of the request. |

Process Frequency |

Select the process frequency from options:

|

Reset Flag |

Select to unmark payments that have been selected but not reported (those not selected by the PIR SRF File Creation process) using the entered selection criteria — Business Unit and Payment Date. |

Process |

Select the business unit process to select payments by the specified BU. |

Business Unit |

Enter the AP Business Unit(s) from which payments are to be selected. |

Description |

Displays the description of the selected AP Business Unit. |

Pay From Date |

Enter the date from which payments are to be selected. |

Pay To Date |

Enter the date to which payments are to be selected. |

Change Selection Dates |

Enter a value and change the specified payment dates by Day(s), Month(s), or Week(s). Click Increment to advance dates by the entered amount, or click Decrement to decrease dates by the amount. Note: After the system runs the PIR Payment Selection process, the dates automatically increment by the amount specified on the same run control. |

The PIR Selection Process uses the following criteria to select payments and cancellations:

Payments

Fields identified on the run control as well as the date criteria applied to the Payment Date field on the Payment Table.

Bank accounts/payment methods/EFT Layout Codes/PIR Classification/PIR Payment Type entered on the PIR Definition page.

Federal Payment that has been paid and reconciled through federal schedule ID reconciliation.

Non-federal Payment requiring bank reconciliation that is paid and reconciled.

Non-federal Payment not requiring bank reconciliation that is paid but not reconciled.

Payments that haven’t already been selected by the PIR SRF File Creation process.

Payment Cancellations

Fields identified on the run control as well as the date criteria applied to the Cancel Date field on the Payment Table.

Bank accounts/payment methods/ EFT Layout Codes/PIR Classification/PIR Payment Type entered on the PIR Definition page

Payment Cancellations that haven’t already been selected by the PIR SRF File Creation process.

ACH/EFT Payment cancellations using run control criteria as well as the date criteria on the PIR Payment Selection page.

The PIR Payment Selection process selects payments recorded in Payables according to the above criteria and then marks them to be selected by the PIR SRF File Creation process. If the same parameters are entered and run more than once, the process will only pick up payments that haven’t been selected by the PIR SRF File Creation process previously. Therefore, if a user runs the selection process and notices an issue when reviewing on the PIR Workbench, the issue can be corrected and the selection process can be made to rerun.

Note: The ENTIRE payment is selected for reporting. If multiple vouchers in different business units are paid in the same payment, ALL voucher distributions are selected for payment regardless of the Business Unit on the PIR Payment Selection run control and the payment is marked as Selected.

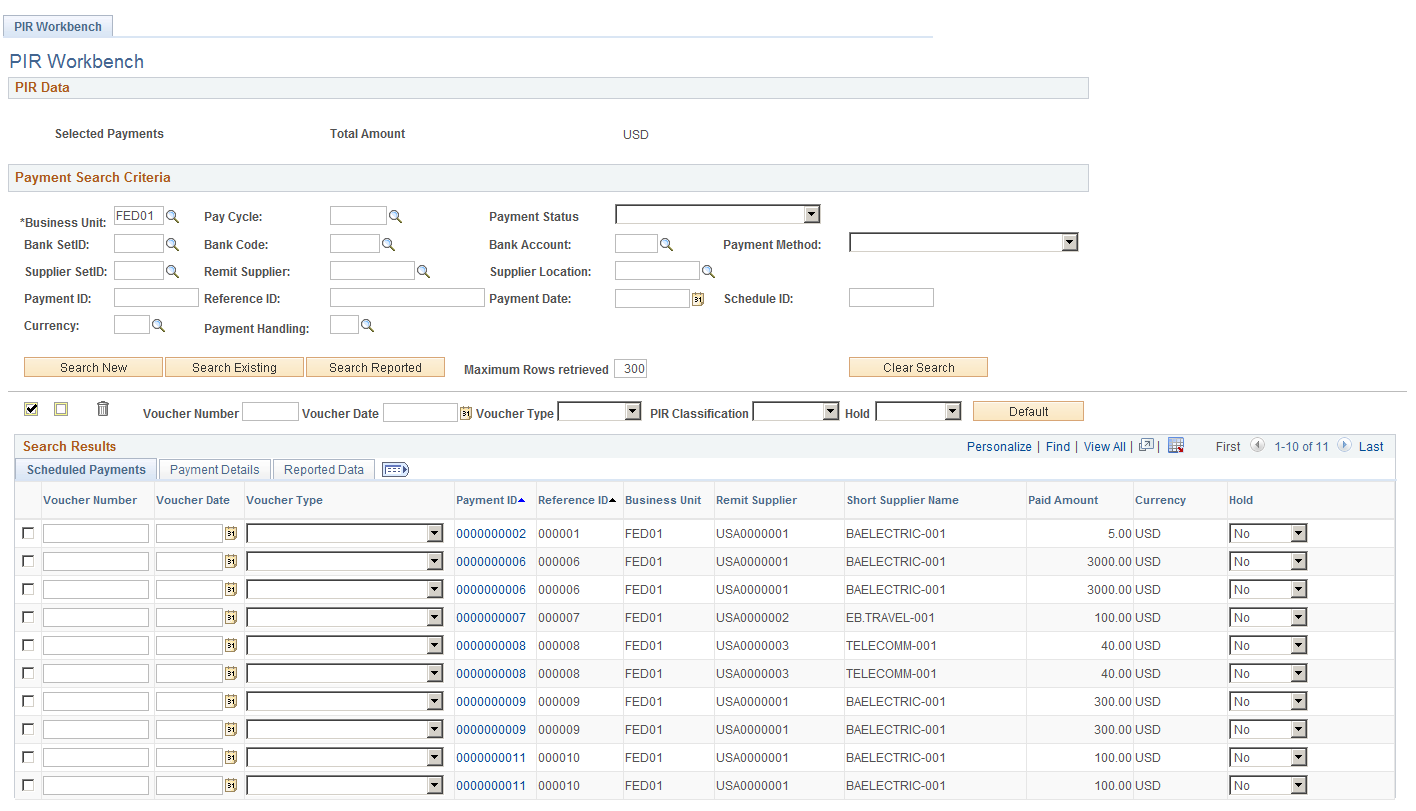

After running PIR Payment Selection the PIR Workbench is used to review the payments that were selected. This PIR Workbench page is used to enter the Voucher Number, Voucher Date, and Voucher Type for all selected payments. The PIR Classification Code can be overridden for manual payments through this page. Additionally, payments can be excluded from reporting on this page, as deemed necessary by the agency to meet PIR reporting requirements.

Use the PIR Workbench (PIR_WORKBENCH) page to review the selected payments.

Navigation:

This example illustrates the fields and controls on the PIR Workbench page. You can find definitions for the fields and controls later on this page.

Enter the payment search criteria to list payments based on the criteria selected.

Field or Control |

Description |

|---|---|

Selected Payments |

Displays the number of payments already selected with status Selected and Saved or Existing. |

Total Paid Amount |

Displays the total paid amount for payments already selected with status Selected and Saved or Existing. |

Business Unit |

Enter a Payables business unit to search for payments by Payables business unit. |

Search New |

Click to search for payments selected for reporting by the PIR Payment Selection process but NOT previously saved in the list using the entered search criteria. |

Search Existing |

Click to search for payments selected for reporting by the PIR Payment Selection process AND previously saved in the list using the entered search criteria. |

Search Reported |

Click to search for payments reported by the SRF File Creation process using the entered search criteria. |

Max Rows |

Enter a number to return a limited number of search rows when searching for payments. |

Remove from List |

Click to remove the payment from the search results. This is helpful when you want to set default values to a group of payments. |

Voucher Number |

Enter a voucher number to set as default for all selected payments in the search results grid. |

Voucher Date |

Enter a voucher date to set as default for all selected payments in the search results grid. |

Voucher Type |

Enter a voucher type to set as default for all selected payments in the search results grid. Valid values are 5515 or 215. |

PIR Classification |

Enter a PIR Classification to set as default for all selected manual payments in the search results grid. Valid values are ACH/EFT, Check, Wire, or International. |

Hold |

Select a Hold value to set as default for all selected payments in the search results grid. Valid values are Y and N. Setting this value to Y will exclude the payment from PIR reporting. |

Default |

Click to set the entered Voucher Number, Voucher Date, Voucher Type, PIR Classification, and/or Hold value as default values to the selected payments in the search results grid. |

Selected Payments

Field or Control |

Description |

|---|---|

Voucher Number |

Enter a voucher number that applies to the payment. This value can be taken from the Voucher Number default field. Once the payment has been selected by the PIR SRF Creation process this field is not available for entry. This field is required for all non-held non-check payments in the search results grid in order to save the page. |

Voucher Date |

Enter a voucher date that applies to the payment. This value can be taken from the Voucher Date default field. Once the payment has been selected by the PIR SRF Creation process this field is not available for entry. This field is required for all non-held non-check payments in the search results grid in order to save the page. |

Voucher Type |

Enter a voucher type that applies to the payment. This value can be taken from the Voucher Type default field. Valid values are 5515 or 215. Once the payment has been selected by the PIR SRF Creation process this field is not available for entry. This field is required for all non-held non-check payments in the search results grid in order to save the page. |

Payment ID |

Displays payment IDs and when you click an ID link the details of the payment inquiry are displayed in a new window. You can also view the voucher data on the same page. |

Hold |

Select Y or N to denote whether the payment is on hold (currently not part of the list) or not on hold (currently included in the list). |

Save |

Click to save all of the selected payments in the list. Upon saving, selected payments cannot be selected again. Previously selected payments are not displayed in the search results when you search using Search New. Note: When you click Save the search criteria is also saved. When you access the Workbench page the saved search criteria is populated. |

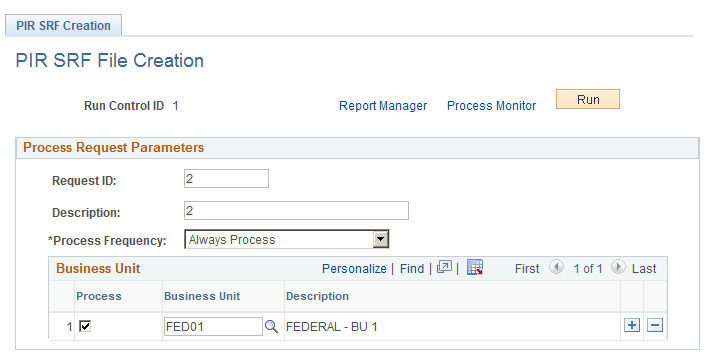

Use the PIR SRF File Creation (PIR_SRF_CREATION ) page to create the SRF file.

Navigation:

This example illustrates the fields and controls on the PIR SRF File Creation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Request ID |

Enter a Request ID. |

Description |

Enter a description of the request. |

Process Frequency |

Select the process frequency from options:

|

Process |

Click to select payments by the identified AP business unit. |

Business Unit |

Enter the AP Business Unit(s) from which payments are reported. Note: The PIR file will be stored in the same directory with other trace/log files and will not be accessible via Process Monitor. Note: The ENTIRE payment will be selected for reporting. If multiple vouchers in different business units are paid in the same payment, ALL voucher distributions will be selected for payment regardless of the Business Unit on the PIR Payment Selection run control. Then the entire payment will be marked as Reported. |