Processing PeopleSoft Payables with GST

India GST and TDS: Tax Deduction at Source (TDS) is calculated based on the setup at the Withholding Entity level. If GST is enabled at the Withholding Entity setup, then TDS is calculated on GST whether or not reverse charge is applicable on the voucher.

Note: A voucher created and posted during the GST regime cannot be unposted if the voucher has been selected for extraction to the reporting tables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VCHR_EXPRESS1 |

Enter or view invoice information. |

|

|

VCHR_GST_ANEX_SEC |

Enter or override GST header annexure information. |

|

|

VCHR_LINE_EXS |

Enter or override GST and GST line annexure information. |

|

|

VNDR_PROC_OPT_SEC |

Define currency options for the supplier. |

|

|

VCHR_ACTG_ENTRIES |

Review the results of the Voucher Posting Application Engine process |

To enable GST see Installation Options - Overall Page

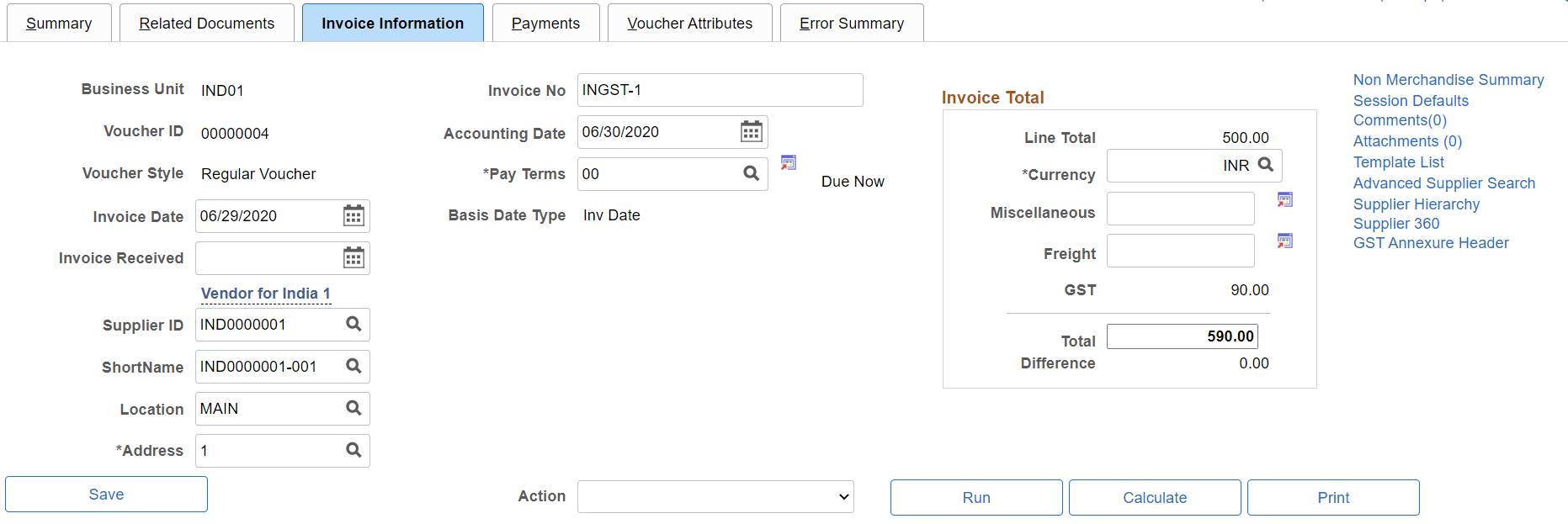

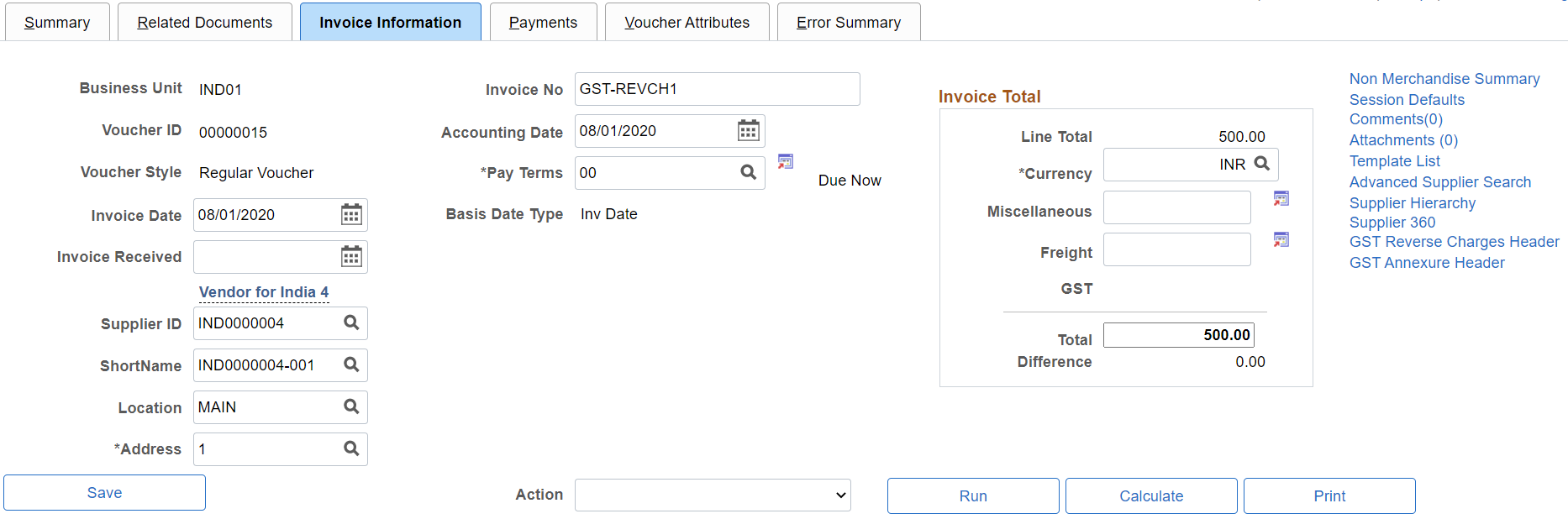

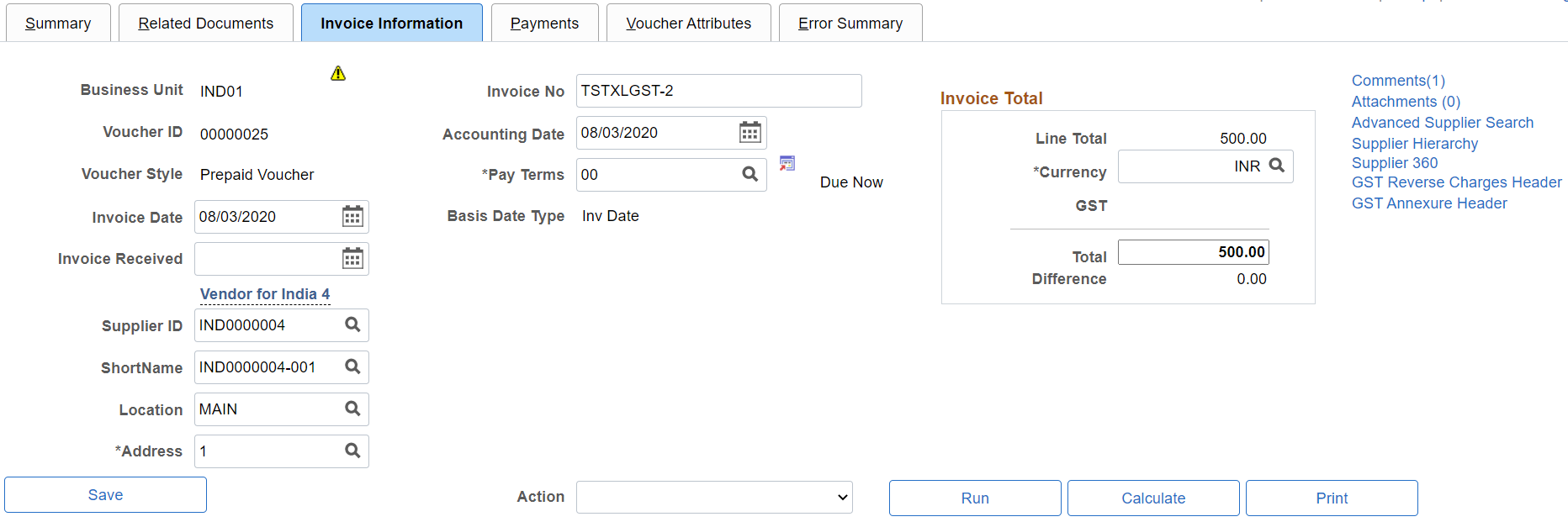

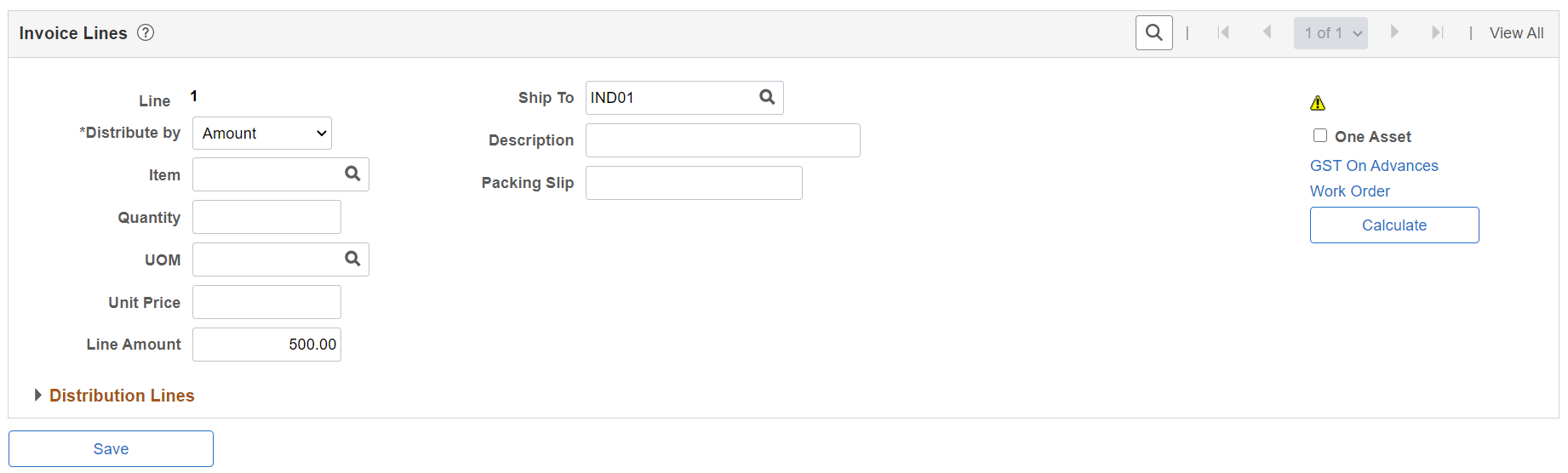

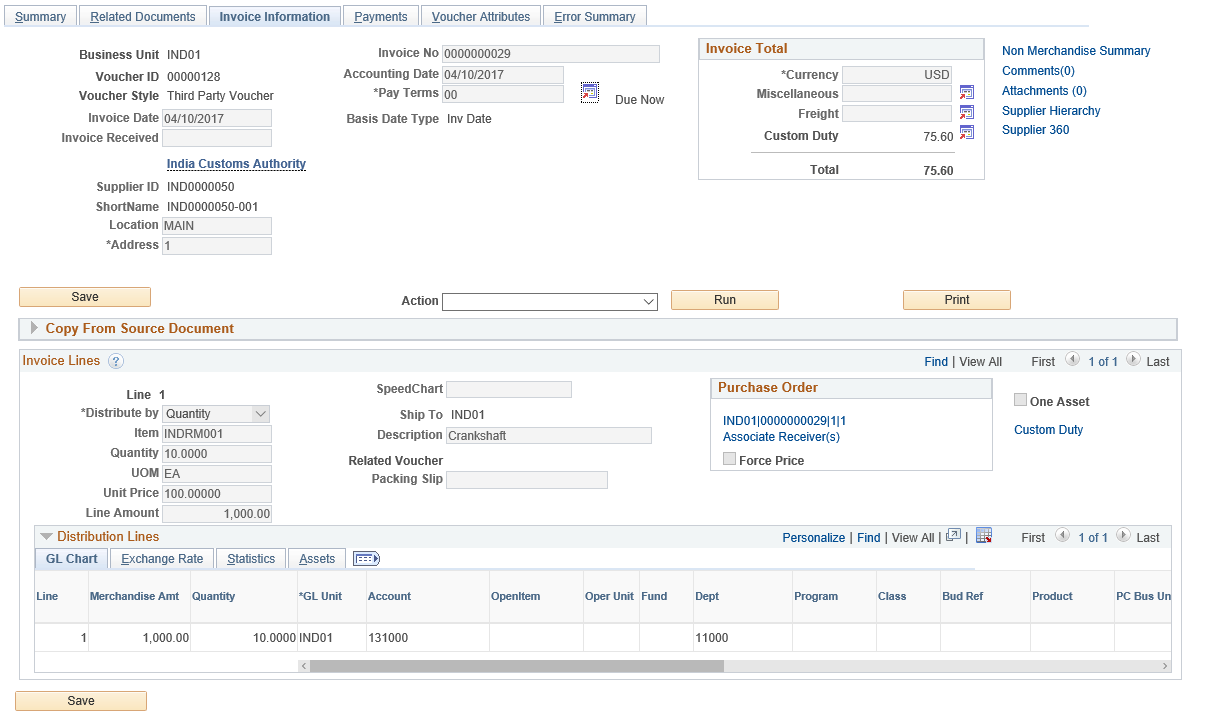

Use the Invoice Information page (VCHR_EXPRESS1) to enter or view invoice information, including invoice header information, non-merchandise charges, and voucher line and distribution information.

Navigation:

This example illustrates the fields and controls on the Invoice Information page for regular voucher style (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Invoice Information page for regular voucher style (2 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Invoice Information page for regular voucher style with Reverse Charge transaction (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the invoice Information page for regular voucher style with Reverse Charge transaction (2 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Invoice Information page for prepaid voucher style - Reverse Charge transaction (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Invoice Information page for prepaid voucher style - Reverse Charge transaction (2 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Invoice Information page. You can find definitions for the fields and controls later on this page.

The Copy Voucher functionality for third-party voucher is modified to copy the GST reverse charge lines from the related source voucher to settle the payments with the GST Authority.

The system uses the voucher ID and supplier ID to copy the GST reverse charge lines from the related source voucher, which are mandatory. All lines are selected by default and the user is not allowed to remove any lines at this point. When the Copy Selected Lines option is clicked the GST tax parameters are copied from the related voucher. While copying the related voucher back to the third-party voucher, if the copied transaction currency is equal to the transaction currency of the third-party voucher, then the merchandise amount is taken from the related voucher and the user is not allowed to make changes to the merchandise amount. On the other hand, if the copied transaction currency is not equal to the transaction currency of the third-party voucher, the amount is set to zero and the system displays a warning message. In such a case it is mandatory for the user to enter a value by manually calculating the merchandise amount on the basis of the transaction currency. Once the user enters all details and saves the page – and if a related voucher exists – the Global Tax Calculation engine calculates the taxes. If these values include any miscellaneous or freight charges, the system displays an error message indicating that these charges cannot be present when paying to the GST authority.

Users are allowed to process multiple vouchers to settle with a single payment. Also, a user can select and remove reverse charge lines after they are copied from a related voucher into a third-party voucher. In this case the system displays a warning message and the tax calculations are altered accordingly.

Field or Control |

Description |

|---|---|

GST |

Displays GST value. Note: The GST value and the Total amount for non-reverse charges are displayed on save. The GST value is not displayed for a reverse charge transaction. |

GST Annexure Header |

Click to view the GST Annexure Header page. |

GST Reverse Charges Header |

Click to view the GST Reverse Charges Header page and view the details of the GST reverse charges. Note: This link appears only if the voucher involves a reverse charge transaction. |

Goods and Services Tax (GST) |

Click to view the Goods and Service Tax (GST) Details page and enter the GST information. Note: This link appears as Custom Duty in case of a third party voucher paying custom duty. Clicking the link opens the Invoice Line Custom Duty Tax Detail page. |

GST On Advances |

Click to view the Goods and Service Tax (GST) Details page and view the GST information. Note: This link appears only if a prepaid voucher involves a reverse charge transaction. |

Save |

Click to save the entries and to display the GST and total amount values. Note: It is mandatory for a supplier to have their GSTIN number registered with the PeopleSoft system by entering it into the Supplier Tax Applicability page. The system allows you to save the voucher only if the supplier’s GSTIN number is present in the records, when interstate supplies of goods and services are received. |

When creating a regular voucher that is sought to be set off against a prepaid voucher with Reverse Charge applicability, you should not select the Apply Automatically check box on the Attributes Tab of the Regular voucher. Instead, you manually select the relevant Prepaid Voucher after ensuring that both the prepaid voucher as well as the regular voucher have the same Supplier and Location. Also, the items on the regular voucher should be present on the prepaid voucher.

Note: GST Annexure fields are not mandatory for third-party vouchers created for GST Authority as Trading Partner GST Setup is optional.

Copy from Source Document

Procurement may create Purchase Orders with all schedules pointing to one Ship To state or multiple Ship To states. Users must ensure that after using the Copy From PO functionality, all voucher lines point to the same Ship To state; else the voucher in this case cannot be saved.

GST Annexure Header fields such as Trading Partner Type, Transaction Category, IRN Applicable and IRN Mandatory default from the Trading Partner GST Setup page for supplier when copying PO into regular voucher. GST line annexure fields such as ITC Eligible and Item Tax Applicability default from the Item Tax Applicability page for line Item ID.

When you create an Adjustment/ Reversal voucher by copying the source document regular voucher, the header annexure data of Adjustment/ Reversal vouchers are populated as follows:

Preceding IRN of Adjustment/ Reversal voucher is IRN of source regular voucher.

Preceding IRP Date of Adjustment/ Reversal voucher is IRP Date of source regular voucher.

Invoice Document Reference of Adjustment/ Reversal voucher is Invoice Document Reference of source regular voucher.

Contract Reference Number of Adjustment/ Reversal voucher is Contract Reference Number of source regular voucher.

IRN of Adjustment/ Reversal voucher is tentative IRN of source regular voucher. You can change the tentative IRN of Adjustment/ Reversal voucher if supplier provides the IRN for revised invoices.

IRP Date is tentative IRP Date of source regular voucher. You can change the tentative IRP Date of Adjustment/ Reversal voucher if supplier provides the date for re-filing the revised invoice.

Batch Process

When the Voucher Build process runs and detects multiple Ship To states on a voucher, the voucher is created in Recycle status. To prevent the Voucher Build process from creating a voucher in Recycle status, it is recommended that data from external sources should point to the same Ship To state for a particular voucher.

In cases where adhoc items are created, the PeopleSoft system determines GST only on the basis of Supplier Tax Applicability. Users have to input the HSN/SAC code manually on the GST Details page in the voucher line.

In cases where billing charge codes are setup without creating a corresponding item in the item master, when these charge codes are used for interunit /intercompany transactions, the HSN/SAC code for the payables transaction is derived from the GST Details page to prevent a voucher from going into the Recycle status.

For adhoc items, you need to enter GST line annexure fields manually after creating the voucher in Recycle status. GST Annexure Header fields such as Trading Partner Type, Transaction Category, IRN Applicable and IRN Mandatory default from the Trading Partner GST Setup page for supplier. IRP date will have current date time as the default option if IRN Applicable and IRN Mandatory fields are selected on the Trading Partner GST Setup page. User has to manually enter IRN once voucher is created in Recycle status if IRN Applicable and IRN Mandatory fields are selected on the Trading Partner GST Setup page.

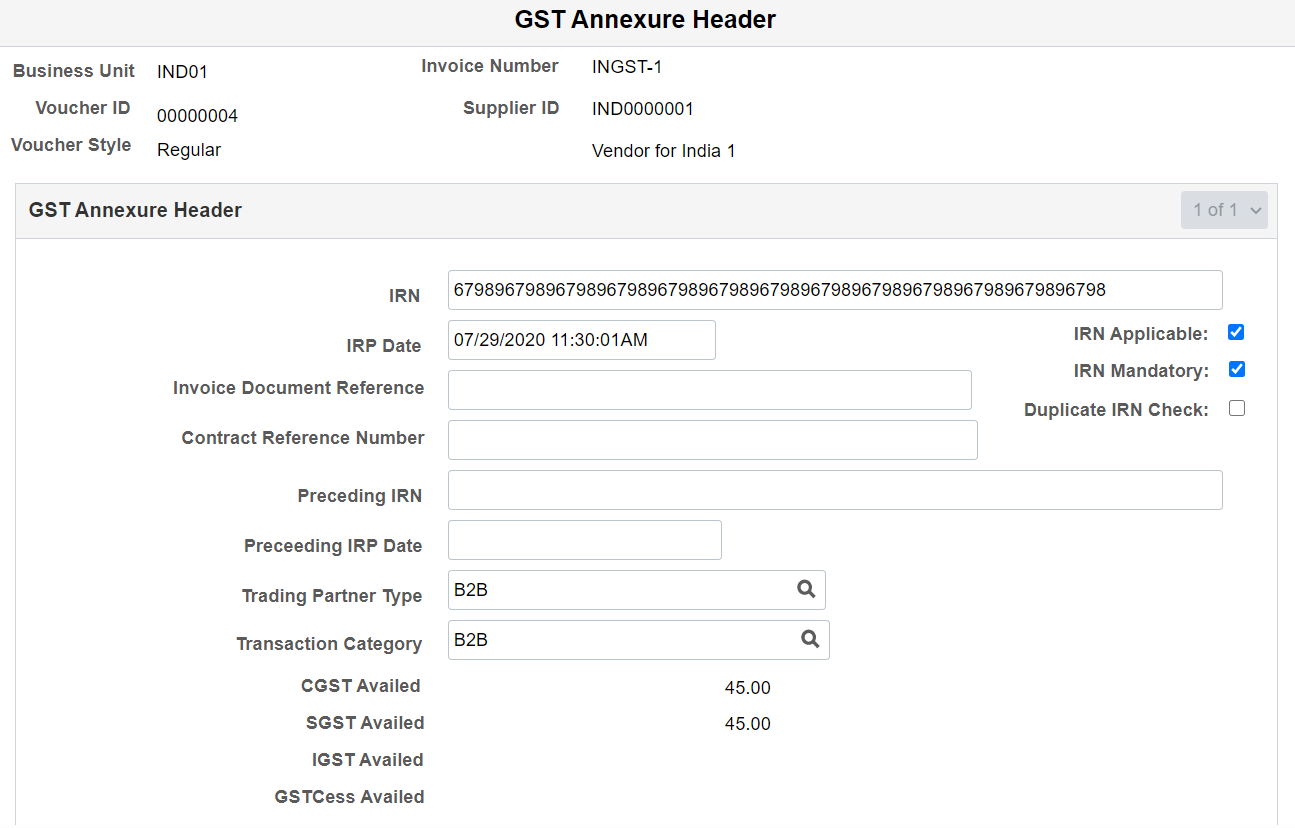

Use the GST Annexure Header page (VCHR_GST_ANEX_SEC) to enter or override GST annexure information.

Navigation:

Click the GST Annexure Header link on the Invoice Information page.

This example illustrates the fields and controls on the GST Annexure Header page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

IRN |

Enter the 64 character Invoice Reference Number (IRN). |

IRP Date |

Enter IRP date in Date Time format. The default value is the current date and time. You can edit the IRP Date value if the IRN Applicable and IRN Mandatory fields are selected on the Trading Partner GST Setup page. For additional information, see Trading Partner GST Setup Page |

Trading Partner Type, Transaction Category, IRN Applicable, IRN Mandatory |

Enter a value or override the default information. You can edit the values until the voucher is posted. The default options are populated from the Trading Partner GST Setup page. For additional information, see Trading Partner GST Setup Page |

CGST Availed, SGST Availed, IGST Availed, GSTCess Availed |

Displays the accumulation of the recoverable portion of each tax component at header level. The amount is displayed in transaction currency. |

Use the Goods and Service Tax (GST) Details page (VCHR_LINE_EXS) to enter or override GST information.

Navigation:

Click the Goods and Service Tax (GST) link on the Invoice Information page.

This link appears if GST is enabled in the setup hierarchy.

This example illustrates the fields and controls on the Goods and Service Tax (GST) Details page for a Regular Voucher. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Goods and Service Tax (GST) Details page for a Regular Voucher - Reverse Charge Transaction. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Invoice Line Custom Duty Tax Detail page.

Field or Control |

Description |

|---|---|

Transaction Type, Tax rate Code, Ship To Location, HSN Code, SAC Code, Tax Item Type |

Enter a value or override the default tax information. You can edit the values until the voucher is posted. |

Item Tax Applicability, ITC Eligible |

Select a value from the available options. The default options are populated from the Item Tax Applicability page. For additional information, seeItem Tax Applicability Page. |

Calculate |

Click to recalculate and display new tax amounts. |

GST calculations are performed by the global common routine that is called during voucher online creation and the Voucher Build process. These calculations are based on the defaults defined if no changes are made to this page.

Note: GST Annexure fields are not applicable for third-party vouchers created for custom duty authority or any supplier created to settle Freight/ Miscellaneous charges.

Use the Supplier Information - Location: Procurement Options page (VNDR_PROC_OPT_SEC) to define currency options for the supplier.

Navigation:

. Click the Procurement link on the Supplier Information - Location page and expand the Additional Procurement Options section.

This example illustrates the fields and controls on the Supplier Information - Location: Procurement Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Ship From |

Enter the location. For every supplier location, ensure that the value entered here points to the correct state where the Supplier Ship To location is intended. For each such Ship From location a corresponding Ship From location should be set up at the Supplier Tax Application page. |

Use the Voucher Accounting Entries page (VCHR_ACTG_ENTRIES) to review the results of the Voucher Posting Application Engine process (AP_PSTVCHR).

Navigation:

. Click the Accounting Entries button on the Voucher Inquiry page.

|

Monetary Amount DR |

Monetary Amount CR |

Currency Code |

Ledger |

GL Unit |

Accounting Date |

|

|---|---|---|---|---|---|---|

|

Prepaid Account |

100,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Accounts Payable |

100,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Inter Set off - IGST |

18,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Tax - IGST |

18,000 |

INR |

Local |

IND01 |

03/31/2017 |

The above example illustrates sample accounting entries for a prepaid voucher, where GST is calculated on reverse charge basis. GST recoverable will be debited to the relevant intermediate set off account. Non recoverable portion of GST if any will be added to the Merchandise/service prepaid account. Total GST on reverse charges on the voucher will be credited to the relevant GST liability account.

|

Monetary Amount DR |

Monetary Amount CR |

Currency Code |

Ledger |

GL Unit |

Accounting Date |

|

|---|---|---|---|---|---|---|

|

Accounts Payable |

100,000 |

INR |

Local |

IND01 |

04/06/2017 |

|

|

Assembly Tool |

103,600 |

INR |

Local |

IND01 |

04/06/2017 |

|

|

Set off - CGST |

7,200 |

INR |

Local |

IND01 |

04/06/2017 |

|

|

Tax - CGST |

9,000 |

INR |

Local |

IND01 |

04/06/2017 |

|

|

Set off - SGST |

7,200 |

INR |

Local |

IND01 |

04/06/2017 |

|

|

Tax - SGST |

9,000 |

INR |

Local |

IND01 |

04/06/2017 |

The above example illustrates sample accounting entries for a regular voucher, where GST is applicable on reverse charge basis. The GST payable is credited to the tax account of the relevant GST component liability and debited to the corresponding GST recoverable account. Total GST on reverse charges on the voucher will be credited to the relevant GST liability account.

|

Monetary Amount DR |

Monetary Amount CR |

Currency Code |

Ledger |

GL Unit |

Accounting Date |

|

|---|---|---|---|---|---|---|

|

Accounts Payable |

7,983,580 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Expense Distribution |

7,009,312 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Set off – CGST |

487,133 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Set off – SGST |

487,133 |

INR |

Local |

IND01 |

03/31/2017 |

The above example illustrates sample accounting entries for a regular voucher with non-reverse charges. GST recoverable if any is debited to a separate relevant account as appropriate. Non recoverable portion of GST if any will be included in the expense distribution line.

|

Monetary Amount DR |

Monetary Amount CR |

Currency Code |

Ledger |

GL Unit |

Accounting Date |

|

|---|---|---|---|---|---|---|

|

Assembly Tools |

103,600 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Accounts Payable |

100,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Inter Set off – CGST |

7,200 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Tax – CGST |

9,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Inter Set off - SGST |

7,200 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Tax - SGST |

9,000 |

INR |

Local |

IND01 |

03/31/2017 |

The above example illustrates sample accounting entries of a prepaid voucher with reverse charge accountability. The intermediate GST accounted for at the time of advance payment to the GST input credit account will be reversed to the respective final input credit accounts.

|

Monetary Amount DR |

Monetary Amount CR |

Currency Code |

Ledger |

GL Unit |

Accounting Date |

|

|---|---|---|---|---|---|---|

|

APA |

40,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Tax – CGST |

20,000 |

INR |

Local |

IND01 |

03/31/2017 |

|

|

Tax – SGST |

20,000 |

INR |

Local |

IND01 |

03/31/2017 |

The above example illustrates sample accounting entries of a Posted third party voucher where reverse charge details have been copied from the related regular voucher. In this case, the GST liabilities are closed and transferred to Accounts Payable, which in turn is transferred to cash distribution account at the time of posting the payment of this third-party voucher.