Processing Withholding Updates

This section provides an overview of the Withholding Update process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_LINE_UPDT |

Enter and store the updated voucher line withholding information which will be used to update the withholding transaction table and underlying voucher tables when you run the Withholding Update process. |

|

|

WTHD_VNDR_UPDT |

Enter and store updated withholding information for suppliers. This information will be used to update the withholding transaction table and voucher tables with withholding information for all of the supplier's vouchers when you run the Withholding Update process. |

|

|

UPDT_WTHD_RQST |

Request a run of the Withholding Update process to update the withholding transaction table and voucher tables with the updated withholding information you've entered on the Withholding Supplier Update and Withholding Invoice Line Update pages. |

Occasionally, you may discover that a supplier's withholding setup was incorrect during the year and that you must correct it before generating your final withholding reports. You can do this by:

Updating individual voucher lines.

You may find, for example, that originally a supplier was not set up for withholding, but that the supplier changed to withholding-applicable in mid-year. Perhaps you created several vouchers with the wrong withholding information and you need to update them. In a case such as this one, use the Withholding Invoice Line Update page to update the voucher lines that have the wrong withholding flag or class.

View each voucher line for a specified supplier, business unit and payment date on the Withholding Invoice Line Update page. You can update the withhold flag or the withhold class for a single voucher line. At save, the system stores the changes in a pre-processing table until you run the Withholding Update process. During that process, the system makes the changes to the voucher lines and transaction tables.

Updating all voucher lines for a supplier.

You can easily update individual lines using the Withholding Invoice Line Update page, but what if you need to update all vouchers lines for a supplier? Perhaps you discover that a supplier whom you did not set up for withholding, is, in fact, withholding-applicable. In this case, update all voucher lines for the supplier using the Withholding Supplier Update page.

Use this page only if you intend to update all voucher lines with the same withholding information. If you want to specify different withholding information for different voucher lines for one supplier location, use the Withholding Invoice Line Update page on which you can select voucher lines and update them individually.

Important! For Global Withholding, the Withholding Update process is not advised if there are multiple withholding classes per voucher line or there are multiple entity-withholding type combinations for a given voucher or for a supplier's vouchers (the latter when updating by supplier).

Also, the Withholding Update process does not adjust entries in the WTHD_PERIOD_LOG or WTHD_CALC_RPT tables.

Note: To change a supplier's voucher lines to withholdable, you must first ensure that the withholding information on the supplier is correct before running the Withholding Update process.

Special Cases and How the Withholding Update Process Handles Them

The following situations may require some manual processing in addition to or instead of using the Withholding Update process:

The Withholding Update process does not consider the basis amount options you specify on the Withholding Options page when you set up withholding entities (that is, whether sales tax, freight, miscellaneous charges, discounts, freight, or VAT amounts are included in the withholding basis amount).

For example, if you use the Withholding Update process to change from withholding class 01, which includes freight and sales tax in the basis amount, to withholding class 02, which includes only freight, the Withholding Update process will not recalculate the basis amount to include only freight; the basis amount will still include freight and sales tax.

The Withholding Update process always uses the invoicing supplier when creating new withholding transaction data, regardless of the Apply Withholding Balance To option (Remit to supplier or Invoicing Supplier) selected on the Withholding Options page.

You cannot use the Withholding Invoice Line Update page to update partially paid vouchers.

You must either make adjustments manually, using the Withhold Adjustments page, or fully pay the vouchers in question before running the Withholding Update process. You can, however, update partially paid vouchers using the Withholding Supplier Update page.

You cannot use the Withholding Invoice Line Update page to update fully paid vouchers whose payment schedules are extended into the next tax reporting year or period.

You must make adjustments in those cases manually, using the Withhold Adjustments page You can update vouchers whose payment schedules are extended into the next tax reporting year or period using the Withholding Supplier Update page, but only if you run the same supplier update for both the current tax reporting period and the next one.

Updated withholding data is for reporting purposes only and will not take into account any rule tier definition, contract reference, threshold, cumulative flag, surcharges, or similar local withholding setup.

Take the way the Withholding Update process handles a withholding class combination with a threshold of 100,000 INR, for example. If all existing vouchers for a supplier total 90,000 INR, and you update the withholding for them all by running the Withholding Update process, the new withholding transactions are available for reporting, but when you create new vouchers for the supplier, the withholding accumulated basis amount reverts to zero even though there are 90,000 INR worth of vouchers for this supplier.

The Withholding Update process is designed such that withholding is reported as one "bucket" per withholding class combination.

Warning! Pay close attention to the exclusions listed above before attempting to use the Withholding Update process.

Field or Control |

Description |

|---|---|

Action |

Select an on-demand process group option and click Run to perform the following process online: Withhold Update: Select to run the Withholding Posting process and the Withholding Update process. The on-demand update process will process all pending transactions. |

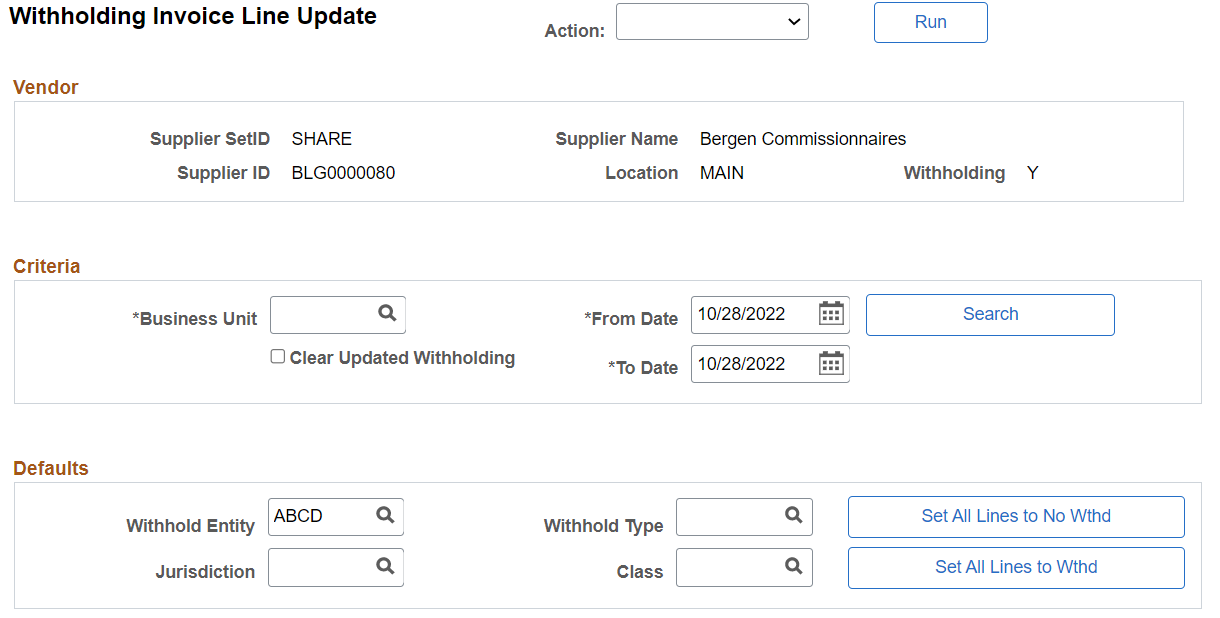

Use the Withholding Invoice Line Update page (WTHD_LINE_UPDT) to enter and store the updated voucher line withholding information which will be used to update the withholding transaction table and underlying voucher tables when you run the Withholding Update process.

Navigation:

This example illustrates the fields and controls on the Withholding Invoice Line Update page (1 of 2). You can find definitions for the fields and controls later on this page.

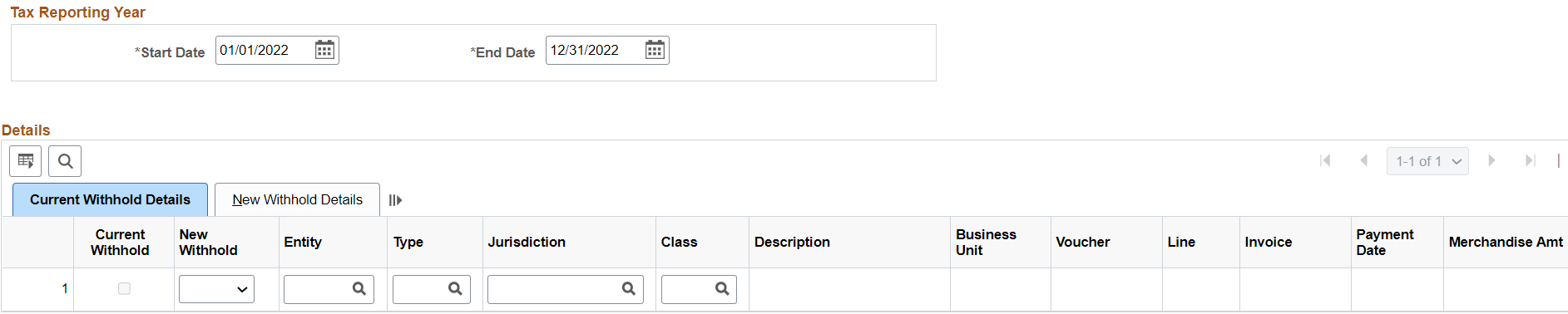

This example illustrates the fields and controls on the Withholding Invoice Line Update page (2 of 2). You can find definitions for the fields and controls later on this page.

Use the Criteria and Tax Reporting Year group boxes to enter the selection criteria for the vouchers you want to update. Click Search when you have entered all of your search criteria in these group boxes.

Use the Defaults group box to enter the withholding class combination you want to apply to your updated voucher lines.

Use the Details grid to view the voucher lines retrieved by your search and select voucher lines for updating.

Criteria

Enter a business unit and date range for the vouchers you want to update. These fields are required.

Field or Control |

Description |

|---|---|

Clear Updated Withholding |

Select to delete all the previously updated voucher lines from the staging table upon save. This does not delete the voucher lines from the transaction table. It is for cleaning up previous update requests. |

|

Click to show all columns. |

Defaults

Specify any withholding entity, type, jurisdiction, and class you want to apply to all of your updated voucher lines. You can also override these for individual lines on the Details grid after you've applied them to all of the lines.

Field or Control |

Description |

|---|---|

Set All Lines to Wthd (set all lines to withhold) |

Click to apply the withholding combination you enter here to all of the voucher lines in the Details grid. |

Set All Lines to No Wthd (set all lines to no withholding) |

Click to set all voucher lines in the Details grid to withholding not applicable. |

Tax Reporting Year

Enter the start and end dates of the tax year for which you are reporting withholding.

Details

The Details grid lists the voucher lines returned by your search. The Current Withhold Details tab displays the original withholding information for the selected voucher lines. You can update these by entering new values on each row. If you want to update all the voucher lines to the same new withholding combination, enter the withholding combination in the Defaults group box and click the Set All Lines to Wthd button.

The New Withhold Details tab shows the updated withholding details after you have saved the page.

The following are fields that appear on the Current Withhold Details tab:

Field or Control |

Description |

|---|---|

Current Withhold |

Displays selected to indicate that the voucher line is currently withholdable. |

New Withhold |

Select Y for withholding applicable or N for no withholding on the voucher line. Note: You must complete the remaining line information (Entity, Type, Jurisdiction, and Class fields), regardless of whether selecting Y or N. This ensures the system correctly processes the withholding data. |

Payment Date |

Displays the voucher payment date. Vouchers must be paid before you can update voucher lines. |

The following field appears on the New Withhold Details tab:

Field or Control |

Description |

|---|---|

Status |

Displays the update status: P (pending) means that an update occurs the next time you run the Withholding Update process. U (updated) means that the Withholding Update process has run and the transaction tables are updated. If this field is blank, the line is not selected for update. |

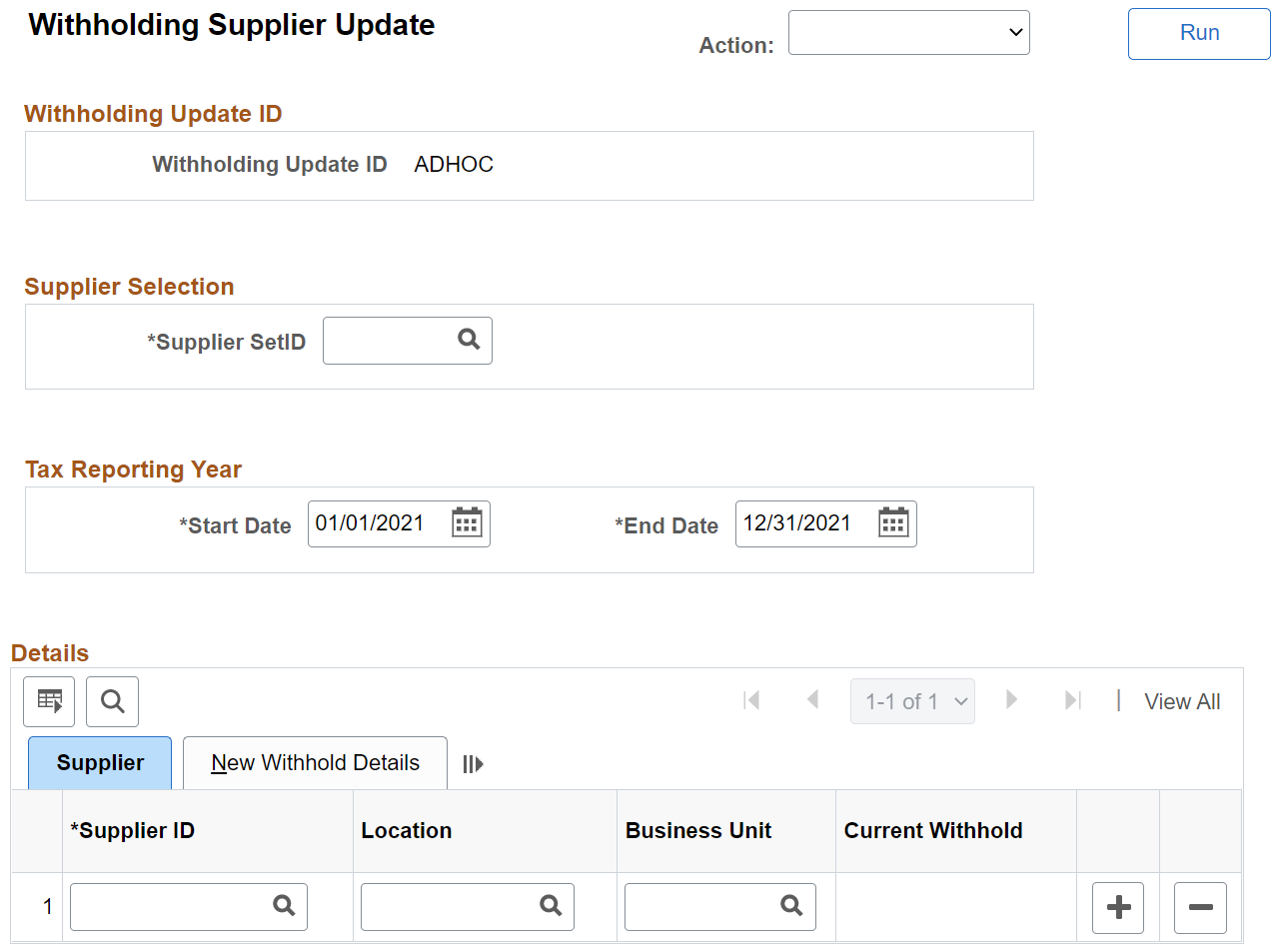

Use the Withholding Supplier Update page (WTHD_VNDR_UPDT) to enter and store updated withholding information for suppliers.

This information will be used to update the withholding transaction table and voucher tables with withholding information for all of the supplier's vouchers when you run the Withholding Update process.

Navigation:

This example illustrates the fields and controls on the Withholding Supplier Update page. You can find definitions for the fields and controls later on this page.

Enter a supplier SetID and tax reporting year before you enter information in the Details grid.

Warning! If you change the supplier SetID, the system deletes all the information in the grid. This is necessary to ensure that only suppliers for the specified SetID exist in the grid.

Details

You must select a supplier ID, supplier location, and business unit. The following fields also appear on the Supplier tab:

Field or Control |

Description |

|---|---|

Current Withhold |

Displays the current withholding applicability of the supplier location: Y if the supplier location is currently withholding applicable. N if the supplier location is not withholding applicable. |

The following fields appear on the New Withhold Details tab:

Field or Control |

Description |

|---|---|

New Withhold (new withholding) |

Select the new withholding applicability status for the supplier location: Y if the new supplier location is withholding applicable. N if the new supplier location for withholding is not applicable. If you select Y, the withholding combination fields appear. |

If the new withholding applicability is Y, then you must enter a withholding entity in the Entity field. Fields for new withholding type, new jurisdiction (New Jur CD), and new class also appear. Enter as needed.

Field or Control |

Description |

|---|---|

Criteria |

Displays the update status: P (pending) means that an update occurs the next time you run the Withholding Update process. U (updated) means the Withholding Update process has run and the transaction tables are updated. |

Use the Withhold Update Request page (UPDT_WTHD_RQST) to request a run of the Withholding Update process to update the withholding transaction table and voucher tables with the updated withholding information you've entered on the Withholding Supplier Update and Withholding Invoice Line Update pages.

Navigation:

For the run control, enter the request ID and a description.

Field or Control |

Description |

|---|---|

Process Option |

Select Process Only Supplier Updates or Process Only Voucher Lines. |

Note: For Global Withholding, the Withholding Update process is not advised if there are multiple withholding classes per voucher line or there are multiple entity-withholding type combinations for a given voucher or for a supplier's vouchers (the latter when updating by supplier).

Also, the Withholding Update process does not adjust entries in the WTHD_PERIOD_LOG or WTHD_CALC_RPT tables.