Understanding Tax Deducted at Source Transactions

TDS is a form of withholding with complex rules and regulations. Different rules apply to different types of payments. TDS requires that you calculate withholding when you book the liability (meaning, when you post the voucher) or when you make the payment, whichever is earlier. Some types of withholding are calculated only after you reach or exceed a set minimum basis amount. When the minimum basis amount is exceeded, the system calculates withholding for prior amounts and future transactions. TDS also has surcharges in addition to the calculated withholding. For Education Cess, you also define an additional surcharge percent.

PeopleSoft Payables provides a withholding architecture that enables you to meet the withholding requirements for India. You can easily calculate surcharge and tax amounts and report accurate TDS and Education Cess information when required. PeopleSoft Payables has modified several pages to enable TDS processing.

To process TDS reporting:

Set up withholding information at the withholding, business unit, and supplier levels.

Specify the (Basic Statistical Returns (BSR) code of the withholding entity's supplier bank account on the Supplier Bank Account Options collapsible region on the Supplier Information - Payables Options page.

Create a voucher on the withholding supplier.

Post the voucher.

Create a payment to the withholding supplier.

Post the payment.

Run the Withholding Posting Application Engine process (AP_WTHD).

Update the TDS Challan information using the Update TDS Challan Information page.

Run the Withholding Reporting Application Engine process (AP_WTHDRPT).

Run the TDS Register (APY8070) and the TDS Certificate (APY8080) reports.

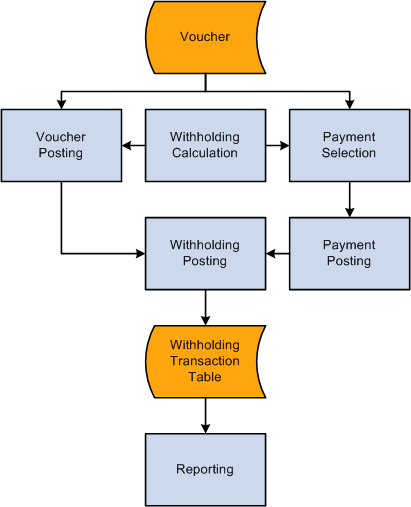

This diagram illustrates the process flow of TDS in PeopleSoft Payables.

Note: The voucher must be paid and the payment posted prior to the withholding posting.