Setting Up Payment Terms

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAY_TERMS_TIME1 |

Define timing IDs, which define the time increments for payment terms. |

|

|

PAY_TERMS_AR |

Define payment terms, which specify the rules for calculating an item due date and the discount terms. |

To set up payment terms, use the Payment Terms Timing (PAY_TERMS_TIME1) and the Payment Terms (PAY_TERMS_AR) components.

Use these components to:

Define timing IDs.

Define payment terms.

Set up payment terms if you plan to have the system automatically calculate payment due dates, discount amounts, and discount due dates. Defining payment terms is a two-step process.

Payment terms govern the length of time that a customer has to pay an item and determine discount eligibility and amount. You use the range of terms that you set up now as defaults for the following levels:

Business units

Customers

Items

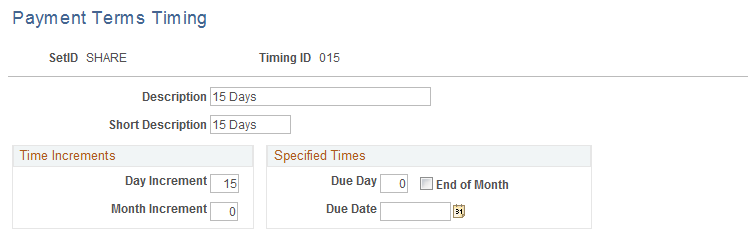

Use the Payment Terms Timing page (PAY_TERMS_TIME1) to define timing IDs, which define the time increments for payment terms.

Navigation:

This example illustrates the fields and controls on the Payment Terms Timing page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Day Increment |

Select to have the system add the specified number of days to the base date of your terms. For example, if your terms are 2/10 net 30, your net terms reference a timing ID with a day increment of 30 and your discount terms reference a timing ID with a day increment of 10. |

Month Increment |

Select to have the system add the specified months to the base terms date. For example, if your terms are End of the Next Month, you reference a timing ID with a month increment of one. |

Due Day |

Enter the specific due day that the payment is due each month. For example, enter 15 if you want the payment due on the 15th of the month. Enter a due date if you know that payment for specific items is due on the same day every year. |

End of Month |

Select to indicate that the system should use the last day of the indicated month. For example, If your terms were due at the end of the next month, enter a month increment of 1 and select the End of Month check box. |

Due Date |

Enter a due date if you know that payment for specific items is due every year on the same date. |

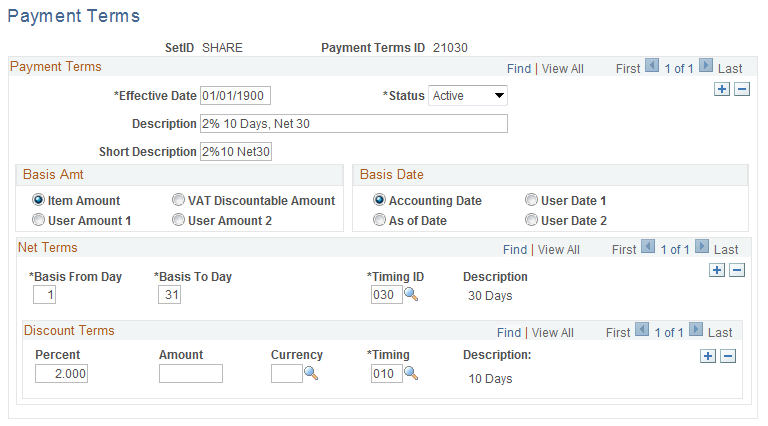

Use the Payment Terms page (PAY_TERMS_AR) to define payment terms, which specify the rules for calculating an item due date and the discount terms.

Navigation:

This example illustrates the fields and controls on the Payment Terms page. You can find definitions for the fields and controls later on this page.

Basis Amount

Specify the basis that the system uses to calculate the discount amount.

Field or Control |

Description |

|---|---|

Item Amount, User Amount 1, and User Amount 2 |

Select the option that corresponds to either the item amount or a user-defined amount that you enter on the pending items during item entry to use one of these amounts to calculate the discount amount. |

VAT Discountable Amount |

Select to have system calculate the discount amount on the net amount of the item after VAT. Deselect to have the system calculate the discount amount on the gross amount. |

Basis Date

The basis date tells the system where to start counting when it calculates the discount due date and invoice due date. The system takes these options directly from values that you enter on the pending item entry pages. Select one of these options:

Accounting Date

As of Date

User Date 1

User Date 2

Net Terms

The net term values determine the due date. A due date that varies depending on when the basis date occurs in the month is called split terms. For example, if you use two different due dates (one if the basis date occurs between the first and the fourteenth of the month and a second if the basis date occurs between the fifteenth and the end of the month), you will have two rows in the grid, as shown in this table:

|

Basis From Day |

Basis To Day |

Timing ID |

|---|---|---|

|

1 |

14 |

1M1 (1st day of next month) |

|

15 |

31 |

15N (15th day of next month) |

To determine the payment due date, add the number of days that is indicated in the Timing ID field to the base date.

Discount Terms

The discount terms determine the discount amount and date for each due date that is defined by the net terms.

Field or Control |

Description |

|---|---|

Percent and Amount |

Enter either a percent of the base amount or a fixed amount. You define a single discount formula or set up cascading terms with two levels. For example, discount terms of 1/10 and 3/5 with net terms specified as 20 days means a 1 percent discount if you pay within 10 days, a 3 percent discount if you pay within 5 days, and the total is due in 20 days. |

Currency |

Select the currency that the system uses to calculate discount terms. If the currency differs from the currency in the profile, the process uses the discount terms currency to calculate discount terms. |

Timing |

Select a value that indicates when discounts are available. |