Setting Up System Functions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ENTRY_USE_TABLE |

View system function attributes, which enable the processing of a system function. PeopleSoft Receivables maintains these attributes, and you typically should not change them. |

|

|

ENTRY_VAT_PNL |

View the rules for updating the VAT tables during the Pending Group Generator Application Engine process (AR_PGG_SERV). |

|

|

ENTRY_USE_TABLE2 |

Review the system-defined portion of the accounting entries. |

To define system functions, use the System Functions component (ENTRY_USE_TABLE).

Use this component to:

Select system function attributes.

Review rules for value-added taxes (VAT) processing.

Review system function accounting entries.

System functions are the activities that your PeopleSoft Receivables system supports. The System Functions table lists the system functions and describes how the system generates accounting entries for the general ledger. Each system function has an accounting entry definition that indicates how the system creates accounting entries. You cannot change these accounting entries—they are system-defined entries. Specify the user-defined entries either in an item entry or automatic entry template or during processing on the Accounting Entries pages.

Each system function is prefixed with a two-letter identifier describing the part of the system that uses the function:

|

Identifier |

Description |

|---|---|

|

DD |

Direct debit management |

|

DM |

Draft management |

|

FC |

Overdue charges |

|

IT |

Item entry |

|

MT |

Maintenance worksheet, item splits, or Automatic Maintenance Application Engine process (AR_AUTOMNT) |

|

TR |

Transfer worksheet |

|

WS |

Payment worksheet or Payment Predictor Application Engine process (ARPREDCT) |

This table lists the system function parameters that may be helpful when you map entry types and automatic entry types to system functions:

|

System Function ID |

Description |

Entry Function |

Sign |

Item |

Reason |

Auto Number |

Accounting Entry |

|---|---|---|---|---|---|---|---|

|

DD-01 |

Direct Debit Remit - Clearing |

Auto |

Neg |

NA |

NA |

NA |

DR Cash Control CR Accounts Receivable |

|

DD-02 |

Direct Debit Remit - Cash |

Auto |

Neg |

NA |

NA |

NA |

DR Cash Received CR Accounts Receivable |

|

DD-03 |

Direct Debit Cancel - Clearing |

Auto |

Pos |

NA |

NA |

NA |

DR Accounts Receivable CR Cash Control |

|

DD-04 |

Direct Debit Cancel - Cash |

Auto |

Pos |

NA |

NA |

NA |

DR Accounts Receivable CR Cash Received |

|

DD-05 |

Direct Debit Cash Clearing |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Cash Control |

|

DD-06 |

Direct Debit Cash Clearing |

Auto |

Un |

NA |

NA |

NA |

DR Bank Cash Received CR Cash Control |

|

DD-07 |

Direct Debit Cancel - Clearing |

Auto |

Pos |

NA |

NA |

NA |

DR Accounts Receivable CR Cash Control |

|

DD-08 |

Direct Debit Cancel - Cash |

Auto |

Pos |

NA |

NA |

NA |

DR Accounts Receivable CR Cash Received |

|

DD-09 |

VAT at Due Date |

Auto |

Un |

NA |

NA |

NA |

DR VAT Output Intermediate CR VAT Output Final |

|

DM-01 |

Pay an Item |

Auto |

Neg |

NA |

NA |

NA |

DR Draft Receivable CR Accounts Receivable |

|

DM-02 |

Prepay an Item |

Auto |

Neg |

New |

X |

X |

DR Draft Receivable CR AR Distribution |

|

DM-03 |

Place an Amount On Account |

Auto |

Neg |

New |

X |

X |

DR Draft Receivable CR AR Distribution |

|

DM-04 |

Adjust Remaining Overpayment |

Auto |

Neg |

New |

X |

X |

DR Draft Receivable CR AR Distribution |

|

DM-05 |

Adjust Remaining Underpayment |

Auto |

Pos |

New |

X |

X |

DR AR Distribution CR Draft Receivable |

|

DM-06 |

Create a Deduction |

Auto |

Pos |

New |

X |

X |

DR AR Distribution CR Draft Receivable |

|

DM-07 |

Write off an Item |

Auto |

Neg |

|

X |

|

DR User line CR AR Account(s) |

|

DM-08 |

Write off an Overpayment |

Auto |

Pos |

2nd - DM-04 |

X |

X |

DR AR Distribution CR User line |

|

DM-09 |

Write off an Underpayment |

Auto |

Neg |

2nd - DM-05 |

X |

X |

DR User line CR AR Distribution |

|

DM-20 |

Draft Remitted to Bank |

Auto |

Un |

NA |

NA |

NA |

DR Draft Cash Control CR Draft Receivable |

|

DM-21 |

Draft Remitted with Discount |

Auto |

Un |

NA |

NA |

Na |

DR Discount Draft Cash Control CR Draft Receivable |

|

DM-22 |

Draft Remitted to Bank |

Auto |

Un |

NA |

NA |

NA |

DR Cash Control CR Draft Receivable |

|

DM-23 |

Draft Remitted to Bank |

Auto |

Un |

NA |

NA |

NA |

DR Remitted Draft Distribution CR Draft Receivable |

|

DM-24 |

Draft Remitted with Discount |

Auto |

Un |

NA |

NA |

NA |

DR Draft Discount Receivable CR Draft Receivable |

|

DM-30 |

Collect Cash on Discount Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Cash Control |

|

DM-31 |

Collect Cash on Discount Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Cash Control |

|

DM-32 |

Collect Cash on Discount Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Cash Control |

|

DM-33 |

Collect Cash on Discount Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Draft Discount Liability |

|

DM-40 |

Collect Cash on Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Cash Control |

|

DM-41 |

Reverse Discount Liability |

Auto |

Un |

NA |

NA |

NA |

DR Draft Discount Liability CR Draft Discount Receivable |

|

DM-42 |

Collect Cash on Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Cash Control |

|

DM-43 |

Reverse Discount Liability |

Auto |

Un |

NA |

NA |

NA |

DR Draft Discount Liability CR Draft Discount Receivable |

|

DM-44 |

Collect Cash on Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Draft Receivable |

|

DM-45 |

Reverse Discount Liability |

Auto |

Un |

NA |

NA |

NA |

DR Draft Discount Liability CR Draft Receivable |

|

DM-46 |

Collect Cash on Draft |

Auto |

Un |

NA |

NA |

NA |

DR Cash Received CR Remitted Draft Distribution |

|

DM-47 |

VAT on Discounted Draft |

Auto |

Un |

NA |

NA |

NA |

None (This function generates VAT accounting only for items with declaration point of payment.) |

|

DM-50 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Draft Receivable |

|

DM-52 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Cash Control |

|

DM-53 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Cash Control |

|

DM-54 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Cash Control |

|

DM-55 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Remitted Draft Distribution |

|

DM-56 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Discount Draft Receivable |

|

DM-57 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Cash Received |

|

DM-58 |

Dishonor Draft |

Auto |

Un |

NA |

NA |

NA |

DR Dishonored Draft Distribution CR Cash Received |

|

DM-90 |

Draft Bank Fees |

Auto |

Pos |

NA |

X |

X |

CR Cash Received |

|

DM-98 |

Cancel Remitted Draft |

Auto |

Neg |

NA |

NA |

NA |

None (PeopleCode creates accounting entries based on the status of the draft.) |

|

DM-99 |

Void Drafts |

Auto |

Neg |

NA |

NA |

NA |

None (PeopleCode creates accounting entries based on the status of the draft.) |

|

FC-01 Overdue Charge |

Create an Overdue Charge |

Auto |

Pos |

New |

NA |

X |

DR Accounts Receivable CR User line |

|

IT-01 Item Entry |

Create an Invoice/Debit Memo |

Item |

Pos |

NA |

X |

NA |

DR Accounts Receivable CR User line |

|

IT-02 Item Entry |

Create a Credit Memo |

Item |

Neg |

NA |

X |

NA |

DR User line CR Accounts Receivable |

|

MT-01 Maintenance Worksheet |

Offset an Item |

Auto |

Un |

NA |

X |

NA |

DR Maintenance Control CR Accounts Receivable |

|

MT-02 Maintenance Worksheet |

Write off a Credit |

Auto |

Pos |

NA |

X |

NA |

DR Accounts Receivable CR User line |

|

MT-03 Maintenance Worksheet |

Write off a Debit |

Auto |

Neg |

NA |

X |

NA |

DR User line CR Accounts Receivable |

|

MT-04 Maintenance Worksheet |

Create New Debit |

Auto |

Pos |

New |

X |

X |

DR AR Distribution CR Maintenance Control |

|

MT-05 Maintenance Worksheet |

Create New Credit |

Auto |

Neg |

New |

X |

X |

DR Maintenance Control CR AR Distribution |

|

MT-06 Maintenance Worksheet |

Write off Remaining Credit |

Auto |

Pos |

2nd - MT-05 |

X |

NA |

DR AR Distribution CR User line |

|

MT-07 Maintenance Worksheet |

Write off Remaining Debit |

Auto |

Neg |

2nd - MT-04 |

X |

NA |

DR User line CR AR Distribution |

|

MT-08 Maintenance Worksheet |

Refund Remaining Credit |

Auto |

Pos |

2nd - MT-05 |

X |

NA |

DR AR Distribution CR Refund Control |

|

MT-09 Maintenance Worksheet |

Refund a Credit |

Auto |

Pos |

|

X |

|

DR Accounts Receivable CR Refund Control |

|

TR-01 Transfer Worksheet |

Transfer Item From Customer |

Auto |

Un |

NA |

NA |

NA |

DR Transfer Control CR Accounts Receivable |

|

TR-02 Transfer Worksheet |

Transfer Item To Customer |

Auto |

Un |

NA |

NA |

NA |

DR Accounts Receivable CR Transfer Control |

|

TR-03 Transfer Worksheet |

Transfer Item to Doubtful Receivable Account |

Auto |

Un |

NA |

NA |

NA |

DR Doubtful Receivables Distribution Code CR Transfer Control |

|

WS-01 Payment Worksheet |

Pay an Item |

Auto |

Neg |

NA |

NA |

NA |

DR Cash Received CR Accounts Receivable |

|

WS-02 Payment Worksheet |

Take Earned Discount |

Auto |

Neg |

NA |

NA |

NA |

DR User line CR Accounts Receivable |

|

WS-03 Payment Worksheet |

Take Unearned Discount |

Auto |

Neg |

NA |

NA |

NA |

DR User line CR Accounts Receivable |

|

WS-04 Payment Worksheet |

Prepay an Item |

Auto |

Neg |

New |

X |

X |

DR Cash Received CR AR Distribution |

|

WS-05 Payment Worksheet |

Place An Amount On Account |

Auto |

Neg |

New |

X |

X |

DR Cash Received CR AR Distribution |

|

WS-06 Payment Worksheet |

Adjust Remaining Overpayment |

Auto |

Neg |

New |

X |

X |

DR Cash Received CR AR Distribution |

|

WS-07 Payment Worksheet |

Adjust Remaining Underpayment |

Auto |

Pos |

New |

X |

X |

DR AR Distribution CR Cash Received |

|

WS-08 Payment Worksheet |

Create a Deduction |

Auto |

Pos |

New |

X |

X |

DR AR Distribution CR Cash Received |

|

WS-09 Payment Worksheet |

Write off an Item |

Auto |

Neg |

NA |

X |

NA |

DR User line CR Accounts Receivable |

|

WS-10 Payment Worksheet |

Write off an Overpayment |

Auto |

Pos |

2nd - WS-06 |

X |

X |

DR AR Distribution CR User line |

|

WS-11 Payment Worksheet |

Write off an Underpayment |

Auto |

Neg |

2nd - WS-07 |

X |

X |

DR User line CR AR Distribution |

Note: NA means not applicable.

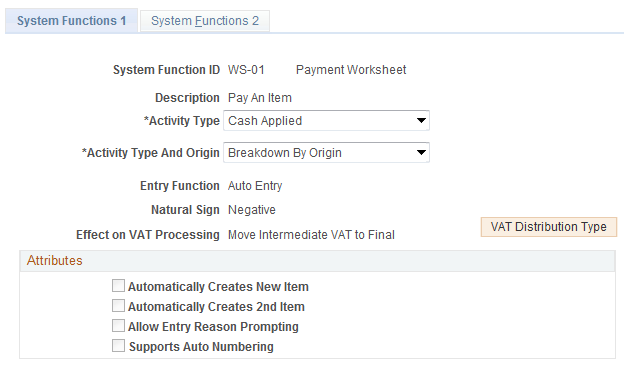

Use the System Functions 1 page (ENTRY_USE_TABLE) to view system function attributes, which enable the processing of a system function.

PeopleSoft Receivables maintains these attributes, and you typically should not change them.

Navigation:

This example illustrates the fields and controls on the System Functions 1 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Activity Type |

Select an activity type that indicates how system functions are classified. You must associate each system function with an activity type. You can assign an activity type to more than one system function. This structure determines how the system presents data on the Unit Activity page and the Unit Activity report. |

Activity Type And Origin |

When you view the inquiry page by activity type and origin, the system uses the Activity Type And Origin field to determine whether to break the category down by origin or bank code. This determines how the system displays information on the Unit Activity page. For example, suppose that you select Billing for the activity type and Breakdown By Origin for the Activity Type And Origin field. On the Unit Activity page, under Activity Type/Origin/Bank Code you will see that billing activity came from two different origins, OBILL and XBILL. The individual totals for each origin appear on the page. If you choose not to break down by origin, select Do Not Break Down By Origin for system functions IT-01 and IT-02. The Unit Activity page lists billing without an origin—meaning that the system has bundled together all the billing transactions, rather than breaking them into totals under their associated origin IDs. As another example, if you select Breakdown by Origin for the WS-01 system function, you will see a separate row for each bank account for the payment activity. If you select Do Not Break Down By Origin, all the payment activities are combined in one row. |

Entry Function |

Displays a system-defined value. It can be either Auto Entry (automatic entry) or Item Entry. Item entry types identify pending items created during online item entry or by an external interface. The system uses item entry types to handle processing when you directly build a pending item—during online entry or when an interface process constructs groups of pending items. When you enter or build pending items that make up a group, you use entry types that you have specifically enabled for use as item entry types. Item entry types take two forms:

Automatic entry types work in the background to translate instructions for overdue charging, payments, maintenance, transfers, direct debits, and drafts into pending items. When you initiate an online or background process for these types of groups (such as selecting an item on one of the worksheets, or running the Payment Predictor process or the Automatic Maintenance process), the system creates the necessary pending item using the information that you defined on the automatic entry type for that action. For example, every time you select an item for payment on the payment worksheet, the system uses the entry type, entry reason, and accounting entry information from the WS-01 (Pay An Item) automatic entry type to create the pending item. Automatic entry types fall into the following categories:

|

Natural Sign |

Displays a positive (+) or negative (–) sign, which. the system applies to pending items to determine the effect that a system function has on the customer balance. The only unsigned system functions are transfers, offsets, direct debits, and drafts (they can be said to offset an item), because their sign varies with the sign of the item being offset, transferred, or included in draft and direct debit processing. Debit memos must be positive, and credit memos must be negative. |

Effect on VAT Processing(effect on Value Added Tax processing) |

Indicates how VAT balances are adjusted for the system function. |

VAT Distribution Type (Value Added Tax distribution type) |

Click to view the account types that you selected for each declaration point for the system function. |

Automatically Creates New Item |

Displays the system setting. If this option is selected, the system creates a new item for activities that occur in the background. These system functions are all automatic entry types: new debits and credits, prepayments, on-account payments, deductions, and adjustments for overpayments and underpayments. |

Automatically Creates 2nd Item |

Displays the system-setting. If selected, it enables write-off of remaining debits and credits on the maintenance worksheet and by the Automatic Maintenance process, or write-off of overpayments and underpayments on the payment worksheet and draft worksheet, and by the Payment Predictor process. |

Allow Entry Reason Prompting |

Displays the system setting. If selected, it indicates that entry types tied to the system function can require an entry reason. Entry types define activity, and entry reasons enable you to further qualify the activity. So if a system function enables you to require an entry reason, you can generate reports, run aging, and view history at a greater level of detail. |

Supports Auto Numbering (supports automatic numbering) |

Displays the system setting. If selected, it enables you to enter a prefix and starting number for pending items. For example, these system functions could be assigned: PR: Prepayments. AO: Overpayment adjustments. AU: Underpayment adjustments. DE: Deductions. OA: On-account payments. |

Use the VAT Distribution Type page (ENTRY_VAT_PNL) to view the rules for updating the VAT tables during the Pending Group Generator Application Engine process (AR_PGG_SERV).

Navigation:

Click the VAT Distribution Type button on the System Functions 1 page.

The values determine how to update the VAT tables for the system function. If more than one row is in the grid, the processing varies depending on the declaration point.

Field or Control |

Description |

|---|---|

Declaration Point |

Indicates when the system recognizes VAT transaction information for reporting purposes. Values are: Invoice: Recognize VAT at invoice time. Payment: Recognize VAT at the time of payment. Delivery: Recognize VAT at the time of delivery. |

VAT Accounting Entry Type (Value Added Tax accounting entry type) |

The accounting entry types, together with VAT codes and VAT transaction types, determine VAT accounting and reporting. |

Effect on VAT Processing(Value Added Tax processing) |

Displays the action for VAT processing. Values are:

|

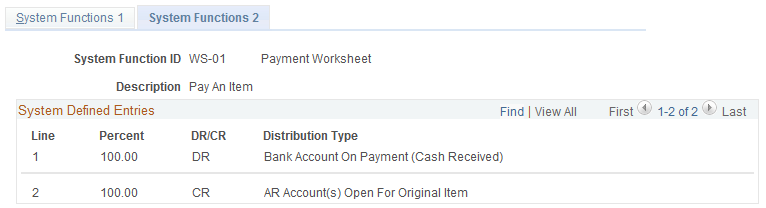

Use the System Functions 2 page (ENTRY_USE_TABLE2) to review the system-defined portion of the accounting entries.

Navigation:

This example illustrates the fields and controls on the System Functions 2 page. You can find definitions for the fields and controls later on this page.

System-Defined Entries

The system-defined entries fall into one of two categories:

Two lines are defined: one for the accounts receivable entry and one for the cash entry.

In this case, the system generates a balanced accounting entry by itself. Cash system functions related to the payment worksheet, drafts, and direct debits fall into this category. Also, system functions related to the maintenance and transfer worksheet and the Automatic Maintenance process define two lines: one for the accounts receivable account and one for a control account.

A single line is defined: either a debit or credit for the accounts receivable entry.

Write-offs, discounts, and item entry system functions require two-sided accounting entries to be posted; therefore, you must create user-defined lines for the offsetting entries on your templates or during processing.

Revenue Estimate Attributes

If you selected the Receivables check box in the Enabled Commitment Control group box on the Installation Options – Products page, the Revenue Estimate Attributes group box appears. The revenue estimate attributes define whether source transactions for the control budget should be generated and if so, how.

Field or Control |

Description |

|---|---|

Revenue Estimate Affected |

Determines whether the Revenue Estimate Application Engine process (AR_REV_EST) creates source transactions. Yes indicates that the process creates source transactions, and No indicates it does not. |

User Definable |

Indicates whether you must specify which revenue bucket to update for each entry type and reason combination for the automatic entry type or item entry type associated with the system functions. Yes indicates that you must specify the revenue buckets for the automatic entry type or item entry type, and No indicates that the system function defines them. |

Revenue Estimate Updated |

Indicates whether the accounting entries update the recognized or collected bucket or both buckets. If the bucket is user-defined for the automatic entry type or item entry type, the default bucket appears. |