Accounting Distributions for Interunit Transfers

When you define a PeopleSoft Contracts business unit, you associate it with a PeopleSoft General Ledger business unit. When you select a product onto a contract line, the system populates the Accounting Distribution page with the distribution code that you defined for that product. The system also populates the GL Unit field for that contract line with the PeopleSoft General Ledger business unit that you defined for that PeopleSoft Contracts business unit. For contract lines where PeopleSoft Billing manages revenue, the GL Unit field is not editable. When PeopleSoft Contracts manages revenue for a contract line, you can change the PeopleSoft General Ledger business unit on an accounting distribution line to a PeopleSoft General Ledger business unit different from the one associated with the PeopleSoft Contracts business unit. When you do this, the system generates interunit transfer entries. Interunit transfers enable you to specify revenue to be booked to a PeopleSoft General Ledger business unit that is different from the one originally defined on the contract.

Note: Interunit transfers are enabled only for revenue line distributions; they are not enabled for the contract asset and contract liability entries. The system does not book any balance sheet entries to a PeopleSoft General Ledger business unit other than the one to which the contract's PeopleSoft Contracts business unit is linked.

You can perform interunit transfers for fixed-amount contract lines by editing the PeopleSoft General Ledger business unit for a contract line's revenue distribution rows on the Accounting Distribution page. When you save the Accounting Distribution page, the system performs ChartField edit combinations to check that the ChartFields that you entered are valid for the PeopleSoft General Ledger business unit that you specified for a particular distribution row.

When you run the Amount-based Revenue process, the system looks for revenue distributions where the PeopleSoft General Ledger business unit value differs from the contract's PeopleSoft General Ledger business unit (which is identified by the PeopleSoft Contracts business unit). For each row where a difference exists, the system creates two additional rows of distribution in the CA_ACCTG_LINE table, where the rows are picked up and sent to the GL when you run the Journal Generator process. The PeopleSoft General Ledger tables that these rows are written to depend upon these factors:

The type of interunit accounting that you specified during system setup—affiliate or nonaffiliate, direct or indirect.

The accounting distribution (PeopleSoft General Ledger ChartFields) for the interunit distribution rows.

The system does not store these interunit entries in the PeopleSoft Contracts historical tables (CA_AP_DST, CA_AP_DFR, and CA_AP_UAR) because each revenue distribution row reflects the PeopleSoft General Ledger business unit to which the entry was made. Entries that the system makes to the GL are always to the primary ledger of the target PeopleSoft General Ledger business unit.

If the transfer is between PeopleSoft General Ledger business units that use different currencies, the system performs the currency conversions on the interunit entries by using the rate type and GL currency exchange rates from the translated amount.

The Amount-based Revenue process verifies that the accounting entries are in balance both before and after the transfer.

The following example examines the entries generated by PeopleSoft Contracts when PeopleSoft Contracts manages revenue for a fixed-amount contract line. In this example, the user did not enable contract liability recognition at the either the contract line or product group level.

First, establish a new contract with these parameters:

|

Field Name |

Value |

Comments |

|---|---|---|

|

Contract Number. |

9999999 |

|

|

Contracts business unit. |

USA1 |

|

|

General Ledger business unit that is mapped to the Contracts business unit. |

123 |

The base currency for this PeopleSoft General Ledger business unit is USD. All balance sheet entries are managed on the PeopleSoft General Ledger business unit 123 books, including: contract liability, contract asset or inventory, and billed AR |

|

Billing business unit. |

|

All billing plans within the contract must be mapped to PeopleSoft Billing business units that are associated with PeopleSoft General Ledger business unit 123. |

|

Contract gross amount/currency code. |

100,000/DEM |

The contract was signed on January 1999, but no accounting is booked until there is activity against the contract. |

|

Contract/Billing currency. |

DEM |

|

To perform interunit accounting without contract liability, you:

Bill for the total contract amount.

PeopleSoft Contracts sends the billing information to PeopleSoft Billing, and PeopleSoft Billing books accounting entries upon finalization of invoice. The accounting month for the bill finalization is February 1999. In February 1999, the contract total in the currency of the primary PeopleSoft General Ledger business unit (GLBU 123) equals DEM 100,000 @ 2/99 rate .580930 = USD 58,093.00.

Indicate that revenue should be recognized.

On the Accounting Distribution page you have split the revenue between two PeopleSoft General Ledger business units: 50 percent for GLBU 123 and 50 percent to GLBU XYZ. The currency code for GLBU XYZ is in CAD. The accounting month for this transaction is May 1999. The contract total in the currency of GLBU 123 = DEM 100,000 @ 5/99 rate .540435 = USD 54,043.50.

You run the Amount-based Revenue process to generate the revenue entry and its associated interunit transfer from GLBU 123 to GLBU XYZ, and the system uses GLBU 123's currency as the base currency code for the transfer: USD 54,043.50 * 50% = USD 27,021.75 @ 5/99 rate (USD/CAD) 1.4565 = CAD 39,357.18.

Harmonize the contract asset in PeopleSoft General Ledger by using PeopleSoft General Ledger functionality for balances with foreign and base amounts with differing currencies.

To enable this functionality, the Amount-based Revenue process and PeopleSoft Billing populate the foreign amount field with the DEM value of 100,000.

Revaluation in PeopleSoft General Ledger compares the May 1999 balances for both amount fields and translates at the current rate of .540435. The system compares the foreign amount = 0 (DEM 100,000 − DEM 100,000) at .540435 = 0 to the base amount = (USD 4049.50), then generates a reduction entry crediting foreign exchange gain or loss and debiting contract asset (in this scenario) for the difference = USD 4049.50.

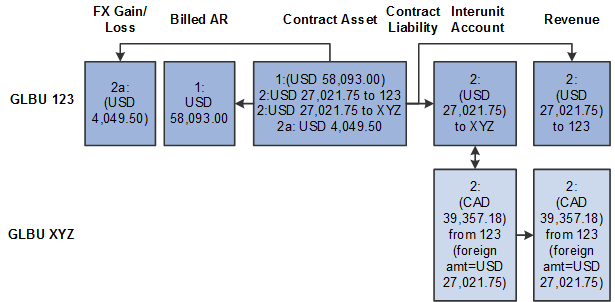

This figure shows the interunit accounting distribution flow when contract liability is not enabled. The numbers in each box refer to the interunit accounting steps listed above.

The interunit accounting distribution flow when contract liability is not enabled is displayed. The numbers in each box refer to the interunit accounting steps listed above.

The following example examines the entries generated by PeopleSoft Contracts when PeopleSoft Contracts manages revenue for a fixed-amount contract line. In this example, the user enabled contract liability recognition at the either the contract line or product group level.

First, establish a new contract with these parameters:

|

Field Name |

Value |

Comments |

|---|---|---|

|

Contract Number. |

9999999 |

|

|

Contracts business unit. |

USA1 |

|

|

General Ledger business unit that is mapped to the Contracts business unit. |

123 |

The currency for this PeopleSoft General Ledger business unit is USD. All balance sheet entries are managed on PeopleSoft General Ledger business unit 123's books, including: contract liability, contract asset or inventory, and billed AR. |

|

Billing business unit. |

|

All billing plans within the contract must be mapped to Billing business units that are associated with PeopleSoft General Ledger business unit 123. |

|

Contract gross amount/currency code. |

100,000/DEM |

The contract was signed on January 1999, but no accounting is booked until there is activity against the contract. |

|

Billing currency. |

DEM |

|

To perform interunit accounting with contract liability, you:

Run the Contract Liability process for the accounting month January 1999 to book entries to the balance sheet: DEM 100,000 @ 1/99 rate .599018 = USD 59,901.80.

Bill for the total contract amount.

PeopleSoft Contracts sends the billing information to PeopleSoft Billing; the system books accounting entries upon finalization of invoice. The accounting month for the bill finalization is February 1999. In February 1999, the contract total in the currency of the primary PeopleSoft General Ledger business unit (GLBU 123) = DEM 100,000 @ 2/99 rate .580930 = USD 58,093.00.

True-up contract asset in PeopleSoft General Ledger by using PeopleSoft General Ledger functionality for balances and base amounts with foreign and differing currencies.

To enable this functionality, the Amount-based Revenue process and PeopleSoft Billing populate the Foreign Amount field with the DEM value of DEM 100,000.

Revaluation in PeopleSoft General Ledger compares February 1999 balances for both amount fields and translates at the current rate of .580930. The system compares the foreign amount = 0 (DEM 100,000 − DEM 100,000) at .580930 = 0 to the base amount = (USD 1,808.80), then generates a reduction entry crediting foreign exchange gain or loss and debiting contract asset (in this scenario) for the difference = 1,808.80.

Indicate that revenue should be recognized.

On the Accounting Distribution page, you have split the revenue between two PeopleSoft General Ledger business units: 50 percent to GLBU 123 and 50 percent to GLBU XYZ. The currency code for GLBU XYZ is in CAD. The accounting month for this transaction is May 1999.

When you run the Amount-based Revenue process, the system generates the entry for the interunit transfer from GLBU 123 to GLBU XYZ. The system uses GLBU 123's currency as the base currency code for the transfer: USD 59,901.80 * 50% = USD 29,950.90 @ 5/99 rate (USD/CAD) 1.4565 = CAD 43,623.49.

You set up the revenue distribution and offsetting contract asset account for rate-based contract lines on the Accounting Rules page. If the PeopleSoft General Ledger business unit for the debit side of a transaction is different from the PeopleSoft General Ledger business unit for the credit side of a transaction, the system generates interunit entries when you run the rate-based revenue process (Accounting Rules Engine - PSA_ACCTGGL). The system performs conversion of amounts for currency differences in the current accounting month. For rate-based contract lines with a value-based billing method, the Accounting Distribution page displays the contract asset account information. PeopleSoft Contracts does not associate contract liability for rate-based contract lines.