Understanding Period End Accrual Processing for PeopleSoft Expenses

The Period End Accrual (PE_ACCRUAL) process enables you to accrue for liabilities that have not been fully processed. This enables you to post a liability to the general ledger and to account for expenses in the next fiscal period.

The transactions that can be accrued at period end are:

Expense transactions that match the criteria defined on the Period End Accrual Options - Document page.

My Wallet transactions that are not attached to an expense report.

Commitment Control is supported if you elect to implement commitment control on period end accruals. However, Commitment Control does not support My Wallet transactions.

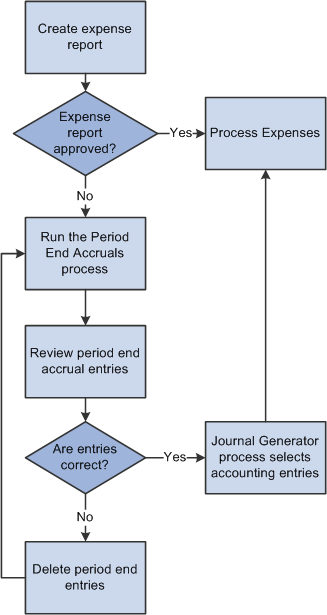

This diagram illustrates the process of creating an expense report to processing entries through the journal generator. After creating an expense report, if the expense report is approved, then it is ready to be picked up by the Process Expenses run control. If the expense report is not approved, then run the Period End Accruals process and review period end accrual entries. If the entries are correct, run the Journal Generator process and then Process Expenses process. If the entries are not correct, delete period end entries, make corrections and run the Period End Accruals process again.

The first step in the process is to create an expense report. If the expense report is approved, it is ready to be processed to the general ledger. If the expense report is not approved, it can be processed through the Period End Accrual process.

The run control page of the Period End Accrual process enables you to review the period end accrual entries. You can remove entries from the process or initiate the process.

The accounting entries that result from the Period End Accrual process can be reviewed by a user. If the user determines that the accounting entry was created in error, he or she can delete the entry. If the user determines that the accounting entry is correct, the Journal Generator selects the entry and the entry is ready to be posted to the general ledger.

The Period End Accrual Inquiry page enables you to view and inquire on existing accruals.

When creating accrual entries for expense transactions that have not been processed, you need to understand the implications of creating a period end accrual entry and processing the expense transaction through normal posting in the same period. Oracle recommends that you run all month end processes for Expenses before running period end accrual processing so that liabilities are not duplicated.

The Period End Accrual Process

The Period End Accrual process is an application engine batch process that creates an accrual journal entry and its corresponding reversal journal entry. The Period End Accrual process selects expense reports that match the criteria defined on the Period End Accrual Options - Document page or My Wallet transactions that are not added to an expense report and that meet the criteria selected on the run control page. The transaction status that is eligible for accrual processing is determined on the Period End Options component for the transaction type.

The Period End Accrual process run control page provides a secondary review page where you can view the transaction counts that are selected for accrual processing prior to running the process. This page specifies whether any error or warning conditions exist for the business units selected.

The accruals process does not delete any existing accruals in the same period. The Delete Accruals component enables you to delete any accruals that are incorrectly generated.

Period End Accrual Accounting Type and Templates

The Expenses Period End Accruals (EXB) account type is used to distinguish the period end accrual entry from other accrual entries.

The EX_PACCRUE template determines the accounting rules for the entry that is created during the Period End Accrual process.

Commitment Control Entries for Accruals

If budget checking is enabled, create the expense and encumbrance reversal entries as needed. Note these high-level rules:

If the expense sheet is created from a travel authorization and the expense sheet is not budget checked, encumbrance reversal entries are created that are budget checked and the encumbrance budget is relieved.

The encumbrance entry ChartField information is inherited from the travel authorization.

If the expense sheet is created from a travel authorization and the expense sheet is budget checked, commitment control expense and encumbrance entries are not created.

If the expense sheet is not created from a travel authorization and the expense sheet is budget checked, commitment control expense entries are not created.

If the expense sheet is not created from a travel authorization and the expense sheet is not budget checked, commitment control expense and expense reversal entries are created.

If commitment control entries are created during the accrual process, the encumbrances may get double counted. Consider this scenario:

An expense report is created from a travel authorization.

The travel authorization was previously budget checked and the encumbrance was created.

The expense report is not budget checked.

Therefore, the encumbrance is not relieved and actuals are not posted.

The Period End Accrual process is defined to select expense reports that have not been budget checked and to create commitment control entries.

When the Period End Accrual process runs, encumbrance relief entries are created in the accounting line table with the ENR distribution type.

When the budget processor runs and you indicate to select all transaction types, the encumbrance relief is created twice, once from the entry in the accounting line table and once from the expense report.

The entries that are created from the Period End Accrual process are reversed in the next period, but the budget may be incorrect for a period of time.

Expense reports are candidates for the accrual process if they have a status that matches the criteria defined on the Period End Accrual Options - Document page. Expenses that are identified as a personal expense are not included. Sales Tax and value-added tax (VAT) are not calculated.

Commitment Control is supported for expense sheet accruals if the Enable Commitment Control for Accruals option is selected on the Expenses - Business Unit 1 page.

This table illustrates a basic scenario for an expense report transaction that has two lines. Budget checking is not considered for this basic scenario.

|

Document ID |

Document Type |

Line Number |

Distribution Account Type |

Accounting Period |

Amount |

Account |

Department |

|---|---|---|---|---|---|---|---|

|

0000000040 |

Expense Sheet Accrual |

1 |

DST – Expense Distribution |

5 |

1500.00 |

650080 |

1100 |

|

0000000040 |

Expense Sheet Accrual |

1 |

EXB - Expense Advance Accrual |

5 |

–1500.00 |

207100 |

1100 |

|

0000000040 |

Expense Sheet Accrual |

2 |

DST – Expense Distribution |

5 |

1500.00 |

650100 |

1100 |

|

0000000040 |

Expense Sheet Accrual |

2 |

EXB - Expense Advance Accrual |

5 |

–1500.00 |

207100 |

1100 |

This table illustrates the reversal entries for the expense sheet with two lines:

|

Document ID |

Document Type |

Line Number |

Distribution Account Type |

Accounting Period |

Amount |

Account |

Department |

|---|---|---|---|---|---|---|---|

|

0000000040 |

Expense Sheet Accrual |

1 |

DST – Expense Distribution |

6 |

–1500.00 |

650080 |

1100 |

|

0000000040 |

Expense Sheet Accrual |

1 |

EXB - Expense Advance Accrual |

6 |

1500.00 |

207100 |

1100 |

|

0000000040 |

Expense Sheet Accrual |

2 |

DST – Expense Distribution |

6 |

–1500.00 |

650100 |

1100 |

|

0000000040 |

Expense Sheet Accrual |

2 |

EXB - Expense Advance Accrual |

6 |

1500.00 |

207100 |

1100 |

My Wallet transactions are accrued if they have the status of Expense, ATM Advance, or Credit and are not selected on an existing expense report. My Wallet transactions do not have accounting information on the document; therefore, accounting information is created during the accrual process. Creating the accounting entries follows the same logic as expense report transactions. The expense type of the My Wallet transaction determines the ChartField information on the expense entry.

Commitment Control is not supported for My Wallet accruals.

This table illustrates a basic scenario for a My Wallet transaction:

|

Document ID |

Document Type |

Line Number |

Distribution Account Type |

Accounting Period |

Monetary Amount |

Account |

Department |

|---|---|---|---|---|---|---|---|

|

0000000040 |

EX MyWallet Accrual |

1 |

DST – Expense Distribution |

5 |

1500.00 |

650080 |

1100 |

|

0000000040 |

EX MyWallet Accrual |

1 |

EXB - Expense Advance Accrual |

5 |

–1500.00 |

207100 |

1100 |

This table illustrates the reversal entries for the My Wallet transaction:

|

Document ID |

Document Type |

Line Number |

Distribution Account Type |

Accounting Period |

Monetary Amount |

Account |

Department |

|---|---|---|---|---|---|---|---|

|

0000000040 |

EX MyWallet Accrual |

1 |

DST – Expense Distribution |

6 |

–1500.00 |

650080 |

1100 |

|

0000000040 |

EX MyWallet Accrual |

1 |

EXB - Expense Advance Accrual |

6 |

1500.00 |

207100 |

1100 |