Defining Subsidiary Ownership and Minority Interest Sets

General Ledger evaluates minority interest relationships at the time a consolidation is run, based on the data in the minority interest sets and Ownership table. It calculates the adjustment prior to generating elimination entries.

You define the relationship for the subsidiary business unit, the parent company that owns the majority of that subsidiary, and any other minority owners. You do not specify minority owners that exist outside your organization.

If a minority parent exists in the same consolidation tree as a majority parent, General Ledger makes a second adjustment to reflect the minority parent's ownership percentage. Because the original adjustment creates a liability for the minority interest, the second adjustment effectively reduces that liability because a minority parent is included in the consolidated results. This means that you do not overstate your minority interest liability.

General Ledger supports any number of minority parents and generates the adjustment entry at the appropriate point in the consolidation according to the consolidation tree level.

To define subsidiary ownership and minority interest sets, use the Subsidiary Ownership component (CONSOL_OWNERSHIP) and the Minority Interest Sets component (MINORITY_INTEREST).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CONSOL_OWNERSHIP |

Define the relationships for the parent company, subsidiary, and any other minority owners. |

|

|

MINOR_INT_SOURCE |

Identify the subsidiary equity and parent investment accounts. |

|

|

MINOR_INT_TARGET |

Specify the minority accounts of the majority parent company. |

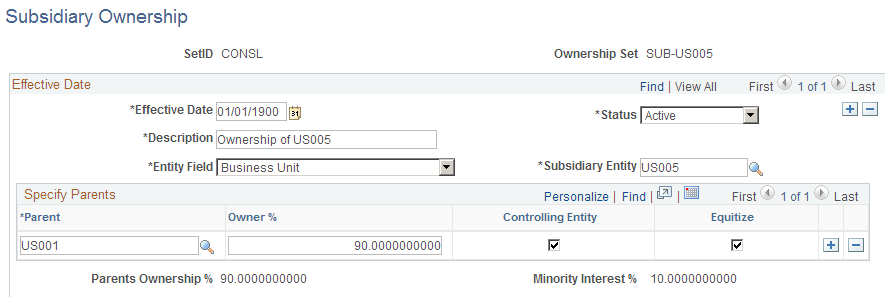

Use the Subsidiary Ownership page (CONSOL_OWNERSHIP) to define the relationships for the parent company, subsidiary, and any other minority owners.

Navigation:

This example illustrates the fields and controls on the Subsidiary Ownership page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Entity Field |

Select the consolidating entity field. This is usually the business unit, but you can consolidate based upon other fields, like Operating Unit. This field should be the same field upon which your consolidation tree is based. |

Subsidiary Entity |

Organizational unit owned by the parent. |

Note: Add a new effective-dated row to reflect valid changes in subsidiary ownership. When adding new effective-dated rows, make changes only to the Specify Parents group box. The Subsidiary Entity field must stay constant, as that is the subsidiary for which you are defining ownership.

Specify Parents

Field or Control |

Description |

|---|---|

Parent |

Owner of the subsidiary. |

Owner % |

Amount of the subsidiary owned by the parent. List any minority owners that exist within your system by adding rows. |

Controlling Entity |

Indicates which parent is the subsidiary's majority owner. Use this option to indicate a particular parent business unit for which elimination entries will be created. The parent company selected as the controlling entity holds the minority interest liability. Only one parent entity can be the controlling entity. |

Note: To prevent duplication, the system does not allow you to enter the same parent entity value twice.

Field or Control |

Description |

|---|---|

Equitize |

Indicates whether equitization should be run for specified parent entities. The system processes this ownership set only when the subsidiary entity and all the parent entities marked for equitization are included in the consolidation tree. |

Parents Ownership % |

Total should be less than or equal to 100%. |

Minority Interest % |

Percentage of minority shareholder ownership. |

Use the Minor Int Source (minority interest source) page (MINOR_INT_SOURCE) to identify the subsidiary equity and parent investment accounts.

Navigation:

This example illustrates the fields and controls on the Minor Int Source (minority interest source) page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Subsidiary Equity |

Specifies the ChartField value set that identifies the subsidiary's equity accounts. |

Parent Investment |

Specifies the ChartField value set that identifies the asset account where the subsidiary is carried on the parent company's books. |

Match Affiliate Value |

Select the check box if you are using a single investment account and have populated the Affiliate ChartField with the subsidiary. |

Use the Minority Int Target (minority interest target) page (MINOR_INT_TARGET) to specify the minority accounts of the majority parent company.

Navigation:

This example illustrates the fields and controls on the Minor Int Target (minority interest target) page. You can find definitions for the fields and controls later on this page.

Minority Interest

Field or Control |

Description |

|---|---|

Field Name and Value |

Identifies the parent's equity or liability account for minority ownership in the subsidiary. After General Ledger generates the minority interest adjustment, it eliminates the majority parent's investment account against the subsidiary's equity accounts. |

Out of Balance Debit and Out of Balance Credit

Field or Control |

Description |

|---|---|

Field Name and Value |

If the elimination does not balance, the system directs the remaining amount to the appropriate out-of-balance account or ChartFields. You can specify special ChartFields for the out-of-balance amounts. For example, you can enter a department for both the Debit and Credit ChartFields in addition to an account. |