Establishing Facilities and Administration and Direct-Cost Cost-Sharing Options

This topic provides overviews of F&A processing and direct-cost cost sharing, and discusses how to establish F&A options using the FA Options (GM_FA_OPTIONS) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GM_FA_OPTIONS |

Establish default F&A information that is used by the F&A process. |

|

|

GM_FA_OFFSET |

Establish links between departments and operating units, funds, programs, classes, budgets, products, and affiliates. |

|

|

INSTALLATION_CSR |

Establish cost-sharing analysis types for each feeder system with which you plan to use the PeopleSoft Grants cost-sharing features. This page is also used to indicate that you can include optional attachments, and to determine the source for calculating unliquidated obligation balances for the Federal Financial Report. |

This topic discusses:

F&A processing basics.

Processing options.

F&A base account tree.

Tree definition and properties.

F&A Processing Basics

PeopleSoft delivers PeopleSoft Grants with a process that calculates and stores F&A costs, user-definable F&A base types, and effective-dated F&A rates. This process calculates F&A on the applicable sponsor-funded amounts as well as any waived and cost-shared F&A amounts.

F&A is synonymous with indirect costs or overhead. Some examples of F&A categories include travel, subcontracts, rent, salaries, and so on.

Facilities can be defined as depreciation and use allowances, interest on debt that is associated with certain buildings, equipment and capital improvements, operation and maintenance expenses, and library expenses.

Administration is defined as general administration and general expenses, departmental administration, sponsored projects administration, and student administration and services.

The base type on which F&A is awarded is typically Modified Total Direct Costs (MTDC). The base is significant in that it identifies the direct costs on which F&A can be charged.

For the F&A process to function properly in PeopleSoft Grants, you need to define several items:

F&A base tree

F&A options

F&A offsets

Processing Options

PeopleSoft Grants provides various options for processing F&A expenses. It enables you to establish effective-dated rates, define the bases, and initiate three distinct computations. The key computation is Sponsor Facilities and Administration (SFA). This computation is fed to PeopleSoft General Ledger and billed. The other two optional computations include Waived Facilities and Administration (WFA) and Cost Share Facilities and Administration (CFA). You can establish the F&A definitions at the institution, the sponsor, or the award level.

For the F&A process (GM_GMFACS) to function correctly, complete these initial setup steps:

After you fully define the chart of accounts, establish an F&A base account tree that includes all of the expense accounts under the appropriate node representing the F&A base type that is being used.

The F&A process uses these nodes as the basis for calculation. The base node that you identify on this tree must be exactly the same value as the F&A base that you enter on the Project Activity F&A Rates page.

Establish default F&A information, calculation methods, and ChartField editing combinations on the Facilities Admin Options page.

Establish links between departments and operating units, funds, programs, classes, budgets, products, and affiliates on the Facilities Admin Offsets page.

The F&A process looks at the business unit and project that is on the transaction line to determine the departments that are associated with the project or grant. You assign department percentages to the project on the Project Department page (select ). The percentages must total 100 percent.

F&A Base Account Tree

The sole function of the F&A base tree is to calculate F&A expenses based on actual expenses that post to the accounts that are identified on the tree. This process happens during the post-award phase. You need to define a tree with node values that represent each base type that you are using, including:

TDC (Total Direct Costs).

MTDC (Modified Total Direct Costs).

However you set up your tree, the base node values that you assign on the tree must also be the same base node values that you indicate on your F&A setup pages. If the value does not match, the system cannot find the base node to use to calculate F&A, and your F&A process will not function correctly.

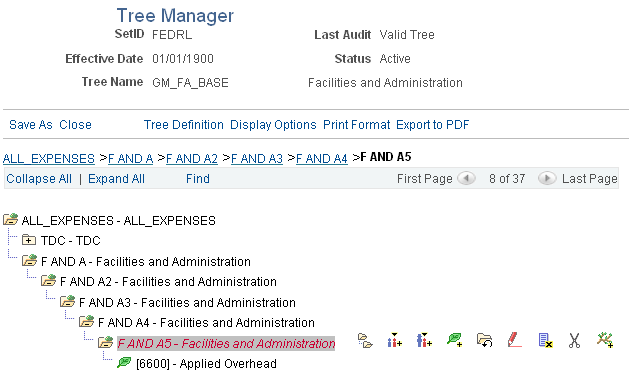

PeopleSoft Grants delivers a sample F&A base tree that you can refer to as a model. It is delivered under the FEDRL SetID. The tree name is GM_FA_BASE.

To access this tree, select

This example illustrates the fields and controls on the Example of the GM_FA_BASE tree. You can find definitions for the fields and controls later on this page.

If the institution has exclusionary accounts or identical accounts in different nodes, you can create a tree with duplicate account values. To establish this type of tree, click Tree Definition on the Tree Manager page. Then, select the Allow Duplicate Detail Values check box on the Tree Definition and Properties page.

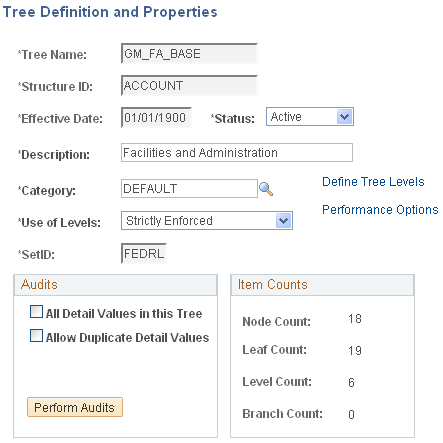

Tree Definition and Properties

The following example illustrates the Tree Definition and Properties page.

This example illustrates the fields and controls on the Example of the Tree Definition and Properties page. You can find definitions for the fields and controls later on this page.

Warning! Typically, you should not have to duplicate detail values within a tree, and you can preclude people from creating them. If duplicate values are allowed, do not assign different rate types within the same project activity to bases that contain the same accounts. If you do, the F&A calculations will be incorrect.

See PeopleTools PeopleBook: PeopleSoft Tree Manager.

Organizations may frequently need to calculate cost-sharing percentages and distribute them among departments, other units, or internal business units and external agencies. PeopleSoft Grants enables you to budget for a number of cost-sharing relationships. You can also calculate F&A rates at the expenditure level and differentiate between sponsor expenditures and institution cost sharing.

Cost sharing represents the portion of the research or project that is not funded by the sponsor. For example, an institution may decide to contribute funds or resources to support a project in addition to the amount that is awarded by the sponsor.

In some instances, awarding sponsors expect or require recipients to contribute a certain dollar amount or percentage of the award as a precondition for their support. PeopleSoft Grants enables you to track direct cost-shared amounts, F&A cost-shared amounts, and waived F&A amounts.

To implement cost sharing, you must define direct cost sharing by the ChartField combinations that you establish on the Facilities Admin Options page. You can select one or more ChartFields to designate the ChartFields that constitute cost sharing, for example:

Class

Department

Fund

Program

After you select a ChartField, you must select values for the From Value and To Value fields.

For example, if you select Fund as the cost-sharing ChartField and then select a range (F250 / F260), the system considers each transaction that is coded with fund F250 through F260 as cost shared.

If you enter more than one cost-sharing ChartField, (for example, fund F250 and department 90280), the system recognizes the transaction as being cost shared only if the transaction references both (or all) ChartFields. If more than one ChartField value is specified (for example, department ID 90280 and 90000), then the system treats this as an OR situation, meaning that as long as one of the values is referenced, the transaction is deemed cost shared.

For example, to enter a 2,000.00 USD salary transaction with 50 percent cost sharing, you would:

Define cost sharing by using a fund value of 100.

Code one salary line for 1,000.00 USD to the normal account, department, and fund.

Code the second, or cost-shared, line for 1,000.00 USD to fund 100 to distinguish it as a cost-shared line.

When the two lines come into PeopleSoft Project Costing, the cost-shared line, which is based on its fund of 100, is assigned a unique analysis type. You can use the analysis type for reporting, analysis, and billing purposes.

When you run the award generation process, the system computes the cost-sharing amount to be brought forward into the award by using the percentages that you set up within the pre-award environment. When you establish the post-award budget, you should verify that the cost-sharing totals that are brought forward are for the amount that you want, and make any adjustments that may be necessary due to rounding.

Note: ChartField values that are used for cost share cannot be used for reimbursable/funded dollars.

Use the Facilities Admin Options page (GM_FA_OPTIONS) to establish default F&A information that is used by the F&A process.

Navigation:

This example illustrates the fields and controls on the Facilities Admin Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Exclude Project From Offsets |

Select this option if you want to exclude the project from the F&A offset rows created by the F&A process. If you do not select Exclude Project From Offsets, the F&A rows inherit the project from the original direct cost line being burdened. |

FA Accounts

Field or Control |

Description |

|---|---|

Account |

Select the expense account that you want to use when F&A lines are created. All the other ChartField values in the F&A lines are inherited from the original transaction line on which F&A is being burdened. |

Distribution Code |

Displays the distribution code. This value defines the F&A Offset account that is to be used in F&A processing. This value should be a revenue account. |

Journal Template

Field or Control |

Description |

|---|---|

Template |

Select the journal template that you want to use to feed the F&A accounting entries from PeopleSoft Grants to PeopleSoft General Ledger. |

FA Budget Checking

Select the type of F&A (Facilities and Administration) transaction lines that will be budget checked.

Base Tree Info

Field or Control |

Description |

|---|---|

Tree SetID |

Select the SetID or business unit that you want the system to use as a base for calculating F&A expenses. |

Tree Name |

Select the account on the tree that you want the system to use to determine the F&A base amounts when the system calculates F&A. |

FA Calculation Options

The options that you select here enable the institution to choose the types of F&A that you want to calculate and maintain in PeopleSoft Grants. Options are:

Sponsor: This value is always selected and cannot be deselected. Sponsor F&A costs are stored in both the Project Resource table (PROJ_RESOURCE) and in PeopleSoft General Ledger.

Waived and Cost Shared: These are optional computations and are stored only within the Project Resource table.

FA Status Defaults

These fields are used to select default options during the Award Generation process.

Field or Control |

Description |

|---|---|

Preaward Spending |

Select the preaward spending status. The status selected is used as the default option in the Project Activity FA Rates page during the Award Generation process when the Pre-award spending check box is selected. The available options are:

|

Generated Award |

Select the spending status. The status selected is used as the default option in the Project Activity FA Rates page during the Award Generation process when the Pre-award spending check box on the Generate Award run control page is not selected. The available options are:

For more information, see Generate Award Page |

Ready at Activation |

Select the check box to ensure that the Ready at Activation check box is selected as the default option on the Project Activity FA Rates page. This selection allows you to control whether or not the FA Rate status is changed to Ready, when the status for the Contract the activity is assigned to is changed from Pending to Ready. The Ready at Activation check box is available for editing only when the Generate Award option is Pending. |

Cost Sharing

Field or Control |

Description |

|---|---|

CS ChartField (cost-sharing ChartField) |

Indicate the values for the ChartFields that identify transactions as cost sharing when they are used (for example, FUND_CODE). |

Values

Field or Control |

Description |

|---|---|

From Value |

Select the ChartField value that you want to designate for cost-shared transactions. When the line comes into PeopleSoft Project Costing, the cost-shared line is assigned a unique analysis type for reporting, analysis, and billing purposes. |

To Value |

Select a value that is greater than the one that is entered in the From Value field to code cost-shared transactions to a range of values. The system does not accept a value that is less than the one in the From Value field. To code cost-shared transactions to only one department, class, fund, or program, enter the same value that is in the From Value field. |

Note: If the institution uses a combination of ChartFields and values to define what combinations constitute cost sharing, enter multiple cost-sharing ChartFields and from and to values.

Use the Facilities Admin Offsets page (GM_FA_OFFSET) to establish links between departments and operating units, funds, programs, classes, budgets, products, and affiliates.

Navigation:

This example illustrates the fields and controls on the Facilities Admin Offsets page. You can find definitions for the fields and controls later on this page.

FA Offset

Field or Control |

Description |

|---|---|

Department, Operating Unit, Fund Code, Dept, Program Code, Class Field, Budget Reference, Product, Affiliate, Fund Affiliate, and Operating Unit Affiliate |

At the project level, you identify the departments and the percentage share associated with each of them. The F&A process then looks to the F&A Options page to identify the offsetting chartfields that you associate with each department. Within this page, you identify for each department the offsetting chartfields that should be used in creating the Offset F&A Account (OFA, or revenue) lines associated with the F&A transactional processing. For each field, select a value to which you want the system to offset F&A transactions. The Department field is the F&A department. Enter any department ID from the department chartfield in the Dept field that is located to the right of the Fund Code. Note: For searches, the system uses the value that you enter for the first department ID. |

Use the Installation Options - Grants page (INSTALLATION_CSR) to establish cost-sharing analysis types for each feeder system with which you plan to use the PeopleSoft Grants cost-sharing features.

This page is also used to indicate that you can include optional attachments, and to determine the source for calculating unliquidated obligation balances for the Federal Financial Report.

Navigation:

This example illustrates the fields and controls on the Installation Options - Grants page. You can find definitions for the fields and controls later on this page.

Use the Cost Sharing Analysis Types group box to establish cost-sharing analysis types for each feeder system with which you plan to use the PeopleSoft Grants cost-sharing feature.

This table lists some of the cost-sharing analysis types that are defined for specific feeder systems and delivered with PeopleSoft Grants:

|

Feeder System |

Cost-Sharing Analysis Type |

|---|---|

|

Accounts Payable |

CAC |

|

General Ledger |

CGE |

|

Budget |

CBU |

|

Purchasing - Purchase Orders |

CCO |

|

Time & Labor |

CPY |

|

Purchasing - Close Adjustment |

CAJ |

|

Purchasing - Commitment Reversal |

CCR |

|

Purchasing - Requisition Reversal |

CQR |

Based on the feeder systems in which the transactions originated, the system automatically assigns a cost-sharing analysis type to a transaction that includes designated cost-sharing ChartFields.

This table lists feeder systems and the fields to which they correspond on the Installation Options - Grants page:

|

Feeder System |

Field |

|---|---|

|

Accounts Payable |

Cst Shr AP |

|

Expenses |

Cst Sh EX |

|

Grants Budget |

Cst Shr GM-Bud |

|

Inventory |

Cst Shr IN |

|

Order Management |

Cst Shr OM |

|

Purchasing - Close Adjustments |

CS/PO-Close Adj |

|

Purchasing - Commitment Reversals |

CS/PO-COM Rev |

|

Purchasing - Purchase Orders |

CS/PO - PO |

|

Purchasing - Requisitions |

CS/PO-REQ |

|

Purchasing - Requisition Reversals |

CS/PO-REQ Rev |

|

Time & Labor Actuals |

CS/TL-Actual |

|

Time & Labor Billing Estimate |

CS/TL-Bill Est |

|

Time & Labor Estimate |

CS/TL - Est |

|

Time & Labor Contractors |

Cst Shr TL Con |

|

Time & Expense Time |

Cst Shr TE Time |

By assigning a distinct analysis type to cost-shared transactions, PeopleSoft Grants enables you to track the feeder systems from which the cost-sharing transactions originated. PeopleSoft Grants also enables to calculate and track F&A expenses on cost-shared amounts.

Note: The system assigns all cost-sharing F&A costs with an analysis type of CFA (Cost-Sharing Facilities and Administration). To activate the cost-shared F&A calculation, navigate to the Facilities Admin Options page (select ) and select the Cost Shared check box. When this is activated, the system calculates F&A on direct cost-shared amounts (assuming that the accounts are in the F&A base) with an analysis type of CFA.

The system uses either the institution's F&A rate or sponsor's F&A rate for calculating the cost-sharing F&A. To determine which rate to use, the system looks at the Waived FA Calc Method group box on the Project Activity - Definition page (select Grants, Awards, Project Activity, Definition). If the Institution Minus Funded check box is selected, the system uses the institution's F&A rate for calculating the cost-sharing F&A. If the Sponsor Minus Funded check box is selected, the system uses the sponsor's F&A rate for calculating the cost-sharing F&A.