Creating Lease Administration Business Units

After you determine how many business units that you use and how to organize them, you must define PeopleSoft Lease Administration-specific business unit definitions. A business unit definition specifies the transaction processing defaults and configuration options associated with the business unit. Two pages are used to define lease administration business units:

The Business Unit Definition General page.

The Business Unit Definition Transaction Settings page.

This topic lists prerequisites and discusses how to define lease administration business units and transaction settings.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Lease Administration Business Unit Definition - General Page |

RE_BU_CFG1 |

Create or update a Lease Administration business unit definition. This page enables you to set various configuration options, such as the mappings to other business units, the auto-straightline option, the general limits and measures, and lease expiration notifications. |

|

Lease Administration Business Unit - Transaction Settings Page |

RE_BU_CFG2 |

Define transaction processing options, such as processing lead time and default transaction routing codes. |

You must establish at least one assets, billing, contract, payables, and general ledger business unit in each of those respective applications to map to the Lease Administration business unit when it is created. You must also set up a PeopleSoft calendar to define the term calendar ID and percent rent calendar ID to define the proration method.

Use the Lease Administration Business Unit Definition - General page (RE_BU_CFG1) to create or update a Lease Administration business unit definition.

This page enables you to set various configuration options, such as the mappings to other business units, the auto-straightline option, the general limits and measures, and lease expiration notifications.

Navigation:

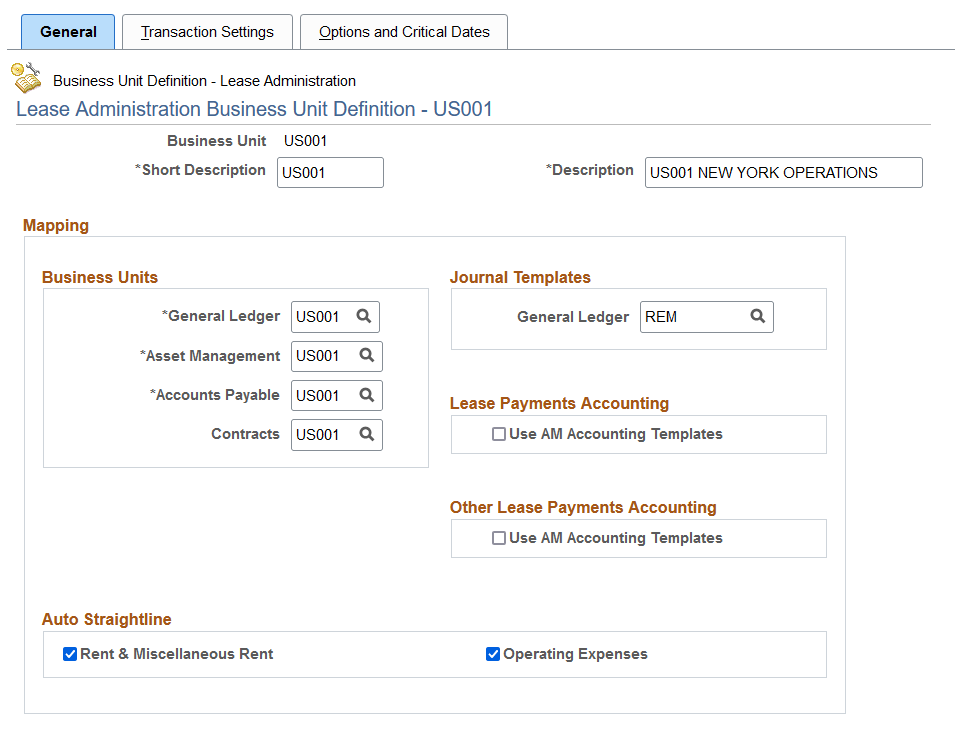

This example illustrates the fields and controls on the Lease Administration Business Unit Definition - General page (1 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Lease Administration Business Unit Definition - General page (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

When you add a business unit, you must provide a description and specify a value in the Default SetID field. |

Business Units

Field or Control |

Description |

|---|---|

General Ledger |

Displays general ledger business unit. This general ledger business unit defines the accounting processing for the associated lease administration business unit for straightline accounting entries. All leases with straightline accounting entries created for this lease administration business unit post to the general ledger business unit specified here. Note: Transactions generated through the PeopleSoft Payables and PeopleSoft Billing interfaces are posted through those respective applications. |

Asset Management |

Displays asset management business unit. The asset management business unit (AMBU) defines the asset information associated with this lease administration business unit. All leases created use the PeopleSoft Asset Management asset information to manage the life cycle of the lease for the asset specified on the lease from the AMBU. Because PeopleSoft Asset Management might post accounting entries to the general ledger for its own purposes (such as capitalization), assets selected on leases under this lease administration business unit are restricted to only the assets under the business unit mapped here. Note: General Ledger and Asset Management business units are display only. Lease Administration always uses the GL Business Unit mapped in the AM Business Unit Book Definition for the accounting entries created from the Lease Administration product. Lease Administration will map with AM Business Unit in a one to one manner. You cannot edit this business unit mapping. |

Accounts Payable |

Select a payables business unit. All payments made for leases under a lease administration business unit are sent to Payables for processing using this business unit. |

Contracts |

Select a contracts business unit. When creating a lease in the lease administration business unit, a contract header and line is also created in the contracts business unit. This initiates the transaction billing processor within the contracts business unit to determine the routing of the rent to be billed. |

Journal Templates

Field or Control |

Description |

|---|---|

General Ledger |

Select the general ledger template to be associated with the lease administration business unit. Accounting entries created for this lease administration business unit use this general ledger accounting template to generate the journal in PeopleSoft General Ledger. |

Lease Payments Accounting

|

Field or Control |

Description |

|---|---|

|

Use AM Accounting Templates (Use Asset Management Accounting Templates) |

Select this check box to disable GL account overrides for lease-level asset cost distributions. All GL account distributions related to the lease liability and right-of-use asset default from the Asset Management Accounting Entry Template. When you select this check box, the Account and Prior Period Accounts tabs do not appear on the Asset Cost Distribution page. For more information about Accounting Entry Templates, see Defining Accounting Entries. |

Other Lease Payments Accounting

Field or Control |

Description |

|---|---|

Use AM Accounting Templates |

Select this check box to create payables lease entries by the Depreciation Close process in Asset Management. If the check box is not selected, then Lease Administration accounting rules will be used to send Payables and Receivables accounting entries needed to record the voucher and bill, respectively. |

Auto Straightline

PeopleSoft Lease Administration provides the ability to support the accounting and reporting for operating leases by allowing you to enable or disable the straightline processing at the business unit level. For example, let's say that a tenant agrees to rent a space from the landlord. Under FASB-13 Operating Lease provisions, if the rent amount or recurring expense amount for the rented space is not evenly termed across periods, or free rent (zero rent) is applicable for certain periods, those amounts must be reported in the PeopleSoft General Ledger on a straightline basis (an even distribution).

See Understanding Straightline Accounting.

Field or Control |

Description |

|---|---|

Rent & Miscellaneous Rent |

Select to enable base rent and miscellaneous rent transactions to use the straightline accounting process by default for this lease administration business unit. This mechanism assists with lease entry. When a new lease or recurring rent term is added, the straightline check box is automatically selected or cleared based on the setting defined here. You can deselect the check box on the lease from the default value defined on the business unit to enable or disable straightline processing on specific financial terms on a specific lease. |

Operating Expenses |

Select to enable operating expense transactions to automatically perform straightline accounting processing for this lease administration business unit. When a new lease or an operating expense is added, the straightline check box is selected or cleared by default based on the setting defined here. You can deselect the check box on the lease from the default value defined on the business unit to enable or disable straightline processing on specific financial terms on a specific lease. |

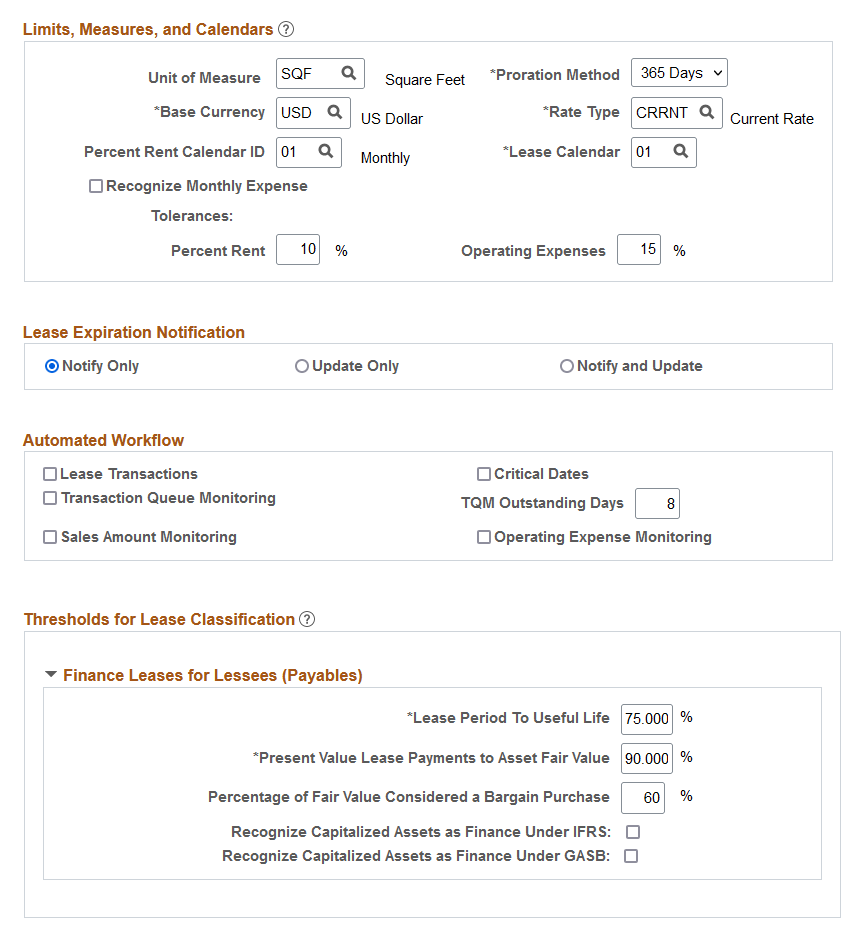

Limits, Measures, and Calendars

Field or Control |

Description |

|---|---|

Unit of Measure |

Select the default unit of measure for referencing the space measurement of a property in a lease for this lease administration business unit. |

Proration Method |

Defines the rule that the system uses to determine how much to apportion to the recurring rent based on the term calendar and the proration method that you define on the lease. The term calendar determines the start and end date of the billing period. If the term start date does not correspond with the calendar period start date, the payment for the first period will be for the prorated period. For example, if you use the normal monthly calendar, January to December, and base rent starts on 01/12/2005, then the first payment must be for the prorated amount for the time frame 01/12/2005 to 01/31/2005. The system also performs proration when the term end date does not correspond to the calendar period end date. The selection drives the default while setting up the recurring terms on the lease. You can override the default. Available methods for proration are: 360 Days: Select to prorate on monthly frequencies, where each month has only 30 days. 365 Days: Select to prorate according to a standard 365 day Gregorian calendar using each of the 12 months as the start and end dates (31 days in January, 28 or 29 days in February, 31 days in March, and so on). This method supports weekly, monthly, quarterly, and annual frequencies. No Proration: Select if you do not want the proration method for the rent provided by default. You can define the proration method at the lease level. |

Base Currency |

Select the default base currency for this lease administration business unit. Lease transactions created in this lease administration business unit automatically inherit this base currency, although you can override the base currency on the lease. The currency specified on the lease is the currency used for invoicing or payment by PeopleSoft Billing and PeopleSoft Payables, respectively. |

Rate Type |

Select the currency exchange rate type to be used when the system must perform currency translations for this business unit. Note: The most commonly used rate type is CRRNT (current). |

Percent Rent Calendar ID |

Select the detail calendar ID. Percent rent sales reporting uses a specific calendar with distinct periods and start and end dates. The detail calendar that you select provides the system with the appropriate information to understand the frequency with which you report or receive sales reports. In addition, this calendar structure enables the system to search for and determine when sales reports are missing, as well as to prevent duplicate sales reports for the same period. |

Lease Calendar |

Define the lease calendar, which the system populates on all financial terms of the lease by default for this business unit. The lease calendar determines the start and end date of billing periods for recurring financial terms. You must select a calendar with a 12 period monthly allocation type. |

Recognize Monthly Expense |

Select this option to enable the Recognize Monthly Expense option on the Create New Lease - Financial Terms Page. You can still manually deselect the option on the Create New Lease - Financial Terms page, should you wish to do so. This option prorates non-monthly financial terms (such as quarterly schedules) by period. Lease interest for finance leases and the amortization of the underlying assets for operating leases are recognized on a monthly basis. |

Tolerances: Percent Rent |

Define the percentage tolerances for a sales category amount for this lease administration business unit. This value is used for visual purposes on the sales report only. If a sales report category amount has changed significantly over the previous month, the system displays a warning message on the sales reporting entry worksheet to indicate that it has exceeded the tolerance. |

Tolerances: Operating Expenses |

Define the percentage tolerance for operating expense amounts for this lease administration business unit. This value is used for visual purposes on the operating expense audit page only. If an operating expense category amount has changed significantly over the previous year, the system displays an icon on the operating expense audit/reconciliation worksheet to indicate that it has exceeded the tolerance. |

Lease Expiration Notification

The Transaction Generator Application Engine (RE_GENTRANS) includes a process that automates lease expiration. The automated lease expiry process sets the status of any active lease to expired when the lease end date precedes the execution date of the transaction generator. The Lease Expiration Notification option determines how the automated lease expiry process treats leases attached to the current business unit.

Field or Control |

Description |

|---|---|

Notify Only |

Select to have the lease expiry process send an email notification when a lease is due to expire. The status of the lease is not changed. The notification email is sent to the Lease Administrator and Portfolio Manager named on the lease. |

Update Only |

Select to automatically set the status of a lease to Expired when the lease end date has passed. No notifications are issued, however, a system generated note is added to the lease to record the expiration. |

Notify and Update |

Select this option to automatically set the status of a lease to Expired when the lease end date has passed. A notification email is sent to the Lease Administrator and Portfolio Manager named on the lease. In addition, a system-generated note is added to the lease to record the expiration. |

Automated Workflow

Field or Control |

Description |

|---|---|

Lease Transactions |

Select this check box to enable workflow for lease transactions based on events setup on the workflow configuration. Tasklists will be created for the Lease Administrator or Portfolio manager based on the role which would enable them to review the lease. |

Field or Control |

Description |

|---|---|

Critical Dates |

Select this check box to enable workflow for critical dates. The reviewer of the critical date notification will be directed to the Lease Abstract worksheet to review the cause of the notification and take appropriate action based on the upcoming event. |

Field or Control |

Description |

|---|---|

Transaction Queue Monitoring |

Select this check box to enable workflow for transaction queue monitoring. A batch process will identify all the transactions in the queue which are beyond a threshold setup in BU level and send notifications to the Lease Administrator or Portfolio Manager about the pending approval. |

Field or Control |

Description |

|---|---|

TQM Outstanding Days |

If Transaction Queue Monitoring is enabled, the outstanding days has to be entered. |

Field or Control |

Description |

|---|---|

Sales Amount Monitoring |

Select this check box to enable workflow to create tasklists if the sales billing amount exceeds tolerance. The approver will be directed to an approval page from the tasklist. The transactions will only be sent to the Transaction Queue after approval. |

Field or Control |

Description |

|---|---|

Operating Expense Monitoring |

Select this check box to enable workflow to create tasklists if the operating expense for a category exceeds tolerance. The approver should be directed to an approval page from the tasklist. The transactions should be sent to the Transaction Queue only after approval. |

Thresholds for Lease Classification

Allows you to establish thresholds for capitalizing a lease component based on your internal accounting policies. The system uses the thresholds entered to suggest a lease classification for each lease component (asset ID). The lease classification can be overridden.

Field or Control |

Description |

|---|---|

Lease Period to Useful Life |

Enter a percentage to compare the lease period to remaining useful life. |

Present Value Lease Payments to Asset Fair Value |

Enter a percentage to compare the present value lease payments to the asset’s current fair value. |

Percentage of Fair Value Considered a Bargain Price |

Enter a percentage to compare a purchase option as a percentage of expected asset fair value at end of the lease. The default value is 0. |

Recognize Capitalized Assets as Finance Under IFRS |

Select this option to identify leases within the selected business unit as IFRS. Note: You can chose only one leasing guidance for the selected business unit—FASB, GASB, or IFRS. If you do not select either the IFRS or GASB option on this page, the selected business unit uses FASB standards. |

Recognize Capitalized Assets as Finance Under GASB |

Select this option to identify leases within the selected business unit as GASB. Note: You can chose only one leasing guidance for the selected business unit—FASB, GASB, or IFRS. If you do not select either the IFRS or GASB option on this page, the selected business unit uses FASB standards. |

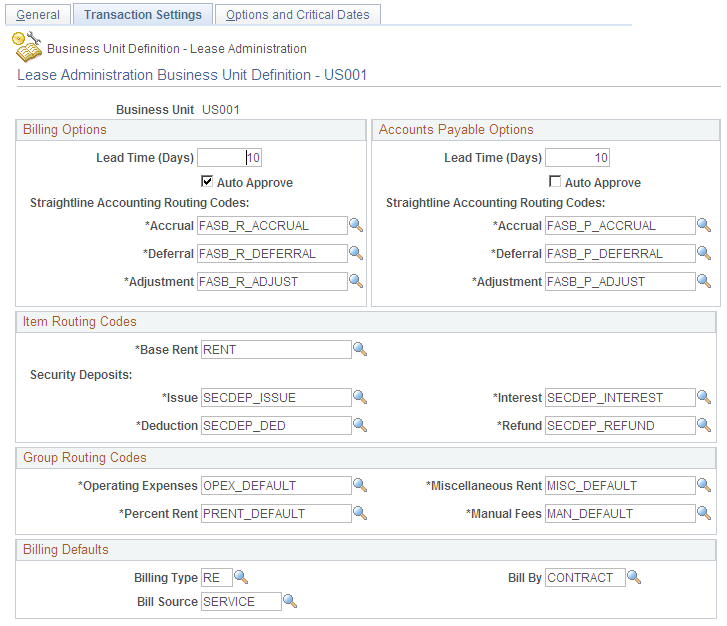

Use the Lease Administration Business Unit Definition - Transaction Settings page (RE_BU_CFG2) to define transaction processing options, such as processing lead time and default transaction routing codes.

Navigation:

This example illustrates the fields and controls on the Lease Administration Business Unit Definition - Transaction Settings page. You can find definitions for the fields and controls later on this page.

Billing Options

Field or Control |

Description |

|---|---|

Lead Time (Days) |

Specify the billing default transaction lead time for automatically generated transactions for this lease administration business unit. The date specified determines the number of days before the billing date that you want the automatically generate process to occur. If the invoice due date is the end of the month and it takes your organization approximately 10 days to process the invoice, then set the lead time to 10. This setting is used to compensate for processing times needed for invoices to reach the tenant before the due date. Then, on each lease, the Transaction Generator picks up any recurring transactions based on the lease due date, less the lead time established here. Each recurring rent page includes an Anticipated Process Date field, which takes this setting into account. |

Auto Approve |

Select to automatically approve transactions in the transaction queue. The system sets the transactions to Pending status if nothing is selected. You need to approve each transaction before the transactions can be processed. |

Billing Options - Straightline Accounting Routing Codes

Field or Control |

Description |

|---|---|

Accrual |

Enter the transaction routing code for the system to use as a default for straightline accruals in this lease administration business unit. The routing code for accruals determines the processing for receivables lease transactions in the general ledger. |

Deferral |

Enter the transaction routing code for the system to use as a default for straightline deferrals in this lease administration business unit. The routing code for deferrals determines the processing of receivables lease transactions in the general ledger. |

Adjustment |

Enter the transaction routing code for the system to use as a default for straightline adjustments in this lease administration business unit. The routing code for adjustments determines the processing of receivables lease transactions in the general ledger. |

Accounts Payable Options

Field or Control |

Description |

|---|---|

Lead Time (Days) |

Specify the payables default transaction lead time for auto-generated transactions for this lease administration business unit. The date specified determines the number of days prior to the due date that you want the auto-generate process to occur. If the due date is the end of the month and it takes your organization approximately 10 days to process (from vouchering to mailing), then set the lead time to 10. This setting is used to compensate for processing times needed to ensure that a payment reaches the landlord by the due date. Then, on each lease, the Transaction Generator picks up any recurring transactions based on the lease due date, less the lead time established here. Each recurring rent page includes an Anticipated Process Datefield, which takes this setting into account. |

Field or Control |

Description |

|---|---|

Auto Approve |

Select to automatically approve transactions in the transaction queue. The system sets the transactions to Pending status if nothing is selected. You need to approve each transaction before the transactions can be processed. |

Accounts Payable Options - Straightline Accounting Routing Codes

Field or Control |

Description |

|---|---|

Accrual |

Enter the transaction routing code for the system to use as a default for straightline accruals in this lease administration business unit. The routing code for accruals determines the processing for payables lease transactions in the general ledger. |

Deferral |

Enter the transaction routing code for the system to use as a default for straightline deferrals in this lease administration business unit. The routing code for deferrals determines the processing of payables lease transactions in the general ledger. |

Adjustment |

Enter the transaction routing code for the system to use as a default for straightline adjustments in this lease administration business unit. The routing code for adjustments determines the processing of payables lease transactions in the general ledger. |

Item Routing Codes

Field or Control |

Description |

|---|---|

Base Rent |

Select the routing code for base rent transactions for this lease administration business unit. All rent transactions generated for this lease administration business unit use this routing code to generate entries that are interfaced into the general ledger. |

Security Deposit

Field or Control |

Description |

|---|---|

Issue |

Enter the routing code to be used for standard security deposit transactions. |

Deduction |

Select the routing code for security deposit deductions. Security deposit deduction transactions that you create use this default to generate entries that are interfaced into the general ledger. Deductions are used only in the security deposit refund process. Any deductions for damages also use this code. |

Interest |

Select the routing code for security deposit interest. Security deposit transactions that you create use this routing code to generate entries that are interfaced into the general ledger. Interest is used only in the security deposit refund process. Any interest earned on security deposits held use this code. |

Refund |

Select the routing code for security deposit refunds. Security deposit refund transactions that you create use this default to determine processing in the general ledger. Refund is used only in the security deposit refund process to reverse the initial issue amount. |

Group Routing Codes

The Lease Administration application uses transaction groups to link certain classes of transaction. The transaction groups—Operating Expense, Percentage Rent, Manual Fees and Miscellaneous Rent are collections of transaction categories. The Group Routing Codes field enables you to define the default routing code for each transaction group if you elect not to specify a routing code at the transaction category level. For example, let's say that you have defined an Operating Expense category called Garbage Removal and you choose not to provide a specific routing code for Garbage Removal. When an Operating Expense transaction is generated for Garbage Removal, the transaction generator attempts to locate the category's routing code. Since the routing code is not specified at the category level, the transaction generator looks for a routing code specified at the transaction group level, and the system picks up the default routing code for Operating Expenses.

Note: Transaction Group default routing codes are all required fields. A transaction cannot be processed unless a routing code exists and the transaction group is the top level of the defaulting chain.

Field or Control |

Description |

|---|---|

Operating Expense |

Select the default routing code for all operating expenses. The system provides this routing code by default when a specific routing code is not defined for an operating expense. |

Percent Rent |

Select the default routing code for all percent rent transactions. The system provides this routing code by default when a specific percent rent routing code is not defined for percent rent transactions. |

Miscellaneous Rent |

Select the default routing code for all miscellaneous rent. The system provides this routing code by default when a specific routing code is not defined for miscellaneous rent transactions. |

Manual Fees |

Select the default routing code for all manual fees. The system provides this routing code by default when a specific routing code is not defined for manual fee transactions. |

Billing Defaults

Field or Control |

Description |

|---|---|

Bill Type |

Select a default bill type for leases created under this lease administration business unit. The bill type represents a category of activity being billed. This is prompted from Billing Setup. This is not a required field in RE BU setup. If this is left blank, this will be defaulted from the Contracts BU setup. If this is null for that BU in Contracts also this will raise an error on Lease Activation. |

Bill Source |

Select the default billing source. The billing source is used to identify where the billing activity came from and to then associate default billing information with that billing activity. This is prompted from Billing Setup. This is not a required field in RE BU setup. If this is left blank, this will be defaulted from the Contracts BU setup. If this is null for that BU in Contracts also this will raise an error on Lease Activation. |

Bill By |

Select a default bill by for leases created under this lease administration business unit. The Bill By field enables you to group bill lines on invoices. This is prompted from Billing Setup. This is not a required field in RE BU setup. This can be blank in the Contracts side also. |

Access the Lease Administration Business Unit Definition - Options and Critical Dates page (Set Up Financials/Supply Chain, Business Unit Related, Lease Administration, LA Business Unit Definition, Options and Critical Dates)

This example illustrates the fields and controls on the Lease Administration Business Unit Definition - Options and Critical Dates page. You can find definitions for the fields and controls later on this page.

The options setup here will be defaulted onto the lease. Users can add additional lease-level critical dates to the lease that are in addition to the business unit defined defaults.