Performing Operating Expense Audits for a Payables Lease

This topic provides an overview of operating expense audits and discusses how to perform operating expense audits for a payables lease.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RE_OPEXAUDIT |

Create an operating expense worksheet to compare estimated operating expense payments against actual expenses. |

|

|

Accounting Distributions Page |

RE_LS_OPEX_CTG |

Enter accounting distributions for the audit. |

|

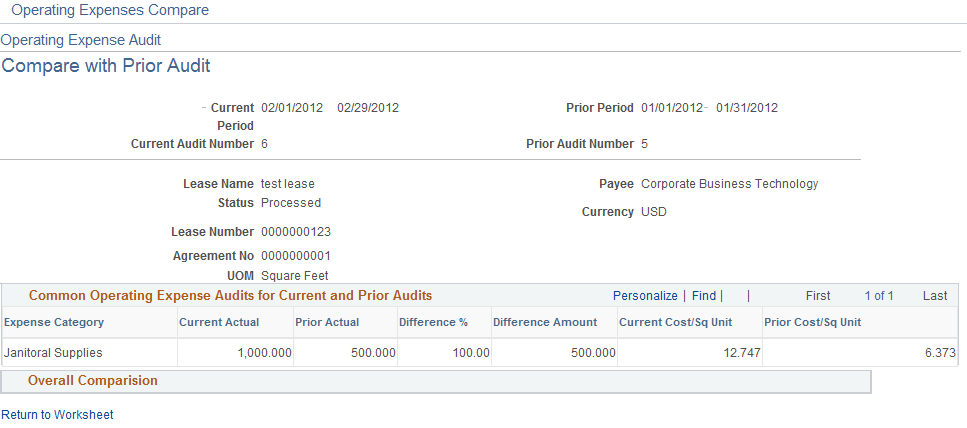

Audit Operating Expenses - Compare Operating Expenses with Previous Audit Page |

RE_OPEXAUDIT_CMP |

Displays the current audit data and prior audit data, if available. You can use this comparison data to ensure continuity in operating expense charges from year to year. |

The PeopleSoft Lease Administration system provides you with the ability to reconcile annual operating expenses or CAM against your estimated payments. When the landlord sends the annual CAM reconciliation statement with any invoice or credit against the estimated payments that you have made, you can compare the information against your records of estimated payments, as well as the CAM charges from the previous year. If the charges significantly increase or decrease or the data that is provided by the landlord is insufficient, you can initiate a formal CAM audit.

You can use the Audit Operating Expenses - Operating Expense Audit page to enter the values from the reconciliation statement for each expense category. The system automatically calculates the amounts that you paid to the payee, which includes all of the recurring amounts and the audit adjustment amounts. To calculate the paid amount, the system uses only processed transactions from the transaction queue. You can enter manual adjustments the final total for each expense category. The system compares the data that you entered against the data that is stored in the lease and flags any value that exceeds a certain tolerance threshold.

Note: You set up the tolerance threshold at implementation in the lease administration business unit.

After you have reviewed and compared the data in the worksheet and are satisfied with the final calculated numbers, you can issue a payment for any underpayments. If an overpayment occurs, you can create a negative payables line and apply it to any future payments, or, the landlord can issue a refund check or credit.

Before you can perform an operating expense audit, the lease that you are auditing must be in active, expired, or holdover state. You must also enter operating expenses terms against the lease.

Use the Audit Operating Expenses - Operating Expense Audit page (RE_OPEXAUDIT) to create an operating expense worksheet to compare estimated operating expense payments against actual expenses.

Navigation:

This example illustrates the fields and controls on the Audit Operating Expenses - Operating Expense Audit page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

Displays the lease administration business unit selected on the search page. |

Lease Number |

Displays the lease number selected on the search page. |

Currency |

Displays the currency of the lease. |

Lease Name |

Displays the lease name. |

Agreement No (agreement number) |

Displays the agreement number for the lease operating expense. |

Audit Number |

Displays the sequential number that is assigned to this audit. |

Status |

Displays the audit status. |

Landlord |

Displays the landlord for this lease. |

From Date |

Enter the date on which you want the audit period to begin. This date must occur after the lease start date and cannot be later than one day after the To Datefrom the previous audit. The system sets the From Date to one day later than the previous audit by default. For first audit period the system uses the lease commencement date by default. |

To Date |

Enter the date on which you want the audit period to end. This date must occur after the from date and cannot be later than the current date. |

UOM (unit of measure) |

Displays the unit of measure of this lease. |

Received Date |

Enter the expense audit creation date. |

Audit Window |

Enter the audit time required. You have the option to specify the time in Days, Weeks, Months or Years. |

Deadline Date |

Select a date for the audit deadline. The date will be automatically updated if you enter the time in the Audit Window field. |

Revision |

Displays the revision number for this audit. |

Accounting Distributions |

Select this link to access the Accounting Distributions page. |

Opex Audit Status |

Enter the user defined status. You can define the audit status in the Opex Audit Status page. You can edit the status regardless of the overall audit status. |

Update Audit |

Click to update this audit. The system compares the actual charges in the current audit with the charges for the operating expense categories in the previous audit and creates and invoice for the balance amount. You can update an audit only after all of the audit transactions have been processed. This field appears only for processed audits. |

Prorata Basis

Prorata details group box will not be available for the user if:

Fixed percentage method is used for sharing expenses.

Prorata share is not used to calculate tenant's share.

Field or Control |

Description |

|---|---|

Prorata Share Method |

Displays the prorata share method for this operating expense. |

Gross Up Percentage |

Displays the gross up percentage for this operating expense. |

Gross Up Method |

Displays the gross up percentage for this operating expense. |

Calculate Prorata Basis |

Click this button to calculate the prorata basis. |

Prorata Basis |

Displays the prorata basis selected for this operating expense. |

Tenant Area |

Enter the area this tenant occupies. |

Rentable Area |

Enter the total rental area available. |

Occupied Area |

Enter the total area occupied. |

Occupancy Percentage |

Displays the percentage of area this tenant occupies. |

Prorata Share |

Displays the percentage of the total area that you are occupying. The system displays the value from the lease. The field is informational only. The system does not use the field for any calculations. |

Expense Details

Field or Control |

Description |

|---|---|

Admin Fee Percentage (Administration Fee Percentage) |

Displays the administration fee percentage. |

Base Year |

Displays the base year entered on the lease. |

Base Year Adjustment |

Displays the base year adjustment entered on the lease. |

Add Category |

Click this button to create a new operating expense category for the lease. This button appears only for pending audits. |

Base Year Gross Up |

Displays the base year gross up entered on the lease. |

Category |

Select the expense category. Operating expense categories that are in a processed state will be retrieved from the Transaction Queue for the given lease and payee. |

Actual Amount |

Enter the actual amount for this expense category. |

Previous Period |

Displays the amount for the previous period if available. |

Change |

Displays the change in amounts from the previous period. |

Caps |

Select this check box to indicate if caps are applied to this category. |

Fee |

Select this check box to indicate if administration fees apply to this category. |

Gross Up |

Select this check box to indicate if gross up applies to this category. |

Overall Expense

Field or Control |

Description |

|---|---|

Grossed Up Expense |

Enter the grossed up expense for this expense category. |

Admin Fee (administration fee) |

Enter any administration fees applied to this category. |

Anchor Contribution |

The anchor contribution defaults from the lease, the user can override the value here. |

Adjusted Expense |

Enter the adjusted expense for this category. |

Minimum |

Enter the minimum for this category. |

Maximum |

Enter the maximum for this category. |

Sharable Expense |

The system calculates this value. This is the expense which needs to be shared based on the prorata share of the tenant. |

Tenant Share

Field or Control |

Description |

|---|---|

Prorata Share |

Displays the prorata share calculated using the values entered. |

Occupancy Percent (occupancy percentage) |

Enter the occupancy percentage for this category. The default is 100 percent. |

Tenant Share |

Displays the tenant share calculated based on the sharable expense, prorata share, and the occupancy percentage entered. |

Paid Amount |

Displays the amount paid to the landlord. |

Prorated Manual Adjustment |

Displays the final manual adjustment value prorated for each expense category lines. |

Amount Due |

Displays the amount due to the landlord. |

Sales/Use Tax |

Click this link to access the Sales/Use Tax Information page. For additional information on Sales/Use Tax Information page, refer Defining Lease Financial Terms |

VAT |

Click this link to access the VAT Information page. This field appears only for VAT enabled business units. For additional information on VAT Information page, refer Defining Lease Financial Terms |

Operating Expense Categories

The system automatically populates the Operating Expense Categories grid with the operating expense categories that are associated with the lease and payee on which you are performing the audit.

Operating Expense Categories in the processed state will be retrieved from the Transaction Queue for the given Lease and Payee.

Field or Control |

Description |

|---|---|

Calculate |

Click the button to calculate the total lines that were entered. When you click the button, the system calculates the difference between the paid amount and the actual amounts and displays the totals and the adjustments. |

Total Paid To Landlord |

Displays the total operating expenses that were paid to the landlord. The system adds all of the amounts in the Paid Amount column. |

Total Adjusted Actual Amount |

Displays the total amount of the operating expenses that should have been paid to the landlord or payee. The system adds all of the amounts in the Actual Amount column. |

Total Manual Adjustment |

Displays the total amount of the manual adjustments. The system adds all of the amounts in the Adjust Amount column. |

Total Administration Fee |

Displays the total administration fee. The system adds all of the amounts in the Admin Fee column. |

Final Manual Adjustment |

Enter the amount for the final manual adjustments. You can edit the amount when the worksheet status is in pending status and negative values are accepted. |

Total Amount Due |

Displays the amount that you owe the landlord or payee. The system uses this formula to calculate the amount: Amount Owed = Total Adjusted Actual Amount + Total Manual Adjustment + Total Administration Fee − Total Paid To Landlord. |

Create Payment |

Click to create a payment for underpayment of the operating expenses for the year. When you click this button, the system sends the transaction to the transaction queue for payment processing. |

Compare Previous Audit |

Click to select the previous audit for comparison, if it exists. The system bases the comparison on the audit end dates. The previous audit is the one with an audit end date less the current audit end dates. The system retrieves the two audits and displays them side-by-side. The system flags category differences from year-to-year and identifies massive increases or charges that are above the maximum that is allowed. If the system cannot find a category match, it separates those categories that are not available for comparison. |

Use the Audit Operating Expenses - Compare Operating Expenses with Prior Audit page (RE_OPEXAUDIT_CMP) to displays the current audit data and prior audit data, if available.

You can use this comparison data to ensure continuity in operating expense charges from year to year.

Navigation:

Click the Compare Previous Audit link.

This example illustrates the fields and controls on the Audit Operating Expenses - Compare Operating Expenses with Previous Audit page. You can find definitions for the fields and controls later on this page.

This page enables to you compare and audit operating expenses against previous audit data, if it exists. The system retrieves the two audits and displays them side-by-side. The system flags category differences from year-to-year and identifies massive increases or charges that are above the maximum that is allowed. If the system cannot find a category match, it separates those categories that are not available for comparison.

Field or Control |

Description |

|---|---|

Current Period |

Displays the date range for this audit period. |

Prior Period |

Displays the date range for the prior audit period that you are comparing. |

Common Operating Expense Audits for Current and Prior Audits

Field or Control |

Description |

|---|---|

Current Actual |

Displays the current actual amount that you entered based on the reconciliation statement. |

Prior Actual |

Displays the previous audit actual amount. |

Difference % (difference percentage) |

Displays the percentage difference between the current actual amount and the prior actual amount. ((Current Actual - Prior Actual) ÷ Prior Actual). |

Diff Amt (difference amount) |

Displays the difference amount. (Current Actual - Prior Actual). |

Current Cost/Sq Unit (current cost per square unit) |

Displays the current cost per square unit.(Current Cost ÷ Sq Unit = Adjusted Actual Amount ÷ Total Rentable Area). |

Prior Cost/Sq Unit (prior cost per square unit) |

Displays the prior cost per square unit. (Prior Cost/Sq Unit = Prior Actual Amount ÷ Prior Total Rentable Area). |

Unmatched Categories

When the system cannot match up one or more categories from a previous audit with the categories from the current audit, the system displays the discrepancies in the Unmatched Categories grid. This occurs when you create a new category or an existing category from a previous audit does not exist, or if you change the category in the middle of the year. As a result, the system is unable to provide any comparisons for these categories because there is no exact match.

Calculated Total for Current and Prior Audits

Field or Control |

Description |

|---|---|

Current Actual |

Displays the total amount that you paid to the payee. This amount might differ from the reconciliation statement that is provided by the landlord. The current actual amount paid is based on an estimate that is provided to you at the beginning of the lease. |

Prior Actual |

Displays the total amount that you paid to the payee in the prior period. |

Diff Amt (difference amount) |

Displays the difference between the prior actual amount and the current actual amount. |

Current Payor Actuals |

Displays the current total amount that is paid by the payor. |

Payors Actuals Difference |

Displays the total amount that the payor paid in the prior audit. |

Current Rentable Area |

Displays the current total rentable area in the lease. |

Prior Rentable Area |

Displays the total rentable area in the prior audit. |

Rentable Area Difference |

Displays the difference between the current and prior rentable area in the lease. |

Current Cost Per Sq Unit (current cost per square unit) |

Displays the total current cost per square unit. |

Prior Cost/SQ Unit (prior cost per square unit) |

Displays the total prior cost per square unit. |

Cost/SQ Unit Difference (cost per square unit difference) |

Displays the difference of the total cost per square unit between the current period and the prior periods. |