Configuring Bank Reconciliation

This topic discusses how to configure bank reconciliation, including setting up reconciliation record source types, reconciliation rules, and reconciliation tolerances.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RCN_RECORD_PNL |

Set up the record source types. |

|

|

RCN_DEFINE_EFLD_PL |

Create aliases for field names to make field names easier to identify in setup pages. |

|

|

RCN_STATUS_PNL |

View system-defined statuses that are applied during the auto-reconciliation process. |

|

|

BANK_RECON_RULE |

Define reconciliation rules for an individual transaction source. Set up aggregate criteria, match criteria, and filter criteria for statement lines and transactions. |

|

|

RCN_CREATE_SQL |

Run Reconciliation Rules SQL processing for an individual source and the specified rule within the source. |

|

|

BANK_PNLRECON |

Select a method of reconciliation to use for each external account. Specify reconciliation sources to be used by semi-manual reconciliation. |

|

|

BANK_RECON_TOL |

Define day or monetary reconciliation tolerances to associate with a reconciliation rule. |

|

|

BANK_ACCT_RCN_RULE |

Assign reconciliation rules by source to a bank and bank account. The Automatic Bank Reconciliation process (BNK_RECON) uses these rules to reconcile bank statement lines with transaction lines. |

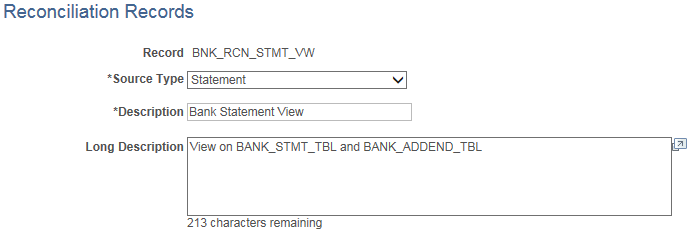

Use the Reconciliation Records page (RCN_RECORD_PNL) to set up the sources of information that will be the foundation of the reconciliation process.

Using this page, you create or map the source records of your reconciliation process. You can map to items in PeopleSoft applications, such as Payables and Receivables, or to third-party information sources.

Navigation:

This example illustrates the fields and controls on the Reconciliation Records page.

Field or Control |

Description |

|---|---|

Record |

Select from the following records delivered for and used by automatic reconciliation:

|

Source Type |

Select either Statement (bank statement side) or Transaction (system transaction side) for the reconciliation record. |

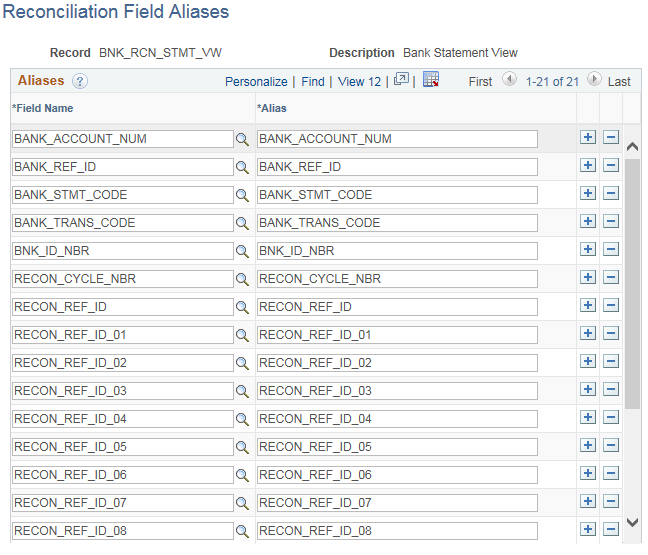

Use the Reconciliation Field Aliases page (RCN_DEFINE_EFLD_PL) to create aliases for field names to make field names easier to identify in setup pages.

Navigation:

This example illustrates the fields and controls on the Reconciliation Field Aliases page.

The selected reconciliation record determines which field names you can access on the Reconciliation Rules page.

Field or Control |

Description |

|---|---|

Field Name |

Enter the field name in the record. |

Alias |

Enter an alternate name from the field name to use when defining reconciliation rules. |

Use the Reconciliation Status Codes page (RCN_STATUS_PNL) to view system-defined statuses that are applied during the auto-reconciliation process.

If you want to add additional exception status values and generate exceptions with those status values, a system administrator must customize the Bank Reconciliation program.

Navigation:

This example illustrates the fields and controls on the Reconciliation Status Codes page.

This list shows the delivered reconciliation exceptions generated for each reconciliation source:

|

Reconciliation Source |

Exception Status |

|---|---|

|

External Transactions |

Amount Tolerance, Date Tolerance, Type Tolerance |

|

Payables |

Alignment Tolerance, Amount Tolerance, Date Tolerance, Duplicate Tolerance, Overflow Tolerance, Type Tolerance |

|

Receivables Debits |

Amount Tolerance, Date Tolerance, Duplicate Tolerance |

|

Receivables Deposits |

Amount Tolerance, Date Tolerance |

|

Receivables Drafts |

Amount Tolerance, Date Tolerance, Duplicate Tolerance |

|

Receivables Payments |

Amount Tolerance, Date Tolerance, Duplicate Tolerance |

|

Treasury |

Amount Tolerance, Date Tolerance, Type Tolerance |

Use the Reconciliation Rules page (BANK_RECON_RULE) to define reconciliation rules for an individual transaction source. Set up aggregate criteria, match criteria, and filter criteria for statement lines and transactions.

Navigation:

This example illustrates the fields and controls on the Reconciliation Rules page.

Field or Control |

Description |

|---|---|

Source |

Bank reconciliation supports rules for these sources:

|

Recon Type |

Select from the following reconciliation types:

|

Rule ID |

Enter the rule ID. |

Rule Alias |

Enter a rule name. |

Description |

Enter a description of the rule. |

Reconciliation Criteria

Field or Control |

Description |

|---|---|

Group Statement Lines |

Enter aggregate criteria for statement lines. Do not include the amount field. When one statement line should be matched with one or more transaction lines (One to One or One to Many), group statement lines by Bank ID Number, Bank Account Number, Statement ID (Recon Cycle Number), Record Sequence Number, and Value Date. Add additional grouping criteria as needed. When multiple statement lines should be summed up to match with one or more transaction lines (Many to One or Many to Many), group statement lines by Bank ID Number, Bank Account Number, Statement ID (Recon Cycle Number), and Value Date. Add additional grouping criteria as needed. |

Group Transactions Lines |

Enter aggregate criteria for transaction lines. Do not include the amount field. The transaction field alias varies by reconciliation source. When one transaction line should be matched with one or more statement lines (One to One or One to Many), group transaction lines by key fields, bank information, and transaction date. Use the following grouping criteria for each source:

Add additional grouping criteria for each source as needed. |

Match Criteria |

Enter match criteria. Only match using criteria that have been used to group statement lines and transaction lines. For all rules, match on Bank ID Number, Bank Account Number, and Date. Add additional match criteria for each rule as needed. |

Filter Criteria |

Click this link to access the Filter Criteria page (BANK_RCN_FLT_SP), where you can add statement filter criteria and transaction filter criteria. |

|

Attachments |

Click to view/ add attachments. See Installation Options - Multiple Attachments Page to define the maximum attachment upload limit for various products. |

You can run the BANK_RECON_RULES query to view all configured bank reconciliation rules.

The query provides the following information for each rule:

Source Name

Reconciliation Type

Rule ID

Rule Alias

Description

Statement Group

Statement Filter

Transaction Group

Transaction Filter

Match Criteria

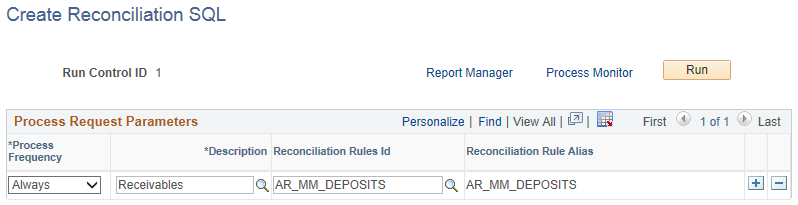

Use the Create Reconciliation SQL page (RCN_CREATE_SQL) to run Reconciliation Rules SQL processing for an individual source and the specified rule within the source.

Run the RCNCREATESQL process each time a new reconciliation rule with filter criteria is added to a source or filter criteria are added or modified for a rule.

Navigation:

This example illustrates the fields and controls on the Create Reconciliation SQL page.

Bank Reconciliation processing (RCNCREATESQL) evaluates the source and reconciliation rules to build the filter SQL, and stores the SQL.

Use the External Accounts - Reconciliation page (BANK_PNLRECON) to select a method of reconciliation to use for each external account. Specify reconciliation sources to be used by semi-manual reconciliation.

Note: Reconciliation sources specified on the External Accounts - Reconciliation page are not used by the Automated Reconciliation process.

Before establishing reconciliation rules for bank accounts, you must set up the bank accounts.

Navigation:

This example illustrates the fields and controls on the External Accounts - Reconciliation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Recon Method (reconciliation method) |

Select the method to use for reconciling transactions for this account. Automatic: Matches bank transactions to system transactions automatically. You must receive transaction information from your bank in an electronic format or enter your bank statements online to use this option. Manual: You must use manual reconciliation when you have only printed bank statements. With this option, you view only the system transactions online and match them to those in your printed bank statement. None: Use this option when reconciliation processing is not necessary. Semi Manual: Use this option to compare system transactions and bank transactions online and match them manually. |

Notification Method |

Select a notification method for bank reconciliation exceptions. The reconciliation method must be Automatic to select a notification method. If the reconciliation method is Manual, None, or Semi Manual, the notification method is No Workflow. If the reconciliation method is Automatic, you can choose from these options:

|

Enforce Bank Statement Edits |

Selecting this option affects bank statement entry by:

|

Reconciliation Sources

The source types that you select determine which system data (reconciled against the bank statement) appear on the different reconciliation pages (Semi Manual Reconciliation page and Manual Reconciliation page).

Field or Control |

Description |

|---|---|

Source Type |

Defines the process type to take place. Assign Recon Process to all rows for semi-manual and manual reconciliation. |

Source Seq (source sequence number) |

Specify a number to order the processing of the source types. The first row contains the lowest number and executes first, and the last row has the highest number. |

Recon Rule (reconciliation rule) |

Identifies the reconciliation rule used for reconciling the reconciliation sources. PeopleSoft delivers seven rules: PS_BNK_RCN_DEALS - Treasury Cash Flow Rules. PS_BNK_RCN_DEBIT - Receivables Direct Debit Rules. PS_BNK_RCN_DEPOSIT - Receivables Deposit Rules. PS_BNK_RCN_DISBRSE - Payables Disbursement Rules. PS_BNK_RCN_DRAFT - Receivables Draft Rules. PS_BNK_RCN_PAYMENT - Receivables Payment Rules. PS_BNK_RCN_TRAN - External Transaction Rules. Note: For receivables, reconcile either Deposits or Payments, not both. Ensure that both the External Accounts - Reconciliation page and the Bank Account Reconciliation Rules page are configured to reconcile the same source. If you choose Deposits on the Bank Account Reconciliation Rules page, then also choose Deposits on External Accounts - Reconciliation page. Semi-manual reconciliation displays Deposits or Payments on the transaction grid based on the configuration on External Accounts - Reconciliation page. If you use your own rules, the system administrator should make appropriate code changes. |

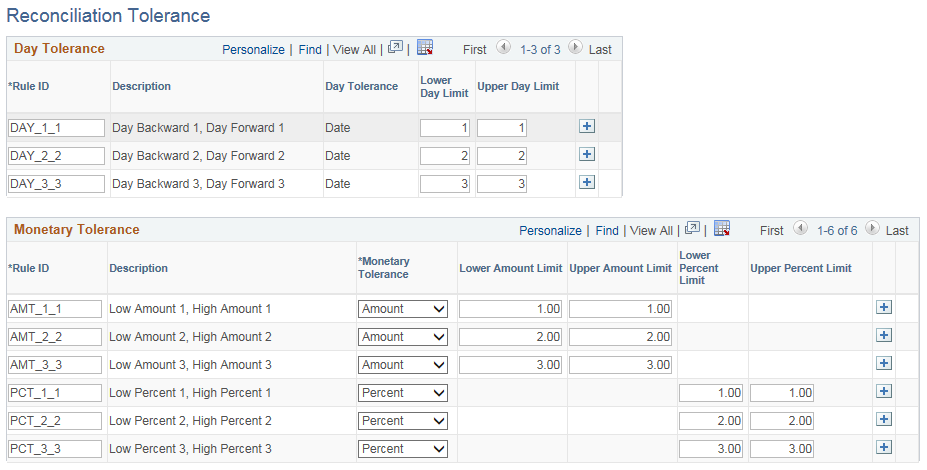

Use the Reconciliation Tolerance page (BANK_RECON_TOL) to define day or monetary reconciliation tolerances to associate with a reconciliation rule.

For monetary tolerances, the tolerance type can be an amount or percent.

Associate tolerances defined on this page with a reconciliation rule on the Bank Account Reconciliation Rules page.

Navigation:

This example illustrates the fields and controls on the Reconciliation Tolerance page.

When you select Day Tolerance, enter the following values:

Rule ID

Day Tolerance

Lower Day Limit and Upper Day Limit

When you select Monetary Tolerance, enter the following values:

Rule ID

Monetary Tolerance - Select from Amount or Percent.

Lower Amount Limit and Upper Amount Limit

or

Lower Percent Limit and Upper Percent Limit

Some reconciliation tolerances are delivered as system-defined tolerances, and these cannot be deleted.

Reconciling Multiple Currencies

To work with reconciliation situations in which you handle more than one currency, you can define tolerance amounts to reconcile transactions within the set tolerance. The automatic Bank Reconciliation process (BNK_RECON) converts system-side transactions to the bank account default currency as defined on the External Accounts page. Processing reconciles the bank statement line with the transaction line where there is a difference in exchange rate between the rate used by system and the rate used by bank, provided the difference is within the amount tolerance limits.

The system uses the decimal positions definition for the currency code to determine how to round amounts, and creates an external transaction for the tolerance exceptions. The delivered reference ID for tolerance exceptions is bank statement processing (BSP) plus a sequential number (this is in the auto-numbering definition). The external transactions for tolerance exceptions show up in semi-manual reconciliation; however, if amounts are not the same between bank statement line and transaction line, you cannot reconcile them on the Semi Manual Reconciliation page. If the difference in the exchange rate between the rate used by the system and the rate used by the bank is outside the amount tolerance limits, the system changes the statement line status to Amount Exception (AMT) provided the other criteria match. To reconcile transactions with an amount exception status, you must either enter an adjustment entry to match the amount in question or increase the amount tolerance for the next automated reconciliation run.

For Receivables Deposits, Receivables Payments, and Payables, you can leverage the Rate option to convert transaction amounts to the default bank account currency using the exchange rate on the transaction table.

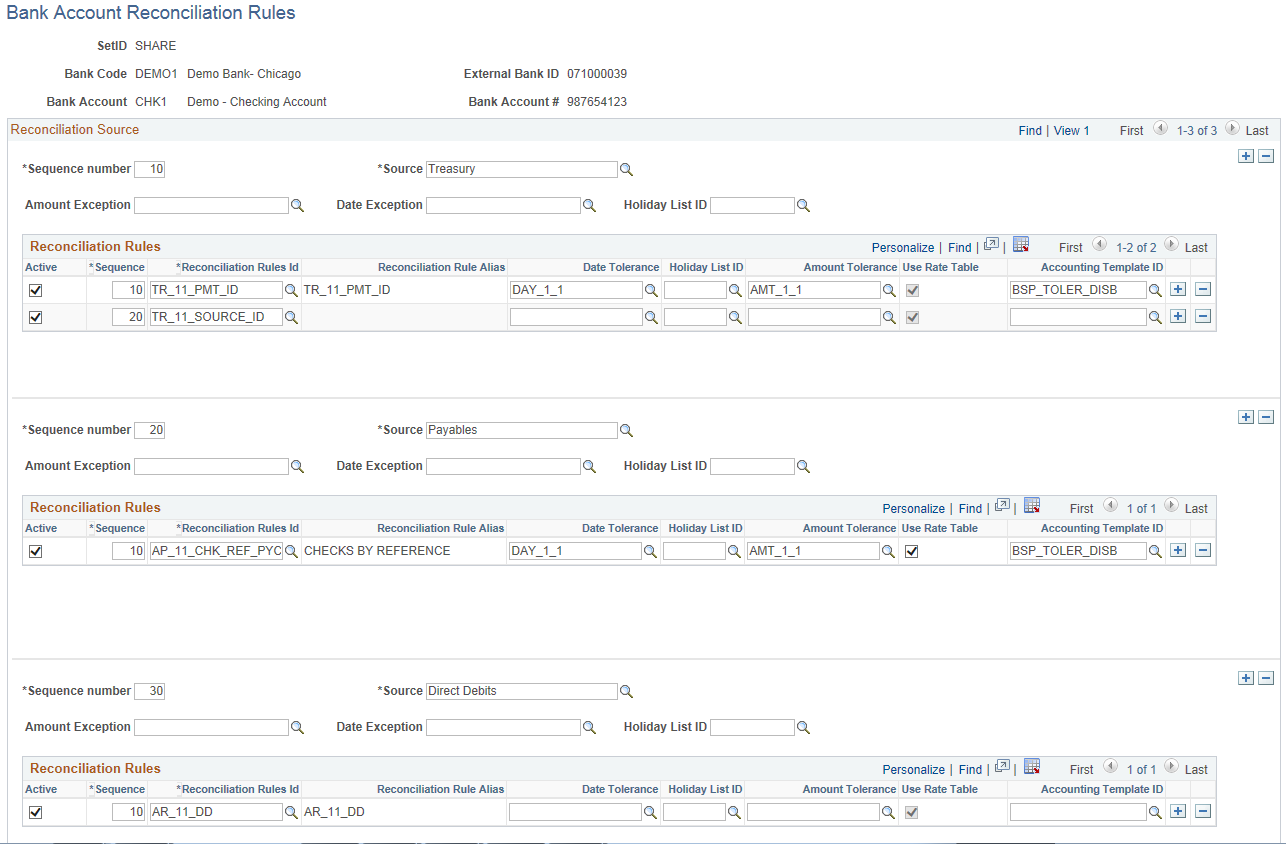

Use the Bank Account Reconciliation Rules page (BANK_ACCT_RCN_RULE) to assign reconciliation rules by source to a bank and bank account. The Automatic Bank Reconciliation process (BNK_RECON) uses these rules to reconcile bank statement lines with transaction lines.

After setting up reconciliation rules and running the Reconciliation Rules SQL process, you can attach the bank reconciliation rules to a bank and bank account.

Navigation:

This example illustrates the fields and controls on the Bank Account Reconciliation Rules page.

For each bank and bank account, assign the reconciliation source and assign reconciliation rules associated with the source. For example, for one bank account, you do the following:

Select a source and identify a sequence number.

Enter date and amount exceptions for the bank account reconciliation rule, and a holiday list ID, if desired.

Add reconciliation rules, including the reconciliation rules ID, a date or amount tolerance, and an accounting template ID.

Note: When the amount on the bank statement line is different from the amount on the source transaction, reconciliation process checks if the difference is within the acceptable amount tolerance limits associated to the reconciliation rule. If the difference is within the acceptable amount tolerance limits, reconciliation process creates an external transaction for the difference that is stamped with the accounting template ID associated to the reconciliation rule.

Use the Add a New Row button to select another source and corresponding reconciliation rules for the bank account.

Deselect the Use Rate Table check box to use the exchange rate at the transaction level. This option is available only for these reconciliation sources: Payables, Deposits, and Receivables Payments. For other sources, this option is display-only and the market rate table is used by default.

Note: When assigning the reconciliation source for a bank and bank account, you can configure either Receivable Deposits or Receivable Payments, not both at the same time.