Generating VAT Reports

To generate VAT reports, use the VAT Report Definition component (VAT_RPT_ID1), the VAT Return XML Data (AUS) component (VAT_XML_NODE), and the VAT Transaction Report component (LC_RPT_SETUP_GBL).

This section provides an overview of VAT reports, lists prerequisites and lists common elements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VAT_RPT_ID1 |

Create or update a VAT report definition by defining the lines to be included in the VAT report. |

|

|

Line Criteria Page |

VAT_RPT_ID2 |

Define the fields to use as the selection criteria for each line that you defined on the VAT Report Definition page. |

|

LC_RPT_SETUP |

Set up for the VAT transaction report that provides details of the amounts making up the totals on VAT returns for use in audits and for the justification of the accumulated amounts that are reported on VAT returns. |

|

|

VAT_XML_NODE_ENTRY |

(AUS) Maintain XML metadata for the electronic Business Activity Statement (e-BAS). If the Australian Tax Office (ATO) changes the e-BAS, use this page to update the format. |

|

|

XML Node Detail Page |

VAT_XML_NODE_SEC |

(AUS) View or update metadata details for the e-BAS report. |

|

VAT_RPT_RQST |

Generate the VAT Report Extract process (VAT1001) to extract specific VAT transactions to the VAT reporting tables in preparation for printing VAT reports. |

|

|

VAT_RPT_INST1 |

Generate reports to use in producing and reconciling your VAT return, including the VAT Transaction report for line item detail. |

|

|

VAT Reports - Detail Page |

VAT_RPT_INST_DTL |

View information about a report instance, including the run parameters and reporting history. |

|

RUN_VAT2000 |

Generate the VAT Reconciliation report (VAT2000) to help in the reconciliation of your VAT accounts and for tax auditing purposes. |

|

|

RUN_VAT2000_EXT |

Create VAT audit file extracts containing VAT transaction information to use for tax auditing purposes. |

|

|

VAT_RPTG_RQST2 |

(AUS) Run the electronic return for the e-BAS (electronic Business Activity Statement ) (VAT0650). After you generate a final VAT report, run this process to create a flat file for transmission. |

|

|

VAT_REGISTER_RQST |

(ITA) Generate Italian sales and purchases VAT registers. Available as a VATX0910 BI Publisher report. |

So that you can comply with government regulations, PeopleSoft software provides VAT reports for you to use in the preparation of your VAT returns.

PeopleSoft software delivers:

Predefined VAT returns for Australia, Belgium, Canada, France, Germany, Italy, Luxembourg, Spain, the Netherlands, Switzerland, and the UK.

Before generating these reports in your system, you must first modify the report definitions by specifying the information you want to print on each of the lines, based on the VAT codes and VAT transaction types you have defined in your system.

A VAT transaction SQR (Structured Query Report) report (VAT0150.SQR).

This report lists all VAT transactions for the selected period by customer, supplier, and other sources.

A report for the EC Sales List.

This report lists all sales made to customers in a foreign country within the EU.

UK Reverse Charge Sales List.

This report lists domestic business sales subject to domestic reverse charges, and the VAT due from the purchasers on these sales.

Standard Audit File for Tax purposes (SAF-T)

VAT reconciliation reports.

A VAT transaction BI Publisher report for details of the accumulated amount on each VAT report line.

VAT audit file extracts and reports for tax auditing purposes.

Creating and Defining VAT Return Reports

You can use any of the predefined reports or the SQR transaction report by linking each report to your VAT entity. You can also modify or write a VAT report and generate the modified report by linking it to the VAT entity.

Creating a VAT return report is a three-step process:

Create a report definition that includes the VAT codes and VAT transaction types that you created, and the system-defined VAT accounting entry types.

You must create a VAT report definition for each type of VAT report that you want to generate.

Run the VAT Report Extract process that applies your VAT report definitions to the VAT transaction data in the VAT reporting tables.

This process selects transactions from the VAT transaction table and stores VAT transaction information in the VAT reporting tables. You run the Report Extract for a specific VAT entity and country, indicating the type of report you want to produce as well as various date selection criteria. Each time you run the Report Extract process, a report instance is created. The transactions in the VAT transaction table that were selected by the Report Extract process are all linked to this report instance.

Generate and print VAT return reports for a VAT entity.

To define VAT reports:

Determine what information is required on your VAT report on a line-by-line basis.

You might start by using an empty official tax return form to determine which information to print on each line of your VAT report.

Specify, for each line on your report, a combination of values for the VAT codes, VAT transaction types, and VAT accounting entry types for the VAT report to print transactions.

Create or modify a corresponding BI Publisher, or SQR report.

Return reports that can be produced:

VAT returns

Reverse charge sales list

EC sales lists

Other

Any given VAT transaction can be selected only once to appear on a report with a return report type of VAT return and once to appear on a return report with a report type of EC Sales List. However, prior to printing these types of return reports as final reports, you can delete the report instance, enabling you to select the VAT transactions again for that report type. You can select a VAT transaction to appear on any number of return reports with a report type of Other.

When you print a return report, you select the report instance for the report that you want to produce. You have three print options:

Term |

Definition |

|---|---|

Draft |

This option enables you to print your return report for purposes of review without finalizing it. At this point, you can still delete the report instance and start over. |

Final |

Once you print a return report as final, you can no longer delete the report instance. For VAT return or EC sales list reports, the VAT transactions cannot be selected again to appear in a report with that specific report type. |

Reprint |

This option enables you to reprint a return report that has previously been printed as final. |

Understanding the VAT Transaction Report

PeopleSoft VAT functionality provides for the reporting of VAT data from ledgers and tables based on country-specific report layouts, which are referred to as VAT report definitions. These definitions are used in the preparations of the actual VAT returns. Most VAT report definitions are designed to report accumulated amounts by specific transaction types, such as sales, purchases, export, import, and domestic transactions from the VAT-related tables at various VAT rates.

The VAT Transaction report provides the details of the totals on VAT returns for use in audits and for the justification of the accumulated amounts that are reported in VAT returns. The VAT Transaction report can provide a list of all transactions accumulated for a specific line or box on a delivered VAT return if the VAT return does not have embedded logic or formulas that prevent a direct reconciliation with the related, or underlying, transactions. The VAT transaction report is built from and based on the same set of data from which the VAT return values are derived for a specific line or box on the VAT return, but instead of giving a summarized amount, it retrieves the detailed information.

Information comes from the reporting tables (VAT_RPT_INSTx), the VAT transaction table (VAT_TXN_TBL), and the VAT Cross Reference tables with source transactions (VAT_XREF_xxxx). Additionally, you can drill down to the source transaction in AP, AR, BI, GL, TR, EX, or AM. The VAT transaction report is a single generic report for all country-specific VAT returns. It uses the VAT report definition to assimilate and present the VAT return data. So any new delivered VAT returns will automatically be candidates for generation of the VAT transaction report as long as the return uses a VAT report definition.

However, some additional setup is required to allow for a relevant reconciliation between the vat return and the transaction report. The detail report depends on the VAT reporting architecture, including VAT report definitions, VAT transaction loader, VAT extract, and the VAT return run control page. The VAT Transaction Loader and VAT extract processes must be used to populate the VAT reporting tables; otherwise, the VAT transaction detail report cannot retrieve data.

If you are using an in-house, or customized, VAT reporting solution, you will not be able to use them to generate the VAT Transaction detail report.

The transaction report is based on BI Publisher technology and the output format can be either an Excel spreadsheet, html, or a pdf file.

You can use the Burst by Report Line option to produce multiple smaller output files by VAT report line item or amount rather than a large single output file, and thereby make the report more manageable. This is particularly useful if you want to produce a Microsoft Excel report, but the limit of 64,000 lines might present a problem.

Oracle provides BI Publisher functionality and delivers two XML report definition templates.

The Burst Transaction Report definition (LC_RPT_VAT_B) is provided for use by the system when you select the Burst by Report Line option and allows multiple transaction reports to be generated by individual VAT report line item.

The VAT Transaction Report definition (LC_RPT_VAT_N) is provided for use by the system when bursting is not used because the size of the report is not an issue.

Regardless of whether you use bursting, if a resulting report contains more than the maximum number of transactions specified on the run control and the output format is Excel, then the report automatically uses the default output format specified on the report definition page. However, if that default is Excel, then the system will automatically use the pdf format. When you use bursting, the limit is applied based on the number of transactions existing for a single report line. If you do not use bursting, then the limit is applied based on the number of transactions for the entire report.

You can readily change the default output format type on the report definition page; however, changing other parameters should be done advisedly because it may prevent the transaction report from being properly produced.

Some VAT returns may use complex formulas or if-then or end-if instructions to calculate amounts. Such complex algorithms are not supported by the VAT transaction report, and so this report may not be able to justify all lines for all VAT returns. In addition, if a VAT return has lines or boxes that do not have a VAT report definition line associated with them, such as lines that are just totals or have complex logic that cannot be translated into a VAT report definition line, then the lines by their very nature will not show up on the VAT transaction report.

Use the run control page (VAT_RPT_INST1) that is used to launch VAT returns to also generate the VAT Transaction report. This enables you to use the same set of data to produce the VAT Transaction report and the official VAT return at the same time.

Reporting VAT on Third-Party Vouchers

When creating a VAT report definition that includes recording VAT on third-party vouchers, confirm that the transactions are included correctly and only once.

Both the voucher lines from the original supplier invoice and the third-party voucher are loaded into the VAT transaction table. Confirm that the VAT transaction type that is specified on the third-party voucher differs from the value that the original invoice specifies. This enables you to distinguish between the two lines and to determine which one to include on any given line in the VAT return.

You can set up defaults to allow different VAT transaction types to be entered on your transactions automatically. You can do this by defining a specific set of default VAT transaction types for each third-party supplier.

Before you can generate and print reports:

If you are generating reconciliation reports and audit extracts, the following PeopleSoft applications must have generated accounting transactions: PeopleSoft Receivables, Billing, Payables, Expenses, Asset Management, Treasury, and General Ledger.

Additionally, some products must have generated accounting entries before you run the VAT Transaction Loader. Refer to the specific PeopleSoft application documentation for details on whether this is required for the particular application.

The VAT Transaction Loader process must have loaded VAT transactions into the VAT transaction table.

Field or Control |

Description |

|---|---|

Language |

Select the language for the report. |

Run |

Click to define the parameters (date, time, frequency) for generating your reports. |

Although you can create your own VAT returns and reports using the VAT Report Definition component, PeopleSoft software also delivers predefined VAT returns for a number of countries. The following table lists the predefined VAT report definitions provided with PeopleSoft software:

|

Report ID |

Definition |

|---|---|

|

BAS |

Australian GST return. |

|

BEVATRTN |

VAT return for Belgium. |

|

CA3 |

CA3 for France. |

|

CARCVRPT |

VAT recovery report for Canada. |

|

CAVATRPT |

VAT report for Canada. |

|

DEVATRPT |

VAT transaction report. |

|

DEVATRTN |

VAT return for Germany. |

|

ITALIQ |

Italian liquidation. |

|

SP320 |

Spanish VAT return 320. |

|

UKECSALE |

EC sales list for the UK. |

|

UKVATRTN |

VAT return for the UK. |

|

VAT1006 |

VAT return for Switzerland. |

|

VAT1007 |

VAT return for the Netherlands. |

|

VAT1008 |

VAT return for Luxembourg. |

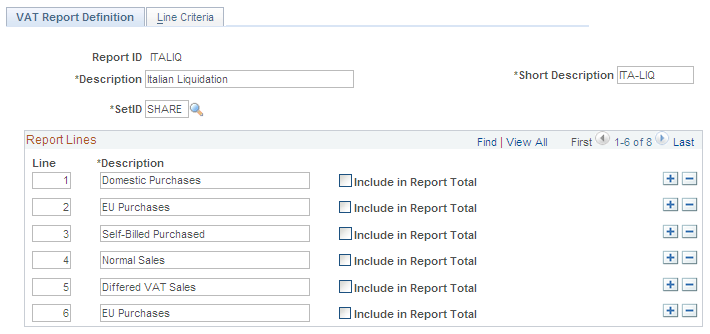

Use the VAT Report Definition page (VAT_RPT_ID1) to create or update a VAT report definition by defining the lines to be included in the VAT report.

Navigation:

This example illustrates the fields and controls on the VAT Report Definition page. You can find definitions for the fields and controls later on this page.

Enter a description, short description, and SetID.

Field or Control |

Description |

|---|---|

Line and Description |

Enter the number of each report line you add and a description for the line. |

Include in Report Total |

Select if you want the transaction to be included in the calculations. |

Note: For the predelivered VAT Returns defined by PeopleSoft applications, note that the line number on the report definition corresponds to the line numbers or box numbers on the appropriate layouts. Depending on the layout for each country, those numbers are not necessarily sequential, and the numbers do not necessarily start with 1. Before you change the report definition, print a sample report to get an understanding of line numbers and box numbers, if applicable, and the information required on each line of the VAT Return.

Defining Data Selection Criteria for Each Report Line

Use the Line Criteria page (VAT_RPT_ID2) to define the fields to use as the selection criteria for each line that you defined on the VAT Report Definition page.

Navigation:

For each VAT line, you define line criteria.

The key element in defining your VAT report is the selection of the combinations of VAT code, VAT accounting entry type, and VAT transaction type for which you want VAT amounts or taxable amounts included on your report.

Field or Control |

Description |

|---|---|

Field Name |

For each line, specify which fields to use as selection criteria using this field. The values are VAT Accounting Entry Type, VAT Code, and VAT Transaction Type. Depending on which field name you select, the Criteria group box presents a field where you can indicate the specific VAT codes, accounting entry types, or transaction types to be included on each line. You do not need to specify selection criteria for all three fields. When a given field is not selected, the system selects all field values for that field. |

Depending on your field selection, you can define the following fields:

|

VAT Field Name Selection |

VAT Reporting Definition Field Values |

|---|---|

|

VAT Accounting Entry Type |

VAT accounting entries to include. |

|

VAT Code |

VAT codes to include. |

|

VAT Transaction Type |

VAT transaction types to include. |

You may want to start by specifying the types of VAT transactions that should be included on that line. Select the VAT accounting entry type to indicate the general types of VAT entries that should be selected, such as VAT Output (VO) or VAT Input (VI). Select the VAT transaction type to include, or effectively exclude, specific types of VAT transactions, such as domestic purchases or exports. Once you have determined the types of transactions that should be selected for a given line, select the VAT code if you require VAT information only for specific VAT rates to be reported on that line.

By combining these selection criteria, you can fine-tune the information that appears on each line. For example, you might have specified that transactions with VAT accounting entry types of VO (VAT output) and VOP (VAT output on purchases) should be selected. You might then further specify that, for those VAT accounting entry types, only transactions with VAT transaction types that indicate domestic sales and services provided by foreign suppliers should be selected. On another line, you can again specify the selection of transactions with VAT accounting entry types of VOP, but this time also indicating that only transactions with VAT transaction types that indicate intra-EU acquisitions should be selected. By not specifying any VAT codes for these lines, you are enabling the selection of transactions with all VAT codes that meet the other specified selection criteria.

Warning! When reporting VAT included on third-party vouchers, ensure that these transactions are included correctly and that they are included only once.

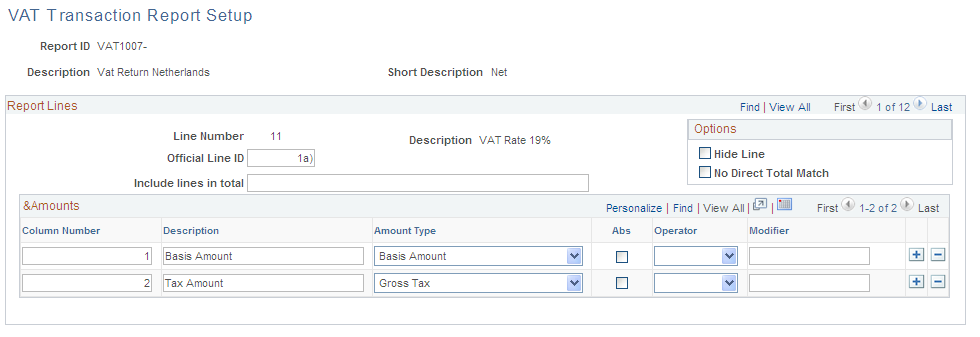

Use the VAT Transaction Report Setup page (LC_RPT_SETUP) to set up for the VAT transaction report that provides details of the amounts making up the totals on VAT returns for use in audits and for the justification of the accumulated amounts that are reported on VAT returns.

Navigation:

This example illustrates the fields and controls on the VAT Transaction Report Setup page. You can find definitions for the fields and controls later on this page.

This page is populated automatically based on an existing report definition. However, you must still define the additional setup for what information is reported for each line and how it appears. VAT report definition rows cannot be added or deleted from this page. Because the data set is shared with the VAT report definition, addition or deletion of VAT report lines is done using the VAT report definition component.

Field or Control |

Description |

|---|---|

Report ID |

Select the desired VAT report. |

Line Number and Description |

Displays the VAT report line number and its description as defined by the VAT report definition. |

Official Line ID |

Enter the official line ID if the Line Number field does not match the line identifier that appears on the specified VAT return. This discrepancy can occur because the Line Number field (VAT_RPT_LINE_NBR) is numeric and the official line number contains characters, or because the official line number is the sum of several VAT report definition lines. For example, in the delivered Belgium VAT report, BEVATRTN, the first line number is 00, which cannot be stored in the current Line Number field because it is a numeric field. The value in this field is used in the group header and total. This value is provided by default to the Line Number field. You can override this value with the required Official Line ID value if required. The internal line ID in the detail section of the report shows the actual, internal line number for reconciliation purposes. |

Include lines in total |

Enter report definition lines that are to be merged in the line number. This is a free text field, which means that the detail section can contain data coming from several VAT report definition lines. Enter the real VAT report definition line number here, not the official line ID. Each line number must be separated by a comma. This real VAT report definition line value is shown in the Internal Line ID column of the report detail section, even if accumulated in another report definition line. If the Include lines in total field is empty, the field is ignored. When line numbers are entered here, transactions associated with those VAT report definition line numbers are included in the current VAT report definition line detail information. An error message is issued at save time if the field syntax is incorrect. The system checks that only integers and commas are entered in the field. Formulas that are defined for the current, main report line are applied to all report lines that are included in the current line. If formulas are defined for lines that are included in another line, those formulas apply only to the line in which the formula is defined. |

Hide Line |

Select to hide a VAT report definition line for the VAT transaction report. This selection is helpful when lines are defined to be included in another line total but do not show up individually on the VAT return. |

No Direct Total Match |

Select for VAT report definition lines that cannot allow a direct reconciliation between the VAT return and the VAT transaction report. This result is mainly due to a VAT report definition having formulas embedded in the VAT report. In such cases, the transactions and their totals are still listed, along with a comment stating that transaction totals might not match the VAT return value due to complex formulas. |

Column Number |

Defines the order of the amount columns in the report line. Numeric only, it must be sequential and less than 4. |

Description |

This description is shown as the column header on the VAT Transaction report. This label is prefixed by an * when formulas, absolute values, modifiers, and so on are used to modify the amount. |

Amount Type |

Select VAT amounts to be reported in the VAT transaction report. For each VAT report definition line, up to three amount columns can be printed on the justification report. Each of these refers to a specific VAT amount or formula:

|

Abs (absolute) |

Select this check box if the absolute value of an amount is to be used. |

Operator |

Use the operator in conjunction with the Modifier field. Select one of the four basic operators (+, -, *, or /) if the VAT report line requires that you apply these calculations. The amount printed in this column on the VAT transaction report will be the final outcome after these calculations are applied. The original amount type is not printed. If the original amount must be visible, an additional column can be defined to display it. |

Modifier |

Use this field in conjunction with the Operator field by specifying the amount by which the Amount type selected from the drop-down list box should be modified. For example, if the Amount type output is 100, the operator is *, and the modifier is 11, then the final result printed in that column will be 1100. This is a numeric field. If you select / as the operator, zero cannot be chosen as a modifier. If you leave the operator blank, the modifier value is ignored. |

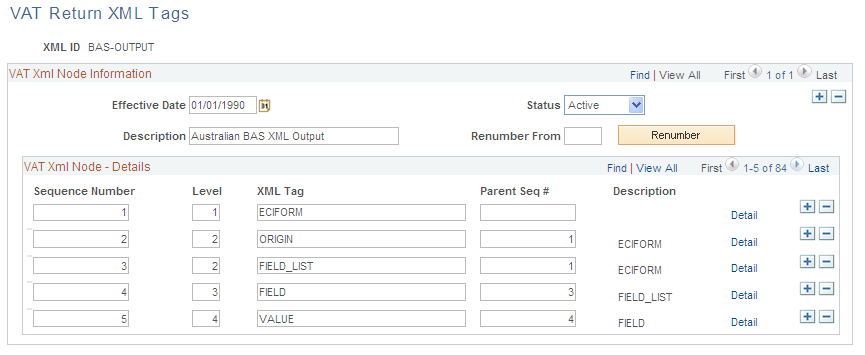

Use the VAT Return XML Tags page (VAT_XML_NODE_ENTRY) to (AUS) Maintain XML metadata for the electronic Business Activity Statement (e-BAS).

If the Australian Tax Office (ATO) changes the e-BAS, use this page to update the format.

Navigation:

This example illustrates the fields and controls on the VAT Return XML Tags page. You can find definitions for the fields and controls later on this page.

Enter an effective date and status.

Maintaining XML Metadata

Field or Control |

Description |

|---|---|

Description |

Enter a description for the e-BAS (electronic Business Activity Statement) XML definition, for example, the version of the e-BAS from the ATO (Australian Tax Office) that you are currently using. |

Renumber From |

If you add rows, use this field to specify the sequence number of the row where you want to insert the new row and the system renumbers all of the subsequent rows when you click the Renumber button. |

Renumber |

Click to renumber of the rows. |

Sequence Number |

Identifies each node detail and determines the row sequence in the file. The sequence numbers must be contiguous. |

Level |

Enter to determine the hierarchy (indentation) of the row sequence. |

XML Tag |

Enter the XML tag descriptor for the type of XML data: field, value, edit state, field list, origin, or ECI (electronic commerce interface). |

Parent Seq # (parent sequence number) |

Enter the parent to the level you select. |

Detail |

Click to access the XML Note Detail page to view XML metadata details. |

Viewing or Updating Metadata Details

Use the XML Node Detail page (VAT_XML_NODE_SEC) to (AUS) View or update metadata details for the e-BAS report.

Navigation:

Click the Detail button on the VAT Return XML Tags page.

This example illustrates the fields and controls on the XML Node Detail page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

XML Source |

Select the appropriate XML source from the following options: None: No value specified. Array: Cells G1 to G20 of the BAS (Business Activity Statement). Constant: Constant value specified. Field Val (field value): Permits specification of a field from the VAT_RPT_INST1 table. Runtime: Value defined on the Electronic Return run request page on which you define parameters for generating the e-BAS flat file. This page is described later in this section. |

XML Detail |

Enter a description for the XML source you are defining. For example, if you select Array as the XML source, use the XML detail to describe the placement of the source in the cells. |

XML Attribute and XML Detail |

Enter the XML attribute according to the XML source you select. For example, if you select Field Val as the XML source, enter the XML ID that describes the type of cell. Enter the XML detail according to the XML source you select. Again, for example, if you select Field Val as the XML source, enter the field number of the report. |

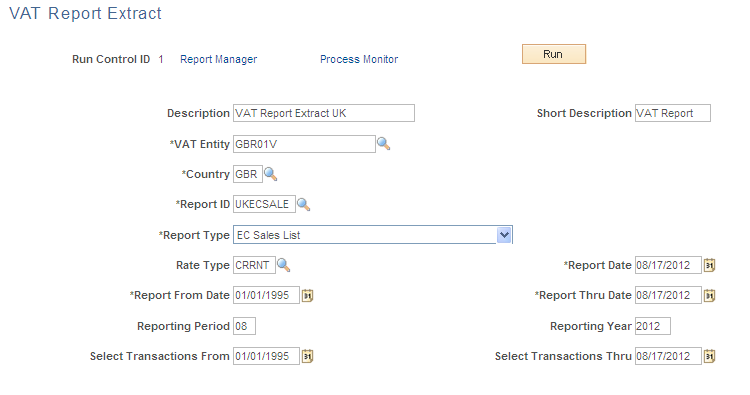

Use the VAT Report Extract (process) page (VAT_RPT_RQST) to generate the VAT Report Extract process (VAT1001) to extract specific VAT transactions to the VAT reporting tables in preparation for printing VAT reports.

Navigation:

This example illustrates the fields and controls on the VAT Report Extract page. You can find definitions for the fields and controls later on this page.

Set up your run requests for extracting data in preparation for printing your VAT report.

Enter a description and short description.

Field or Control |

Description |

|---|---|

VAT Entity and Country |

Select the entity and country for which you want to extract VAT transaction data. |

Report ID |

Enter the name of the report for which you are running the report extract. |

Report Type |

Select the type of report. Valid values are: Other: Select to produce any type of report other than a VAT Return or EC Sales List. Use to select the same VAT transactions repeatedly. Return: Select to report the VAT transactions in the specified date range on a VAT Return. You can make this selection only one time. If you have already selected Return for the transactions in the specified range, the process will not pick up these transactions again. Sales List: Select to report the VAT transactions in the specified date range on an EC Sales List report. You can make this selection only one time. If you've already selected Sales List for the transactions in the specified range, the process will not pick up these transactions again. |

Rate Type |

Specify the currency exchange rate type that the system should use to convert VAT amounts into the reporting currency. |

Report Date |

Enter the date that you generate the report. |

Report From Date and Report Thru Date (report through date) |

Enter the date range to print on the report as the date range of the return you are submitting. |

Reporting Period and Reporting Year |

Enter the period and year associated with the date range above to print on the report as the reporting period of the return you are submitting. |

Select Transactions From and Select Transactions Thru (select transactions through) |

Enter the date range to determine the transactions selected for the report. You can use these fields to extend the transaction selection beyond the date range for the tax return. For example, if you had missed some transactions from a previous quarter, you can include the missed transactions in the current quarter's figures by including the previous quarter in the date range that you define. Only the missed transactions are added to the current quarter's figures. |

You are now ready to generate the extract process.

Each time you generate the VAT report extract process, the system creates a report instance. The transactions in the VAT transaction table are linked to this report instance. You select the report instance that you want to use when you are preparing to generate your VAT report on the VAT Reports page.

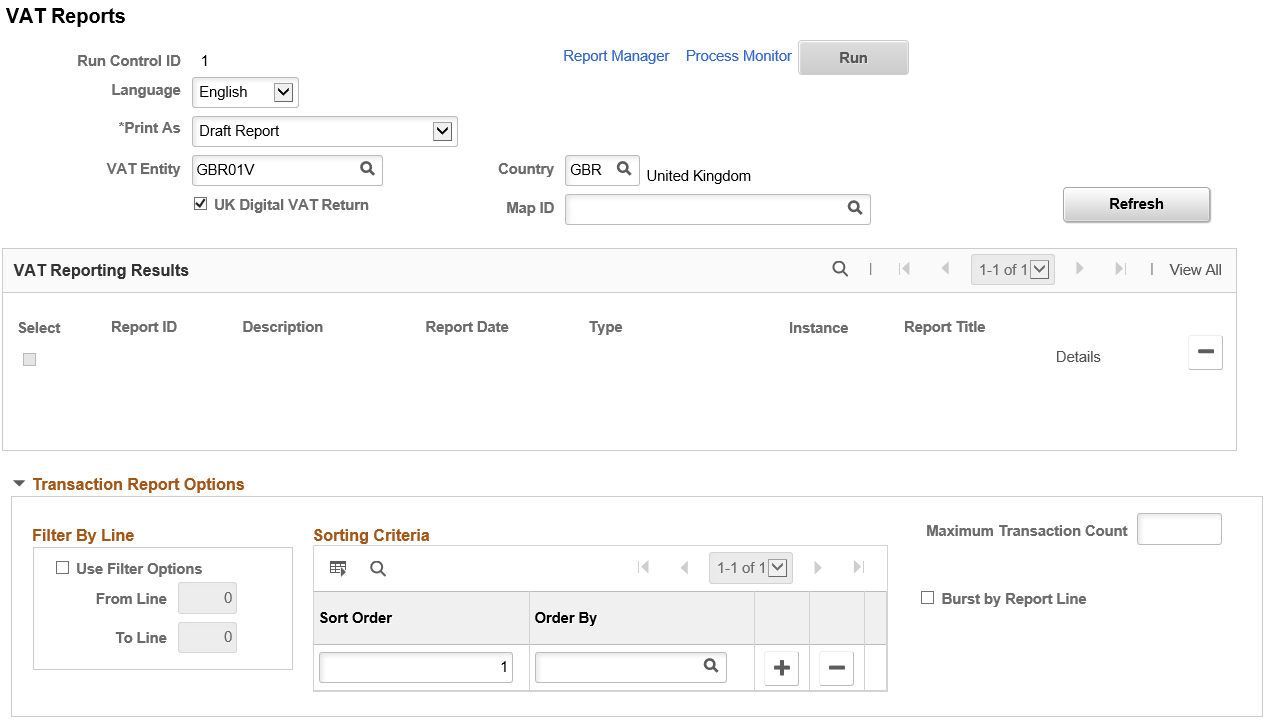

Use the VAT Reports page (VAT_RPT_INST1) to generate reports to use in producing and reconciling your VAT return, including the VAT Transaction report for line item detail.

Navigation:

This example illustrates the fields and controls on the VAT Reports page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Print As |

Select from the following values: Draft: You can reprint the report as many times as necessary. Final: Print a final report. Reprint: If you have printed a report as final, you can reprint the report as many times as needed. |

VAT Entity and Country |

Specify a VAT entity and country for the report. The system retrieves only those report instances generated for this entity and country combination. |

UK Digital VAT Return |

Select to generate UK VAT digital XML file for electronic transmission. Note: UK Digital VAT Return check box is available only for VAT entities that have a registration in VAT Reporting country GBR. |

Map ID |

Select a Map ID to generate UK VAT Digital XML file. Map ID field is displayed only when you select the UK Digital VAT Return check box. For more information on map definitions, see Defining the Data Source and Target |

Refresh |

Click to retrieve the report instances created by the VAT Report Extract process for the specified entity and country combination. The report instances appear in the VAT Reporting Results group box. |

VAT Reporting Results |

Displays the report ID, a description of the report, the report date, the report type, and the instance for each report extract that has been generated for this VAT entity and country combination. |

Select |

Click this check box for the report instance for which you want to print the VAT report. |

Details |

Click to access the Detail page to view details for a report instance. |

Note: For VAT returns and EC sales lists, any given VAT transaction can be selected only once for a report. However, before you print these types of reports as final reports, you can delete the report instance, enabling you to select the VAT transactions again for that report type. For other types of reports, this restriction does not apply.

Transaction Report Options

After completing the VAT Transaction Report Setup page, you can specify additional options for producing the VAT Transaction Report that shows line item details for the VAT return. You can generate the transaction report at the same time or before or after you generate the VAT report using the same run control page (VAT_RPT_INST1) that you use to generate the VAT report.

As with the VAT return, a report ID and process instance must be selected in the VAT Reporting Results grid to launch the VAT transaction report.

Note: The same set of data can be selected to provide both the transaction report and the VAT return report in the same run; however, the VAT transaction report options apply only to the VAT transaction report. While the VAT transaction report may or may not be generated at the same time as the VAT report, the transaction report must be generated after the VAT extract.

Field or Control |

Description |

|---|---|

Use Filter Options |

Click this check box, and the From Line and To Line fields become available with associated lookup for the line values. |

From Line and To Line |

Select line values to generate the report for one or a range of VAT report definition lines. Use the search function to retrieve valid line numbers based on the report ID present in the VAT reporting results scroll area. If multiple reports are present in that grid, the prompt can retrieve values from all the VAT report definitions. No edit is performed to ensure that the from and to values are for the same report. Ensure that the from line number is less than or equal to the to line number; otherwise, an error message is issued. If the specified report lines do not exist for the report definition, the report retrieves nothing. If both fields are empty, the system treats this as an entry of zero and returns only lines with a line number of 0. If you do not want to use the filter option, deselect the Use Filter Options check box. If the from field is not specified but the to line is specified, lines are considered to be designated from the beginning. If the to line field is not specified but the from line is specified, values are considered as all lines until the end. By default, if the To Line field is empty, it is populated with the from line value when the from value is changed. |

Sorting Criteria |

Enter criteria to sort detailed transactions within a VAT report line. You can specify up to three sorting criteria for the report detail section. The same field value cannot be used more than once in the grid and no more than three rows can be present in the grid at save time. The main report section is by VAT report line definition. These lines are printed in the sequential order as determined by the report definition. Sorting criteria applies to the transactions listed for each report line. |

Sort Order |

Enter a number used to determine the order in which the sort criteria fields are applied. |

Order By |

Enter the name of the fields to be used as sorting criteria. The same field value cannot be used more than once in the grid and no more than three rows can be present in the grid at save time. If no rows are present in the grid, no user-defined sorting criteria are used. Because database field names are used, be aware that fields such as CUST_ID and VENDOR_ID show up in the same third-party field in the report output. Because a transaction points only to either a supplier or customer, you might want to use both fields in conjunction. Also, some transactions do not involve a third party, and the sort criteria will be ineffective for such transactions. Note: The main report section is by VAT report line definition. These lines are printed in sequential order as determined by the report definition. Sorting criteria applies to the transactions listed for each report line. |

Maximum Transaction Count |

Use this field to split the output data to accommodate the Microsoft Excel format limit of 64,000 lines per spreadsheet. If the selected output type is Excel and the number of rows entered in this field is reached, the default output format is used instead. However, if the default output format is Excel, then pdf is used. This enables the system to work around the Excel limit. If the field is left blank, it is ignored by the process. Note: Because report output includes headers and totals, these rows must also be taken into consideration in the 64,000 limit. For example, if 63,500 transaction rows are found in the table, the overall number of rows might likely exceed the 64,000 lines due to rows required by the headers and totals. |

Burst by Report Line |

Click to split up the report output by report line. This selection enables you to produce multiple smaller output files rather than a single huge output file. Bursting by report line is especially advantageous when the output type is xls. When bursting is used, the maximum transaction count is checked by report line for the output file and not by report. Additionally, if Excel has been specified as the output format and Burst by Report Line is used, the default output format or pdf will be used only if any given report line exceeds the specified maximum number of transaction lines. |

Viewing Report Instance Details

Use the VAT Reports - Detail page (VAT_RPT_INST_DTL) to view information about a report instance, including the run parameters and reporting history.

Navigation:

Click the Details link on the VAT Reports page.

This example illustrates the fields and controls on the VAT Reports - Detail page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Report ID and Description |

ID and a description of the report definition used for the report extract. |

Report Date and Report Type |

Date of the report extract and type of report extract run. |

Process Instance |

Process instance for the report extract assigned by the system. The VAT transactions are linked to this process instance. |

Run Date and Time |

Date and time on which the report extract was generated. |

Report Transactions From and Report Thru Date (report through date) |

Date range of the transactions selected for the report extract. |

Country |

Country for which the report extract was generated. |

VAT Registration ID |

Associated VAT registration ID for the country that will print on the report. |

VAT Reporting History |

Lists the printing history. |

Transactions Not Selected |

Lists the transactions that are not included in the report and why. Use this section to associate transactions not selected with the report instances to prevent those transactions from being treated as exceptions for future reports. The transactions may include transactions that exist in the VAT transaction table for the date range entered on the extract page but that do not meet the criteria specified by the VAT report definition. The transactions are not necessarily in error. For example, transactions indicated as outside of the scope of VAT may exist in the VAT transaction table, but printing them on a VAT return may not be required. Note: You can prevent transactions that are not required on a VAT return from being specified as exceptions in the first place by creating an additional line on your VAT report definition to pick up these additional transactions. In this way, the transactions do not show up as exceptions, but they also do not appear on the report. Within the Report Exceptions group box is the Select All button, which enables you to select the Associate with VAT Report check box on all the lines within the Transactions Not Selected group box. You can select the Associate with VAT Report check box to link the transaction to the report instance, and prevent the transaction from being selected during future runs on the VAT Report Extract. This prevents the transaction from appearing on future reports as an exception. |

No Exchange Rates Available |

Lists the missing exchange rates needed to calculate the VAT amounts that appear. |

Note: The Transactions Not Selected and No Exchange Rates Available fields appear only if exceptions exist.

If a transaction has not been selected in error or if no exchange rate exists, you must correct the problem that caused the error, delete the report instance, and rerun the VAT report extract. This action enables all the previously selected transactions plus the transactions flagged as exceptions to be selected for the report.

Once you have reviewed the instance details and are satisfied that you have selected the correct instance, you are now ready to generate the VAT report.

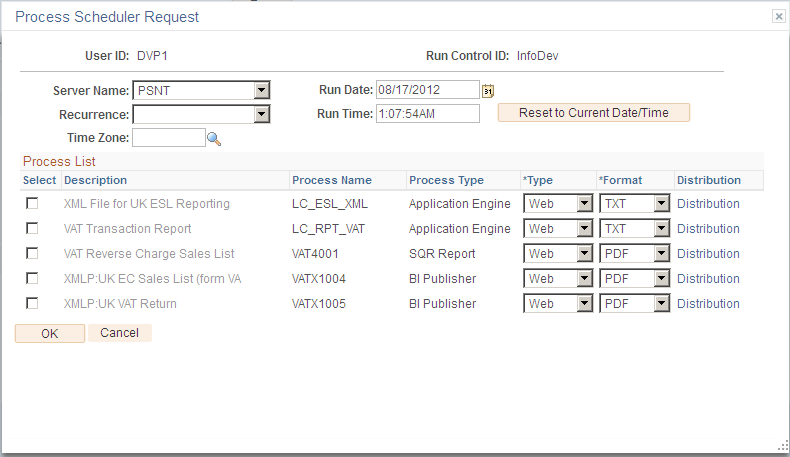

Running the Reports Listed on the Process Scheduler Request Page

The reports that appear on the Process Scheduler Request page vary based on the VAT Entity for which the report is being run and the reports that have been linked to that VAT Entity. A couple of examples for a UK VAT Entity are:

VAT Transaction Report (LC_RPT_VAT)

XML file for UK ESL reporting (LC_ESL_XML )

XMLP: UK VAT Return (VATX1005)

This example illustrates the fields and controls on the VAT Entity — Process Scheduler Request page. You can find definitions for the fields and controls later on this page.

Note: If you are generating the XML File for UK ESL Reporting, you must manually modify the file prior to submission to HM Revenue and Customs:

When initially created, the first two lines in the file appear as follows:

<?xml version="1.0" ?>

-<Submission>

Modify the first line by using single quotes and adding the encoding notation as shown below in italics.

Modify the second line by adding the type attribute to the file definition tag as shown below in italics.

<?xml version=’1.0’ encoding=’UTF-8'’?>

- <Submission type='HMRC_VAT_ESL_BULK_SUBMISSION_FILE'>

Use the VAT Reconciliation Rpt page (RUN_VAT2000) to generate the VAT Reconciliation report (VAT2000) to help in the reconciliation of your VAT accounts and for tax auditing purposes.

Navigation:

This example illustrates the fields and controls on the VAT Reconciliation Rpt page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Report Type |

Select from the following values: Account Balance Reconciliation: For a specified range of VAT-applicable accounts and dates, allows comparison of the amount of expected VAT to the amount of VAT that was actually posted for VAT transactions that have been recorded in PeopleSoft Payables, Receivables, Billing, Asset Management, Expenses, Treasury, and General Ledger. This report also allows the total amount of posted VAT reported for each VAT account to be compared to the GL balance for that VAT account. Account/VAT Account Recon (Account/VAT Account Reconciliation): For a specified range of accounts and dates, lists the taxable basis amounts as well as corresponding VAT amounts calculated from VAT transactions that have been posted by PeopleSoft Payables, Receivables, Billing, Asset Management, Expenses, Treasury, and General Ledger. Taxable Basis Reconciliation: Verifies that the VAT Basis amounts stored on the VAT Transaction table, multiplied by the appropriate VAT percentage, is equal to the actual VAT amount also stored on the same table. VAT Transaction Reconciliation: Provides an overview of VAT transactions generated by PeopleSoft Payables, Receivables, Billing, Asset Management, Expenses, Treasury, and General Ledger applications and verifies that those transactions have been reported on a VAT Return report. Zero VAT Justification: Illustrates why no VAT was collected or paid. |

Report Detail |

If you are generating the Taxable Basis Reconciliation, the VAT Transaction Reconciliation report, or the Account Balance Reconciliation report, select whether you want to view the report as Summary or Detail. If you select Detail, the report prints one line for each VAT transaction. If you select Summary, VAT information is printed on an aggregated level. Note: The Zero VAT Justification and Account/VAT Account Recon reports are always detail reports. |

Print Exceptions Only |

For the Taxable Basis Reconciliation report, the VAT Transaction Reconciliation report, or the Account Balance Reconciliation report, select to display discrepancies. This table lists the content for each of these reports if printed as an exception: |

|

Report |

Content of the Report |

|---|---|

|

Taxable Basis Reconciliation report |

Transactions for which the posted VAT amount and the calculated VAT amount (calculated as VAT basis amount multiplied by the VAT percentage) differ. |

|

VAT Transaction Reconciliation report |

Transactions that have not yet been printed on a final VAT return report. |

|

Summary option for the Account Balance Reconciliation report |

Accounts for which the general ledger balance does not match the total taxable basis amount. |

|

Detail option for the Account Balance Reconciliation report |

Detail lines for accounts with a difference between the GL balance and total taxable basis amount, as well as all detail transactions for which the accounting date falls into a fiscal period that is different from the VAT declaration date. |

Field or Control |

Description |

|---|---|

VAT Entity and Country |

Select the VAT entity and country combination for which you want to generate the reconciliation report. |

Business Unit |

If applicable, you can also generate this report for a specific business unit. |

Alternative Sort Criteria |

If you are generating either the Taxable Basis Reconciliation report or the Zero VAT Justification report, select to sort by discrepancies in descending order. For the Taxable Basis Reconciliation report, transactions are sorted by the difference amount calculated as the posted VAT amount minus calculated VAT amount. For the Zero VAT Justification report, transactions are sorted by VAT basis amount. |

Tolerance Amt (tolerance amount) |

If you are generating the VAT Transaction Reconciliation report, you can enter a tolerance amount. VAT transactions are printed only when the posted VAT amount and the calculated VAT amount (calculated as VAT basis amount multiplied by the VAT percentage) differ by more than the amount entered. |

Report From Date and Report Thru Date (report through date) |

Specify the date range for the transactions to include in the report. |

Select By |

Use this group box to enter a range of ChartFields to include if you are generating either the Account Balance Reconciliation report or Account/VAT Account Recon report. |

You are now ready to generate the VAT reconciliation report.

Use the VAT Audit File Extracts page (RUN_VAT2000_EXT) to create VAT audit file extracts containing VAT transaction information to use for tax auditing purposes.

Navigation:

This example illustrates the fields and controls on the VAT Audit File Extracts page. You can find definitions for the fields and controls later on this page.

Select the VAT extract type from the following types:

|

VAT Extract Type |

Description |

|---|---|

|

AP, GL, Expenses, Treasury |

Extracts PeopleSoft Payables, General Ledger, Expenses and Treasury VAT data from the Payables, General Ledger, Expenses, and Treasury tables. |

|

Asset Mgmt Transactions |

Extracts asset retirement VAT data from the Asset Management tables. |

|

Billing Transactions |

Extracts Billing VAT data from the Billing tables. |

|

General Ledger Journals |

Extracts General Ledger journal data from the General Ledger tables. |

|

Input VAT Transactions |

Extracts VAT Input transactions from the VAT transaction table for Payables, Treasury, and Expenses, and both VAT Input and Output transactions for General Ledger. It also retrieves information from the corresponding source tables. For example, for Payables transactions it retrieves the related voucher and supplier information. |

|

Output VAT Transactions |

Extracts VAT Output transactions from the VAT transaction table for Asset Management, Receivables, and Billing. It also retrieves information from the corresponding source tables. For example, for Billing transactions it retrieves the related sales invoice and customer information. |

|

Receivables Transactions |

Extracts Receivables VAT data from the Receivables tables. |

Field or Control |

Description |

|---|---|

VAT Entity and Country |

Select the VAT entity and country combination for which you want to generate the audit extract report. |

Business Unit |

If applicable, you can also generate this report for a specific business unit. |

Output File Name |

Enter the path and file name for the extract file. |

Print Summary Totals |

Select to summarizes the data content of the extract files in the report. |

Report From Date and Report Thru Date (report through date) |

Specify the date range for selecting transactions for this report. |

Refresh |

Click to populate the ChartField Selection group box with a listing of ChartFields. |

Include CF (include ChartField) |

Select to include the listed ChartField in the report. |

You are now ready to generate the VAT audit report.

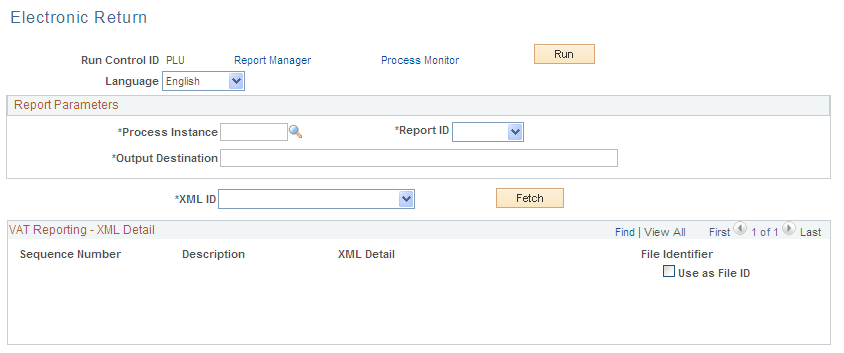

Use the Electronic Return page (VAT_RPTG_RQST2) to (AUS) Run the electronic return for the e-BAS (electronic Business Activity Statement ) (VAT0650).

After you generate a final VAT report, run this process to create a flat file for transmission.

Navigation:

This example illustrates the fields and controls on the Electronic Return page. You can find definitions for the fields and controls later on this page.

Note: The VAT report for the BAS (Business Activity Statement) must be printed as final before the data can be extracted into the flat file for submission to the ATO (Australian Tax Office).

Field or Control |

Description |

|---|---|

Process Instance |

Select an instance from the list of finalized BAS report instances. The report instances are listed in descending order with the most recent report listed first. |

Report ID |

Select the report ID for the report. |

Output Destination |

Enter the directory to which the file is written. You can include the file name. However, do not include the file name if you want to use a field value as the file name. You specify this by selecting the File Identifier check box in the VAT Reporting - XML Detail group box. |

XML ID |

Select an XML ID from the available options. |

Fetch |

Click to load the fields specified at runtime and display the VAT reporting XML detail. |

Sequence Number and Description |

The sequence number displays the DIN (document identification number), which is typically a runtime variable. The DIN is a unique number given to each tax period return and is not stored in the PeopleSoft application because of its dynamic nature. To include a DIN as the file name, select the File Identifier check box for that DIN. |

XML Detail |

Displays the runtime field values. Enter or change runtime values here. |

File Identifier |

Select to use the DIN as the electronic file name. |

You are now ready to generate the electronic return.

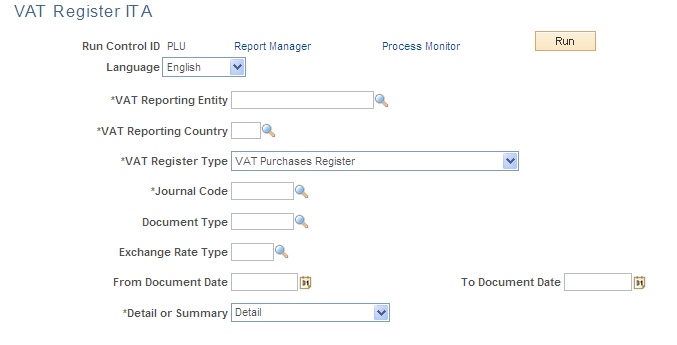

Use the VAT Register ITA page (VAT_REGISTER_RQST) to (ITA) Generate Italian sales and purchases VAT registers.

Available as a VATX0910 BI Publisher report.

Navigation:

This example illustrates the fields and controls on the VAT Register ITA page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT Reporting Entity and VAT Reporting Country |

Select the VAT entity and country combination for which you want to generate the report. |

VAT Register Type |

Select either VAT Purchases Register or VAT Sales Register. |

Journal Code |

Select the journal code. |

Document Type |

Use to select the document type to use for the selected journal code. This field is optional. |

Exchange Rate Type |

Select the type of exchange rate that you want the system to use to convert VAT amounts into the reporting currency. |

From Document Date and To Document Date |

Use to specify the date range for the documents to be included. |

Detail or Summary |

Select whether to run a Detail or Summary report. |

You are now ready to generate the report.

Use the Connected Query Manager page (PSCONQRS) to generate XML files for use in the creation of the SAF-T file

Navigation:

Using connected queries, you may generate a set of XML files containing transaction and master file data that may then be used to create the SAF-T file in the required format