Managing VAT on Interunit Transactions

To manage VAT on interunit transactions, use the Business Unit Interunit Option component (VAT_BU_OPT) and the Business Unit Interunit Pairs component (VAT_BU_PAIR).

This section provides an overview of VAT on interunit transactions .

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VAT_BU_OPT |

Specify whether to post VAT on interunit transactions to the distribution line GL business unit or the transaction header GL business unit. If you are using legal entities, specify these options for IntraEntity and InterEntity. Otherwise, specify these options for interunit. These settings determine which business units do the recording and reporting of VAT on interunit transactions. |

|

|

VAT_BU_PAIR |

Enter exceptions to the VAT business unit options settings for specific business unit pairs. |

PeopleSoft software enables you to manage how you account for and report VAT on interunit transactions, including those that cross legal entities and VAT jurisdictions.

VAT accounting entries are divided into the following three types, or accounting entry groups:

Non-recoverable input VAT.

Other input VAT.

Output VAT.

Note: Output VAT recorded on purchases is included with other input VAT to ensure that the input VAT and associated output VAT are recorded together.

When you enter transactions in PeopleSoft Payables, Expenses, and General Ledger, the transactions as a whole are associated with a general ledger business unit. However, you can enter a different general ledger business unit on the distribution line.

You use general ledger business unit source options to specify where you want the different types of VAT accounting entries to be posted. You can specify the general ledger business unit to be used for each of the three types of VAT accounting entries for interunit transactions in the following way:

Distribution Line GL Business Unit.

This selection allows the specified type of accounting entry to be posted to the general ledger business unit on the associated distribution line.

Transaction (header) GL Business Unit.

This selection allows the specified type of accounting entry to be posted to the general ledger business unit associated with the transaction as a whole.

In addition, you set up the general ledger business unit source options in two ways:

By SetID.

This approach allows the same set of options to be shared by multiple general ledger business units. If you are using legal entities, you can set up separate sets of options for transactions that take place between two general ledger business units within the same legal entity and for transactions that take place between two general ledger business units that are in different legal entities. If you are not using legal entities, the options that you specify are applicable to all types of interunit transactions.

By specific pairs of from and to general ledger business units.

The options defined for a specific pair of general ledger business units always override the options defined at the more general, SetID level.

Note: You need to define options at this level only for exceptions to what you defined at the SetID level.

Interunit Example

On the Procurement Accounting Controls, Expenses Business Unit, and General Ledger Business Unit pages, you can specify whether to prorate and post nonrecoverable VAT to the expense distribution ChartFields. If you have specified that nonrecoverable VAT is to be prorated, then the nonrecoverable VAT is always posted by the system to the Distribution Line GL Business unit along with the expense, regardless of the general ledger business unit option that you define for nonrecoverable VAT.

This example illustrates how an Italian business unit might generally record costs on behalf of business units in other VAT jurisdictions and how an exception in the handling of VAT for another Italian business unit is accomplished.

If an Italian business unit incurring costs for other business units must record, account for, and report VAT, but the actual expense must be recorded in the other business units, you specify on the VAT Business Unit Option page for the Italian SetID that the Transaction (header) GL Business Unit be used for each of the three different VAT accounting entry groups. This results in all the VAT accounting entries being created for the Italian business unit allowing the reportable VAT to be included on the VAT return for the Italian VAT entity. Only the actual expense is accounted for as an interunit entry between the Italian and other business units.

However, if business units other than the Italian business unit are generally required to record, account for, and report the VAT, you specify that the Distribution Line GL Business unit is to be used for each of the different VAT accounting entry groups. This enables you to create all the VAT accounting entries for the other business units and, if appropriate, report them on the VAT return for the other VAT entities.

If the requirement is that the recoverable VAT be recorded by the Italian business unit, but any nonrecoverable VAT be passed to the other business unit as part of the cost, you specify that the Transaction (header) GL Business unit be used for Other Input VAT, while the Distribution Line GL Business unit be used for Non-Recoverable Input VAT. In this case, the accounting entry for the recoverable VAT is created for the Italian business unit, while the accounting entry for the nonrecoverable VAT is created for the other business unit. The recoverable VAT is then available to be reported on the VAT return for the Italian VAT entity.

Because the options that you select on the VAT Business Unit Option are intended to govern how the VAT on most but perhaps not all interunit transactions is handled for the business units making up the SetID, you can define exceptions for transactions between specific business units on the VAT Business Unit Pairs page. For example, if an Italian business unit generally records, accounts for, and reports VAT on transactions with business units in other countries, but this is not intended to be the case for another Italian business unit, you can create the exception between the two business units by specifying the Distribution Line GL Business Unit as the source for the Italian business unit.

Use the Business Unit Interunit Option page (VAT_BU_OPT) to specify whether to post VAT on interunit transactions to the distribution line GL business unit or the transaction header GL business unit.

If you are using legal entities, specify these options for IntraEntity and InterEntity. Otherwise, specify these options for interunit. These settings determine which business units do the recording and reporting of VAT on interunit transactions.

Navigation:

Field or Control |

Description |

|---|---|

SetID |

Specify how a business unit records each of the three types of VAT accounting entries by SetID. Enter the SetID that represents one or more general ledger business units that will be accounting for VAT on interunit transactions in the same way. |

InterEntity GL Business Unit Source and IntraEntity GL Business Source |

If you set up the system to use legal entities, you can specify the business unit source options separately for InterEntity and IntraEntity transactions. If the system is not using legal entities, you specify these options for interunit transactions. |

Distribution Line GL Business |

Select this option for each VAT accounting entry type that you want posted to the general ledger business unit at the distribution line level. For example, within PeopleSoft Accounts Payable this is the general ledger business unit specified on the distribution line. |

Transaction GL Business |

Select this option for each VAT accounting entry type that you want posted to the transaction, or header business unit. For example, within PeopleSoft Accounts Payable this is the general ledger business unit associated with the voucher as a whole. In other words, it is the general ledger business unit with which the vouchering Payables business unit is associated. |

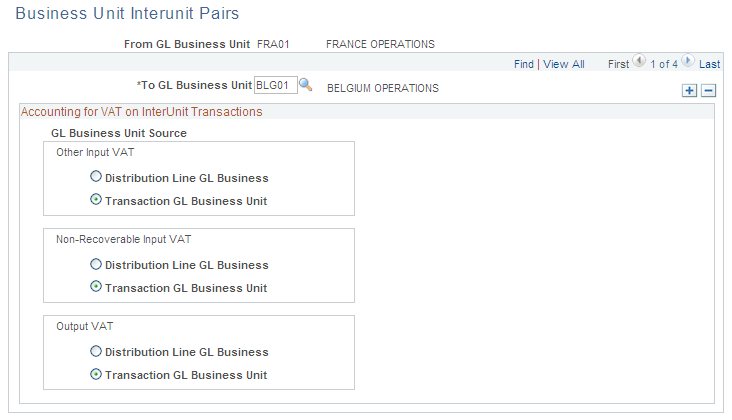

Use the Business Unit Interunit Pairs page (VAT_BU_PAIR) to enter exceptions to the VAT business unit options settings for specific business unit pairs.

Navigation:

This example illustrates the fields and controls on the Business Unit Interunit Pairs page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

From GL Business Unit |

Enter the business unit for which you are creating the exception or exceptions. |

To GL Business Unit |

Enter business units that are exceptions. For example, if the from general ledger business unit generally records, accounts for, and reports VAT on interunit transactions involving VAT, you can specify that this be done instead by the general ledger business unit when you select Distribution Line GL Business for each of the VAT accounting types. You can add multiple exception business units. |

Distribution Line GL Business |

Select this option for each VAT accounting entry type that you want posted to the general ledger business unit at the distribution line level. For example, within PeopleSoft Accounts Payable, this is the general ledger business unit specified on the distribution line. |

Transaction GL Business Unit |

Select this option for each VAT accounting entry type that you want posted to the transaction, or header business unit. For example, within PeopleSoft Accounts Payable, this is the general ledger business unit associated with the voucher as a whole. In other words, it is the general ledger business unit with which the vouchering Payables business unit is associated. |