Setting Up VAT Authorities, and Tax Codes

To set up VAT authorities and tax codes, use these components: Express VAT Code (EX_TAX_CD_VAT), Value Added Tax Authority (TAX_AUTHORITY_VAT), Value Added Tax Code (TAX_CODE_VAT) and VAT Accounts by Business Unit (TAX_BU_CODE_VAT).

Use the TAX_CODE_VAT component interface to load data into the tables for the Value Added Tax Code component, and use the TAX_BU_CODE_VAT component interface to load data into the tables for the VAT Accounts by Business Unit component.

This section provides an overview of VAT authority and tax code setup and discusses how to: work with VAT.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EX_TAX_CD_VAT |

Quickly set up a VAT code by entering the required tax rate and having the system automatically create the associated VAT authority. |

|

|

TAX_AUTHORITY_VAT |

Create VAT authority tax percentages by effective date. Create one VAT authority for each different tax rate. |

|

|

Public Service Body Type |

TAX_AUTHORITY_PSB |

For Canada, specify rebate rates for each applicable public service body type for a VAT authority. |

|

TAX_CODE_VAT |

Create or update VAT codes and select which VAT authorities to associate with the VAT code. |

|

|

TAX_ACCTG_VAT |

Specify accounts and ChartFields used when recording VAT for a VAT code. |

|

|

VAT Accounting Express Setup |

TAX_ACCTG_EXPRESS |

Specify a set of input and output VAT ChartFields as the default for a VAT code. |

|

TAX_ACCTG_VAT_DTL |

Define ChartFields for specific VAT transaction type exceptions. |

|

|

TAX_BUACT_VAT |

Set up VAT accounts by VAT code and general ledger business unit. |

|

|

TAX_BUACT_EXPRESS |

Specify a set of input and output VAT ChartFields as the default for a VAT code and general ledger business unit. |

Defining VAT rates, VAT codes, and VAT accounting involves:

Defining VAT rates in the VAT authority tables.

Defining VAT codes by associating the VAT authorities with those VAT codes.

Specifying VAT accounting information for each VAT code.

Defining VAT Authorities

You create one VAT authority for each different VAT rate that you require, then associate one or more of these VAT authorities with a VAT code. The VAT rate associated with the VAT code is the total of the rates specified on all the associated VAT authorities. In most countries, you would specify only one VAT authority with a given VAT code. However, in some cases, you may want to indicate that a single VAT rate really consists of more than one component; and in this case, you would specify multiple VAT authorities for the VAT code. An example would be Canada's Harmonized Sales Tax (HST), which comprises a federal component of Goods and Services Tax (GST) and a provincial component for those provinces participating in the HST.

Defining VAT Codes and VAT Accounting Information

In many cases, to balance VAT account balances in PeopleSoft General Ledger with your VAT return, VAT must be accounted for separately for each VAT rate. For this reason, when you define each VAT code, you must also define the VAT accounts to be used for posting the VAT recorded at that rate. For each VAT code, VAT accounting information must be specified for each of the VAT accounting entry types. These VAT accounting entry types represent the different types of VAT accounting entries that may be required throughout the system.

When defined at the VAT accounting entry type level, the accounting information defined for a given accounting entry type applies to the combination of that VAT accounting entry type and all VAT transaction types. However, if you need to account for VAT at a more detailed level, you can override the VAT accounting information defined at the VAT accounting entry type level and, instead, define the accounting information for specific VAT transaction types.

Methods for VAT Authority, VAT Code, and VAT Accounting Setup

PeopleSoft software provides two methods for setting up VAT authorities, VAT codes, and VAT accounting information:

Use the Express VAT Code page to define the VAT authority and VAT code at the same time.

You use this method if you need to define only a single VAT authority for each VAT code. You simply enter the VAT rate that you want associated with the VAT code and the system automatically creates the VAT authority. With this method, you specify default input VAT and output VAT accounts, and these defaults are supplied to the appropriate VAT accounting entry types. At this point, you need to update only the information for individual VAT accounting entry types for which the default does not apply.

Use the VAT Authority page to define VAT authorities and then define VAT codes and associate the VAT authorities using the Value Added Tax Code component.

With this method, you set up your accounting information on the Value Added Tax Code component. You can either use the Express Setup page to specify default input VAT and output VAT accounting that the system populates to all VAT accounting entry types, or individually update the VAT accounting information for each VAT accounting entry type.

If you are a public service type organization in Canada, you may also be entitled to a rebate on your input VAT. VAT rebates are calculated based on statutory rebate rates defined for each type of public service organization or Public Service Body by each Canadian VAT authority. Because VAT codes for Canada may be made up of more than one VAT authority, you define the rebate rates for each applicable Public Service Body Type using the Value Added Tax Authority component.

If you are using more than one general ledger business unit and more than one chart of accounts, you can also set up VAT accounts by VAT code and general ledger business unit. You can specify a default set of input and output VAT ChartFields, or set up exceptions for specific VAT transaction types.

Note: You should define a single SetID for VAT information. This single SetID enables access to only one chart of accounts when you define VAT account information by VAT code. When you define VAT accounts by VAT code and general ledger business unit, the system uses the business unit value to access the ChartFields. This way, you can define VAT accounting information in each different chart of accounts as needed.

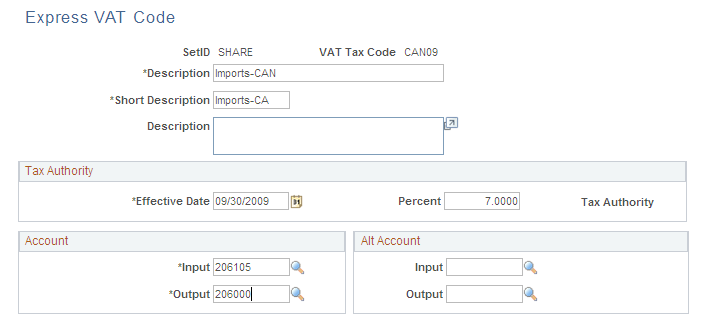

Use the Express VAT Code page (EX_TAX_CD_VAT) to quickly set up a VAT code by entering the required tax rate and having the system automatically create the associated VAT authority.

Navigation:

This example illustrates the fields and controls on the Express VAT Code. You can find definitions for the fields and controls later on this page.

For the VAT code you are adding, enter the VAT code, a description, and a short description.

Note: If you have PeopleSoft Billing, the short description prints on the bills.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the effective date for the tax percentage. |

Percent |

Enter the tax rate as a percentage. |

Tax Authority |

When you save this page, the system automatically assigns a tax authority and populates this field. |

Input and Output |

Enter the default account for input and output tax in the Account group box. You can also enter a default account for input and output tax in the Alt Account (alternate account) group box. |

Note: After you create a VAT code using this page, use the VAT authority and VAT code setup pages to complete setup of VAT authority and tax code and to make any adjustments. For example, for Canada, you can set rebate rates for each public service body.

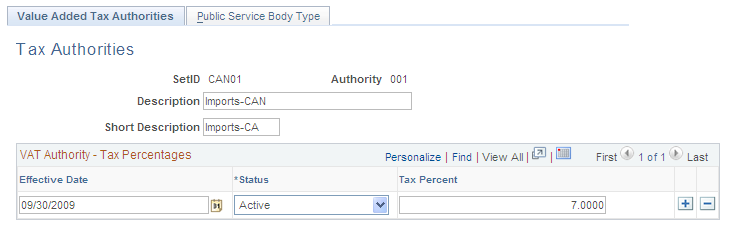

Use the Value Added Tax Authorities page (TAX_AUTHORITY_VAT) to create VAT authority tax percentages by effective date.

Create one VAT authority for each different tax rate.

Navigation:

This example illustrates the fields and controls on the Value Added Tax Authorities page. You can find definitions for the fields and controls later on this page.

Enter a description and a short description.

Enter the effective date, status, and tax percent.

You can add multiple rows to this page enabling you to enter new values if tax rates change.

Note: Create a different tax authority for each VAT rate used in a country.

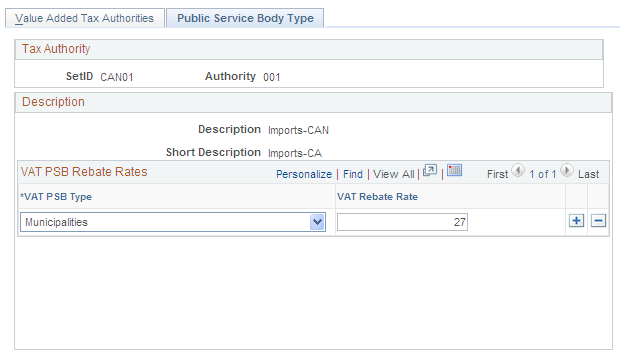

Establishing Public Service Body Type Rebates (CAN)

For Canadian public service organizations, access the Public Service Body Type page (Set Up Financials/Supply Chain, Common Definitions, VAT and Intrastat, Value Added Tax, VAT Authority, Value Added Tax Authorities, Public Service Body Type).

This example illustrates the fields and controls on the Public Service Body Type page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

VAT PSB Type (VAT public service body type) |

Select the appropriate public service body type. Valid values are Charitable, Colleges, Hospital, Municipal, Non-Profit, School, and University. |

VAT Rebate Rate |

Enter the percentage set by Canadian law for rebates on input (nonrecoverable) VAT. |

Note: You must create at least one VAT use type using the VAT Use Type component for each public service body type that you create.

Use the Value Added Tax Code page (TAX_CODE_VAT) to create or update VAT codes and select which VAT authorities to associate with the VAT code.

Navigation:

Field or Control |

Description |

|---|---|

SetID and VAT Tax Code |

Enter the SetID and VAT tax code. |

Percent |

Displays the total percentage based on the selected tax authority or authorities entered in the Authority Information group box. |

Description and Short Description |

Enter a description and short description. If you have PeopleSoft Billing, the short description prints on the bills. |

Authority |

Select the tax authority to which this VAT code is linked. A description and the associated tax percentage appear. |

Note: You can associate one or more VAT authorities with a VAT code. The VAT rate associated with the VAT code is the total of the rates specified for the associated VAT authorities. For example, if you include two VAT authorities under a single VAT code, the first at 7 percent and the second at 8 percent, the rates combine for a total of 15 percent.

Usually, you set up one tax authority for each VAT code. If you need to link more than one VAT authority to one tax code, add more rows.

The total percentage (at the top of the page) is updated automatically whenever you add or modify VAT authorities and whenever you update the tax authority tables.

Use the Accounting Information page (TAX_ACCTG_VAT) to specify accounts and ChartFields used when recording VAT for a VAT code.

Navigation:

This example illustrates the fields and controls on the Value Added Tax Code - Accounting Information page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Express Setup |

Click to access the VAT Accounting Express Setup page to quickly set up default values for input and output VAT ChartFields. The system applies these defaults to all the applicable VAT accounting entry types. |

VAT Accounting Entry Type |

Lists all the VAT accounting entries that apply to the PeopleSoft applications that you installed. For example, if your installation includes only sales-related applications (such as PeopleSoft Order Management, Billing, and Receivables), you see only accounting entry types that are related to output VAT on sales. Clicking any of the VAT accounting entry types listed opens the VAT Accounting Exceptions page on which you can define specific ChartFields for VAT transaction type exceptions. Note: You can specify a single set of ChartFields for a VAT code using the Accounting Information or Express Setup page, and the system uses those values for all VAT transaction types used with that VAT code. However, if a certain type of transaction must be reported separately, then it is easier to reconcile the VAT reports to the general ledger if these transactions are posted to separate ChartFields. |

All Values |

Select to display all values when you click account. Otherwise, the system displays only those accounts that have been flagged in PeopleSoft General Ledger as VAT accounts. |

Account |

You must provide values for all the account ChartFields listed. You cannot save the page without recording an account number for each available field. If a particular account type is not applicable in your environment based on the applications installed, complete the Account field with a dummy value. |

Alt Act (alternate account), Oper Unit (operating unit), Fund, Dept (department), Program, Class, Bud Ref (budget reference), Product, Project, Affiliate, Fund Affil (fund affiliate), and Oper Unit Affil (operating unit affiliate) |

Complete these optional ChartFields as needed. |

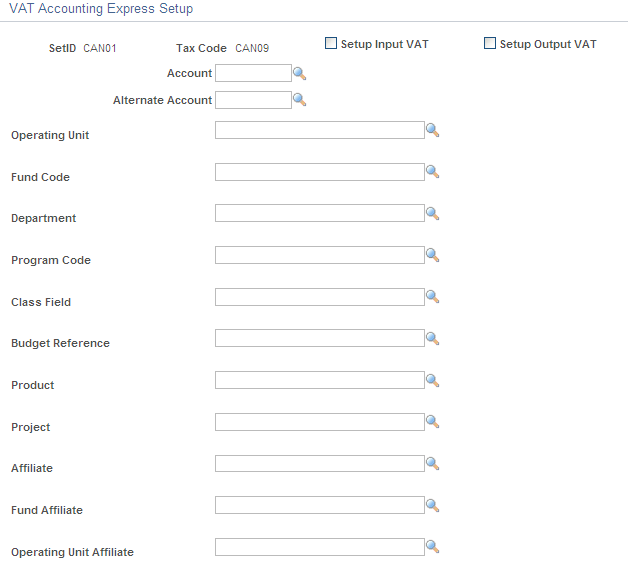

Use the VAT Accounting Express Setup page (TAX_BUACT_EXPRESS) to specify a set of input and output VAT ChartFields as the default for a VAT code and general ledger business unit.

Navigation:

Click the Express Setup link on the VAT Accounts by Business Unit page.

This example illustrates the fields and controls on the VAT Accounting Express Setup page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Setup Input VAT |

Select to specify the ChartField information to be used for recording input VAT. |

Setup Output VAT |

Select to specify the ChartField information to be used for recording output VAT. |

Specify the appropriate ChartField values. Click OK to return to the Accounting Information page.

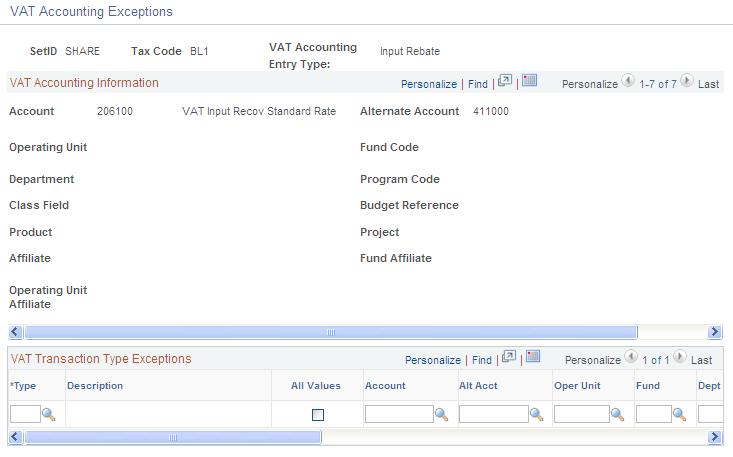

Use the VAT Accounting Exceptions page (TAX_ACCTG_VAT_DTL) to define ChartFields for specific VAT transaction type exceptions.

Navigation:

Click a VAT accounting entry type on the Accounting Information page or on the VAT Accounts by Business Unit page.

This example illustrates the fields and controls on the VAT Accounting Exceptions page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Type |

The VAT transaction type for which you want to define an exception. |

All Values |

If you do not select this check box, you see only those accounts that have been flagged in PeopleSoft General Ledger as VAT accounts. Select the check box if you want to view all account values. |

Enter the ChartField information that you want to modify for the account type.

Click OK to save your changes and return to the Accounting Information page.

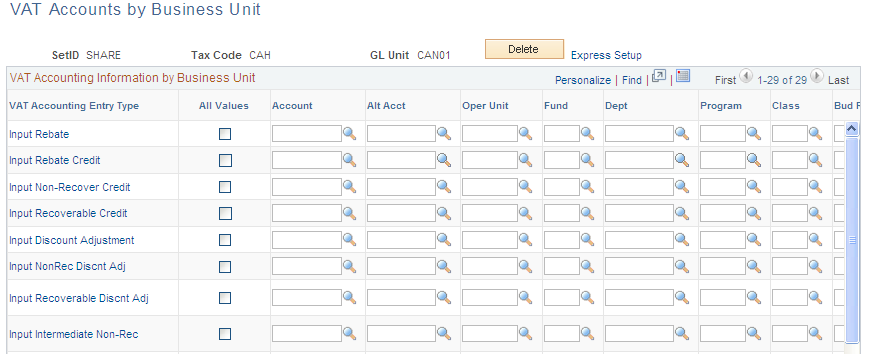

Use the VAT Accounts by Business Unit page (TAX_BUACT_VAT) to set up VAT accounts by VAT code and general ledger business unit.

Navigation:

This example illustrates the fields and controls on the VAT Accounts by Business Unit page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Delete |

Click to delete all entries for this combination of general ledger business unit and VAT code. For example, if you entered a set of defaults for a general ledger business unit and later decided this was not necessary, you would access this page for the general ledger business unit and use the Delete button to delete all entries. |

Express Setup |

Click to access the VAT Accounting Express Setup page to quickly set up default values for input and output VAT ChartFields. The system applies these defaults to all the applicable VAT accounting entry types. |

VAT Accounting Entry Type |

Lists all the VAT accounting entries that apply to the PeopleSoft applications that you installed. For example, if your installation includes only sales-related applications (such as PeopleSoft Order Management, Billing, and Receivables), you see only accounting entry types that are related to output VAT on sales. Clicking any of the VAT accounting entry types listed opens the VAT Accounting Exceptions page, on which you can define specific ChartFields for VAT transaction type exceptions. Note: You can specify a single set of ChartFields for a VAT code using the Accounting Information or Express Setup page, and the system uses those values for all VAT transaction types used with that VAT code. However, if a certain type of transaction must be reported separately, then reconciling the VAT reports to the general ledger is easier if these transactions are posted to separate ChartFields. |

All Values |

Select to display all values when you click account. Otherwise, the system displays only those accounts that have been flagged in PeopleSoft General Ledger as VAT accounts. |

Account |

You must provide values for all the account ChartFields listed. You cannot save the page without recording an account number for each available field. If a particular account type is not applicable in your environment based on the applications installed, complete the Account field with a dummy value. |

Alt Act (alternate account), Oper Unit (operating unit), Fund, Dept (department), Program, Class, Bud Ref (budget reference), Product, Project, Affiliate, Fund Affil (fund affiliate), and Oper Unit Affil (operating unit affiliate) |

Populate these optional ChartFields as needed. |