Processing Accounting Entries

This topic presents a diagram of the inbound and outbound transaction process, provides an overview of the Automated Accounting Build process, and discusses how to process automated accounting.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRA_ACCTG_REQ |

Run the Automated Accounting process, which creates accounting entries and prepares them for the Journal Generator (FSPGJGEN) process. |

During processing, the program calls the centralized processor to generate interunit and intraunit balancing (IU_PROCESSOR).

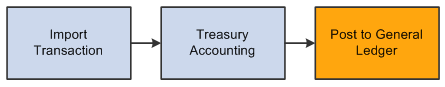

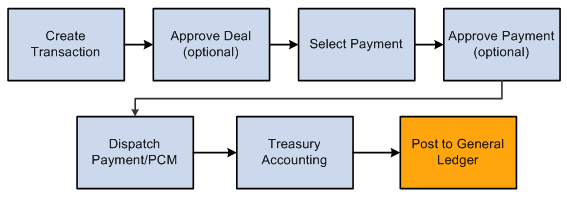

These diagrams illustrate the inbound and outbound transaction processes.

Inbound process from importing a transaction to Treasury Accounting to posting to General Ledger

Outbound process from creating transaction through payment dispatch and Treasury Accounting to posting to General Ledger

The Automated Accounting process populates the treasury accounting event calendar with transaction reference information, event type, event date, template ID, and processing state.

When specific processing events occur (as shown in the following table), the program that builds automatic accounting entries selects any unprocessed transactions from the treasury accounting event calendar and copies them into the Accounting Entries table.

|

Accounting Event Type |

Processing Event |

|---|---|

|

Treasury Deals |

The open deal is saved and the Cash Flows button is clicked. |

|

Bank Transfers, EFT transfers |

The transaction is dispatched. |

|

Fees and Charges |

Fees are saved. |

|

Mark to Market |

During revaluation processing. |

|

Investment Pools |

|

When the underlying data are established, the Automated Accounting process works in the following way:

Selects unprocessed records with the correct event date from the Accounting Event table.

Processes inbound cash flows unconditionally upon receipt of cash.

Processes outbound cash flows after transactions have been approved and sent to the bank.

Constructs the ChartField combination according to the appropriate accounting template.

If ChartField combination errors occur, the system will insert error details for each of the accounting entries. You can review and fix these ChartField combination errors by accessing the Accounting Entries component.

Retrieves the correct monetary amount according to the calculation type.

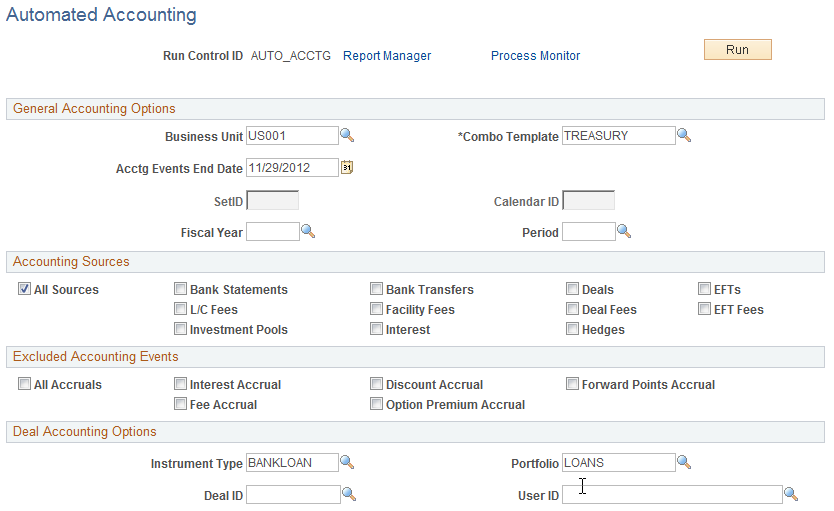

Use the Automated Accounting page (TRA_ACCTG_REQ) to run the Automated Accounting process, which creates accounting entries and prepares them for the Journal Generator (FSPGJGEN) process.

Navigation:

This example illustrates the fields and controls on the Automated Accounting page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

Enter a value to process automated accounting for a specific business unit. You can also leave the Business Unit field blank to set up automated accounting for multiple business units. If you enter a business unit defined with a calendar ID on the Treasury Options page, the calendar ID appears on the page. Note: Your system administrator can set up the option to issue a warning instead of an error message (13550, 70) for processing a single business unit using an Accounting Events End Date when the selected Business Unit is defined with a Calendar ID. This table provides an overview of the selections a user can make on the run control page and the accounting entries that the Automated Accounting Engine processes. |

|

Run Control Selections |

Processing Results |

|---|---|

|

Business Unit Acctg Events End Date |

Specified business unit, must not be defined with a calendar ID. |

|

Business Unit – None (leave field blank) Acctg Events End Date |

All business units that are not defined with a calendar ID. |

|

Business Unit Fiscal Year Period Note: When Fiscal Year and Period are populated, leave Acctg Events End Date blank. |

Specified business unit, must be defined with a calendar ID. |

|

Business Unit – None (leave field blank) Fiscal Year Period Note: When Fiscal Year and Period are populated, leave Acctg Events End Date blank. |

Field or Control |

Description |

|---|---|

Combo Template |

Enter a template ID for the combination of business unit and general ledger. |

Acctg Events End Date |

Enter an accounting events end date. The system processes all associated accounting events on or before the specified date. If a business unit has a calendar associated with it, you must leave this field blank and enter Fiscal Year and Period values. |

SetID |

Displays the SetID value associated with the Calendar ID that controls the Fiscal Year and Period. |

Calendar ID |

Displays the Calendar ID value that controls the Fiscal Year and Period. If you enter a business unit associated with a calendar ID on the Treasury Options page, that calendar ID will appear here. If the business unit has a calendar associated with it, you must enter Fiscal Year and Period values and leave the Acctg Events End Date field blank. |

Fiscal Year and Period |

Enter the Fiscal Year and Period values that will be used to determine the accounting events to be processed by Automated Accounting process. |

Note: The process creates accounting entries even if errors occur. Use the Accounting Entries page to correct any errors, and then change the status from Error to Provisional. Use the View/Approve Entries page to change the status from Provisional to Final. The accounting entries are then ready for General Ledger. You do not have to rerun the Automated Accounting process.