Risk Management and Hedge Accounting

This section discusses:

FAS 133 Documentation requirements.

Periodic effectiveness assessment for FAS 133.

Hedge de-designation.

Risk Management enables you to systemically meet and capture most hedge accounting requirements around documentation for FAS 133 and IAS 39.

There are, however, certain documentation issues in the FAS 133/IAS 39 standard that fall outside of the scope of database features, and these may or may not apply to your organization and its risk management strategy. PeopleSoft discloses and documents these context-sensitive areas during the course of this documentation.

Effectiveness tests provide a means for an organization, its stakeholders, and external auditors to evaluate whether risk management strategies are on track. The tests also evaluate whether hedges are working or are likely to work as planned, and thus remain within bounds for special accounting.

Note: The paragraphs below are purely from FAS 133 documentation provided at the time of issue. The Financial Accounting Standards Board (FASB), however, regularly updates and appends some of the content through amendments or through feedback from Derivatives Implementation Group (DIG) commentaries. PeopleSoft does not take responsibility for such changes and modifications and expects the users to be familiar with the changes recommended by FASB in regards to FAS 133/138 accounting standards.

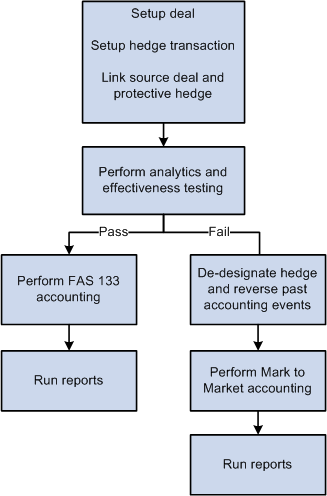

Examining the value of derivative instruments at given points in time, per paragraph 20(b), 28(b), determines whether they have experienced gains and losses on a derivative. When you set up a transaction, its correspondent hedged deal, and the link between the two and document it for FAS 133, you must also define and document tests or methodologies to assess hedge effectiveness.

Effectiveness Assessment at Inception

FAS 133 requires that you define tests of effectiveness assessment at the inception of the hedge, not retroactively or during the hedge's life span. Identifying and recording a derivative's value at predetermined points in time creates an audit trail.

Note: Regarding fair value hedges, ¶ 20(b) states: Both at inception of the hedge and on an ongoing basis, the hedging relationship is expected to be highly effective in achieving offsetting changes in fair value attributable to the hedged risk during the period that the hedge is designated. An assessment of effectiveness is required whenever financial statements or earnings are reported and at least every three months [¶ 20(b)]. Regarding cash flow hedges, ¶ 28(b) states: Both at inception of the hedge and on an ongoing basis, the hedging relationship is expected to be highly effective in achieving offsetting cash flows attributable to the hedged risk during the term of the hedge, except as indicated in paragraph 28(d) below. An assessment of effectiveness is required whenever financial statements or earnings are reported, and at least every three months [¶ 28(b)].

When your hedge transaction criteria are not met, including failed effectiveness assessment tests, you must de-designate the hedges, unwind their components, and apply mark-to-market accounting back to the last recorded date that the hedge passed effectiveness assessment. If a fundamental change in nature has occurred to the criteria you are hedging, FAS 133 accounting ends. For example, if you sell the recognized asset/liability, it expires, or the once firm commitment is terminated, FAS 133 accounting no longer holds.

Whenever deals meet documentation and effectiveness assessment testing requirements, you can use FAS 133's special accounting and benefit from decreased income statement volatility.

This flowchart provides an overview of FAS 133 hedge accounting.

Ineligible and Eligible Hedge Scenarios

These types of hedge scenarios are ineligible under FAS 133:

Liquidity

Theft

Weather

Competition

Seasonality

Political

Operational

These types of hedge changes are eligible under FAS 133:

Fair value of entire financial instrument.

Percentage of entire fair value of the financial instrument.

Fair value attributable to changes in interest (including prepayment as a separate component of interest rate risk).

Fair value attributable to changes in foreign currency exchange rates.

Fair value attributable to changes in the obligator's creditworthiness.