Setting Up Hedges

To define hedge information, use the following components:

Hedge Strategies component (HDG_STRATGY_PNG_GBL).

Hedge Item Sources component (HDG_SRC_PNG).

This topic discusses how to define hedge strategies, if desired, and define hedge item sources.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

HDG_STRATEGY_PNL |

Record any relevant information that a third-party needs to understand the course of action as purposeful and meriting of IAS 39 or FAS 133 special accounting considerations. You can document qualitative concerns and link them to the quantitative dimensions of the hedging activities. |

|

|

HDG_SRC_PNL |

Set up the risk evaluation and accounting of the hedged item. |

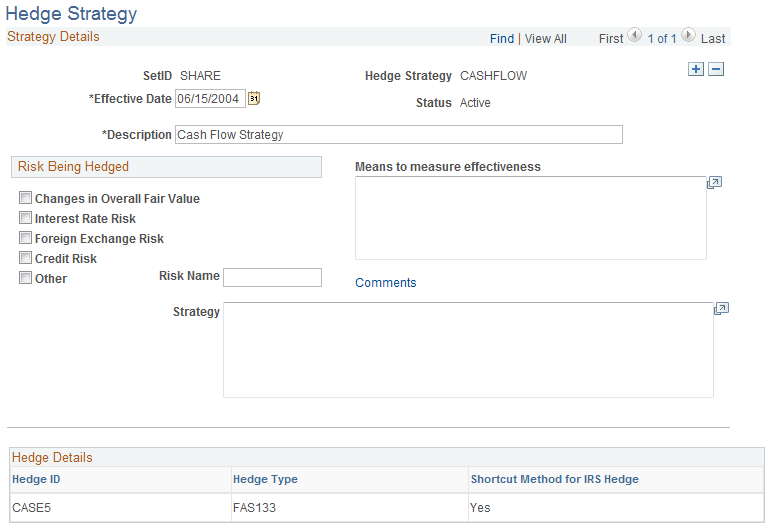

Use the Hedge Strategy page (HDG_STRATEGY_PNL) to record any relevant information that a third-party needs to understand the course of action as purposeful and meriting of IAS 39 or FAS 133 special accounting considerations.

You can document qualitative concerns and link them to the quantitative dimensions of the hedging activities.

Navigation:

This example illustrates the fields and controls on the Hedge Strategy page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Description and Strategy |

Summarize the reasons for your choices. Use the Strategy field to detail those reasons. |

Note: Paragraph 44 of FAS 133 states: "Qualitative disclosures about an entity's objectives and strategies for using derivative instruments may be more meaningful if such objectives and strategies are described in the context of an entity's overall risk management profile. If appropriate, an entity is encouraged, but not required, to provide such additional qualitative disclosures [44]."

Risks You Can Hedge

According to ¶ 21(a-f), you can hedge only these four risks:

Field or Control |

Description |

|---|---|

Changes in Overall Fair Value |

Select to hedge nonfinancial risks, such as commodities. Selecting this check box automatically clears any other hedged risk options that are selected. |

Interest Rate Risk |

Select to hedge risk of instability in interest rates. |

Foreign Currency Exchange Risk |

Select to hedge risk of fluctuation of foreign currency exchange rates. |

Credit Risk |

Select to hedge risk of credit variability. |

Other and Risk Name |

Enter a name in the Other field to designate another type of risk investment to be hedged. |

Comments |

Click to access the Details page to record details of the hedged risk entered in the Risk Name field. |

Use the Hedged Item Source page (HDG_SRC_PNL) to set up the risk evaluation and accounting of the hedged item.

Navigation:

This example illustrates the fields and controls on the Hedged Item Source page. You can find definitions for the fields and controls later on this page.

Note: The fields available on this page depend on the FAS 133 Hedge Type that you select.

This table shows the association between the selected hedge type and a prompt table:

|

FAS 133 Hedge Type |

Prompt Table |

|---|---|

|

Cash Flow Hedges FX (foreign exchange) Cash Flow Hedges |

Select a record. |

|

Fair Value Hedge FX F V (foreign exchange fair value) Available-for-Sale FX F V (foreign exchange fair value of Firm Commitment) |

Select a record, and then define both the Hedged Item Type and the Fair Value Adjustment Type. Hedged Item Type: Select Recognized Asset or Liability, Forecasted Transaction or Unrecognized Firm Commitment. Fair Value Adjustment Type: Select Per Period Fair Value, Cumulative Amortized Cost or Cumulative Fair Value. |

Accounting Templates

Field or Control |

Description |

|---|---|

Do Accounting |

Select the checkbox next to the appropriate Accounting Event Type,and then select an Accounting Template. Available accounting event types depend on the hedge type that you selected. |

Hedge Type and Associated Accounting Event Types

This table shows the association between the selected hedge type and an accounting event types:

|

FAS 133 Hedge Type |

Accounting Event Type |

|---|---|

|

Cash Flow Hedges FX Cash Flow Hedges |

AOCI Adjustment AOCI Reclassification Will Not Occur- AOCI Reclassify. |

|

FX F V of Available-for-Sale |

Fair Value Hedged Item G/L Amortize Adj of Carrying |

|

FX F V of Firm Commitment Fair Value Hedge |

Fair Value Hedged Item G/L Firm Commitment to Carrying Amortize Adj of Carrying Derecognize Firm Commitment. |

Analytic Calculations

Field or Control |

Description |

|---|---|

Analytics Mode |

Enter a mode definition. |

Analytics Supplier |

Associate an installed third-party analytics supplier and select an associated calculation in the Calculation field. |