Understanding Hedge Types

FAS 133 standardizes accounting for derivative instruments. It requires you to recognize derivative instruments as assets and liabilities in their statements of financial position and then to measure them at fair value. If certain conditions are met, your organization can designate a derivative instrument as a fair value hedge, cash flow hedge, or foreign currency hedge.

This section discusses:

Risk Management and hedges.

Fair value hedges.

Cash flow hedges.

Foreign currency hedges.

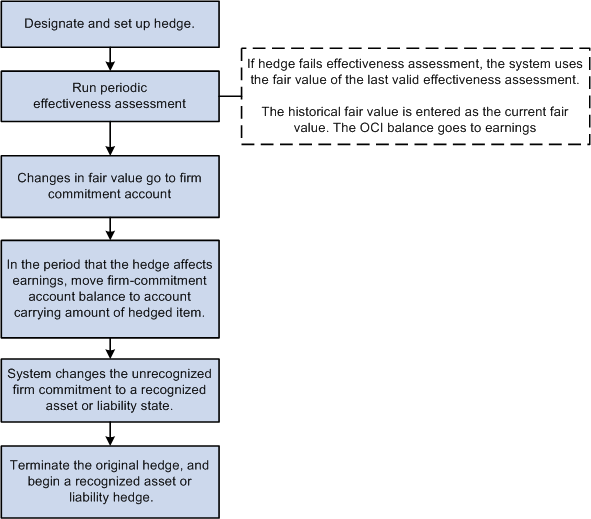

This diagram shows how PeopleSoft Risk Management handles hedges.

This table shows the types of hedges that are available with particular kinds of instruments:

|

Instrument |

Interest Rate |

F/X |

Fair Value |

Cash Flow |

Other |

|---|---|---|---|---|---|

|

Swap |

XXX |

|

XXX |

XXX |

|

|

Forward |

|

XXX |

XXX |

|

XXX |

|

Option |

|

XXX |

|

XXX |

|

Fair value hedges are hedges against exposure to changes (that are attributable to a particular risk) in the fair value of either of the following:

Recognized assets or liabilities on your balance sheet.

Unrecognized firm commitment and specific business commitments having significant financial relevance to your organization, but whose quantitative value does not go to your general ledger.

Firm Commitments

You hedge firm commitments in fair value hedges and in foreign currency cash flow hedges.

See "Fair Value Hedges: Firm Commitments—Statutory Remedies for Default Constituting a Disincentive for Nonperformance" published by Rutgers University.

Note: 540 defines a Firm Commitment as the following: "An agreement with an unrelated party, binding on both parties and usually legally enforceable, with the following characteristics: (a) The agreement specifies all significant terms, including the quantity to be exchanged, the fixed price, and the timing of the transaction. The fixed price may be expressed as a specified amount of an entity's functional currency or of a foreign currency. It may also be expressed as a specified interest rate or specified effective yield. (b) The agreement includes a disincentive for nonperformance that is sufficiently large to make performance probable."

Under FAS 133, gains and losses on qualifying fair value hedges should follow these accounting guidelines:

They must recognize the hedging instrument's gain or loss in current earnings.

The gain or loss (that is, the change in fair value) on the hedged item attributable to the hedged risk must adjust the carrying amount of the hedged item and be recognized in current earnings.

Note: From ¶ 19 of FAS 133: "The change in fair value of an entire financial asset or liability for a period refers to the difference between its fair value at the beginning of the period (or acquisition date) and the end of the period, adjusted to exclude (a) changes in fair value due to the passage of time and changes in fair value related to any payments received or made, such as in partially recovering the asset or partially settling the liability."

Here is an example of how this works:

With regression testing of a fair value hedge, the hedge is considered effective if its period ratio is between 80 and 125 basis points (0.8 to 1.25).

Period ratio equals the difference between the fair value change of hedging instrument (change in swap value) and the fair value change of hedged item (change in debt value).

|

|

Period 1 |

Period 2 |

Net Difference |

|---|---|---|---|

|

Change in swap value (hedging instrument) |

10 |

-7 |

17 |

|

Change in debt value (hedged item) |

-9 |

5 |

14 |

|

Difference in fair value |

1 |

-2 |

3 |

|

Period ratio |

-1.11 passes regression test ratio is within 0.8 to 1.25 |

-1.4 fails regression test terminate hedge |

|

Note: DIG's Fair Value Hedges: Basing the Expectation of Highly Effective Offset on a Shorter Period Than the Life of the Derivative states: "In documenting its risk management strategy for a fair value hedge, an entity may specify an intent to consider the possible changes (that is, not limited to the likely or expected changes) in value of the hedging derivative and the hedged item only over a shorter period than the derivative's remaining life in formulating its expectation that the hedging relationship will be highly effective in achieving offsetting changes in fair value for the risk being hedged. The entity does not need to contemplate the offsetting effect for the entire term of the hedging instrument."

The functionality of Risk Management is not intended for formulating the prospective consideration that a hedge will be effective.

This illustration shows the fair value hedge in time.

This illustration shows the life of an unrecognized firm commitment set up as a fair value hedge.

Cash flow hedges are hedges against exposure to volatility (that are attributable to particular risks) in the cash flows of either:

Recognized assets or liabilities.

Forecasted transactions.

The main purpose of a cash flow hedge is to link a hedging instrument and a hedged item in situations where you expect changes in cash flows to offset one another. Under FAS 133, to achieve this offsetting of cash flows, changes in the fair value of a derivative instrument that is designated and effective as a cash flow hedge must be:

Initially reported as a component of Other Comprehensive Income (OCI) outside earnings.

Later reclassified as earnings in the same periods during which the hedged transaction affects earnings (for example, when a forecasted sale actually happens).

Capture changes in the derivative instrument's fair value using effectiveness testing, which creates OCI accounting events. These events, in turn, generate an audit trail and become available for public reporting. Report OCI in the equity section of the balance sheet.

This flowchart shows the cash flow hedge occurring in time.

Derivatives Implementation Group Issues

When calculating the amount of ineffectiveness of a cash flow hedge according to ¶ 30(b), the guidance in Derivatives Implementation Group (DIG) Issue G7 applies.

See G7 - Cash Flow Hedges: Measuring the Ineffectiveness of a Cash Flow Hedge of Interest Rate Risk, When the Shortcut Method Is Not Applied, published by Rutgers University.

The issue lists three methods. Risk Management supports only the calculations of Methods 2 and 3.

Method 1: The Change in Variable Cash Flows method involves the following amounts that need to be calculated using an analytic:

Cumulative change in fair value of the swap.

Present value of the cumulative change in the cash flow on the floating leg of the swap.

Present value of the cumulative change in the expected future interest cash flows on the floating rate debt.

Method 2: The Hypothetical Derivative method involves the following amounts that must be calculated using an analytic:

Cumulative change in fair value of the actual swap.

Cumulative change in fair value "hypothetical" swap that mirrors the floating rate debt.

The change in the fair value of the "perfect" hypothetical swap can be regarded as a proxy for the present value of the cumulative change in expected future cash flows on the hedged transaction, as described in ¶ 30(b)(2).

With the analytic used to value the forecasted transaction, you calculate the second amount in the previous list: the cumulative change in fair value "hypothetical" swap that mirrors the floating rate debt.

Method 3: Change in Fair Value method involves the following amounts that must be calculated using an analytic:

Cumulative change in fair value of the actual swap.

Present value of the cumulative change in the expected future interest cash flows on the floating rate debt.

Foreign currency hedges are hedges against foreign currency exposure to any of the following:

Unrecognized firm commitments (fair value).

Available-for-sale securities (fair value).

Forecasted transactions (cash flow).

Net investments in a foreign operation.

Unrecognized Firm Commitments

See Firm Commitments.

Available-for-Sale Securities

You can hedge the change in fair value of an available-for-sale debt security (or a specific portion) from changes in foreign currency exchange rates.

You can also hedge available-for-sale equity securities if changes in fair value come from changes in foreign currency under certain conditions. First, the security cannot be traded on an exchange (or another established marketplace) where trades are denominated in your functional currency. Second, dividends, or other cash flows, to the security's holders' must be denominated in the same foreign currency that you expect to receive when the security is sold.

Forecasted Transactions/Recognized Firm Commitments

You can hedge foreign currency exposure to variability in the functional-currency-equivalent cash flows from foreign-currency-denominated forecasted transactions and foreign-currency-denominated intercompany transactions.

Net Investment in a Foreign Operation

The complexity of a foreign operation extends beyond the scope of cash flow and fair value hedges, which address the risks of specific financial components. Net investment in foreign operation hedges are not supported in Risk Management.