Setting up and Maintaining Golden Tax (GT) Options

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BI_SETUP_OPTIONS |

Configure setup options for each VAT applied business unit. |

|

|

BI_GTA_TX_DENOM |

Define and maintain tax denominations required for GT identifiers. |

|

|

BI_GT_IDENTIFIER |

Define and maintain GT identifier data before creating or importing VAT invoices. |

|

|

BI_GT_CUST |

Define and maintain GT customer data before creating or importing VAT invoices. |

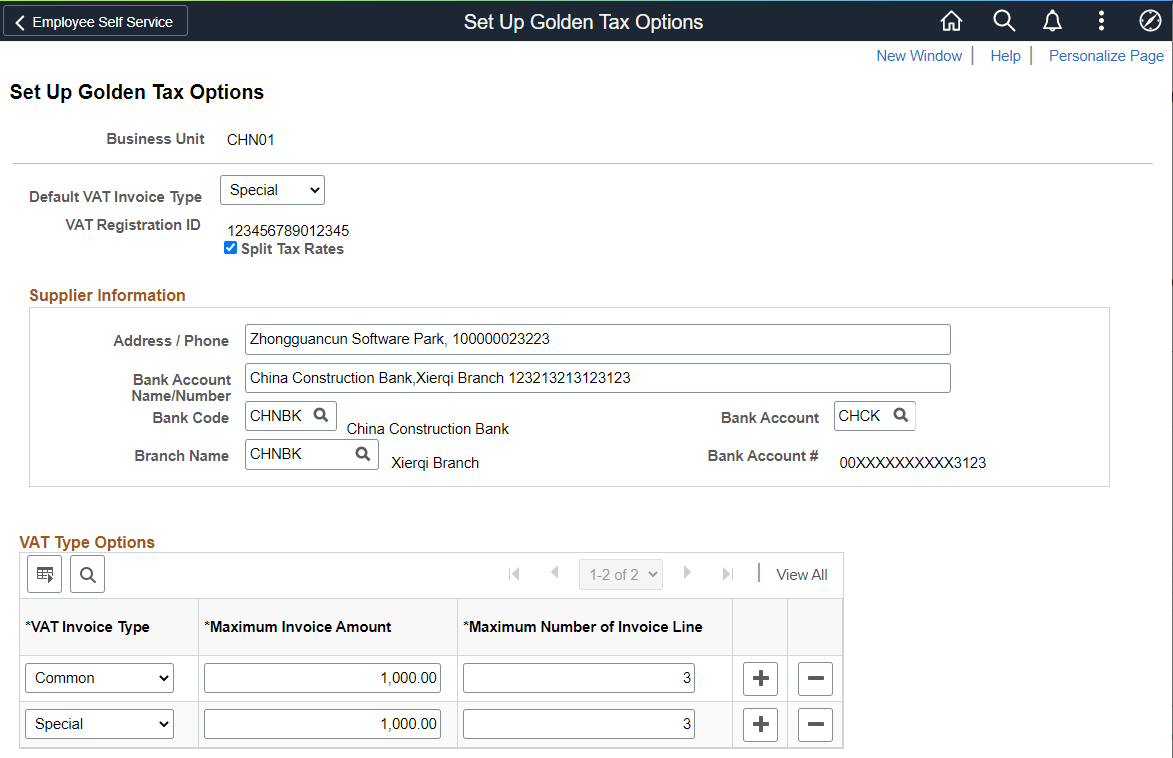

Use the Set Up Golden Tax Options page (BI_SETUP_OPTIONS) to configure setup options for each VAT applied business unit.

Navigation:

This example illustrates the fields and controls on the Set Up Golden Tax Options page.

|

Field or Control |

Description |

|---|---|

|

Default VAT Invoice Type |

Select the default Invoice Type to be assigned as the GT invoice type of the transferred GT invoices. The available options are Common and Special. Note: Common VAT invoice is issued if the sale is made to a small size tax payer (individual). Special VAT invoice is issued if the sale is made to a general tax payer (organization). |

|

Split Tax Rates |

Select to split the billing invoice by tax rate. If the check box is selected, then the Generate Adapter Invoice process will split the billing invoice by tax rate. The check box is not selected as the default option. |

|

Bank Account Name/Number |

Enter Bank and Account Number information if it is different from what is defined in the GT system. |

|

Bank Account # (bank account number) |

Displays the bank account number in a masked format. For more informations about how PeopleSoft FSCM encrypts and masks bank account numbers, see Understanding Bank Account Encryption. |

|

Maximum Invoice Amount |

Set the maximum invoice amount limit for the selected business unit and the invoice type. The invoice must be split into multiple invoices if the limit is exceeded. |

|

Maximum Number of Invoice Line |

Set the maximum number of invoice lines for the selected business unit and the invoice type. |

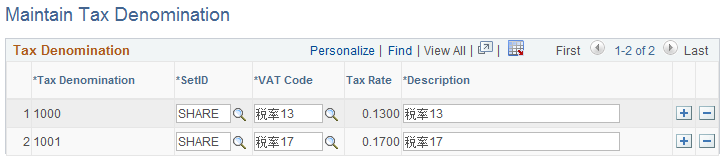

Use the Maintain Tax Denomination page (BI_GTA_TX_DENOM) to define and maintain tax denominations required for GT identifiers.

Navigation:

This example illustrates the fields and controls on the Maintain Tax Denomination page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Denomination |

Values are populated from the official list of tax denominations. Values are display-only and only the new values entered can be edited. |

SetID and VAT Code |

The SetID and VAT Code combination determines the Tax Rate value. |

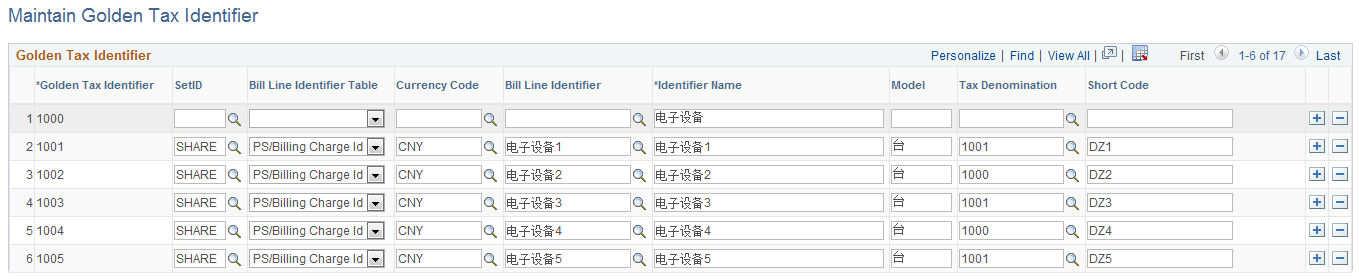

Use the Maintain Golden Tax Identifier page (BI_GT_IDENTIFIER) to define and maintain GT identifier data before creating or importing the VAT invoices. The GT identifier data are exported into a flat file which is then imported into GT.

You can define cross references between PeopleSoft identifiers and GT identifiers, and then define Tax Denomination and GT Identifier Short Code for each GT identifier. All GT Identifiers used for GT invoice lines must be defined in this component to assign Tax Denomination to each GT invoice line.

Navigation:

This example illustrates the fields and controls on the Maintain Golden Tax Identifier page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

GT Identifier |

Values are display-only and only the new values entered can be edited. |

Bill Line Identifier |

Displays identifiers for PS products, charge codes and so on. When the field value is changed, GTA copies the Identifier Name from the selected PS Identifier to GT Identifier Name. Default value is blank. |

Identifier Name |

Enter the descriptive name of the GT Identifier. |

Tax Denomination |

Select the Tax Denomination associated with the GT Identifier. |

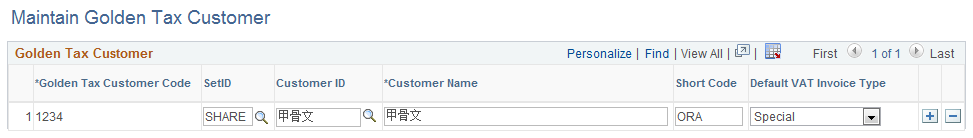

Use the Maintain Golden Tax Customer page (BI_GT_CUST) to define and maintain GT customer data before creating or importing VAT invoices. The GT customer data are exported into a flat file which is then imported into GT.

You can define the referenced PS Customer and then define GT Customer Code, GT Customer Short Code, and GT Default Invoice Type. All customers used for GT invoice headers must be defined in this component to determine GT invoice type of each GT invoice.

Navigation:

This example illustrates the fields and controls on the Maintain Golden Tax Customer page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Golden Tax Customer Code |

Displays the code for the GT customer. Values are display-only and only the new values entered can be edited. |

Customer ID |

Displays the PeopleSoft customer ID. |

Default VAT Invoice Type |

Displays the default VAT invoice type generated for the customer. The available options are Blank, Special or Common. |