Setting Up PeopleSoft Billing Business Units to Process VAT

Every invoice belongs to a Billing business unit. VAT invoices belong to VAT Billing business units that are linked to VAT entities.

The process for linking a VAT entity to a Billing business unit is complex. You must link the Billing business unit to a Receivables business unit that is associated with a General Ledger business unit that is already linked to a VAT entity.

All bill lines have to be MOSS (Mini One Stop Shop) lines or all bill lines have to be non-MOSS lines when:

The Business Unit is VAT applicable and is located in EU.

Customer is located in EU member state and is not registered for VAT.

Bill line identifier is service.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_TBL_BI |

Establish a link to a VAT-enabled General Ledger business unit. |

|

|

BUS_UNIT_TBL_BI4 |

Enable PeopleSoft Billing business units for VAT. |

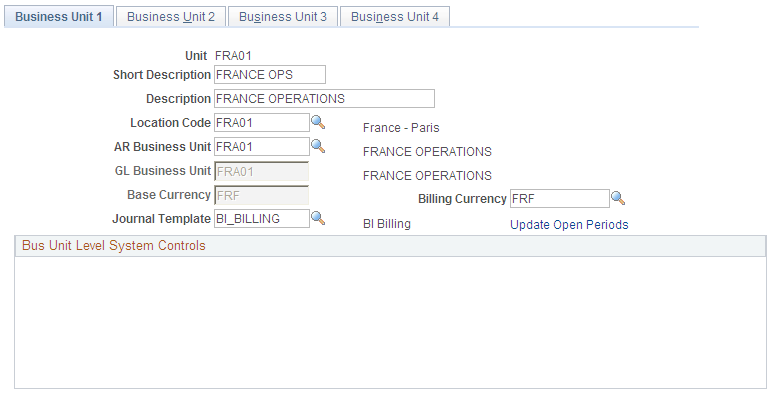

Use the Billing Definition - Business Unit 1 page (BUS_UNIT_TBL_BI) to establish a link to a VAT-enabled General Ledger business unit.

Navigation:

This example illustrates the fields and controls on the Billing Definition - Business Unit 1 page.

Select a location code.

The location code field is critical for VAT because the address country for this location becomes the ship-from country default for VAT invoices.

Select a Receivables business unit.

The relationship between a Billing business unit and a General Ledger business unit is inherited from PeopleSoft Receivables. Therefore, when you define a Receivables business unit, the General Ledger business unit that is associated with that Receivables business unit is the default.

If that General Ledger business unit is tied to a VAT entity, the system displays that entity on the Billing Definition - Business Unit 4 page. If the General Ledger business unit is not tied to a VAT entity, the VAT Reporting Entity field on the Billing Definition - Billing Business Unit 4 page is blank. You establish the relationship between a General Ledger business unit and a VAT entity in the VAT setup process on the VAT Entity - Identification page.

Note: If PeopleSoft Billing and General Ledger are included in the installation, but PeopleSoft Receivables is not, you can associate the General Ledger business unit with a Billing business unit by entering the General Ledger business unit directly on the Billing Definition - Business Unit 1 page.

Ensure that the VAT Reporting Entity field that is on the Billing Definition - Business Unit 4 page is populated.

If it is, then you have created a VAT Billing business unit.

This example illustrates the fields and controls on the Billing Definition - Business Unit 4 page.

Select a default physical nature for the business unit.

Additionally, you can select a default location where services that are billed in this Billing business unit are performed.

Click the VAT Default Setup link to set up business unit VAT defaults. Click the VAT Service Treatment Setup link to specify business unit VAT service treatment defaults.

Warning! If the VAT entity on the Billing Definition - Business Unit 4 page is missing, going to the VAT Entity - Identification page and linking the default General Ledger business unit to a VAT entity does not automatically make the associated Billing business unit a VAT Billing business unit. You must return to the Billing Definition - Business Unit 1 page and relink the Billing business unit to the General Ledger business unit. You can do this by changing the Receivables business unit to some other value and then immediately reinstating its original value. This action causes the system to recheck the General Ledger business unit to determine whether it is linked to a VAT entity. When the system verifies the link between the General Ledger business unit and the VAT entity, the Billing business unit becomes a VAT Billing business unit, and the system copies the VAT entity ID onto the Billing Definition - Billing Business Unit 4 page.

Note: When you have a VAT business unit, you cannot assign a third-party tax provider to that business unit.