Calculating Default Actual Cost and Current Purchase Cost

This topic provides an overview of costs and discusses how to use the Update Default Actual Cost process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_CM_DFLTCOST |

Calculate the value to be stored in the Default Actual Cost field or the Current Purchase Cost field on the Define Business Unit Item - General: Common page. |

The values in the Default Actual Cost field and the Current Purchase Cost field are used by both processes and reports when a item value is needed. These fields are located on the Define Business Unit Item - General: Common page. The value in these fields can be manually updated or you can use the Update Default Actual Cost (CM_BUCST_UPD) process to automatically update these field.

Understanding Default Actual Cost and Current Purchase Cost

The Default Actual Cost field is used as the actual or average cost if the item does not yet have an actual cost generated from the receipt and putaway processes. This value is stored in the DFLT_ACTUAL_COST field of the BU_ITEMS_INV record. The Default Actual Cost is used in these processes and reports:

The Deplete On Hand Quantity process (IN_FUL_DPL). This field value is used to determine the transfer cost of an interunit transfer when the Transfer Pricing Definition component uses the default actual cost option.

The Reconciliation Report (INS5050) and the Stock Quantity Update process (INPOPOST) for a inventory stock count (physical count or cycle count). This field value is used to record a positive inventory adjustment when a receipt cost is not found.

The Adjustments page (ADJUSTMENT2_INV). The field value is used if the item requires a positive inventory adjustment prior to an actual cost being generated from receipt of the item.

The Cost Rollup process in PeopleSoft Manufacturing uses this field value as a preliminary cost if a receipt cost is not found.

The Interunit and RMA Receiving component uses the value in the Default Actual Cost field to cost the receipt of items using actual cost.

The Utilization Type Calculation Summary report (INS5100)

The Slow Moving Inventory report (INS5200) uses this field value if a receipt cost is not found.

The Current Purchase Cost field is used in PeopleSoft Manufacturing. This value is stored in the CURRENT_COST field of the BU_ITEMS_INV record. The Cost Rollup process in PeopleSoft Manufacturing uses this field value as an optional source to calculate the value of a standard-cost item. The Current Purchase Cost field is used to determine the material cost of purchased items and the lower-level material cost of a manufactured item when the cost type that you are rolling uses current costs.

Understanding the Update Default Actual Cost Process

The Update Default Actual Cost (CM_BUCST_UPD) process is a PeopleSoft Application Engine program that can update the Default Actual Cost field and the Current Purchase Cost field for all the items regardless of the item's cost profile. Before running this process, be sure to run the Cost Accounting Creation process to update the PeopleSoft Cost Management tables for any new receipts, cost adjustments, PeopleSoft Payable cost adjustments, or PeopleSoft Manufacturing finalized cost adjustment transactions. Based on your search criteria, the process:

Includes all the zero cost receipts, as they are originally part of average cost calculation during putaway.

Excludes cancelled receipts.

For consigned inventory items, includes all receipts irrespective of the consumption for consigned inventory items.

Rolls up all the cost elements into one default actual cost for each item, receiver ID, receiver line, distribution line before calculating the new cost.

Excludes manufacturing transactions with a cost source of 8 (Preliminary Production Cost).

Note: After the Update Default Actual Cost process is completed, you can query the PS_CM_ACT_COST_TMP and PS_CM_AVG_RCST_TMP tables to see what receipts were used during the cost calculation. These tables are cleared during the next run.

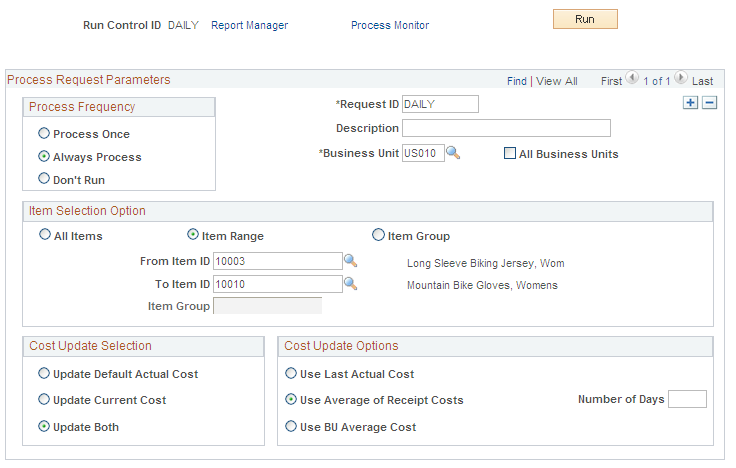

Use the Update Default Actual Cost page (RUN_CM_DFLTCOST) to calculate the value to be stored in the Default Actual Cost field or the Current Purchase Cost field on the Define Business Unit Item - General: Common page.

Navigation:

This example illustrates the fields and controls on the Update Default Actual Cost page. You can find definitions for the fields and controls later on this page.

Use the Update Default Actual Cost process to update the cost fields Default Actual Cost (DFLT_ACTUAL_COST) and Current Purchasing Cost (CURRENT_COST) in the Define Business Unit Item - General: Common page (BU_ITEMS_INV).

Field or Control |

Description |

|---|---|

Business Unit |

Enter the PeopleSoft Inventory business unit in which the process updates the cost fields for item IDs in that business unit. All items meeting the search criteria on this page are updated, regardless of the cost profile used. |

All Business Units |

Select all Inventory business units. The process updates the cost fields for the specified item IDs in all of the business units. If row-level security is enabled, then the user must have security access to all of the Inventory business units for the process to run the cost calculations. |

All Items |

Select this option to include all items in the business units that meet the search criteria of this page. |

Item Range |

Select this option to define a range of item IDs to be processed. |

Item Group |

Select this option to define an item group ID to be processed. |

From Item ID and To Item ID |

Enter a range of item IDs to be processed. The system includes all items in the alphanumeric sequence. The Item Range option must be selected to enter values in these fields. |

Item Group |

Enter an item group ID to be processed. The Item Group option must be selected to enter a value in this field. If the Item Group option is selected and the Item Group field is left blank, then the process includes only the items that do not have an item group assigned on the Define Item - General: Common page (MASTER_ITEM_TBL table). |

Cost Update Selection |

Select the cost fields to be updated by this process. The options are:

|

Cost Update Options |

Choose the method to update the cost fields. The options are:

|

Number of Days |

Enter the past number of days' worth of receipts to be used to calculate the weight average for the transfer price. The field is required when the option Use Average of Receipt Costs is selected. |