Reviewing Interunit Accounting Examples

This section provides an overview of interunit accounting examples and reviews examples of:

Transferring interunit stock using only an intransit account.

Transferring interunit stock using interunit receivables and payables.

Transferring interunit stock using the interunit sales approach (intercompany).

This table describes the accounting entries that you can create using the three different types of interunit stock transfers

|

Type of Transfer |

Description |

Examples |

|---|---|---|

|

Interunit transfer using only an intransit account |

The cost of the inventory stock is entered into an intransit account while being moved from one inventory business unit to another. Use this approach when both inventory business units post to the same general ledger. |

Example 1 |

|

Interunit transfer using interunit receivables and interunit payables accounts |

An intransit account is used along with interunit receivables and payables accounts recorded for each inventory business unit. Both inventory business units post to different general ledger business units. Use this approach when transferring stock between separate legal entities or within the same legal entity. |

Examples 2.1 to 2.3 |

|

Interunit sales approach (intercompany) |

An intercompany sale is recorded with the source inventory business unit recording a sale and the linked billing business unit issuing a voucher (invoice) for the stock transfer to the payable unit of the receiving business unit. Use this approach when transferring stock between separate legal entities or within the same legal entity. The Intercompany method is required if the GL business units use different currencies. |

Examples 3.1 to 3.4 |

All of the examples use the following cost elements:

100 (Material- General)

601 (Landed- Duty)

751 (Addl Trans- Freight)

Determining the Inventory Account

For all the examples below, the location accounting feature determines how the system selects the ChartField combination used for the inventory stock account. The inventory account is debited for receipt of stock and credited for shipment of stock. The location accounting feature is turned on at the business unit level by selecting the Location Accounting Required check box on the Inventory Options page (Set Up Financials/Supply Chain, Business Unit Related, Inventory, Inventory Options).

If the Location Accounting Required check box is not selected, the inventory account is derived from the Accounting Rules page (Account Distribution page) for the applicable transaction group.

If the Location Accounting Required check box is selected, the inventory account is derived from the storage area from which the inventory is shipped.

Determining the Intransit Account

For all the examples below, the intransit inventory account defined using the inventory business unit combinations on the InterUnit Ownership page or from the intransit account defined in the centralized interunit and intraunit processor.

This example illustrates a stock transfer from inventory business unit US012 to inventory business unit US013. Both of these business units post to the same general ledge (US003); in this case, US012 owns the intransit inventory until it is received at the requesting business unit. The item uses the actual-cost method. In this example, the item cost and the transfer price for the item differ.

Example 1

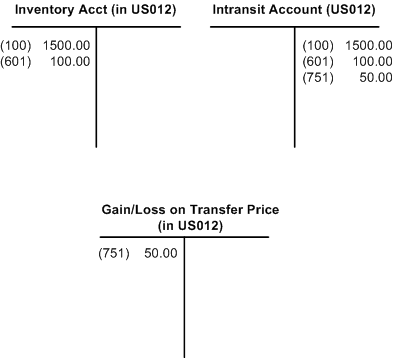

The following diagram illustrates the accounting entry for the shipping transaction in the source business unit US012 (transaction group 031- InterBU Transfer Shipments). The inventory account is credited at item cost for the material and landed costs. The intransit account contains the transfer price of material, landed cost, and additional transfer costs. The gain and loss on transfer price account contains the additional transfer cost plus any difference between the transfer price and the cost of the item.

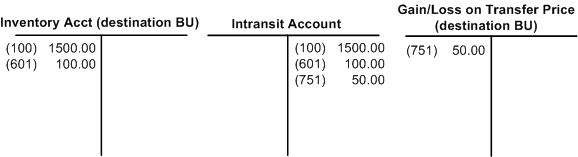

The following diagram illustrates the accounting entry for the putaway transaction in the destination business unit US013 (transaction group 022 - IBU Transfer Receipts). The entire shipment arrives intact, and the intransit account is credited for the transfer price (material, landed, and additional transfer costs). Since the item uses the actual-cost method, the inventory account in US013 is debited for transfer price of the material and landed costs portions. Since the Expense Transfer Fees check box for US013 is selected on Inventory Definition - Business Unit Definition page, the additional transfer costs are written off to the gain and loss on transfer price account rather than added to the cost of the item.

These examples illustrate stock transfers for inventory business units that post to different PeopleSoft General Ledgers.

Example 2.1

This example illustrates a stock transfer from inventory business unit US001 to inventory business unit US012. These inventory business units post to different general ledgers; inventory unit US001 reports to the GL unit US001 and inventory unit US012 reports to the GL unit US003. The source inventory business unit, US001, owns the intransit inventory until it is received. The item uses an actual or average-cost method. The units use the same currency. In this case there is a difference between the item cost and the transfer price for the item. During setup, the intercompany (interunit sales approach) method was not selected for these two units.

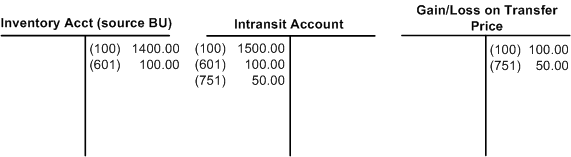

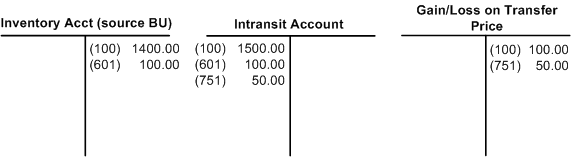

The following diagram illustrates the accounting entry for the shipping transaction in the source business unit US001 (transaction group 031 - InterBU Transfer Shipments). The inventory account is credited, at item cost, for the material and landed costs. The intransit account contains the transfer price of material, landed, and additional transfer costs. The gain and loss on transfer price account contains the additional transfer cost plus any difference between the transfer price and the cost of the item.

The following diagram illustrates the accounting entry for the putaway transaction in the destination business unit US012 (transaction group 022 - IBU Transfer Receipts). The entire shipment arrives intact and the intransit account is credited for the transfer price (material, landed, and additional transfer costs). The interunit receivable account in the source business unit and the interunit payables account in the destination business unit are posted with the transfer price (material, landed, and additional transfer costs). Since the item uses the actual or average-cost method, the inventory account in US012 is debited for the material and landed costs portions of the transfer price. Since the Expense Transfer Fees check box has been selected on Inventory Definition - Business Unit Definition page for US012, the additional transfer costs are written off to the gain and loss on transfer price account rather than added to the cost of the item.

Example 2.2

This example has the same conditions as Example 2.1 except that the intransit account is owned by the destination business unit (US012).

The following diagram illustrates the accounting entry for the shipping transaction in the source business unit US001 (transaction group 031 - InterBU Transfer Shipments). The interunit receivable and interunit payable transactions are recorded at shipment time because the intransit stock is owned by the destination business unit. The inventory account is credited, at item cost, for the material and landed costs. The intransit account contains the transfer price of material, landed, and additional transfer costs. The gain and loss on transfer price account contains the additional transfer cost plus any difference between the transfer price and the cost of the item.

The following diagram illustrates the accounting entry for the putaway transaction in the destination business unit US012 (transaction group 022 - IBU Transfer Receipts).

Example 2.3

This example has the same conditions as Example 2.1 except that the quantity of the item shipped is different from the quantity of the item received.

The following diagram illustrates the accounting entry for the shipping transaction in the source business unit US001 (transaction group 031 - InterBU Transfer Shipments). The inventory account is credited, at item cost, for the material and landed costs. The intransit account contains the transfer price of material, landed, and additional transfer costs. The gain and loss on transfer price account contains the additional transfer cost plus any difference between the transfer price and the cost of the item.

During transit, half of the shipment was stolen. The source business unit (US001) shipped 10 units, but the destination business unit (US012) received only 5 units. Since the source business unit owned the intransit stock, it must absorb the loss for the stolen items.

Example of receiving interunit stock when shipping quantity is more than received quantity.

These examples illustrate different types of accounting transactions that can be generated for intercompany transfers.

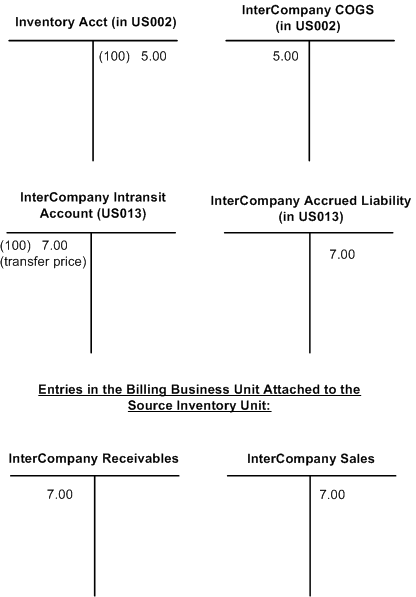

Example 3.1

This example illustrates an intercompany inventory transfer from business unit US002 to business unit US013. These business units all use the same base currency. These inventory business units post to different general ledgers; inventory unit US002 reports to the GL unit US001 and inventory unit US013 reports to the GL unit US003. The inventory unit US013 assumes ownership at the time of shipment. The item is standard costed for US013 and can be any cost type for US002. In this case, there are differences between the item cost in the source business unit, the item transfer price, and the item cost in the destination business unit. Here is what the setup looks like for this example:

Field or Control |

Description |

|---|---|

US002 (source BU) Cost |

5.00 |

Transfer Price |

7.00 |

US013 (destination BU) Std Cost |

6.00 |

This diagram illustrates the accounting entries in PeopleSoft Inventory and PeopleSoft Billing after shipment. These entries belong to the transaction group 301 (Intercompany Cost of Goods).

The above accounts are derived from the following sources:

Inventory account in source unit: If the location accounting check box is deselected in the source business unit, the inventory account is derived from the Accounting Rules page (Account Distribution page) for the Intercompany Cost of Goods transaction group (301). If the location accounting check box is selected, the inventory account is derived from the storage area from which the inventory is shipped.

InterCompany Cost of Goods Sold (COGS) account: The COGS account is the source interunit account defined for the inventory business unit combination on the InterUnit Pair page or InterUnit Template page of the centralized interunit and intraunit processor.

InterCompany Intransit account: The intercompany intransit account is defined on the Interunit Ownership page. This transaction belongs to the InterCompany Transfers transaction group (035).

InterCompany Accrued Liability account: The intercompany accrued liability account, in the destination business unit, is the destination interunit account defined for the inventory business unit combination on the InterUnit Pair page or InterUnit Template page of the centralized interunit and intraunit processor. This transaction belongs to the Intercompany Transfers transaction group (035).

Note: The source inventory business unit doesn't use the gain or loss on transfer price transaction group (300); the margin between the cost of the inventory transferred and the transfer price is intrinsic in the difference between the intercompany sales and the intercompany cost of goods sold.

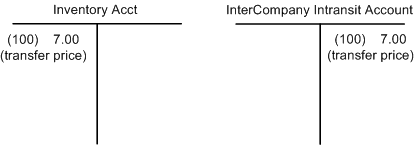

Here is what the accounting entries for PeopleSoft Inventory look like upon putaway in the destination business unit (US013). These entries belong to the transaction group 025 (InterCompany Receipts).

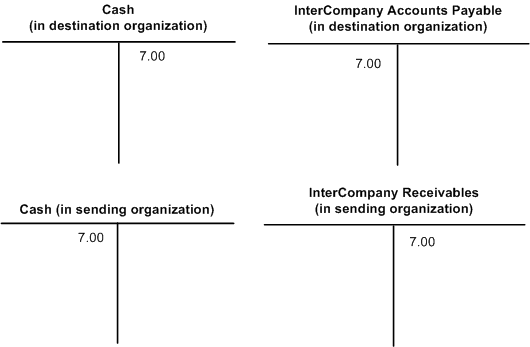

Here is what the accounting entry looks like for PeopleSoft Payables upon voucher processing.

Here is what the accounting entry looks like for the open payable and receivable settlement.

Example 3.2

This example has the same conditions as example 3.1 except the item ID uses the actual or average-cost method in the destination business unit.

This example differs from example 3.1 only in the accounting entries for PeopleSoft Inventory upon putaway. In this example, the item is an actual or average cost item for US013. Here is what the accounting entries look like in PeopleSoft Inventory upon putaway.

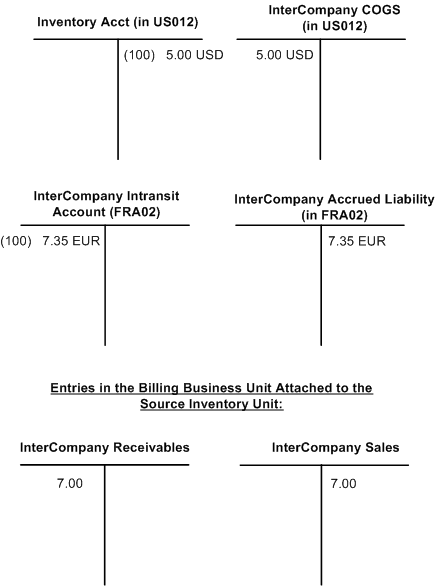

Example 3.3

This example illustrates an intercompany inventory transfer from business unit US012 to business unit FRA02. These inventory business units post to different general ledgers; inventory unit US012 reports to the GL unit US003 and inventory unit FRA02 reports to the GL unit FRA01. In addition, these business units have different base currencies; USD and EUR. The inventory business unit FRA02 assumes ownership at the time of shipment. The item uses the standard-cost method for FRA02 and can be any cost method for US012. In this case, there are differences between the item cost in the source business unit, the item transfer price, and the item cost in the destination business unit.

Field or Control |

Description |

|---|---|

US012 Cost |

5.00 (in USD: US012 base currency) |

Transfer Price |

7.00 (in USD: US012 base currency) |

FRA02 Std. Cost |

6.00 (in EUR: FRA02 base currency) |

Exchange Rate |

1.05 (one unit of USD-US012 base currency = 1.05 units of EUR-FRA02 base currency) |

Here is what the accounting entries look like in PeopleSoft Inventory upon shipment using the transaction group 301 (Intercompany Cost of Goods).

The above accounts are derived from the same sources as in example 3.1; however, the amount recorded in the FRA02 business unit is in FRA02's base currency of EUR. The intransit amount is the transfer price (7.00 USD) multiplied by the exchange rate (1.05) resulting in 7.35 EUR.

Here is what the accounting entries look like for PeopleSoft Inventory unit FRA02 upon putaway using the transaction group 025 (InterCompany Receipts).

Note: Entries are in FRA01 base currency of EUR.

Here is what the accounting entry looks like for PeopleSoft Payables upon voucher processing.

Here is what the accounting entry looks like for open payable and receivable settlement.

Example 3.4

This example has the same conditions as example 3.3 except the item ID uses the actual or average-cost method in the destination business unit (FRA02).

This example differs from example 3.3 only in the accounting entries for PeopleSoft Inventory upon putaway. In this example, the item is an actual or average cost item for FRA02. Here is what the accounting entries look like in PeopleSoft Inventory upon putaway.

Note: Transaction Group 042 (IBU Transfer Adjustments) works the same for intercompany receipts as it does for interunit receipts.