Understanding Production Costs

The Cost Rollup process can calculate the costs for make or buy items within a manufacturing or distribution environment. These new costs are temporarily stored in the CE_ITEMCOST and CE_ITEMCOST_DET tables where you can review them using several PeopleSoft inquiry pages. If you discover that the new standard costs are incorrect, then you can change the cost foundation, bill of materials (BOM), or routings and then run the Cost Rollup process again. Once you are satisfied with the results, run the Update Production job (CEREVAL) to move the new standard costs into the CM_PRODCOST table that the system uses to cost manufacturing and inventory transactions. The new frozen standard costs are used for future manufacturing, production variances, and valuing inventory. Both the Cost Rollup and Update Production processes accommodate yield by operation transactions by calculating yield loss costs at the operation sequence level, maintaining extended precision cost fields, and storing detailed cost rollup calculations.

For production IDs, completions are recorded at the last operation. Completed items from Work in Process (WIP) are putaway as finished goods. These putaways are posted to TRANSACTION_INV. Completions may also be directed into another production ID.

If the end item is standard cost, the system debits the standard costs to finished goods and credits WIP. This may leave a remainder in WIP if the standard is different than the cost in the production ID. This remainder is cleared from WIP as a variance. When production IDs are closed for accounting, the variances between standard and production costs are computed by the Production Close process and stored in the SF_VARIANCES record. These variance transactions account for the difference between the standard cost of the end items putaway into finished goods and the total costs of the components, plus conversion cost consumption. WIP is cleared either to finished goods or as a variance for all completed and closed production IDs.

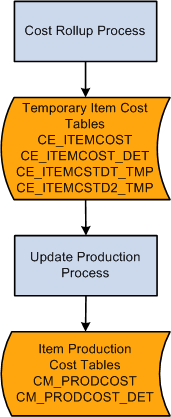

This diagram illustrates setting up frozen standard costs for makeable items. The Cost Rollup process calculates the frozen standard costs and stores the costs in the temporary item cost tables for review. The Update Production process (Cost Update/Revalue process page) moves the new standard costs into the production tables used to cost manufacturing and inventory transactions:

Once you have set the foundation for costing, you can calculate and update item costs. In a manufacturing environment, PeopleSoft Cost Management supports standard costing and enables you to easily perform cost simulations, standard cost updates, inventory, inspection, and WIP revaluations using a system that is well interfaced with other PeopleSoft Supply Chain Management applications.

Within a standard cost environment, you calculate the cost of makeable items based on the cost of purchased items, the makeable items product structure, and the list of tasks necessary to put the components together to form the subassembly or assembly.

Once you calculate and approve the item costs, you must put them into effect as the new frozen standard cost in production. Costs based on engineering bill of materials (EBOM) are calculated but are not used to update the standard cost for the item in production. When you have completed this process, PeopleSoft Cost Management revalues all inventories in the inspection, raw material, WIP, and finished goods storage areas at the new standard cost. Additionally, PeopleSoft Cost Management revalues any assemblies or subassemblies in process in production at the new standard. PeopleSoft Cost Management also records an accounting transaction to adjust the general ledger (GL) inventory balances.

You can maintain many standard costs for various production options and cost approaches, however, there is only one frozen standard cost per item that transcends all standard cost profiles and cost books for a business unit.

When production begins, PeopleSoft Cost Management tracks the cost of production, including any variances from the expected results. You have visibility into potential production variances before production is completed, which gives you time to analyze potential problems before they are booked to the GL.

Field or Control |

Description |

|---|---|

Conversion Code |

Define labor, machine, and other conversion costs in the manufacturing process. Use production conversion codes to define conversion rates associated with work centers or tasks. In the case of subcontracted tasks or operations, the rate should represent the cost of preparing and sending the item to the subcontractor for outside processing. |

Conversion Overhead Code |

Define the different types of overhead costs used in the manufacturing process. Use production overhead codes to define conversion overhead rates associated with work centers or tasks. You can specify up to four production overhead codes for the work center or task. |

Cost Element |

Categorize the components of an item's cost. When you perform a cost rollup, you maintain an item's cost by cost element. Cost elements also help define the debit and credit ChartField combinations in transaction processing. |

Cost Type |

Creates separate costing groupings with different methods of costing, such as current, revised, or forecasting. The cost type also defines how purchased components are calculated. |

Cost Version |

Once you have determined the cost types, you can use cost versions to determine how many iterations or versions of costs you want to calculate. By using different versions for a cost type, you can maintain a history of the different costs calculated for each cost type. You can base these cost versions on different sets of assumptions, such as different BOMs (manufacturing versus engineering), effective dates, different labor rates, or different budgets that determine the overhead expenses. |

Lower Level Costs |

Costs associated with the components used on the assembly. |

Source Code |

Identifies an item as make, buy, floor stock, expense, or planning. This determines how the system uses the item during the Cost Rollup and Update Production processes. |

Standard Cost Group |

Standard cost groups (also know as cost groups) enable you to group together a set of items for cost roll up and update, comparing costs and reporting inventory value. |

This Level Costs |

Costs associated with manufacturing a specific assembly item. |

Costing Conversion Overhead Rates |

Establishes the rates to use for overhead costs based on the units produced, labor and machine hours, or labor and machine costs. The rates are based on business unit, cost type, cost version, conversion overhead code, and cost element. You can establish several different rates. |

Costing Conversion Rates |

Establishes the rates to use for labor and machine costs in the production process. You can enter fixed run, run, postproduction, and set up rates for both labor and machine. The rates are based on several factors including business unit, cost type, cost version, conversion code, and cost element. This structure gives you flexibility to set up and use several different rates. |