Creating Interunit Transfers in India with the India Goods and Services Tax

The India Goods and Services Tax (GST) is required for transfers of goods or provision of services to branches or offices outside the state. GST is not required for transfers of goods or provision of services to branches or offices within the same state and sharing the same Goods and Service Tax Identification Number (GSTIN) number.

When India GST is enabled, the system automatically determines GST jurisdiction and rate by comparing the Shipping Inventory business unit location with the Receiving Inventory business unit location (as defined on the Inventory Definition - Business Unit Definition page).

To send an interunit transfer with GST duty:

In the source PeopleSoft Inventory business unit, create a stock order for the interunit transfer by using the Create/Update Stock Request component or the Express Issue component.

If you used the Create/Update Stock Request component, reserve, pick, and create a shipping ID, then run the Deplete On Hand Qty (Depletion) process.

Create the stock transfer invoice for the stock request using the Stock Transfer Invoice page. The GST duty payable is determined and calculated on this invoice.

(Optional) Create the Stock Transfer Invoice Report using the Stock Transfer Invoice Report run control page.

For more information on the India Goods and Services Tax, including common setups, see:

Understanding the India Goods and Services Tax (GST)

Installation Options - Overall Page

Setting Up the GST Common Tax Structure

Setting Up the GST Organizational Structure

Setting Up Items for GST Processing

Stock Transfer IND (India) Menu Item

When India GST is enabled, you have access to the GST-related menu item Stock Transfer IND. Navigation for this menu item is: Inventory, Fulfill Stock Orders, Stock Transfer IND. This menu item contains the Stock Transfer Invoice, Stock Transfer Invoice Report, and Tax Applicability pages.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EXD_SHP_INVOICE |

Add or update stock transfer invoices by adding invoice lines to this page. |

|

|

RUN_INS6801 |

Use the Stock Transfer Invoice Report page (RUN_INS6801) to create a PDF copy of the stock transfer invoice to accompany the item shipment from PeopleSoft Inventory. |

|

|

Tax Applicability page |

RUN_OM_EXS_APP_CHK |

Run tax applicability for a business unit. |

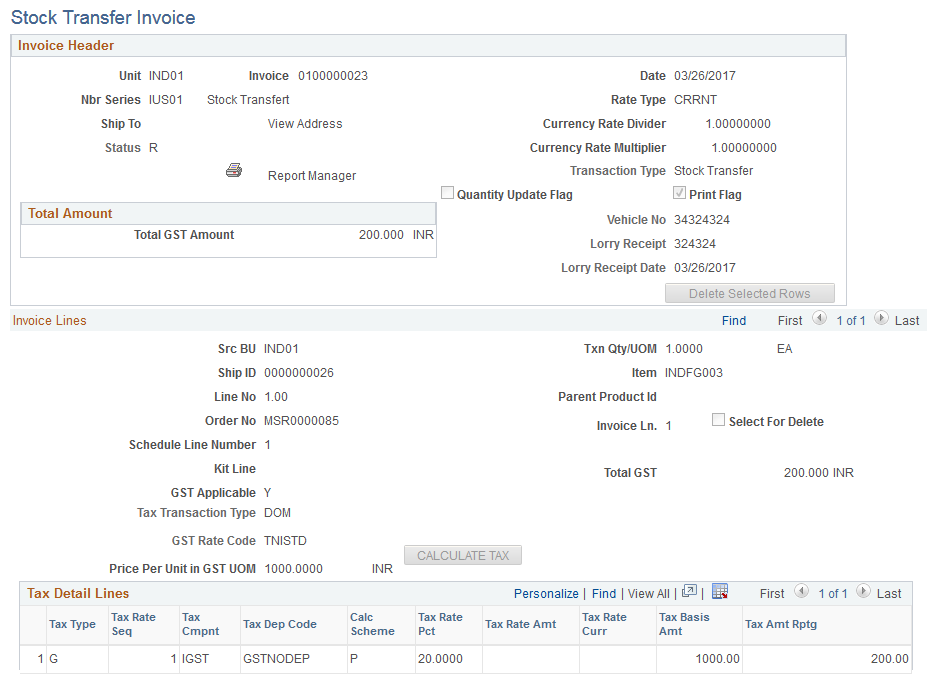

Use the Stock Transfer Invoice page (EXD_SHP_INVOICE) to add or update stock transfer invoices by adding invoice lines to this page.

Navigation:

This example illustrates the fields and controls on the Stock Transfer Invoice page. You can find definitions for the fields and controls later on this page.

Invoice Header

Field or Control |

Description |

|---|---|

Unit |

Enter the PeopleSoft Inventory business unit that shipped the stock. |

Invoice |

Displays the stock invoice number assigned to this stock transfer invoice. The number is from the Document Number Series and the PeopleSoft Inventory business unit defined in the Unit field. The system validates the appropriate tax location for the unit to identify the format for the document number, such as prefix and length. If the Overwrite Allowed check box has been selected on the Document Number Series page, then the user is allowed to add the invoice number. If the overwrite option has not been selected, the excise invoice number field displays NEXT until you save the stock transfer invoice. |

Date |

Displays the date this stock transfer invoice was created. When adding a new invoice, the system automatically uses the current system date. This value cannot be changed. |

Nbr Ser (Number Series) |

Displays the stock transfer number. |

Ship To |

This field does not pertain to GSC and does not display a value. |

View Address |

Select to view the shipping address of the Ship To Customer ID. The address that appears (and used) is the address specified for the address sequence number selected, not any address overrides entered. |

Rate Type, Currency Rate Divider, Currency Rate Multiplier |

Displays the sales order header information linked to the shipping lines added to this invoice. |

Add New Lines |

Click this link to access the Select Shipping Lines page (EXD_SHP_INV_SRCH), where you can search and select the shipping lines to be added to this stock transfer invoice. |

|

Click this button to print the completed stock transfer invoice. The invoice must have a status of Ready or Posted to be printed. |

|

Status |

Displays the status of the stock transfer invoice. Values are:

|

Transaction Type |

Displays the type of transaction to be entered (Stock Transfer). |

Quantity Update Flag |

This field does not pertain to GSC. |

Print Flag |

Indicates the stock transfer invoice has been printed. Any additional prints are identified as duplicates. |

Delete Selected Rows |

Click to delete selected invoice lines. You must select the ‘Select for Delete’ option before you can use this button. |

Enter the required information about the shipment vehicle including vehicle number, lorry receipt number, and lorry receipt date.

Total Amount

Field or Control |

Description |

|---|---|

Total GST Amount |

Displays the total GST amount for all lines in this stock transfer invoice. |

Invoice Lines

Displays the stock transfer invoice lines added using the Select Shipping Lines page. The fields are populated from the shipping ID, sales order, or interunit transfer.

Field or Control |

Description |

|---|---|

Src BU (Source Business Unit) |

Displays the business unit that originated the order. For an interunit transfer it is the shipping PeopleSoft Inventory business unit and for a sales order it is the PeopleSoft Order Management business unit. |

Txn Qty/UOM (Taxation quantity/Unit of measure) |

Displays the transaction Quantity and unit of measurement from the material stock request or express issue. |

Ship ID (Shipping ID) |

Displays the shipping ID from the material stock request or express issue. |

Item |

Displays the item ID of the material that you are transferring. |

Line No (Line Number) |

Displays the line number from the material stock request. |

Parent Product ID |

This field does not pertain to GSC and does not display a value. |

Order No (Order Number) |

Displays the material stock request number. |

Invoice Ln (Invoice Line) |

Displays the invoice line number from the material stock request. |

Select for Delete |

Select this option to flag the invoice row for deletion. You must still click the Delete Selected Rows button to delete the row. |

Schedule Line Number |

Displays the schedule line number from the material stock request. |

Kit Line |

This field does not pertain to GSC and does not display a value. |

Total GST |

Displays the total GST for the individual invoice line. |

GST Applicable |

Indicates whether GST is applicable to the invoice line. |

Tax Transaction Type |

Defines the type of transaction. Values include:

|

GST Rate Code |

Displays the tax rate code for GST duty as defined on the Tax Determination page. |

Price Per Unit in GST UOM (Price Per Unit in GST Unit of Measure) |

Displays the item price based on the item unit of measure. |

Calculate Tax |

Click to calculate GST for the invoice line. |

Tax Detail Lines

The bottom portion of this page displays the GST calculations for each stock transfer invoice line. When you save the page or click the Calculate Tax button, the results of tax determination and tax calculations appear in this section.

Field or Control |

Description |

|---|---|

Tax Type |

Displays the tax type for the row, as defined on the Tax Component page. For GST the value is Goods and Services Tax. |

Tax Rate Seq (Tax Rate Sequence) |

Displays the line number for each GST tax line calculated in the Tax Detail Lines grid. |

Tax Cmpnt (Tax Component) |

Displays tax component codes established for each tax, as defined on the Tax Components page. |

Tax Dep Code (Tax Dependency Code) |

Indicates the basis for calculating the tax as well as the precedence of taxes of the same tax type that must be included. |

Calc Scheme (Calculation Scheme) |

Displays the default calculation scheme associated with the selected tax component code. You can override this value. Values are:

|

Tax Rate Pct (Tax Rate Percent) |

If the Calculation Scheme field value is set to Percentage, this field displays the percentage to be applied against the taxable amount. |

Tax Rate Amt (Tax Rate Amount) |

If the Calculation Scheme field value is set to Amount, this field displays the amount to be applied. |

Tax Rate Curr (Tax Rate Currency) |

Displays the currency associated with the GST tax. |

Tax Basis Amt (Tax Basis Amount) |

If the Calculation Scheme field value is set to Percentage, this field displays the base value used for the tax calculations. |

Tax Amt Rptg (Tax Amount Reporting) |

Displays the tax reporting currency that appears by default from the Tax Location page. |

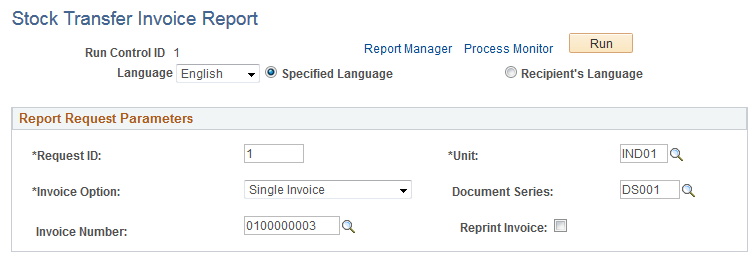

Use the Stock Transfer Invoice Report page (RUN_INS6801) to create a PDF copy of the stock transfer invoice to accompany the item shipment from PeopleSoft Inventory.

If more than one copy is created, the subsequent copies are marked as duplicates.

Navigation:

This example illustrates the fields and controls on the Stock Transfer Invoice Report page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Invoice Option |

Indicates the stock transfer invoices to be printed. Values are:

|

Document Series |

Enter the document number series for the stock transfer invoice that you want to print. This field is available if you selected Single Invoice for the invoice option. |

Invoice Number |

Enter the stock transfer invoice number for the invoice that you want to print. This field is available if you selected Single Invoice for the invoice option. |

Reprint Invoice |

Select to print a second copy of the stock transfer invoice. The invoice is marked as a duplicate. This field is available if you selected Single Invoice for the invoice option. When this option is selected, only invoices that have been previously printed are available in the Invoice Number field. |

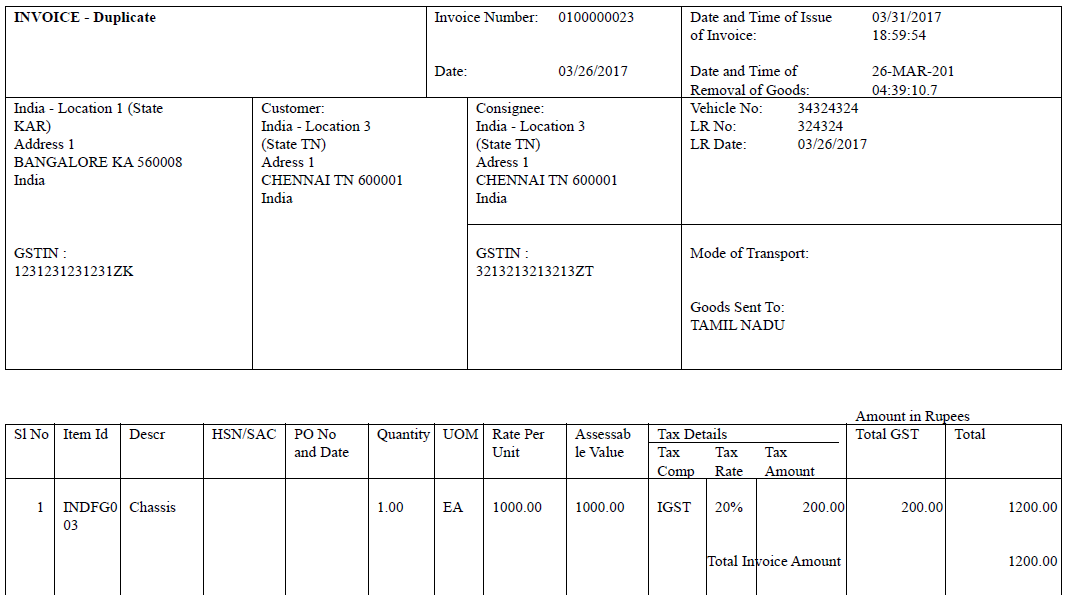

Sample Stock Transfer Invoice Report Output

The following is an example of the Stock Transfer Invoice Report output:

Sample Stock Transfer Invoice Report Output (1 of 2)

Sample Stock Transfer Invoice Report Output (2 of 2)