Defining Rate Code Elements

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_PIN |

Name the element and define its basic parameters. |

|

|

GP_RATE_CODE |

Create a rate code element and map it to a rate code defined in HR. You can also use the page to view rate code elements and change the mapping. |

You can use rate code elements to retrieve multiple components of pay that have been defined in HR—including base pay and non base-pay components.

To have the system retrieve the rate codes set up in HR, matching rate code elements must be defined in Absence Management and mapped to the corresponding HR rate codes. A HR rate code can be associated with only one Absence Management rate code element.

Rate code elements can be defined and mapped to HR rate codes in two ways:

If you install Absence Management after creating rate codes in HR, use the Rate Codes - Definition page to create rate code elements and map them to the corresponding rate codes in HR.

Mapping an element to a HR rate code makes the element take on the values of the HR rate code.

If Absence Management is installed when you create rate codes in HR, the creation of the rate code element is dependant on if a row exists on the User Rules Profile page for the rate code creators user ID.

If there is an entry on the User Rules Profile page for the User ID of the person who is creating the Rate Code in HR a matching rate code element is created automatically in Absence Management. This rate code will have the same Used By and Country values on the Rate Code Name page that are defined for the User ID of the person creating the rate code. If a different one is desired, a user will a user ID of All Countries will have to modify the rate code with the applicable change to the Used By and Country fields.

If there is no entry on the User Rules Profile page for the User ID of the person creating the Rate Code in HR, the system does not create a rate code in Global Payroll. It handles it just as in the same manner as described in #1 above. A user with the appropriate User ID set up on the User Rules Profile page will have to go into the Rate Code element in Global Payroll to create the rate code element.

You can display the rate code elements via the Rate Codes - Definition page in Absence Management. You can also use the page to map the element to a different rate code.

This table lists the values that appear on the Rate Codes - Definition page:

|

Field |

Value |

|---|---|

|

Name |

Same as HR Rate Code Name |

|

Element Type |

Rate Code (RC) |

|

Description |

HR Rate Code description |

|

Field Format |

Decimal |

|

Use Defn As Of |

Calendar Period End Date |

|

Always Recalculate |

Off (No) |

|

Owner |

Customer Maintained |

|

Class |

Not Classified |

|

Used By |

Same as the Used By value defined on the User Rules Profile page for the person creating the Rate Code in HR. |

|

Country |

Same as the Country value defined on the User Rules Profile page for the person creating the Rate Code in HR. |

|

Industry/Region |

Blank |

|

Category |

Blank |

|

Override Levels |

All options set to Off (No) |

|

|

On (Yes) |

|

Store if Zero |

On (Yes) |

|

Customer Fields |

Blank |

|

Comments |

Blank |

Rate code elements return the values of rate codes defined in HR. To use a rate code to calculate a payee's absence information, use the rate code in the absence element definition—either directly, as part of the absence calculation rule, or within a formula or other element used by the absence calculation rule.

When the system encounters a rate code element during the absence process, it calls the Rate Code PIN Resolution program, which first determines whether the element, effective on the calendar period end date, represents a base pay rate code or a non base-pay rate code. It then follows the hierarchy for base pay or non base-pay rate code elements, as appropriate, to resolve the rate code.

Criteria for Selecting the Job Row

Absence Management uses the RATE AS OF DATE system element to determine to which maximum effective-dated job row it refers for the rate code.

If RATE AS OF DATE is unpopulated, the system uses the end date of the current slice or segment to select the job row.

If RATE AS OF DATE is greater than the calendar period end date, the system uses the calendar period end date to select the job row.

If RATE AS OF DATE is before the first effective date on job, the rate code resolves to 0 and the payment is put in error.

In all other cases, RATE AS OF DATE is used.

The FTE factor that applies to some rate codes is retrieved from the maximum effective-dated job row that is less than or equal to the RATE AS OF DATE or slice end date where the payment keys match.

Currency Conversion

When the currency code for a flat amount, hourly, or hourly plus flat amount rate code, as defined in HR, doesn't match the processing currency, Absence Management performs its standard currency conversion during processing. That is, it uses the payee's effective-dated exchange rate type to perform the conversion.

Note: Currency conversion is not required on percent or point rate codes, because returned values are non monetary.

Frequency Conversion

Absence Management also performs frequency conversion on any flat amount or hourly plus flat amount rate code, where the corresponding frequency code in HR doesn't match the calendar period frequency. The system annualizes the rate code using the corresponding frequency factor from HR. It then deannualizes for the calendar period frequency (using the applicable frequency factor). Define all earning elements that use rate codes as Use Calendar Period Frequency.

Note: Frequency conversion is not required on percent or point rate codes, because returned values are non monetary.

Resolving Multiple Instances of the Same Rate Code Element

If the PS_COMPENSATION record contains multiple instances for the same rate code (base pay or non base-pay), the system evaluates each instance separately, sums the instances, and returns one value to the rate code element. Absence Management references two system elements, RATE CODE GROUP and FTE INDICATOR, and applies the following rules:

If the Rate Code Group differs between the instances, the system element RATE CODE GROUP is resolved according to the last instance and an error message is generated.

If the FTE indicator differs between instances, the system resolves the system element named FTE INDICATOR according to the last instance and issues a warning message. The payee is not put into an error status. (Absence Management uses the FTE INDICATOR only for rate codes types of flat amount and hourly plus flat amount.)

For example, if a flat amount rate code has one instance in which FTE applies, Absence Management uses the FTE_COMPRATE for this instance. If a second instance indicates that FTE doesn't apply, the system uses the COMPRATE field value for the second instance and sums the two instances.

Hierarchy for Resolving Base Pay Rate Code Elements

When the system encounters a rate code element that's mapped to a HR base pay rate code, it finds the appropriate rows on the PS_COMPENSATION record, where the element matches the rate code. It then identifies the value to be returned, based on the rate code type, as shown in this table:

|

Rate Code Type |

Fields Evaluated on PS_COMPENSATION |

Value Returned for Rate Code |

|---|---|---|

|

Percent |

COMP_PCT |

Percent |

|

Points |

COMP_RATE_POINTS |

Points |

|

Flat Amount |

COMPRATE and FTE_INDICATOR |

If FTE_INDICATOR = Yes, return COMPRATE * FTE factor (stored on JOB) If FTE_INDICATOR = No, return COMPRATE |

|

Hourly |

COMPRATE |

Hourly rate |

Hierarchy for Resolving Non Base-Pay Rate Code Elements

When the system encounters a rate code element that's mapped to a HR non base-pay rate code, it derives the rate from the following hierarchy, stopping when it finds the rate:

Compensation table (PS_COMPENSATION).

Job Code table (PS_JOBCD_COMP_RATE).

The system looks for the row where the SetID and Job code fields match the SETID_JOBCODE and JOBCODE system elements.

HR Comp Rate table (PS_COMP_RATECD_TBL).

The system identifies the value to be returned, based on the rate code type and FTE_INDICATOR, as shown in this table:

|

Rate Code Type |

Fields Evaluated on PS_COMPENSATION |

Value Returned for Rate Code |

|---|---|---|

|

Percent |

COMP_PCT |

Percent |

|

Points |

COMP_RATE_POINTS |

Points |

|

Flat Amount, or Hourly + Flat Amount |

COMP_RATE FTE_INDICATOR |

If FTE_INDICATOR = Yes, return COMPRATE * FTE factor (stored on JOB) If FTE_INDICATOR = No, return COMPRATE |

|

Hourly |

COMPRATE |

Hourly rate |

Field or Control |

Description |

|---|---|

Base pay components |

Components that contribute to a payee's base pay are called base pay components. All base pay components are stored in the PS_COMPENSATION record in HR. |

Multiple components of pay |

This functionality enables your organization to compensate a payee at more than one rate of pay, such as regular pay and merit pay. Components can represent a flat amount, hourly rate, hourly rate plus flat amount, percentage of the worker's compensation package, or salary points. |

Non-base-pay components |

Components that do not contribute to base pay are called non base-pay components and may or may not be stored in the PS_COMPENSATION record. When you run the absence process, the system follows a hierarchy to determine the applicable rate. |

Use the Rate Code Name page (GP_PIN) to name the element and define its basic parameters.

Navigation:

Note: You name every element and define its basic parameters on an element name page with the object name of GP_PIN. The page title and general appearance of this page change based on the type of Absence Management element that you are naming and defining.

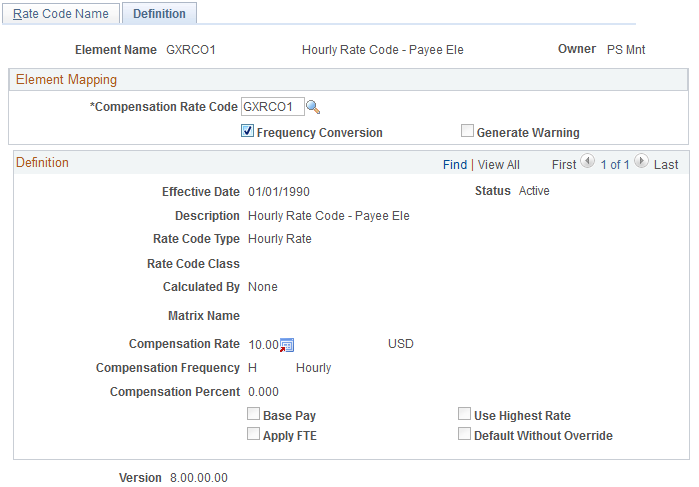

Use the Definition page (GP_RATE_CODE) to create a rate code element and map it to a rate code defined in HR.

You can also use the page to view rate code elements and change the mapping.

Navigation:

This example illustrates the fields and controls on the Rate Codes - Definition page.

Field or Control |

Description |

|---|---|

Compensation Rate Code |

Enter the HR rate code to which you want to map this element. When you select the rate code, the lower half of the page displays information that is defined for the rate code in HR. You cannot change this information in Absence Management. |

Frequency Conversion |

This check box is selected by default to indicate that the system is to perform frequency conversion (annualization and deannualization) on the value returned by the rate code. Clear this check box if you want the system to return the value from the rate code definition without performing frequency conversion. |

Generate Warning |

This check box applies only to rate codes that represent a base pay component. It is selected automatically to indicate that the system generates a warning message during batch processing if it does not find the rate code on the payee's compensation record. Clear the check box if you do not want the system to generate a warning message in these situations. |