Managing Savings Plan Limits

This section discusses how to Manage Savings Plan Limits.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

SAVINGS_MGT_EE |

Review and update savings plan limits. Manage the 402(g), 457 and 401(a) limit extensions and overrides for 401(k), 403(b), and 457 Savings Plans. Suspend savings plan contribution. |

|

|

SAVINGS_MGT_EE_SP1 |

Monitor 403(b) balances. Review the year-to-date (IT'D) and life-to-date (LTD) balances from the 403(b) process, enter contributions made at another company, and review an employee's contribution amount for each applicable limit. |

|

|

SAVINGS_MGT_EE_SP2 |

Monitor the 457 catch-up limit extension and election for 457 plans. |

Use the Savings Management page to:

Review 402(g) and 457 limit extension amounts.

Manually enter 402(g), 457, and 401(a) limit extension amounts.

Override limits.

Manage hardship withdrawals.

Review 402(g) and 457 Limit Extension Amounts

Two processes are used to automatically generate 402(g) and 457 limit extension amounts. The processes can be run for a company's employee population or for an individual employee. These are the processes:

The Calculate 403(b) Extensions process generates both the 402(g) catch-up records and the 457 catch-up records when it runs.

The Identify Age-50 Extension process generates either the 402(g) age extension or the 457 age-50 extension.

These system-calculated limits appear in the Limit Extensions group box on the Savings Management page.

Manually Enter 402(g), 457, and 401(a) Limit Extension Amounts

You can manually enter 401(a), 402(g), and 457 limit extension amounts by adding a row to the Limit Extensions group box on the Savings Management page. Enter the company, calendar year, limit type, and exception reason.

If you select 401(a) as the limit type, the system automatically supplies Adjust Eligible Earnings IT'D as the exception reason and you enter the adjustment amount.

If you select 402(g) as the limit type and A, B, or H as the exception reason, enter the adjustment amount.

Note: Use the 403(b) link to review and adjust data related to the catch-up limit.

If you select 457 as the limit type and A or B as the exception reason, enter the adjustment amount.

Note: Use the 457 link to review and adjust data related to the catch-up limit.

Managing Overrides

The override capability on the Savings Management page affects only those deductions that are subject to the 402(g) or 457 limits. The override function works like this for the two limits:

The EXT_ELECTION must be selected (ON) for the override to be recognized.

When the Age-50 process or the Calculate 403(b) Extensions process is run for a subsequent year, the override amount will be cleared.

The override fields on the SAVINGS_MGT_EE records are used instead of the 402(g) regular/extended limit, the 457 regular/extended limit, or both.

If the employee is not age 50, the client can manually add an Age-50 record to enter an override.

Multiple Expenses

You cannot use the 403(b) catch-up and the Age-50 403(b) extension in the same year. If an extension exists on both 402 Limit Type records, the sum of the extensions will apply to 403(b) plans.

You cannot use the 3-year 457 catch-up and the Age-50 457 extension in the same year. If a value is in the Extension Override, then this value is used; otherwise, the limit is calculated as the higher of the three-year catch-up amount and the age-50 extension amount.

Example: Determining 3-Year Catch-Up Limit for 403(b) Plan

The following example illustrates limit determination when both 403(b) limit extension type records are selected. The example uses the following parameters:

Calendar Year 2006

403(b) 15 Year Catch up extension $3,000

Age-50 extension $5,000

402(g) Maximum Yearly Deduction $15,000

The 403(b) 15 Year catch up and the Age-50 extension can be used in the same year if the employee is eligible. If an extension exists on both 402 Limit Type records, the sum of the extensions applies to 403(b) plans. If the employee qualifies for both extensions then (15,000 + 5,000 + 3,000) = $23,000.

Example: Determining the 3-Year Catch-Up Limit for 457 Plans

The following example illustrates limit determination when both 457 limit extension type (catch-up) records are selected. The example uses the following parameters:

Calendar Year: 2006

457 Limit: $15,000

Max. Annual 457 Catch-up: $30,000

Age-50 extension: $5,000

Employee's Underutilized 457 Amount: $10,000

To determine the 3-Year Catch-up Limit, the system:

Determines the lesser of:

Regular 457 Limit + Underutilized Amount (for example, $15,000 + $10,000 = $25,000)

Max. Annual 457 Catch-up ($30,000)

Determines the higher of the 3-Year Catch-up Limit versus the Age-50 Catch-up Limit:

The result from Step 1 (for example, $25,000) (This record is represented by LIMIT_TYPE 402, LIMIT_EXT_TYPE A.)

Regular 457 Limit + Age 50 extension (for example, $15,000 + $5,000 = $20,000) (This record is represented by LIMIT_TYPE 402, LIMIT_EXT_TYPE B.)

The higher record, $25,000, in Step 2 is the override that is used when both catch-up records are selected.

Manage Hardship Withdrawals

IRS regulations require that employee contributions be suspended for a period following a hardship withdrawal from a qualified savings plan. To set the parameters for the employee contribution's suspension due to hardship, use the Contribution Suspension group box on the Savings Management page.

Use the 402(g) limit type with the Hardship - Reduce Limit exception reason to adjust the 402(g) limit following a hardship withdrawal. Regulations require that the 402(g) dollar limit be reduced by the amount contributed to the plan by the participant prior to the hardship withdrawal.

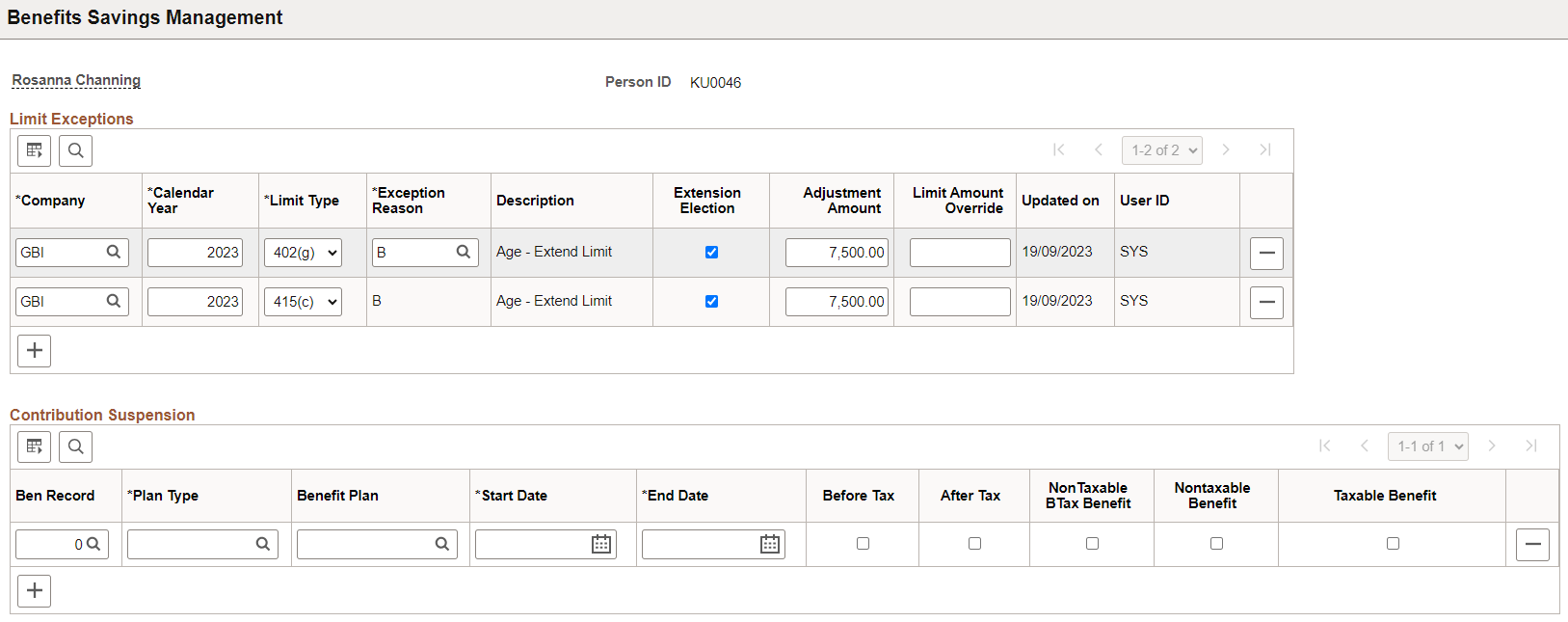

Use the Benefits Savings Management page (SAVINGS_MGT_EE) to review and update savings plan limits.

Manage the 402(g), 457 and 401(a) limit extensions and overrides for 401(k), 403(b), and 457 Savings Plans. Suspend savings plan contribution.

Navigation:

This example illustrates the fields and controls on the Benefits Savings Management page. You can find definitions for the fields and controls later on this page.

Limit Exceptions

Field or Control |

Description |

|---|---|

Company |

Select the company. |

Calendar Year |

Select the calendar year. |

Limit Type |

Select the limit type you want to adjust. Choose from:

|

Exception Reason and Description |

Select the reason for the exception. Choose from:

|

Extension Election |

If applicable, select this check box. |

Adjustment Amount (extension amount) |

For 403(b) plans, the amount displayed here represents the 15-year catch-up extension amount as generated by the 403(b) process. This field is used as an extension to the 402(g) limit when you select the Extension Election check box. The system uses the lesser of the following three:

For 457 plans, the underutilized 457 plan amount for previous years is entered here. The amount represents the three-year catch-up extension amount. |

Limit Amount Override |

The override amount entered here is used instead of the 402(g) limit or extended 402(g) limit if the Ext Election option is selected. It will apply to only 403(b) plans. |

Updated On |

The system enters a date when new information is saved. |

User ID |

The system identifies the user who updated the information. Options are:

|

Contribution Suspension

Field or Control |

Description |

|---|---|

Ben Record (benefit record) Plan Type, and Benefit Plan |

Select the desired plan type and benefit plan for which contributions should be suspended. |

Field or Control |

Description |

|---|---|

Start Date and End Date |

Indicate the dates through which to suspend the contributions. Indicate the tax class for which to suspend contributions. |

Field or Control |

Description |

|---|---|

Before Tax |

Select to suspend the employee's before tax contribution. |

Field or Control |

Description |

|---|---|

After Tax |

Select to suspend the employee's after tax contribution. |

Field or Control |

Description |

|---|---|

NonTaxable Btax Benefit |

Select to suspend the employer before-tax contribution. |

Nontaxable Benefit |

Select to suspend the employer after tax contribution. |

Field or Control |

Description |

|---|---|

Taxable Benefit |

Select to suspend the employer after-tax contribution. |

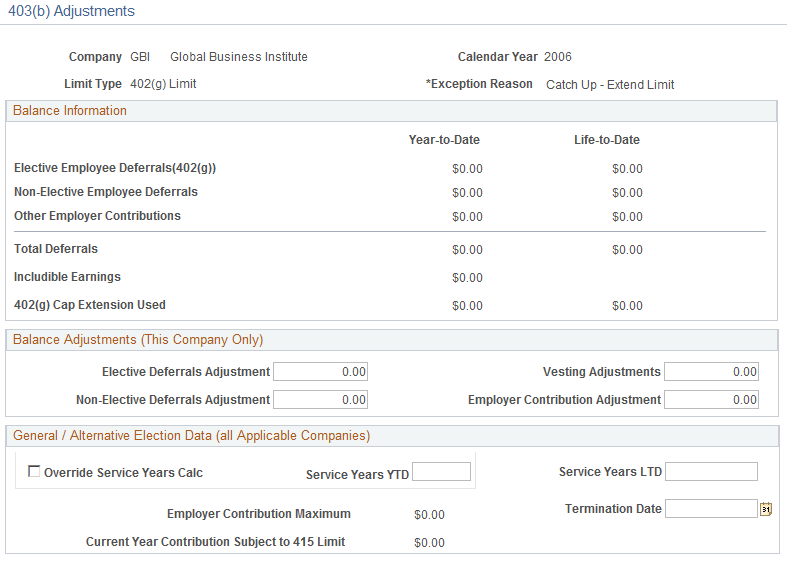

Use the 403(b) Adjustments page (SAVINGS_MGT_EE_SP1) to monitor 403(b) balances.

Review the year-to-date (IT'D) and life-to-date (LTD) balances from the 403(b) process, enter contributions made at another company, and review an employee's contribution amount for each applicable limit.

Navigation:

Click the 403(b) link on the Savings Management page.

This example illustrates the fields and controls on the 403(b) Adjustments page. You can find definitions for the fields and controls later on this page.

Balance Information

The system displays the IT'D and LTD balances calculated from the 403(b) process.

Balance Adjustments (This Company Only)

Use to enter employee contributions from a previous employer. The Calculate 403(b) Extensions process uses these figures.

Field or Control |

Description |

|---|---|

Elective Deferrals Adjustment, Non-Elective Deferrals Adjustment, and Employee Contribution Adjustment |

Enter the new amounts. Both the Calculate 403(b) Extensions and Pay Calculations processes use these fields. |

Vesting Adjustments |

Enter the new amount. Both the Calculate 403(b) Extensions and Pay Calculations processes use these fields. A vesting adjustment is considered to be a type of employer contribution, so it is used along with the Employer Contribution YTD/LTD balance fields and the Employee Contribution Adjustment field. |

General / Alternative Election Data (all Applicable Companies)

Field or Control |

Description |

|---|---|

Override Service Years Calc (override service years calculation) |

Select this check box if you need to override the system-calculated Service Years IT'D field, the Service Year LTD field, or both displayed on the 403(b) Projections page. |

Employer Contribution Maximum |

This is the amount entered in the Maximum Yearly Deduction field located on the 415(c) Limit Table. |

Termination Date (403[b] expected termination date) |

If applicable, enter the date. |

Current Year Contribution Subject to 415 Limit |

This is the year-to-date deductions that are subject to the 415(c) limit. |

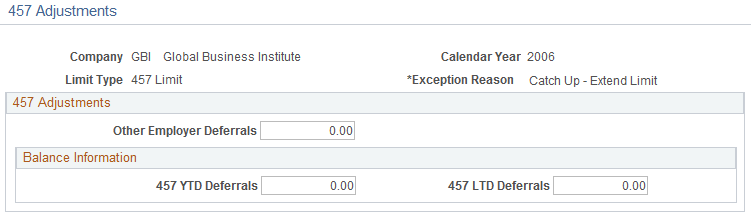

Use the 457 Adjustments page (SAVINGS_MGT_EE_SP2) to monitor the 457 catch-up limit extension and election for 457 plans.

Navigation:

Click the 457 link on the Savings Management page.

This example illustrates the fields and controls on the 457 Adjustments page. You can find definitions for the fields and controls later on this page.

457 Adjustments

This group box appears if you selected 457 in the Savings Plan Type field.

Field or Control |

Description |

|---|---|

Other Employer Deferrals |

The amount deferred to a 457 plan with another employer during the years of service with the current employer. |

457 IT'D Deferrals and 457 LTD Deferrals |

457 year-to-date and life-to-date balances are automatically maintained as part of the 403(b) Extensions process for those employees who are enrolled in both a 457 and 403(b) plan. |